Blog

FX Risk: Optimizing Hedging Costs with Protection is Critical

FX risk is on the rise. Volatility has hit major global currencies, rather than only a handful of the usual emerging market suspects. The result has been the largest magnitude of FX-related headwinds we’ve seen in the 10 years we’ve been tracking global FX impact data.

Effective FX Exposure Management

Figure 1. EUR/USD 6 month Volatility Chart

We’ve seen FX advisory firms recently recommend that companies reduce hedge coverage to combat the rising cost of hedging. Rather than being based on sound theory, this advice seems influenced more by their lack of capabilities to perform deep risk analysis and identify natural hedging opportunities. Leaving yourself exposed in these markets can be dangerous and is not a decision to take lightly.

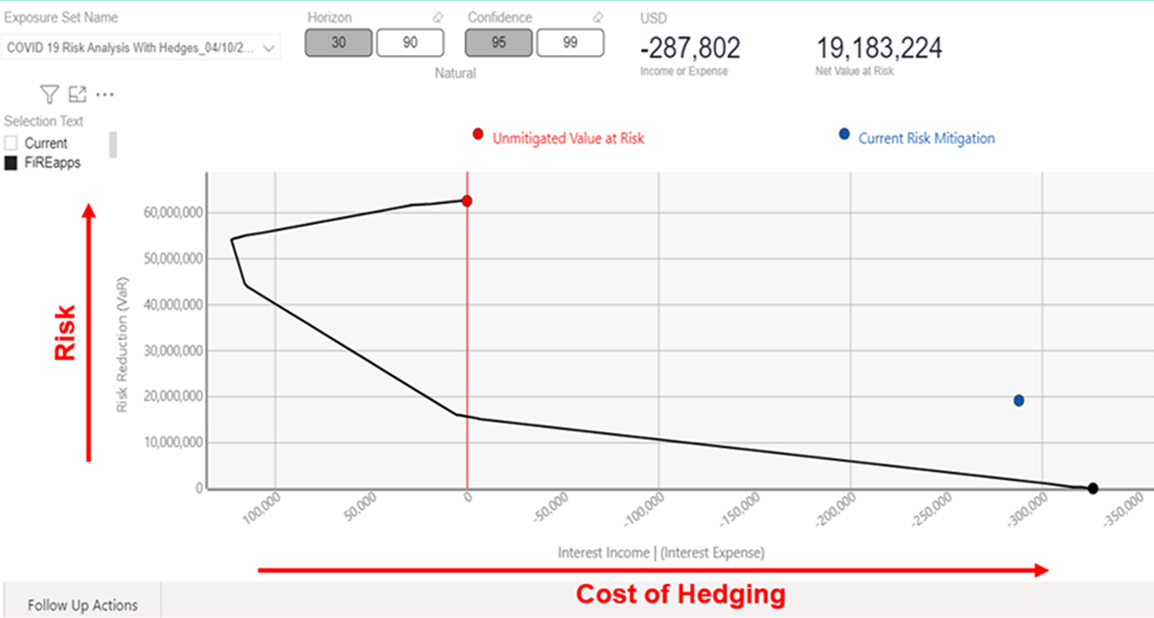

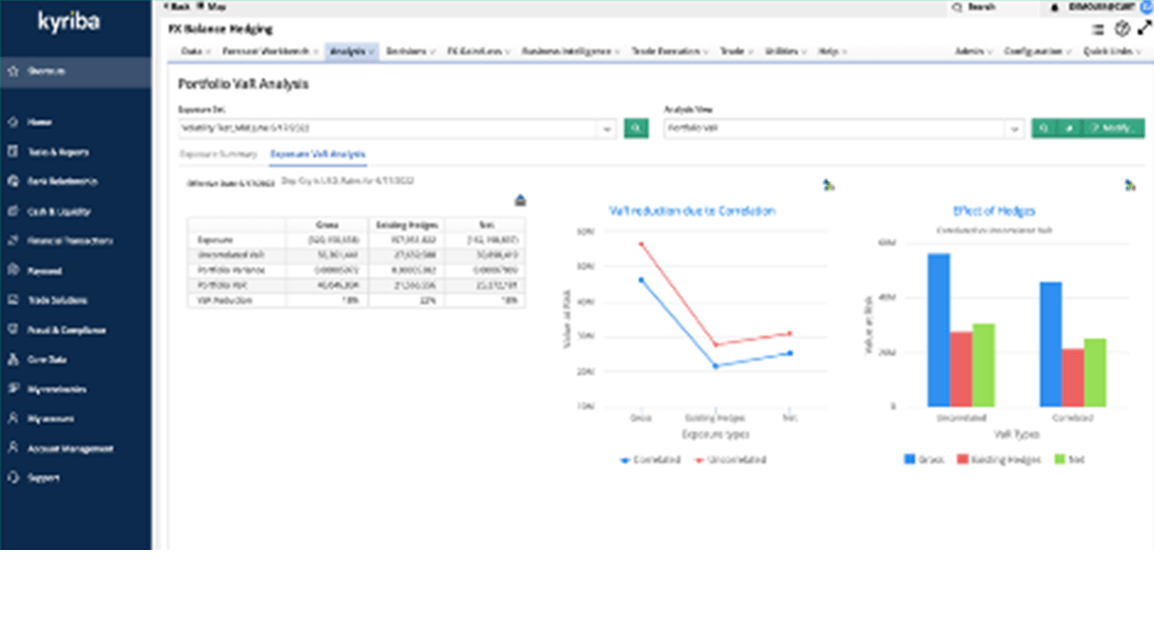

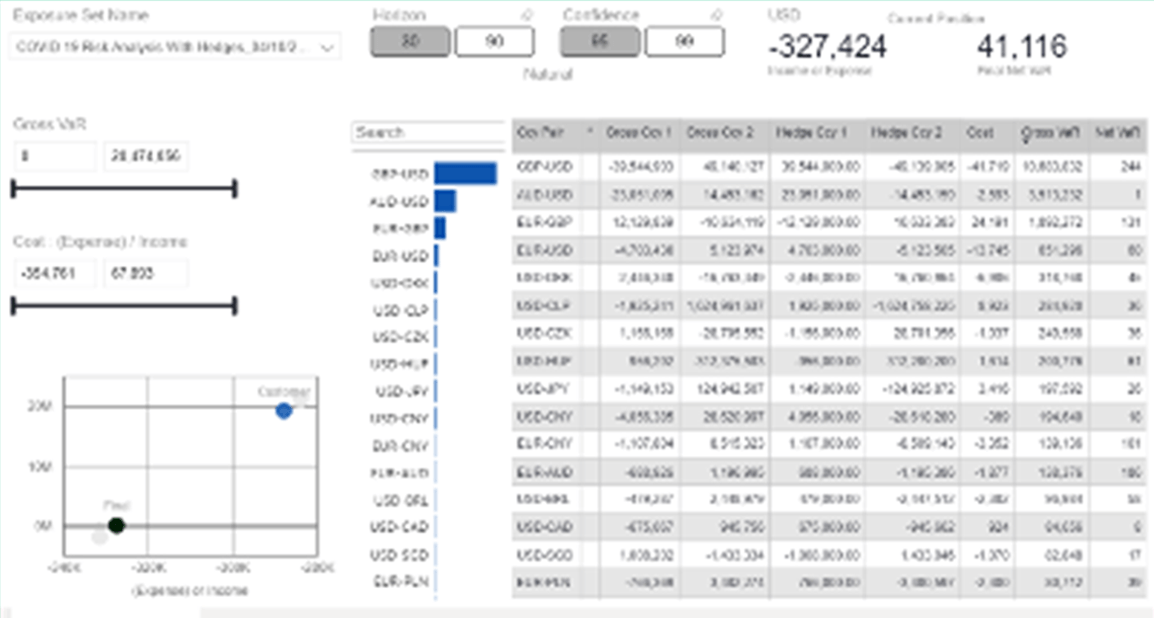

Kyriba FX Risk Advisory leverages our expertise and tools to rapidly perform proprietary FX risk analytics on your portfolio of exposures. Value at Risk and Cost of Carry intelligence can identify the optimal hedge coverage at acceptable cost levels. This allows companies to mitigate the recent cost of hedging hurdles without leaving excessive P&L and EPS risk exposed.

Figure 2. Kyriba CoRE Analysis – Currency Analytics

Figure 3. Kyriba Portfolio VaR Analysis

Figure 4. Kyriba CoRE Analysis – Portfolio Analytics

Balancing Speed and Analytics in the Face of FX Volatility

Would you rather make the wrong decision quickly, or the correct decision too late? In the world of FX hedging, both options leave a company too exposed to volatility, and the market is not sympathetic to this trade-off. Making the wrong knee-jerk decisions can be detrimental, but companies also cannot afford to get trapped in a paralysis by analysis holding pattern.

Kyriba understands that right now, companies need an intelligent analytical assessment of their FX risk in a short period of time. Part of that timing involves effectively communicating your risk profile and mitigation recommendations to all senior management stakeholders, so that the analysis can lead to quick and decisive action. Our approach is designed to respond quickly while delivering clear outputs and recommendations. Kyriba can deliver depth within a short timeframe, ensuring the most appropriate response to current market conditions.

Reach out to our FX Risk Advisory team today to achieve quick wins with our technology enabled risk assessment methodology. Whether looking at hedging for the first time or looking to adapt existing hedge programs to new market conditions, we are ready to partner with you.