Blog

COVID-19: A Wake-up Call to Better Manage Working Capital and De-risk Supply Chains

Much has already been said and written about COVID-19 and its impact on the world. Despite multiple life-stimulating attempts by Feds and governments worldwide, the world is on the verge of falling into a deep recession. Stock markets are barely recovering from the worst crash since the infamous “Black Monday” of 1987. The global pandemic has brought the world to a halt – and it is going to be a while before we can re-crank the economic engine.

A Unique Demand and Supply Conundrum

We are experiencing a very rare event. Both demand and supply are succumbing to tremendous shocks in various industries whereas some vital sectors (e.g., agriculture, consumer goods, medical supplies, etc.) are seeing significant, and rarely seen, demand surges. Currently, we are seeing three main demand and supply scenarios play out:

- Immediate Demand Surge – Supply Shock: Sectors providing food, essential personal care and health goods have been experiencing “stockpiling” and demand in these sectors has gone through the roof because of panic purchases. Those companies are struggling to meet exponentially increasing and unexpected demand, despite core suppliers pushing the limits of their production capacity.

- Mid-term Demand Shock – Supply Shock: Non-essential industries such as retail and electronics are a part of what we refer to as the mid-term demand shock – supply shock category. They are experiencing a lagging demand that will likely bounce back relatively quickly once different parts of the world start coming out of quarantine.

- Long-term Demand Shock – Supply Shock: Non-essential, premium/luxury products and related industries such as automobiles, travel, hospitality and tourism are a part of the long-term demand shock – supply shock category and will most likely experience a much lower recovery rate in demand. As such, they are likely to struggle the most to avoid bankruptcies and serious cash flow crunch while wrestling with supply chain woes.

Possible Actions for Short-term and Long-term Horizons

Demand shocks have been tackled in the past with policies and steps taken by governments that make borrowing cheaper and inject massive liquidity in the market. We are already seeing such attempts in play. However, supply shocks of this magnitude are extremely rare and difficult to manage. The parallel we can draw with the current situation is the United States in 1970s when the oil supply crisis led to stagflation. These are very uncertain times and no one seems to have a manual on how to react.

Despite the heightened level of uncertainty, there are some strategies and tactics companies and industrial sectors should consider following based on demand and supply curves:

In the Short-term (2 to 3 months)

- Examine Cash Flows – It is first necessary to get visibility into cash and cash flows to understand whether the company is in a severe liquidity crunch or has a strong balance sheet that can withstand the demand shock intensity applicable to its industry.

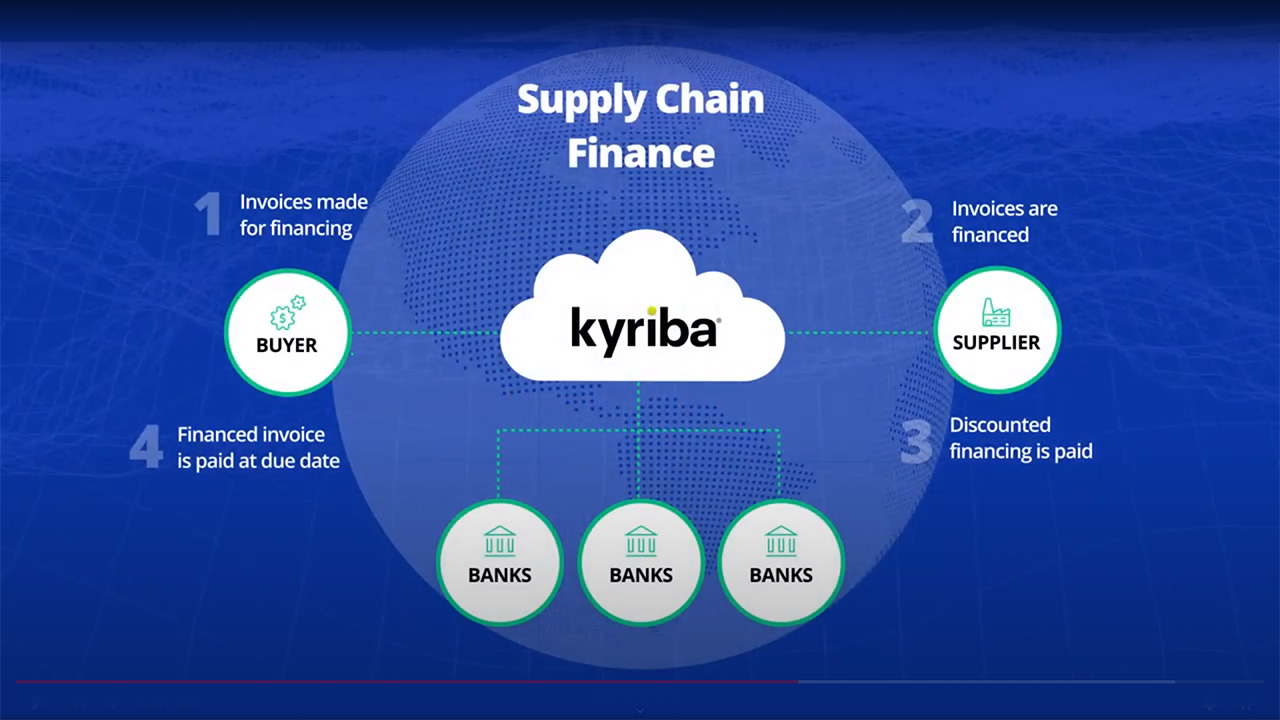

- Support Supply Chain Weaklings – Identify the company supply chain’s weakest links, especially as it applies to resiliency and production capacity in tier one and tier two supplier bases. Then, depending on each company’s cash and cash conversion cycle, find ways to shorten the cash conversion cycle while simultaneously supporting suppliers with self-generated (early discount) or externally funded (supply chain finance) programs.

In the Long-term (6 to 12 months)

- Expand Coverage – Facilitate a systematic and holistic review of the cash conversion cycle and expand available programs or create new ones to ensure the health of the entire supply chain.

- Diversify the Supply Chain – Arrange for alternate sourcing mechanisms and partners to avoid concentration or high dependency on certain suppliers or regions. This requires building production plans in different regions around the world or looking/developing supplier capabilities closer to the home market. Both would necessitate an injection of capital that can be funded from streamlining the financial supply chain and unlocking cash flows within existing supply chains.

Can Working Capital Programs Come to the Rescue Once Again?

When the world was going through avalanches of bankruptcies and cash flow problems during the financial crisis of 2008, which generated demand shocks and triggered significant global supply chain risk, many companies (especially manufacturing and retail) found solace in supply chain finance programs to help improve their survival rate and future preparedness during the liquidity crunch.

Only time will tell if more companies will adopt such programs to recover from the COVID-19 crisis. However, as Mark Twain said, “History doesn’t repeat itself, but it often rhymes.” And one can anticipate that more companies will adopt more formal and structured working capital management programs like supply chain finance (SCF) or self-funded early payment. Adopting a working capital optimization program has many benefits, including:

- Reducing the Cash Conversion Cycle/Supplementing Cash Flow – Companies experiencing a third-degree cash flow crunch can extend payment terms with an SCF program. This will allow suppliers to get paid earlier, shielding them from the negative impact of prolonged payment terms. SCF programs enable buyers to significantly reduce their cash conversion cycle, freeing up cash flow while also incentivizing the suppliers that participate with accelerated payments.

- Providing Financial Support for Suppliers with Internal or External Funding – When critical supplier’s financial health is more adversely impacted than the company itself, it may be advantageous for the company to quickly propose early payment programs to suppliers, either with its own cash or through external funding sources without extending existing payment terms.

- Gaining “Preferred Buyer Status” – In industries in which suppliers are in high demand, investing in working capital optimization programs will pay out “capacity dividend” to secure production lines immediately or in upcoming demand surge periods.

- Supporting Alternate Supply Chain Sourcing/Diversification – Companies that need to set up new production facilities or secure/develop alternate supplier sources to avoid high dependencies on a single region or entity will require investment capital. Such capital can be sourced from supply chains when payments are streamlined with working capital management programs such as SCF.

Over time, supply chains have become more complex and global. Currently, 94% of the Fortune 1,000 companies are experiencing COVID-19 supply chain disruptions. Almost every business will feel the impact on some level. But one thing is certain, when we come out of the current crisis the world will be different. Some experts predict that this is just a trailer and, unless we seriously change our course of actions and priorities, this is just the first in a series of crises. Our new normal will be punctuated with an even flow of quiet periods and prolonged crises. The importance of establishing working capital programs that streamline cash flow, support suppliers and promote sustainability to withstand or avoid crisis is no longer a luxury. It is part of accepting a preparing for the new normal.

So, the million-dollar question is what will companies eventually end up doing in the near-future and longer-term horizon to better prepare for and withstand an unprecedented crisis like COVID-19? We have learned the hard way that we are far from handling such situations smoothly. We need to rethink the old paradigm and get ready for a more turbulent and uncertain tomorrow by leveraging every weapon in our arsenal. Organizations should strongly push for working capital programs to shore up liquidity preparedness while improving their odds of success when the tide turns. Remember it’s not a matter of if, but when. The winning companies will be those that can increase both their financial survival and success rates.

To learn how you can accelerate your cash conversion cycle and free up working capital, download our quick reference guide, “Making the Business Case for Supply Chain Finance and Dynamic Discounting.”