Blog

Treasury’s Opportunity During a Crisis

The COVID-19 pandemic has already caused panic in financial markets, with anyone’s guess how much more damage is yet to come. In the face of crisis, corporate treasury teams are still expected to calm the storm within an organization, especially in an environment that features as much concern, panic and uncertainty as we are seeing evolve nearly every day. As CEOs and boards balancing potential policy changes in the midst of trying to assess waves of news and data, treasury must continue to perform without missing a beat by excelling in three critical areas – business continuity, active liquidity and minimizing disruption to global supply chains.

Business Continuity

In many cases, treasurers are being asked to plan for temporary and continued work from home scenarios, especially in Asia and Europe. And while many treasury teams already have some degree of business continuity planning for short disruptions, today’s crisis may demand longer-term planning, meaning that treasury’s business continuity plan must incorporate security, IT support, productivity and controls.

Security

The first priority for teams working remotely is to ensure that data and/or workflows are secure, and that working remotely does not create more risk for the organization. If there are any concerns over login procedures (e.g. only requiring userID and password to access your TMS), you shouldn’t be working from home until your information security team can ensure remotely accessing treasury systems does not create unnecessary risk.

IT Support

Ideally, no IT support is required to utilize all treasury systems while working from home. Unfortunately, emergency work from home scenarios can yield many surprises – and some treasury teams find out too late that their TMS requires accompanying software, access to local networks for import of data (e.g. from ERP), separate custom reporting software or other IT requirements. To be effective, your treasury systems should not require additional IT support just because you are working from home – and they should be device independent so you can use your phone or tablet without losing key features.

Productivity

Treasury team members must have all the same capabilities and tools available regardless of their location so that treasury is just as productive remotely as they are in the office. Especially in times of crisis, information demands from the CFO, CEO and the board will come in real-time, making it critical for treasury to operate at full capacity even when working from home.

Controls

A challenge many treasury teams have is that procedures may change when treasury employs business continuity plans. For example, some treasury teams’ backup plan is to initiate and approve payments in bank portals, instead of the TMS or ERP, when working remotely. This can be especially troublesome as payments wouldn’t be centralized, meaning that treasury gives up global visibility into payments and has no way to run fraud detection screening. Further, approval procedures will differ when using multiple payment systems and/or bank portals, meaning that backup documentation would not be centrally stored, also making global policy and approval limits difficult to track. This not only drives inefficiency, but also creates an opportunity for policy non-compliance and potentially payments fraud. Unfortunately, anyone that knows of these procedural inconsistencies – or uncovers them through social engineering – is in a good position to exploit those exposures to their advantage.

Active Liquidity

The most important question CEOs are asking of finance is “do we have enough cash?”. Uncertainty about near-term liquidity is high, with vast uncertainty about how long the crisis must be weathered. While very few stocks withstood the mass selloff in equity markets, value-seeking investors are searching for corporations with strong balance sheets and strong access to liquidity. As a result, an active liquidity strategy to see, protect and grow cash will be rewarded.

Treasury can offer strategic value to the CEO and the board by delivering on three key KPIs:

1. Perfecting the Cash Forecast

CEOs and CFOs are being asked by investors and analysts about current and projected cash balances, as well as free cash flow guidance. Treasurers cannot afford to be conservative with their cash forecasting, leaving extra idle cash just in case they are wrong. Minimizing cash required for working capital purposes alongside optimizing investment of excess cash – especially against the backdrop of an unexpected interest rate cut – creates an opportunity for treasurers who excel at liquidity management.

2. Protecting Against Currency Volatility

For most major currencies, FX rates haven’t been as volatile as equity markets, yet near term volatility can still wreak havoc with cash flow projections and earnings results. Regardless of their organizations’ hedging policies, treasurers who lack perfect insight into currency exposures will face difficult questions if FX works against them, especially when the investment community knows full well that “currency headwinds” are not an excuse to lose money. Armed with insight into exposures and the effectiveness of hedging and/or natural currency offset strategies will help their CFOs and CEOs weather the crisis.

3. Operating as a Profit Center

In a recent CFO.com survey, 78 percent of respondents indicated that treasury operated as a profit center, with earning interest income, in-house banking and managing supplier discounts as the top methods to drive financial performance. Recent interest rate cuts, and the possibility of more to come, challenge treasury teams to reduce reliance on interest income and shift focus to bank fee reduction, digital transformation and other cost efficiency objectives. A data-driven treasurer is in a far better position to unlock opportunities to create value and reduce costs than those treasury teams that are playing from behind, buried in manual processes and reporting.

Minimize Disruption to Global Supply Chains

At first glance, minimizing supply chain disruption will seem like a difficult objective for treasurers. How can treasury have any influence over supply chains in affected regions, such as Italy, South Korea or China? Yet, treasurers actually have an incredibly strong lever at their disposal – they have cash.

In times of crisis, large organizations focused on cash preservation may be tempted to improve working capital by delaying payments. This is not a new concept; SME suppliers have been feeling the crunch for many years, especially as many industries extend payment terms to 45, 60, 90 days and beyond.

While this DPO strategy obviously “generates” cash, it does so at the expense of suppliers who may be especially feeling the crunch of quarantines, intermittent production cycles and distribution challenges.

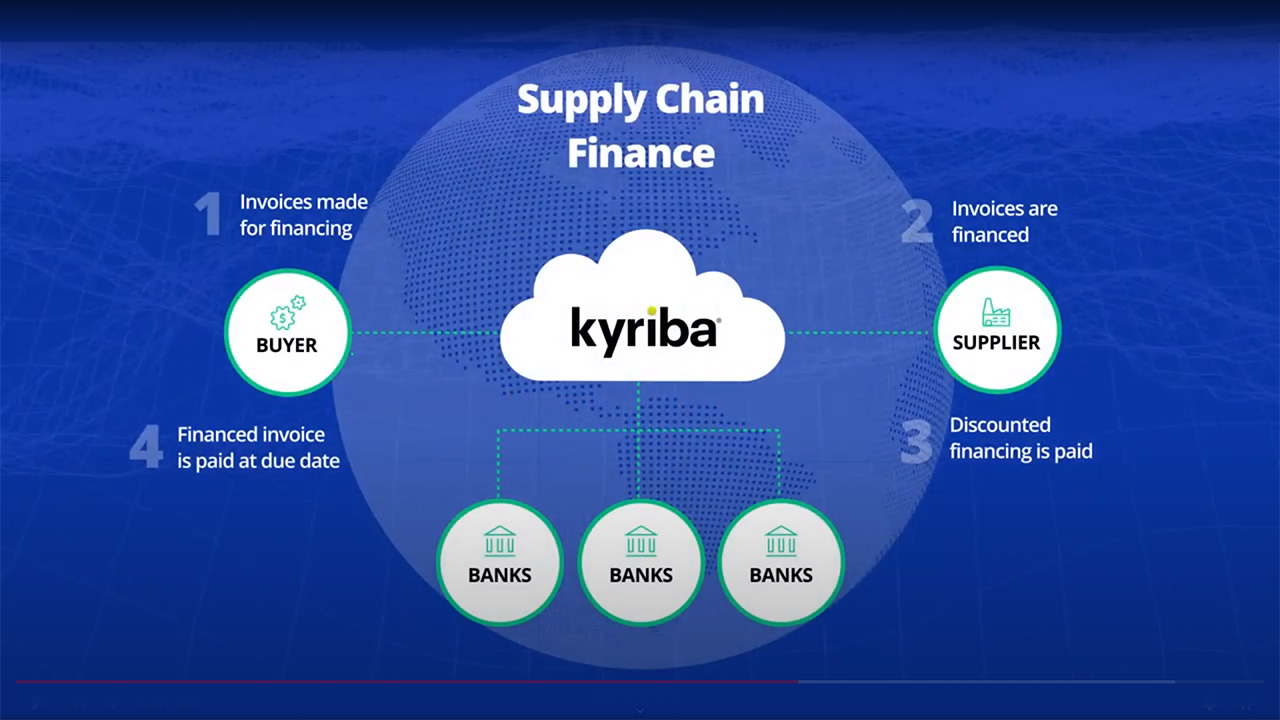

Instead, treasurers can actually help suppliers by offering early payment terms in return for a small discount or via supply chain finance banking partners. Injecting liquidity into the supply chain may offer a financial lifeline to suppliers while at the same time reducing the risk of supplier disruption. Further, treasurers will either improve their own return on cash – especially as money market rates have plummeted – or increase days payable outstanding (DPO) by collaborating with a financing bank.

Whatever the cash and working capital KPIs, early payment financing can offer a win for treasury while simultaneously supporting the liquidity needs of their SME suppliers.

While the coronavirus-infused crisis hopefully ends as quickly as it began, treasury teams can improve their preparedness for temporary and longer-lasting scenarios by practicing business continuity plans, implementing an active liquidity strategy and collaborating internally to inject liquidity into their organization’s supply chains. Treasurers who excel in each of these areas will not only support their management teams but also emerge as valued strategic advisors, creating further opportunities to influence and drive success.