Develop Leading FX Risk Management Programs Through Automation

Nearly every company doing business beyond its own borders faces the challenge of developing cost-effective FX risk management programs, and each year corporations incur billions of dollars in currency related losses due to global currency volatility. Even small organizations with modest international operations can be impacted by currency exposures if treasury fails to effectively manage foreign exchange (FX).

In many cases, these losses are attributable to manual, spreadsheet-based currency risk management programs and processes, which are vulnerable to human error and faulty hedging strategies — strategies that hinge on inadequate or incomplete data. Ongoing FX volatility, lack of access to accurate and timely data, and real time responsiveness to exposure and market risk changes put demands on organizations to embrace fully-automated FX risk management programs.

Regardless of the sophistication or complexity of an organization, every corporation can benefit from automated FX risk management. This is true even for larger or more sophisticated companies already utilizing general treasury software or trading platforms. In fact, automated FX risk management programs can enhance the value of a trading platform, ERP(s) and other technologies.

What Does Automating FX Mean?

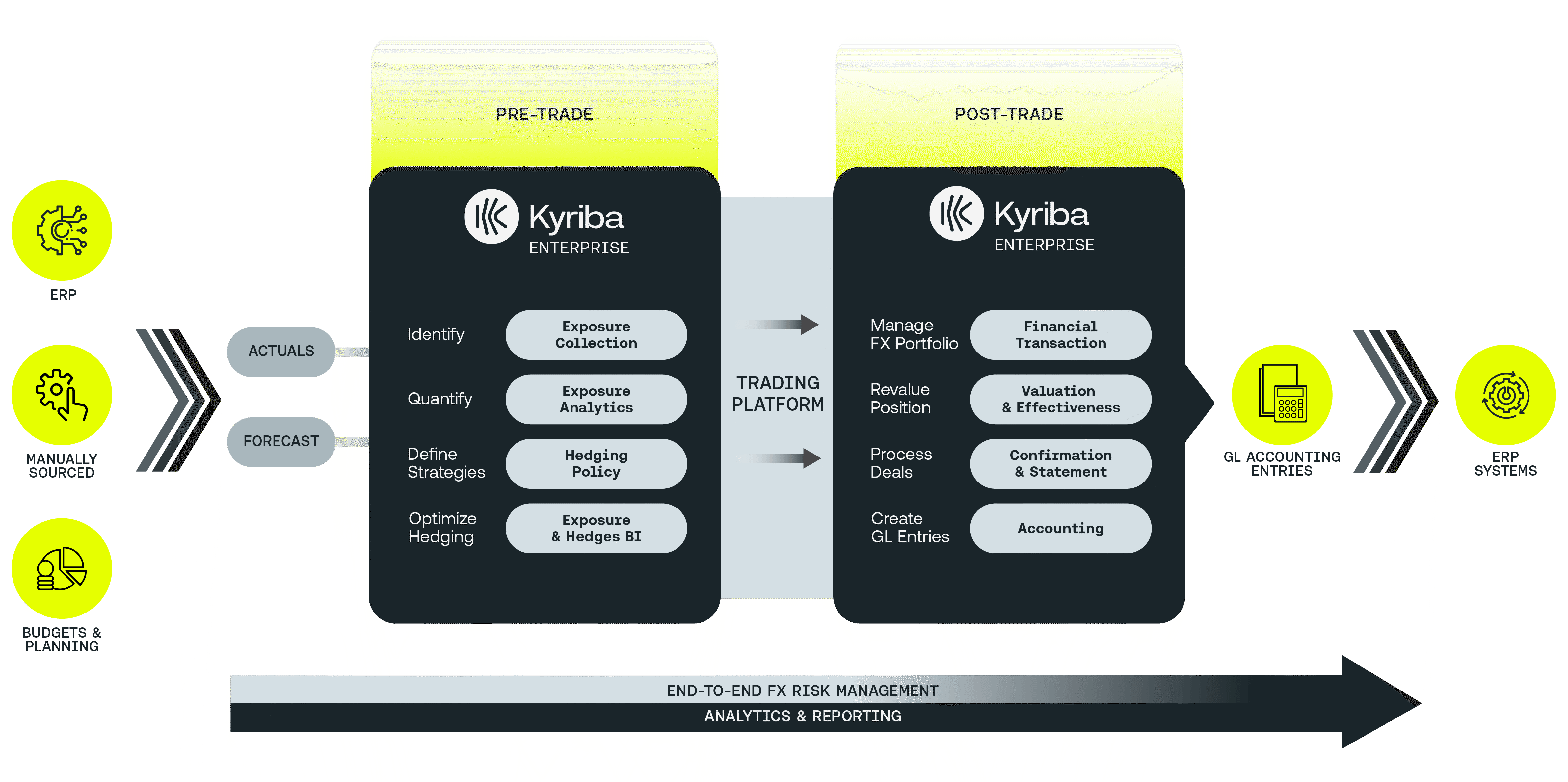

Automation involves modernizing procedures by systematizing each step of a process, eliminating the need for manual intervention along the way. Within the FX risk management programs, this may include automating processes for the data collection exposure consolidation, calculation and analysis, as well as hedge recommendation.

Automation also involves seamlessly integrating multiple systems, including ERPs, trading platforms and market data providers to ensure exposures are aggregated easily and automatically with the latest technology, like APIs.

At Kyrbia, we advise corporations to consider three types of FX automation when looking to enhance their FX risk management programs

- Data Transfer Automation to optimize the data gathering portion of FX risk management, which ensures human “touch-points” are minimized and the potential for error is reduced.

- Workflow Automation to identify and establish exposure benchmarks across the enterprise, ensuring consistency and eliminating currency surprises.

- Process Automation to introduce complete, end-to-end modernization to ensure errors are mitigated, efficiencies are maximized and risk is eliminated.

The Benefits of Automated FX Risk Management Programs

Although automating FX may sound intimidating, by working with the right technology and fintech provider, it can often be completed easily and quickly with quick-strike benefits.

Automation eliminates the need for manual intervention, reducing the potential for costly human errors. Diminishing the need for manual involvement frees treasury professionals from having to gather data from multiple sources, giving them more time to analyze information, track exposure trends and proactively seek out other opportunities to eliminate risk.

Automation transforms how treasury professionals are perceived within an organization, allowing them to be seen as resources in strategic planning. By using automated FX risk management programs, organizations also gain:

- Improved efficiency

- Significant time savings

- Increased FX controls

- Greater insights into FX exposures

- Reduced currency impacts to earnings

- Optimized FX risk management costs

- Managed impacts from FX risk

Leveraging technology allows organizations to perform risk analytics on command, becoming less dependent on financial institutions or outsourced service providers. This provides the most flexibility, visibility, and control over an FX program while not losing time on external dependencies.

By dividing the automation of foreign exchange management into three distinct profiles, we can better examine where companies stand with their current FX programs and determine what steps they need to take to achieve full automation.

These three profiles are broken out by companies looking to expedite processes, create flexible & adaptable workflows, and enrich data intelligence to optimize FX risk management programs.

Expedite: The “expedite” category describes corporations that are interested in incrementally improving their existing FX management programs through efficient data processing. Generally, companies that fit this profile type rely on manual processes that are vulnerable to errors. The CFO may be interested in transitioning away from a spreadsheet-reliant program and looking to automate data aggregation and facilitate in-depth exposure analyses.

Adapt: Global organizations have dynamically changing exposure & risk profiles within a continuously changing foreign currency market. Organic growth, acquisitions, and restructurings can leave hedge programs frequently chasing down issues if the FX risk management program is not designed to quickly “adapt” to evolving conditions. When it comes to FX, chasing down issues ultimately puts the organization at higher risk of ineffective risk mitigation decision and negative P&L impacts.

Enrich: The “enrich” category describes highly-complex organizations seeking to take advantage of efficient processes by shifting efforts to more strategic analysis. Companies in this category have optimized the blocking and tackling of operating an FX risk management program, and are now ready to leverage automation to improve data inputs and risk forecast assumptions. Hedge programs will maximize effectiveness the more hedge decisions accurately align with actual business activity.

Editor’s Note

Companies in each one of these profile types have distinctly different challenges and operate at varying levels of sophistication, but they all share a common trait: the need to automate their FX programs.

Three Corporate Profiles, Three Automation Success Stories

Every corporate environment offers unique challenges, and the following anonymous case studies illustrate how automated workflows can enhance a company’s FX risk management programs — regardless of the inherent complexities. The specifics for each company in this eBook vary— some used FX trading platforms or had previously established in-house banks.

Regardless of the specifics, after modernizing their programs, each organization saw near immediate quantifiable results, including improved operational efficiencies, time savings, reduced expenses and reductions in currency-related risks.

1. Expedite: A $6 Billion Global Electronics Manufacturer

Why They Automated

The company relied on a manual, forecast-based, legacy balance sheet FX program requiring treasury specialists to gather spreadsheets every month from 30 entities around the globe. They consolidated the forecasts, uploading and executing the appropriate trades manually. This process took four days in total (two days for data consolidation; two for currency hedging), requiring additional steps, touch-points and manual calculations along the way – all of which amplified the potential for human error.

Solution

The company looked for a solution to help them design an automated program. Kyriba’s Balance Sheet FX solution offered the cutting-edge SaaS technology and back-end support needed to complement their existing forecasting processes. With Kyriba, their new FX solution enabled a streamlined data aggregation process and initial exposure analysis. This, in turn, supported the development of an end-to-end, automated workflow, which helped the FX team improve their analysis and adjustment process.

The team aggregated data for all entities at a corporate level and then executed trades and hedge accounting with a seamless integrated trade execution portal. By using Kyriba's FX risk management solution, treasury could select what to trade and the trades would immediately be processed. This eliminated unnecessary steps while adding more rigid controls, reducing the likelihood of human error causing something to go wrong during the trade process. The time savings and assurances that processing errors are reduced allow the company to spend more energy on strategic analysis.

Outcome

Kyriba significantly improved the data aggregation and exposure calculation processes, but seeing the trend analytics and having the ability to compare datasets in the system were also vital. With their new FX risk management solution, treasurers could quickly break down exposures – by entity –and identify what drove the changes while drilling into specific accounts.

This was a monumental change compared to their manual processes which did not allow for this advanced degree of reporting; nor did it offer the granular details they needed.

Automation saved time and reduced the potential for error. With the click of a button, trades were moved from one system to the next. Treasury no longer needed to open different files, copy, paste and upload separately. This saved significant transaction time, which amounted to many hours saved each month due to the frequency of trades.

Additional Benefits

- The modernized process gave the FX team more time to analyze data and identify trends. Better still, the entire process could be completed in less than a day compared to the manual process, which took about four days to complete.

- FX professionals could make daily adjustments in exposures, enabling them to immediately identify if – and where – the forecast was off and how to best align currency hedges.

- The treasury team could also lower the exposure hedge threshold while expanding the number of currency pairs tracked and traded. This helped improve the data collection to hedge execution process by 60 percent.

- The treasury team lowered corporate hedge thresholds to less than $200,000.

2. Adapt: A $15 Billion Consumer Goods Company

Why They Automated

With most of the treasury department’s efforts spent manually collecting error-prone data, company decision-makers realized they needed to upgrade their treasury infrastructure. Gathering balance sheet data alone required tapping into 38 different systems in a legacy ERP environment.

This antiquated process limited opportunities for the team to focus on data analysis and risk mitigation. These issues were compounded because the company was acquiring another, smaller company at the same time. Executives tasked the FX team from the smaller company – which was already resource-challenged – with managing the post acquisition currency program.

The post-acquisition balance sheet program was only hedging one-off inter-company loans and FX trades were executed over the phone. Rolling and settling hedges required constant manual intervention. Additionally, FX hedges in spreadsheets (managed by multiple employees) were an ongoing headache because the cost of wrong-way trades or over/under hedging was high. Cohesive, end-to-end automation was needed to improve efficiencies.

Solution

Executives recognized the need for an automated program, eliminating the risk of manual errors. The company introduced a customized backbone treasury infrastructure that drew on best practices and offered various treasury technology solutions, including a currency analytics solution, a TMS and a trading platform.

For its balance sheet program, the entire hedging process was automated – including weekly collections of exposure data from local business units, ERP systems, spreadsheet uploads and user inputs. Once balances were collected, the team analyzed exposures to determine the external hedging needs. These were executed using an automated trading platform and housed in the new treasury workstation.

Kyriba was chosen not only as their TMS, but the company chose its Balance Sheet FX solution to be used as a centralized FX risk center, facilitating automated data collection, exposure calculations and hedge recommendations through technology-enabled automation with the ERP systems, Kyriba TMS and trade executive portal.

Within Balance Sheet FX, the team had visibility into individual entities and profit center details. Data was sourced from 38 legacy ERP systems via a weekly template (from 25 local business units) and SAP automatically pushed the data to Kyriba. Outstanding hedges were automatically transferred and uploaded to display net exposure. Kyriba then created recommended hedge actions based on the corporate policy and generated trades netted at the corporate level for all exposure balances.

Trades were sent (via direct automation) for execution. Confirms were sent back to Kyriba for automated entity-hedge allocation and reconciliation.When the companies acquisition closed, Kyriba provided a strong FX risk management solution framework that made it easy to integrate the new entities. Rather than taking months to work with new entities to gather exposure data and educate new employees, the company could quickly guide entities in how to adopt FX processes and follow policies.

Outcome

By automating, the company revented its treasury infrastructure from the ground up. The transformation took place at the same time the small treasury team managed its day-to-day responsibilities – while the company executed six acquisitions and four divestitures.

Additional Benefits

- The new workflow significantly reduced cumulative FX transaction net losses from$88 million to less than $2 million.

- The notional size of the balance sheet hedging program increased from $800 million to $2 billion.

- Hedge accounting documentation now saves the company $120,000 per year thanks to consolidating technology platforms.

- Trading fees have been reduced by more than $1.3 million in 12 months.

3. Enrich: An $8 Billion Specialty Food Company

Why They Automated

The company originally relied on a non-formalized, manual cash flow exposure forecasting process – one that was completed ad hoc, using numerous spreadsheets and a variety of touch-points. Data collection was inconsistent, calculations were completed manually and the potential for error was high.

Across the business and reporting structures, many currency pairings were complex and represented significant risk. Reviewing spreadsheets and formulas for each forecast period was resource-intensive, requiring the treasury team to manually review each submission.

Additionally, comprehensive management reporting was limited, despite the amount of time devoted to the task.

Solution

Prior to evaluating FX technology to address their needs, the company conducted an inventory of necessary data required to support a more formalized process and quarterly hedging cycle. The goal was to ensure – when an opportunity to hedge was identified, or the business required a hedge – the team had all the necessary data to act quickly. Once the inventory was finalized, they sought out technology that would further enhance their workflow.

The company’s cash flow forecasts were integrated with Kyriba’s Balance Sheet FX reporting reflecting existing hedges, creating an initial view of net exposure by entity. After reviewing the exposure and making desired adjustments and edits, the team executed a decision process in Kyriba to recommend hedges at an entity level (applying the company’s policy-defined threshold, target ratios and level of materiality, creating a report that allocates decisions by entity, currency pair and account group).

Kyriba then created trade recommendations for the company’s in-house bank, including internal and external trades, displayed within the application for review. Once recommended trades were approved, the system generated a report of external trades which are sent automatically to an integrated trade execution portal. Kyriba then received the trade confirms, allocating them back to individual entities.

Outcome

The new workflow empowered the company to standardize a process with currency pairs, exposure types, geographical details and entity information. With corporate-mandated standardization in place, the implementation facilitated improved reporting with complete flexibility supporting individual user-defined views. This proved to be a significant time-saver, enabling the treasury team to focus on analyzing the accuracy of the forecasts, which helped eliminate nearly all calculation errors.

Additional Benefits

- The ability to segregate and analyze specific data sets significantly reduces the time spent on reporting. Previously, it took at least three days (per quarter) to complete; now the process takes less than six hours (including collecting and uploading data and completing board presentations).

- The company has seen a 50 percent increase in participation in the forecasting process.

- Realized increased flexibility in the reporting. The company’s new workflow offers more details on all proposed actions.

- The increased collaboration and visibility allowed the team to add four new entity currency pair combinations to its existing hedge program. There has also been a 50 percent improvement in corporate target hedge ratios.

Conclusion

Before automating, each company profiled had the potential to endure significant losses (due to human error and faulty, incomplete data). After automating, each organization – regardless of its size and complexity – saw near-immediate benefits.

Most importantly, each experienced a reduction in FX-related losses, managed impact from volatility and a substantial decrease in unmanaged FX currency risk.

Kyriba is committed to helping organizations improve the impact currency exposure has on corporate financial results by offering best-in-class technology and services. With Kyriba, organizations can reduce risk, reduce costs and streamline processes.

Kyriba facilitates end-to-end automation, which includes direct ERP data extraction and aggregation, forecast consolidation, exposure and risk analysis generation and automated risk transfer and trade execution connectivity to banking portals and trading platforms using state-of-the-art, highly-secure SaaS solutions.

If your organization is dependent on a sluggish, error-prone manual FX program, you should know adopting an end-to-end, fully-automated currency risk management program can help you achieve the kind of benefits detailed in this eBook. Kyriba has helped leading multinationals and small and mid-size companies with FX exposure, to successfully transition from manual FX programs to modernized, cost-effective programs.

Join our latest

demo session

to learn about

FX automation

Related Resources