FAQ

What is Treasury Data Analytics?

Treasury data analytics is the practice of using data analysis techniques to gain insights into a company’s treasury operations, including cash and liquidity management, investment portfolios, risk management, and supply chain finance. Treasury data analytics involves collecting, processing, and analyzing data from multiple sources, including bank statements, cash flow statements, financial reports, and market data.

Advanced analytics techniques used in treasury data analytics include data mining, predictive analytics, artificial intelligence, and machine learning. These tools help treasurers to identify patterns, trends, and outliers in their data and to make predictions about future cash flows and market conditions.

Treasury data analytics is a critical component of modern treasury management, helping treasurers to make informed decisions, optimize their cash management strategies, and manage risks more effectively.

Table of Contents

- How Does Treasury Data Analytics Work?

- Why is Treasury Analytics Important in Treasury Management?

- How Can Treasury Data Analytics Help in Managing Financial Operations?

- What Are the Benefits of Treasury Data Analytics for Financial Analysis?

- Key Metrics and Tools Used in Treasury Analytics

- What Are the Challenges in Implementing Data Analytics for Treasury?

- What Are the Best Practices for Using Data Analytics in Treasury?

- The Role of Treasury Data Analytics in Liquidity Management

How Does Treasury Data Analytics Work?

Treasury data analytics involves several steps to collect, process, and analyze data to gain insights into a company’s treasury operations. The typical process for treasury data analytics includes the following steps:

- Data collection: Collect data from multiple sources, including bank statements, cash flow statements, financial reports, and market data. Store in a centralized database or a data warehouse for easy access and analysis.

- Data cleaning and preparation: Clean and prepare data for analysis by removing duplicates, fixing errors, and filling in missing data. Then, organize the data into a format that can be easily analyzed.

- Data analysis: Use various data analysis techniques, such as data mining, predictive analytics, and machine learning, to analyze the data and help identify patterns and trends.

- Visualization and reporting: Present the data in a meaningful way, using data visualization tools, such as charts and graphs, or through reports that summarize the key insights from the analysis.

- Actionable insights: Use the insights gained from the analysis to inform decision-making, optimize cash management strategies, and manage risks more effectively.

In general, treasury data analytics involves a combination of technical skills, domain knowledge, and business acumen to effectively collect, process, and analyze data to drive better decision-making in treasury management and financial analysis.

Why is Treasury Analytics Important in Treasury Management?

Treasury data analytics is important in treasury management and financial analysis because it provides treasurers with actionable insights that can inform their decision-making, improve cash forecasting accuracy, optimize cash and liquidity management strategies, identify potential risks and opportunities, and ensure compliance with regulatory requirements.

Traditionally, treasurers used simple historical models to predict future cash flow requirements. However, these models are not sufficient for today’s fast-paced business environment, where companies need to quickly adapt and leverage large sets of data to make important financial decisions.

Legacy thinking and outmoded systems are incapable of modeling to predict fiscal uncertainty. Consequently, organizations using these ineffective methods will not be able to manage the rate at which volatility impacts EBITDA. Using treasury analytics is key to improving forecasting accuracy. Predictive cash flow analytics that use advanced statistical modeling and artificial intelligence provide the flexibility to adapt to changes in the market.

Reasons why treasury analytics makes a difference for treasury practitioners:

- Enhanced Cash Management: By analyzing historical data, cash flow patterns, and market trends, treasurers can optimize cash management strategies, ensure sufficient liquidity, and make informed decisions regarding working capital, cash investments, and funding requirements.

- Risk Identification and Mitigation: By utilizing sophisticated modeling and scenario analysis, treasurers can quantify and evaluate various financial risks, develop matching hedging strategies, and implement risk mitigation measures to protect the organization’s financial health.

- Informed Decision-Making: With access to comprehensive data and analytics, treasurers can choose the most optimal courses of action aligned with the organization’s financial goals.

- Compliance and Regulatory Requirements: By analyzing data and monitoring financial activities, treasurers can identify any potential non-compliance issues, monitor adherence to internal and external policies and regulations, and generate auditing reports for regulatory authorities.

- Strategic Planning and Forecasting: By analyzing historical cash flow data, market situation, and macroeconomic indicators, treasurers can better align treasury strategies with the organization’s overall strategic objectives.

- Continuous Performance Improvement: Treasury analytics facilitates the set-up of key performance indicators (KPIs) and metrics so that treasurers can track and evaluate the effectiveness of treasury initiatives and identify areas for improvement.

How Can Treasury Data Analytics Help in Managing Financial Operations?

Using treasury analytics enables data-driven decision-making and improves financial operations by providing the following types of data:

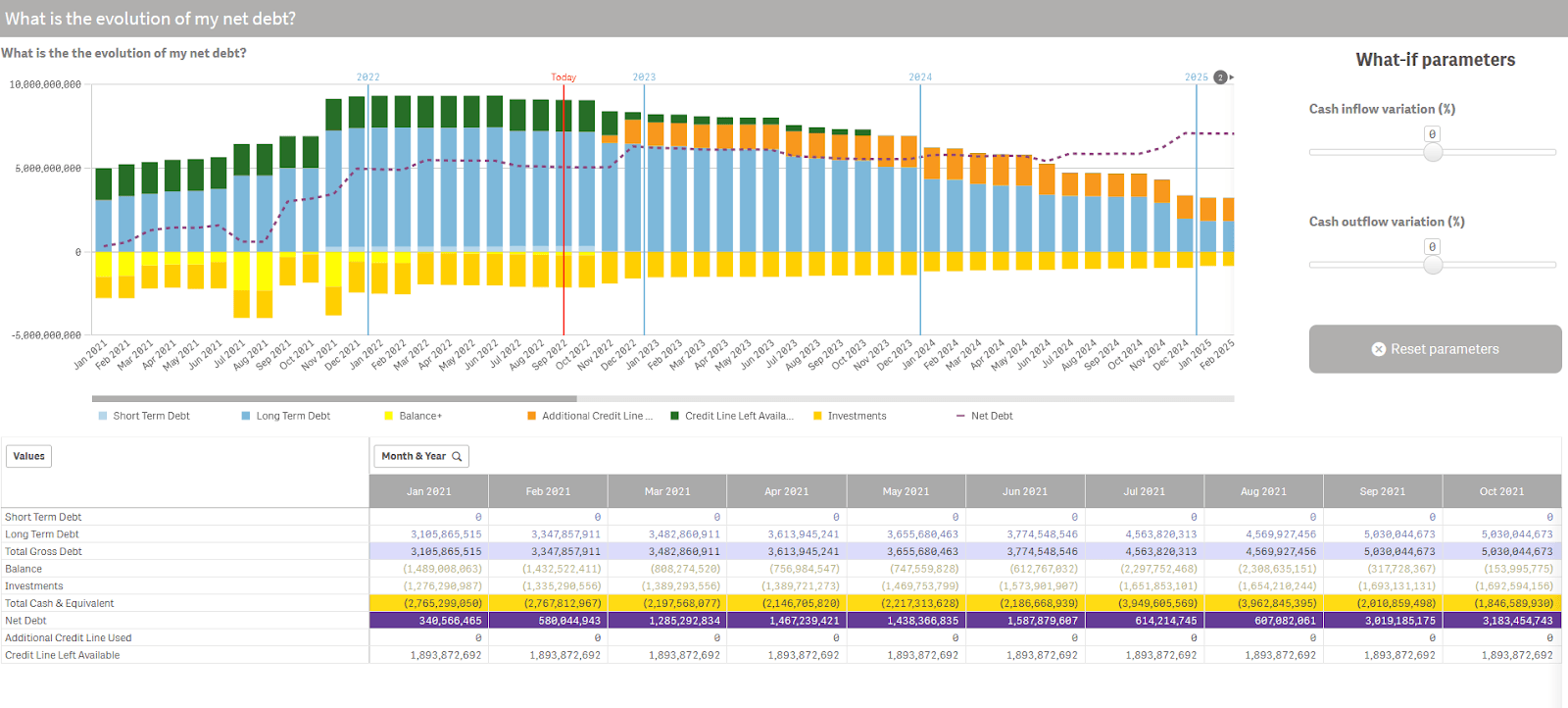

- Liquidity analytics shows net debt and liquidity, how to pay down debt, and when to pay debt

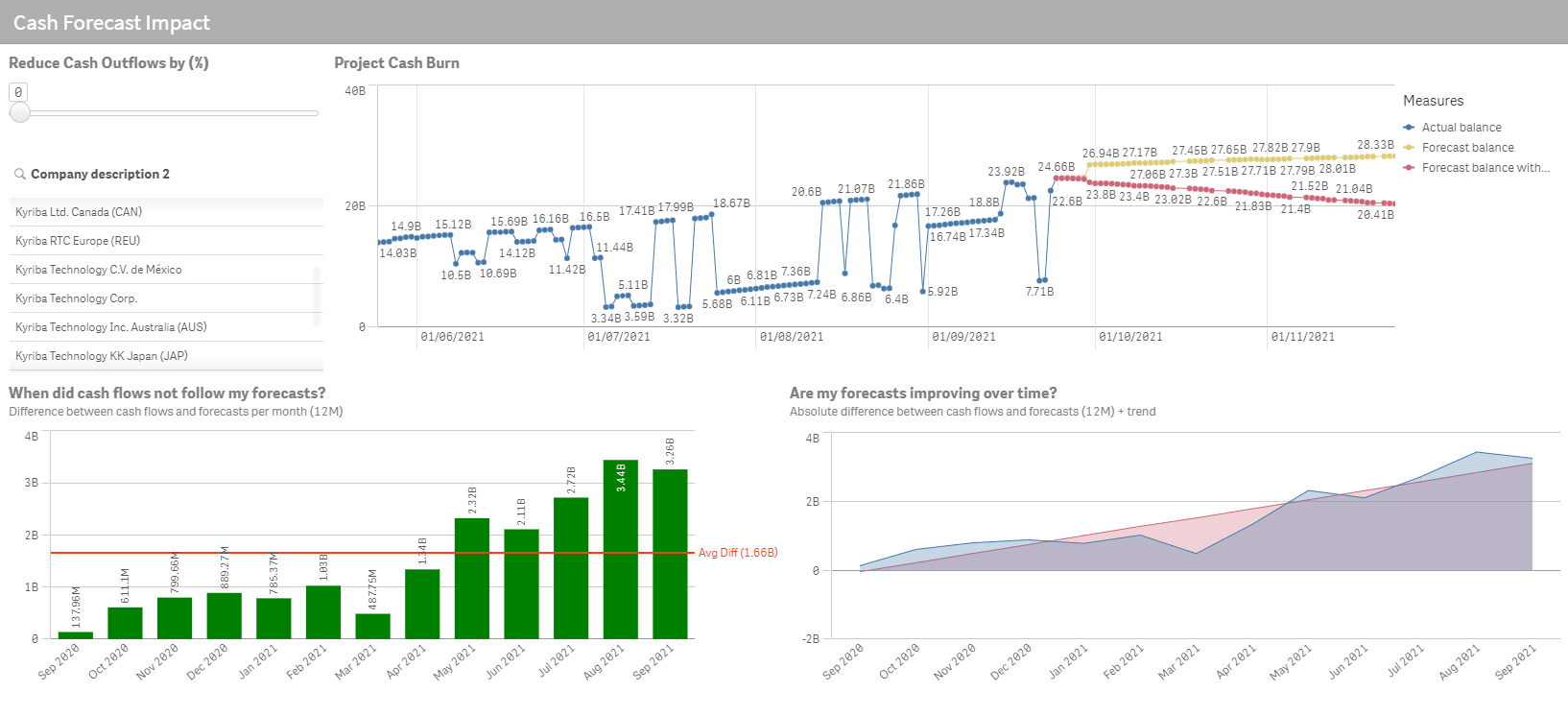

- Cash flow analytics considers if there is enough cash, whether or not cash forecasts are reliable, and bank activity

- Payments analytics displays the largest concentration of payments, who is executing/approving payments, and whether or not companies are sending too many wires

- Risk analytics reveals how much money is available in credit lines, the value of financial assets, and borrowing profiles

- Supply chain finance (SCF) analytics presents supplier participation rate, number of documents uploaded, and which invoices are financed

- Compliance analytics illustrates who the users are and where they are located, which modules users can access with which rights, and what data users can access.

In summary, predictive treasury analytics with advanced treasury dashboards help treasurers and CFOs make informed decisions to optimize financial operations.

What Are the Benefits of Treasury Data Analytics for Financial Analysis?

Treasury data analytics offers many benefits for financial analysis and operations. Analytics can help treasury managers:

- Improve cash flow management and cash flow forecasting accuracy by analyzing historical data, identifying trends, and predicting future cash flows. Use analytics to optimize cash management strategies, such as cash pooling, cash concentration, and short-term investing.

- Reduce risk exposure by evaluating data on interest rates, foreign exchange rates, and other market trends. Identify potential risks and hedge against them to mitigate the impact of adverse market events.

- Optimize financial performance by leveraging treasury data analytics. Identify inefficiencies in cash management processes and take steps to eliminate them, resulting in significant cost savings for the company. Treasurers can optimize their cash balances, reduce borrowing costs, and minimize bank fees.

- Monitor compliance by using data analytics to help monitor compliance with various regulations, including anti-money laundering (AML) and Know Your Customer (KYC) regulations. Improved compliance can help companies avoid costly penalties and maintain their reputation in the market.

In brief, treasury data analytics can help companies make informed decisions by providing insights into their cash and liquidity management, investment portfolios, and risk management strategies. By analyzing data from multiple sources, treasurers can gain a comprehensive understanding of their cash positions, liquidity, and risk exposure, allowing them to make better investment and financing decisions that align with the company’s financial goals.

Key Metrics and Tools Used in Treasury Analytics

By using key metrics and tools, companies can gain valuable insights into cash and liquidity, working capital, and risk management. Companies can use the following treasury metrics to optimize their treasury operations for improved financial performance:

- Cash flow forecasting is an essential tool used in treasury data analytics to predict future cash flows. It involves analyzing historical cash flows and using that data to forecast future cash inflows and outflows. The accuracy of cash flow forecasting is critical for effective cash and liquidity management.

- Liquidity management helps ensure that the company has enough cash to meet its financial obligations. Key liquidity metrics include the cash conversion cycle, days sales outstanding, and days payable outstanding. These treasury metrics are used to monitor cash flow and identify areas where cash can be optimized.

- Risk analysis helps identify and manage financial risks. Key risk metrics include interest rate risk, credit risk, and foreign exchange risk. These treasury metrics are used to identify potential risks and develop strategies to mitigate them.

- Payment processing streamlines and automates payment processing by using technology to automate payment processing, reduce errors, and improve efficiency. Key metrics include payment processing time, payment accuracy, and payment volume.

- Bank account management involves managing and optimizing the company’s bank accounts by monitoring account balances, reconciling bank statements, and managing cash positions. Key metrics include bank fees, bank account balances, and bank account reconciliation accuracy.

These treasury metrics can provide valuable insights for companies, helping to optimize their treasury operations for improved financial performance.

What Are the Challenges in Implementing Data Analytics for Treasury?

Data analytics has the potential to transform how treasury departments operate. However, implementing data analytics into treasury operations comes with its own set of challenges.

- Lack of Skills and Expertise

- Skill Gap: Treasury departments have traditionally been focused on cash and risk management, not data science. Bridging the gap between these two disciplines often requires new skill sets.

- Training and Development: Even if the treasury department sees the value in analytics, they might not know how to use the tools effectively. This means investing time and resources in training.

- Recruitment: There’s a high demand for data scientists and analysts across industries. Attracting top talent to treasury-specific roles can be challenging.

- Data Management and Quality Issues

- Inconsistent Data: Treasury departments deal with multiple financial institutions and systems. Each might provide data in a different format or granularity, making consolidation difficult.

- Accuracy and Integrity: For analytics to be effective, the underlying data must be accurate. This requires robust validation and cleansing processes.

- Storage and Retrieval: As data volumes grow, so do challenges associated with storing this information efficiently and ensuring it’s readily accessible for analysis.

- Integration with Legacy Systems

- Compatibility Issues: Many treasury departments operate on legacy systems that weren’t designed with modern analytics in mind. Integrating new analytics tools can be complex and costly.

- Resistance to Change: Long-standing employees might be accustomed to the old systems and resistant to transitioning to new tools, even if they offer improved functionality.

- Cost Implications: Upgrading or replacing legacy systems requires a significant financial investment. There’s also the potential downtime and productivity loss during transition periods.

- Data Security and Privacy Concerns

- Sensitive Information: Treasury data is highly sensitive. There’s a risk that integrating with new analytics tools might expose this data to vulnerabilities.

- Regulatory Compliance: Different regions have stringent data protection regulations (like GDPR in Europe). Ensuring that data analytics processes comply with these rules is essential to avoid legal repercussions.

- Access Control: It’s vital to ensure that only authorized individuals can access the data. Implementing robust user authentication and authorization processes becomes paramount.

While treasury data analytics presents significant opportunities for the modern treasury department, implementing it requires careful planning and commitment to resource allocation. By acknowledging and addressing these challenges, treasury departments can harness the full power of data analytics, driving efficiency and providing valuable insights to the organization.

What Are the Best Practices for Using Data Analytics in Treasury?

Best practices for implementing data analytics for treasury include setting clear goals, leveraging automation, and collaborating with stakeholders:

- Establish clear goals and objectives: Before implementing treasury data analytics, define clear goals and objectives that align with the company’s overall strategic plan by identifying specific KPIs and metrics to track, such as cash flow forecasting accuracy, working capital optimization, and risk management.

- Leverage automation: Streamline manual and repetitive tasks, such as data entry and reconciliation, with automation to save time and reduce the risk of errors. Use robotic process automation (RPA) and machine learning algorithms to analyze large amounts of data quickly and accurately.

- Collaborate with stakeholders: Involve stakeholders, including the finance team, IT department and business units, to ensure that the analytics solutions meet their needs and requirements.

- Invest in the right technology: Select the right technology infrastructure, including the right analytics software, visualization tools, data storage, and security solutions. Ensure the technology infrastructure is scalable and can handle large amounts of data.

- Ensure data accuracy and integrity: Establish data governance policies and procedures to ensure that data is accurate, consistent, and up-to-date. Ensure that data is secure and protected from unauthorized access.

By following these best practices, companies can successfully implement treasury data analytics and derive valuable insights to support cash and liquidity, working capital, and risk management.

The Role of Treasury Data Analytics in Liquidity Management

Treasury data analytics is a valuable tool for modern treasury management and financial analysis. By leveraging advanced analytics tools and customizable treasury dashboards, treasurers can gain insights into their company’s financial operations, improve decision-making, increase cash forecasting accuracy, optimize cash management strategies, manage risks more effectively, and ensure compliance with regulatory requirements.

Kyriba Analytics delivers integrated treasury dashboards and pre-built analytics for Kyriba Cash, Liquidity, Treasury, Risk, Compliance and Supply Chain Finance modules and data. Kyriba Analytics goes beyond traditional reporting by offering on-demand drill down, dashboard editing, and a transformed visual experience for presentation-ready information sharing.

For example, predictive cash flow analytics features in new liquidity planning tools are creating better capabilities to manage longer-term liquidity performance:

| Liquidity and Working Capital Considerations | Liquidity Planning and Analytics Solutions |

| Do I have visibility to liquidity and when it is available? |

|

| Will I have the liquidity necessary to fund strategic capex or initiatives? |

|

| What adjustments and actions for debt, credit policy, or additional working capital program expansion are needed? |

|

| How confident am I in my cash flow forecasts? |

|

| Do teams spend too much time compiling data and/or spreadsheets? |

|

| How can I enhance global liquidity and financial risk mitigation and positively impact financials? |

|

| Are my working capital strategies helping optimize the cash conversion cycle? Cost of Liquidity? |

|