Blog

Tackling Currency Risk in Today’s Economy

In today’s highly volatile foreign exchange market, companies must be strategic to ensure that their foreign exchange (forex) programs are running as efficiently as possible. With many factors affecting forex exposure, from interest rate movements to political instability, currency volatility and uncertainty show no signs of settling down.

During KyribaLive 2023, Andy Gage, SVP of FX Solutions & Advisory Solutions at Kyriba, and Laura Fisher, Director of Financial Risk Management at Align Technology, explored the challenges faced by foreign exchange professionals when dealing with market upheaval and offered practical solutions for an effective forex exposure management program. Join us as we uncover how Align implemented successful forex risk management strategies to gain stability in an uncertain environment.

Volatile Markets Cause Financial Headaches

In his overview of recent challenges in the currency market, Andy highlighted that companies are “entering into a new regime of currency risk in the marketplace.” According to Kyriba’s May 2023 Currency Impact Report, last year was the worst year for overall corporate impacts due to foreign exchange. With the Fed intervening to combat inflation and a strong U.S. dollar, companies tackled a demanding environment in 2022.

In this constantly changing landscape, treasury teams faced increasing challenges. When the Fed increased its activity in the markets, hedging costs almost doubled overnight, causing a lot of headaches for treasurers who questioned how they would explain these results to boards, CFOs and CEOs. Sharp currency movements, combined with overall market volatility, revealed how even small inefficiencies in multi-currency accounting processes showed up in big ways. At the same time, changing interest rate environments adversely impacted hedging costs.

As a result, treasury teams had multiple complexities to juggle. They had to spend more time identifying and explaining forex impacts, such as rapidly increasing hedging costs and forex results that differed significantly from expectations. Simultaneously, they had to rethink exposure aggregation and definition processes as well as explore additional methods to reduce hedging volume and cost.

In 2023, instability is still creating a lot of challenges. Even with the softening of the U.S. dollar, Andy predicted navigating the uncertainty of currency risk in a dynamic interest rate environment is a “theme that you’re going to be dealing with for years to come because the volatility is here, and it’s going to stay in place until we get through this cycle of interventions by the Fed.”

To ensure a basic understanding of the overall flow of foreign exchange, Andy briefly explained the three basic concepts in foreign exchange:

- Pre-trade involves market analysis, risk assessment and the formulation of trading strategies. Traders and investors gather information, evaluate market conditions and determine the most suitable currency pairs and timing for trades.

- Trade is the buying and selling of currencies at an agreed-upon exchange rate.

- Post-trade includes the confirmation, settlement and reconciliation of the trade.

Ultimately, companies should focus on the pre-trade side of foreign exchange to understand the exposures, analyze inefficiencies and formulate successful forex risk management strategies. As Andy commented, pre-trade is “all about getting the right forex exposure from your business.”

Preparing the Path to a New Program

Introducing Align’s path to improved forex exposure management, Laura shared the company’s narrative. Align Technology, a global medical device and technology company, generates just under $3.7 billion in revenue and operates in both U.S. dollars and local currencies. Align’s first step to a successful hedging program began with a pivotal decision: pressing pause on their existing hedging program, due to serious issues leading to substantial forex losses. This pause gave Align time to review their forex exposure management, where they identified the following concerns:

- No centralized ERP system

- Regions were forecasting exposures using various accounting platforms, many of which lacked visibility into foreign currency exposure data

- Forex exposure data was compiled in spreadsheets, which often contained incorrect forecasting and exposure data

- Forex trades were executed manually over the phone

After gaining a clear perspective of the issues, Align made some changes. They connected most of their subsidiaries on the same SAP ERP installation to optimize business operations, streamline processes and provide better data management and reporting capabilities. Align further improved their forex exposure management by moving from a daily rate to a monthly rate for easier administration and systematically remeasuring for all subsidiaries on the ERP.

An essential part of Align’s forex exposure reset was cleaning up and understanding their data. To help Align analyze their data, they implemented Kyriba FX. Through Kyriba, Align discovered many types of financial problems, including accounting, processing and clearing issues as well as phantom balances.

Align then spent six months scrubbing their data using the information from Kyriba reports. Next, Align trained their personnel on how to properly enter the accounting information because, as Laura remarked, accurate data is “critical in driving your exposures.” Further emphasizing that “the most important part for any organization is understanding the data in your system,” Laura noted treasurers need the proper tools and reports to showcase forex data in insightful ways. Using Kyriba’s readily available waterfall and bubble charts, Align gained a clear picture of where to start building their forex risk management strategies.

Align’s Strategy to Limit Forex Exposure Risk

With a clearer understanding of their data, Align investigated new ways to further reduce risk and lower their hedging costs. As Laura explored some of Align’s strategic insights for forex exposure management, she emphasized corporates cannot control foreign exchange, as it is unpredictable and even “random.” To achieve predictability, financial teams should look internally to ensure their forex exposure programs are running smoothly. Laura stressed taking a comprehensive view internally to “clean up as much as you can to drive those exposures down and control that cost.”

Delving deeper into Align’s internal risk reduction strategies, Laura highlighted the following best practices:

- Settle intercompany balances. Laura pointed out that although this strategy is not a hedging strategy, the cost of hedging is reduced because volatility is going away.

- Establish an FX Risk Committee composed of treasury’s forex partners. At Align, this committee includes the CFO, the corporate controller, the vice president of FP&A and tax. Laura noted that Align’s FX Risk Committee meets twice a year to review their forex exposure program and determine where they can improve their results.

- Prepare monthly regional forecasts for cash, accounts receivable, accounts payable, intercompany and accrued balances. Through Kyriba, Align uses a forecasting process to look at historical and predictive data to validate forecasts and identify areas that need additional support.

- Conduct a mid-month “true-up” process, comparing forecast-to-actual and adjusting hedges if necessary.

- Implement a tolerance level. Align has a monthly forecast-to-actual tolerance level of 90% to 110% accuracy. If an entity does not meet this requirement, they must prepare a variance report.

- Record monthly forecasting accuracy results on a scorecard. Align sends their scorecards to the FX Risk Committee, ensuring entities remain accountable for results.

- Look for natural offsets through the movement of cash balances and/or introducing short-term intercompany loans to reduce risk.

- Treat long-term loans as quasi-capital injections, effectively placing a cap on exposure.

Beyond implementing internal controls, Laura emphasized some general strategies financial teams can use to reduce exposure:

- Anticipate worst-case scenarios that a hedging program might face and be fully prepared for such situations.

- Continually strive to improve hedging programs, understanding that forex exposure management is a continuous process.

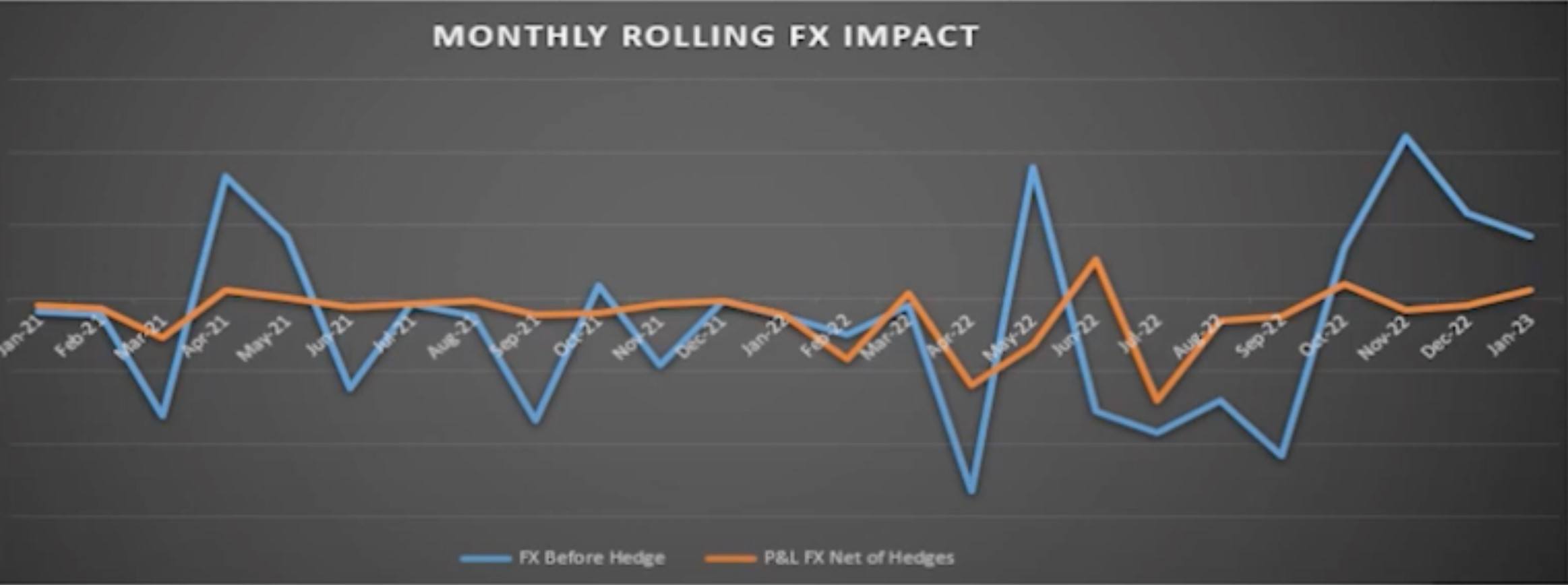

- Use pictorial tools, as they present “a clear picture of your exposures, what to tackle first and what currencies to work on.” Laura and Andy spotlighted the Monthly Rolling FX Impact chart, which displays forex results with and without the hedging program and resonates well with executives.

Thriving Amidst Uncertainty

By pressing pause to assess their hedging program and implementing forex risk management strategies, Align created a successful program to reduce risk and lower the cost of hedging. With the USD as their functional currency, Align is now successfully hedging over 12 currencies with refined forecast methodology and visibility into true exposures.

As financial professionals navigate complex market conditions, the path towards successful forex risk management requires a combination of agility, data precision and a proactive approach to risk reduction. Using Kyriba’s sophisticated tools to help control currency risk and minimize the cost of hedging, companies can successfully manage forex exposure amid volatile markets.