Fact Sheet

Kyriba & Goldman Sachs Asset Management Mosaic

Expanding Investment Options for Treasurers to Increase Return on Surplus Liquidity

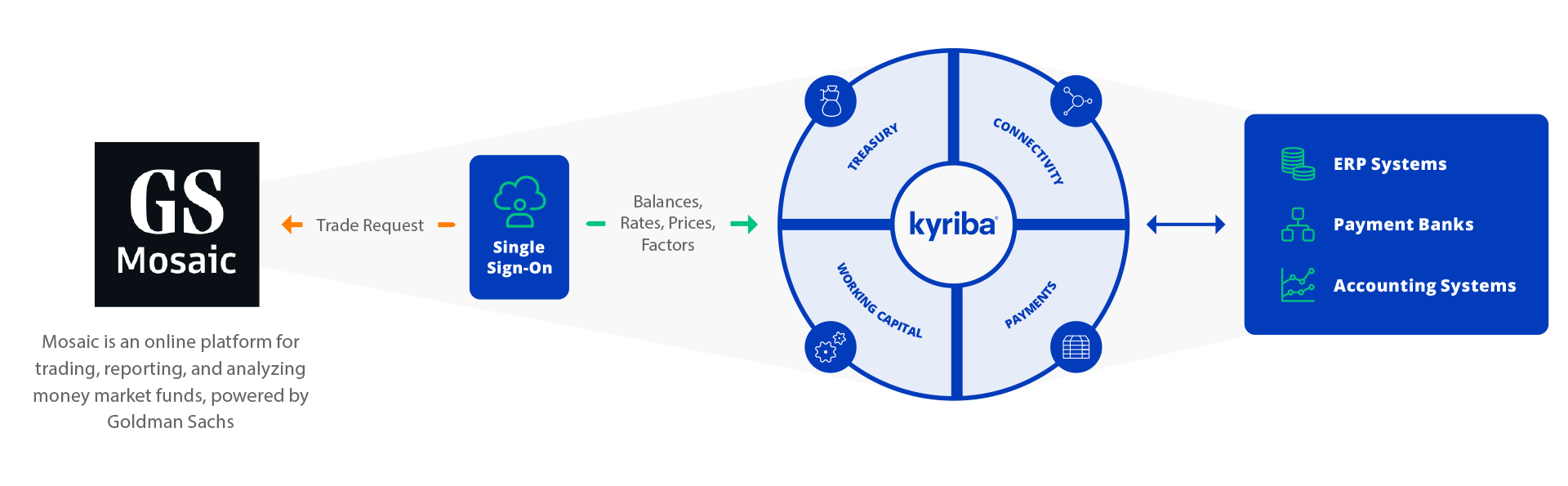

Kyriba’s Treasury Management System now connects with Goldman Sachs Liquidity Solutions Platform, Mosaic, expanding options for treasurers and increasing ways to keep surplus liquidity invested faster and longer. The partnership streamlines investments, creating an end-to-end workflow for investing in money market funds and introducing on-demand connectivity to third-party banking and fintech services.

Highlight for Clients

Single Sign-On (SSO)

- Seamless navigation between the Kyriba TMS and the Mosaic investment portal

- Improved efficiency

- Fewer manual steps

- Quick client onboarding and no additional cost

Trade Request Process

- Executes trades with Goldman Sachs & Co. LLC through to the Mosaic investment portal

- Streamlines subscription and redemption requests

Consolidated View

- Money market funds and cash positions display within the Kyriba dashboard

- Simplified visualization

Real-time Workflows

- Balances, confirmations, fund prices, and daily factors seamlessly flow between the Kyriba TMS and the Mosaic investment portal

- No need for manual data entry

Liquidity Analytics and Reporting

- Access to the rich set of money funds liquidity analytics and reporting unique to Mosaic

A streamlined workflow between the Kyriba TMS and the Goldman Sachs Mosaic Investment Portal enables on-demand connectivity for Treasury teams