Fact Sheet

Kyriba NetSuite API Integration

Unleash the Power of Enterprise Liquidity Management with Oracle NetSuite and Kyriba

Table of Contents

- Why Choose Kyriba NetSuite API Integration

- The Added Value of Kyriba NetSuite API Integration vs. Kyriba NetSuite Bridge (NSB)

- The Kyriba NetSuite API Integrated Payments Workflow Explained

- Kyriba NetSuite API Integration for Cash Management Workflow

- Kyriba NetSuite API Integration for GL Export Workflow

- Kyriba NetSuite API Integration for Bank Statement Export Workflow

- Kyriba NetSuite API Integration for GL Reconciliation Workflow

- Kyriba NetSuite API Integration for FX Balance Sheet Workflow

- FAQs on the New Kyriba NetSuite API Integration

Why Choose Kyriba NetSuite API Integration

Bank requirements for unique or proprietary direct connections and bank- or regional-specific payment formats can extend the time needed to connect your ERP systems to your banking partners. The challenge becomes more complex with multi-bank connectivity and requires significant effort and expertise. Kyriba’s Connectivity-as-a-Service (CaaS) accelerates this process and relieves potential development and maintenance burdens on IT. With one API gateway, clients can connect via Kyriba to over 1,000 global banks, supported by an extensive format library of 50,000 pre-developed and pre-tested payment scenarios.

Kyriba uses NetSuite Web Services APIs to connect NetSuite ERP systems with Kyriba’s Enterprise Liquidity Management platform, enabling mutual clients to embed different workflows into their business processes. The Kyriba NetSuite API integration replaces the previous Kyriba NetSuite Bridge (NSB) solution and is a substantial improvement to further accelerate implementation and time to value. It offers many new features, including flexible batch jobs and customizable data exchange interfaces, which were not supported by the NSB. This integration also provides user-friendly, flexible scripts for NetSuite authorized users to update if needed.

The Added Value of Kyriba NetSuite API Integration vs. Kyriba NetSuite Bridge (NSB)

| Features | Kyriba NetSuite API Integration | Kyriba NetSuite Bridge (NSB) |

| Bank statement with bank account mapping import | Yes, live since January 2023 | Not included |

| GL export with NetSuite advanced intercompany payments | Yes, included | Not included |

| Pre-payments and multi-vendor bank accounts | Yes, supported with additional payment scenarios | Not supported |

| FX balance sheet workflow | Yes, included | Not included |

| Additional future development support | Yes, included | Maintenance mode only |

| NetSuite – multiple instances | Yes, included | Not included |

| NetSuite – API trigger (batch job) | Flexible, on-demand schedule | Rigid, hard-coded schedule |

The integration between NetSuite and Kyriba allows clients to submit and monitor payments and direct debits using NetSuite with automated workflow into the Kyriba Platform.

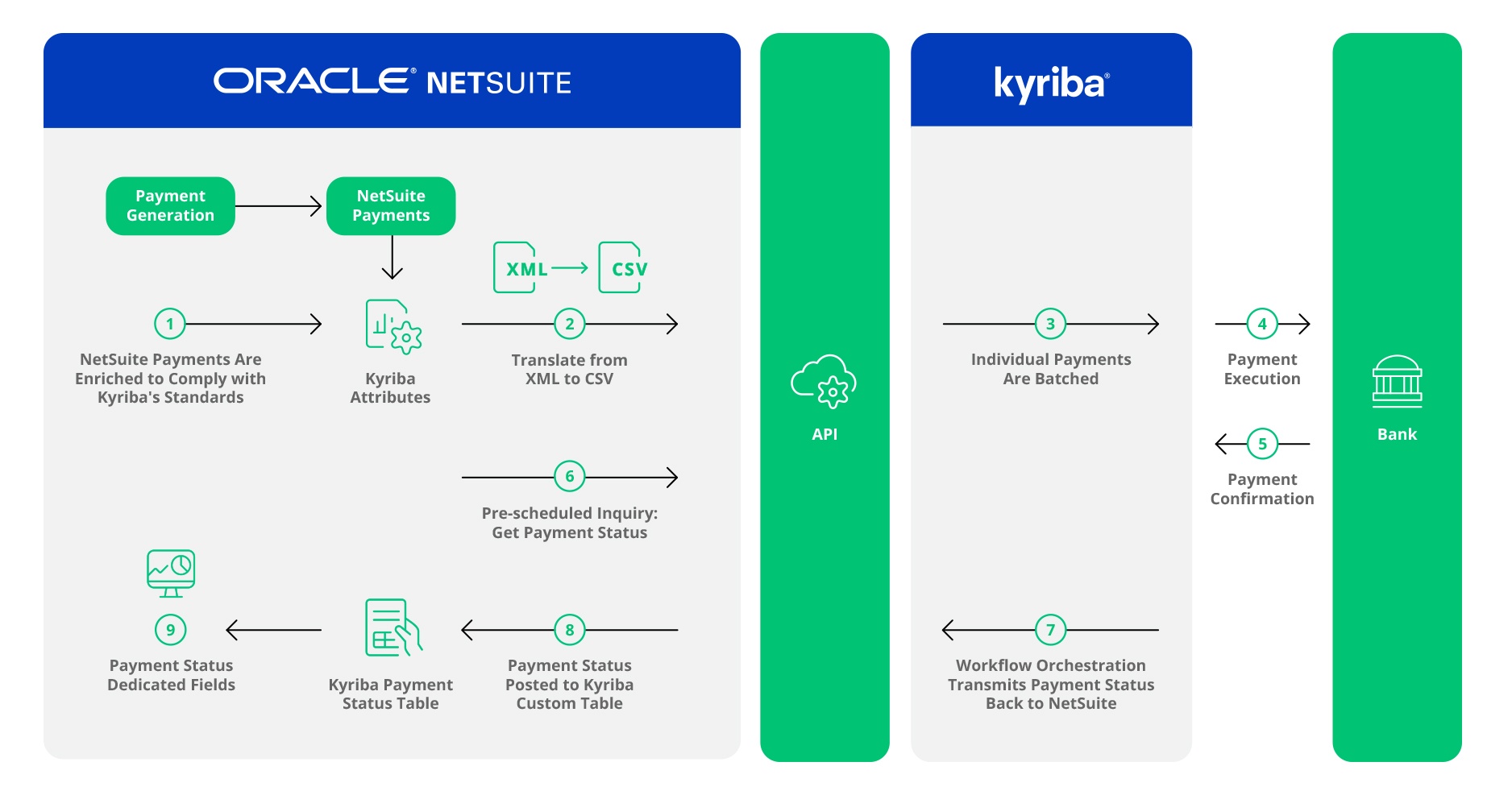

The Kyriba NetSuite API Integrated Payments Workflow Explained

- NetSuite payments are translated to comply with Kyriba’s standard payment information. Kyriba’s custom table provides mapping of relevant information.

- NetSuite payments are translated from XML to CSV and sent to Kyriba as individual payment requests.

- Payment requests are batched in Kyriba.

- Batched payment orders are sent to associated banks to be executed.

- Payment confirmation is sent by the banks to the Kyriba application.

- Inquiries are scheduled in NetSuite ERP to retrieve payment acknowledgments from the Kyriba application.

- Payment status updates are transmitted to NetSuite ERP through API integration.

- Payment status is posted to Kyriba’s custom table.

- Clients can build customizable payment views to see their Kyriba payments only.

Kyriba NetSuite integration also supports cash management, GL export, bank statement export, GL reconciliation and FX balance sheet workflows.

Kyriba NetSuite API Integration for Cash Management Workflow

Supporting cash flow forecasting and positive pay.

The automated workflow features:

- Open customer and vendor invoices

- Non-Kyriba payments, such as checks

- Other GL entries to support cash forecasting

Kyriba NetSuite API Integration for GL Export Workflow

Providing a cash accounting solution, sending GL entries created in Kyriba to the ERP.

Main features include:

- Export of GL entries from Kyriba

- Export of GL entries not otherwise reported to the ERP

- Export of advanced intercompany entries

- Export of financial accounting entries

Kyriba NetSuite API Integration for Bank Statement Export Workflow

Exporting bank statements to ERPs.

The automated workflow features:

- Extraction of bank statements in a format accepted by ERPs

- Export contains prior day and intra-day data

Kyriba NetSuite API Integration for GL Reconciliation Workflow

Facilitating reconciliation of bank transactions to accounting.

It eliminates error-prone manual entry with:

- Import of bank account entries from the ERP

- Posting of GL adjustments back to the ERP

Kyriba NetSuite API Integration for FX Balance Sheet Workflow

Extracting balances for FX analysis (previously as FireApps).

Main features include:

- Extract of life-to-date balances for assets and liabilities

- Balances aggregated by entity, currency and GL account in document, local and reporting currencies

For more details, check out the Kyriba Developer Portal.

FAQs on the New Kyriba NetSuite API Integration

Do different NetSuite platforms require different installations?

No, the Kyriba NetSuite bundle is available for all NetSuite platforms.

What customizations can be used to enhance the functionality of the NetSuite application?

Customizations include configurable mapping and flexible data exchange.

Can customers use their own middleware to call the API?

Yes, customers can use their own middleware to call the API.

What authentication schemes does the integration use?

The integration uses REST API with Basic Authentication or OAuth2.

Can clients connect to multiple ERP systems?

Yes, Kyriba ERP Connectors support the integration of multiple ERPs, including Microsoft Dynamics 365, Oracle Cloud, SAP S/4HANA and ECC.

Are payment transfers batched? Is it possible to transfer a single payment?

Payment transfers from NetSuite to Kyriba are not batched but are sent as individual payment requests. Payments are batched in Kyriba via the automatic API process template (ERP_AB_API) and then sent to associated banks.

What payment types are supported?

The integration supports payment request imports and payment status updates for:

- Vendor payment requests for domestic and international transfers

- Customer payments, including SEPA direct debit

- Intercompany vendor payments (treasury transfers)

How long does it take to connect my ERP to Kyriba?

Historically, installation and API connectivity take 2-5 days, depending on the complexity of a client’s configuration and modules in scope. Kyriba NetSuite API integration reduces the cost, risk, time and effort required to connect NetSuite ERP to Kyriba.

What do I need to do if I am already using Kyriba NetSuite Bridge (NSB)?

For Kyriba clients already on NSB, upgrading to the API integration requires connectivity set-up and functional testing equivalent to a few hours of Kyriba professional services (clients can use their own consulting resources, too). Detailed guidance is available, and the efforts required are minimal. During the initial launching period, there are special service offers for early-bird clients. For more details, please contact your account manager.