Blog

2023 FX Volatility Outlook Points to More Uncertainty

CFOs are expected to deliver predictable revenue, earnings and free cash flow projections, and Kyriba’s Currency Impact Report (CIR) shows corporate CFOs have been challenged more than ever before to reduce the impact of FX on the value of their organizations.

2023 will continue to be volatile and unpredictable meaning that organizations who reduce their vulnerability to currency headwinds and tailwinds will continue to be rewarded by investors.

Global Volatility Drives Need for CFO Diligence Over Liquidity and Risk

We expect to see the beginning of the end of the strong US dollar run in a deeper analysis of earnings reports starting in Q4 2022 and into Q1 2023.

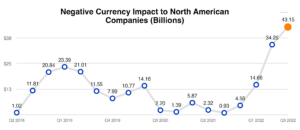

This shift will spell significant reductions in headwinds for N. American companies and relief from the past four quarters of unprecedented increases in adverse earnings impacts. The culmination of which resulted in all-time highs of $43.2B USD to N. American corporates, as reported in Kyriba’s January 2023 Currency Impact Report.

Highest Levels of Negative Currency Impacts to N. American Companies

Highest Levels of Negative Currency Impacts to N. American Companies

The coming months and likely, for most of 2023, will be ‘boom and bust’ created from strong actions to cool off the economy. Price indices and inflation are starting to decelerate. In general, we see seven-year economic cycles of the economy heating and cooling, but this time around, there is an unprecedented combination of geopolitical challenges that impact the high and low end of the volatility.

However, a lack of optimism exists around what is happening across the globe in the form of continued threats on a number of fronts. Climate impacts, geo-political turmoil, war and challenges in global trade are creating fear and uncertainty.

Externalities

CFOs are unable or are having difficulty in predicting the timing or extent of impacts from the wide multitude of external threats. Whether it’s geo-political conflict, attacks on stability of elections, or healthcare or food supply concerns, these all create uncertainty.

For instance, no one saw a global pandemic or could understand way to predict the multitude of crises encountered during the past two to three years. While the externalities are nearly impossible to predict, there are steps and actions CFOs take to deliver a response-mechanism to stave off the extent of attacks and threats.

Currency Impacts Continue to Challenge Corporates

Currency shifts and volatility continue to play havoc with the financials of MNCs, as confirmed by Kyriba’s Currency Impact Report that has quantified negative impacts, reported by both North American and European companies, to have totaled $47.18 billion in Q3 2022, a 26.6% increase from Q2 2022.

Opening Window for Economic Optimism as USD Strength Subsides

The Federal Reserve has been making it clear that they are slowing their stance on interest rate increases. This means that the Fed is concerned about recessionary pressures, cost of debt and inflationary boom and bust cycles. Much of the inflationary fear is in contrast to other indicators that show much of the economy has actually performed well. The U.S. Federal Reserve (Fed) to raised rates again on February 1, 2023, 0.25 percentage points to 4.5%-4.75%. The February decision is the first of eight scheduled meetings for the Fed to set interest rates in 2023.

Interest Rates Continue Rising

FX volatility is accelerating, rather than subsiding. In many ways, expectations in North America are continuing the volatility and uncertainty that the steps taken by the Fed are beginning to impact the economy in the desired fashion:

- USD has weakened some against major benchmark currencies (EUR, GBP)

- Lower consumer prices

- Supply chains stabilizing

- Lower home prices and sales volume

A ‘Rebalancing’ of expectations in the direction of interest rates will begin to drive a reduction in the ‘overage of investment in USD’. Disorderly markets and late reactions from the Federal Reserve have created longer-term FX volatility and 2023 will spell a fluctuating model with a general softening of USD strength.

CFO Mindset in 2023: Highly Cost Conscious

Recently, a survey of CFOs by PWC revealed that 77% of CFOs are deploying new cost-cutting measures to strategically focus costs on the most valued areas and uses in the coming months. CFOs are creating that focus through the investment in analytics and advanced solutions to drive more cost-effective hedging decisions, automation and better insights into risk components across finance. One such area, is FX risk hedging because the past 12 months have resulted in massive hits to corporate revenue and EBITDA related to FX impacts.

In 2023, CFOs will need to insist on reshaping the practice of tracking FX volatility impacts across the organization and invest in tools to effectively manage, analyze and optimize the decisioning practice required to generate cost effective hedges. One example of facing off against the challenge of defining exposures has been resolved with modern hedging analytics – VaR and CoRE Analysis. With these solutions, risk managers have the capacity to analyze hundreds of currency pairs simultaneously and derive the most effective hedge plan within minutes.

Moving Ahead Into 2023

CFOs should be ready to act as a reduction in headwinds for many North American companies should see greater returns and increased demand for US goods and services. The only way to be ready for the next wave of challenges is to invest in capabilities that give visibility to exposures and risks, deliver intelligent risk program creation and result in real financial results for finance.