eBook

Is In-House Banking Right for Your Organization?

Table of Contents

- What is an In-House Bank?

- What Are the Top Five Benefits of Introducing an In-house Bank?

- What Services Could an In-house Bank Provide to an Organization?

- In-house Bank Account Design

- FX and the In-house Bank

- Key Considerations When Implementing an In-house Bank

- Integration with ERP

- Benefits of Implementing an In-house Bank Program

- Conclusion

What is an In-House Bank?

- An in-house bank provides an internal current account structure and other services to group entities, which replicate the services typically provided by an external bank.

- In-house banks provide services similar to those of a commercial bank, such as offering payment processing, liquidity management and collection functions to various subsidiaries of large global corporations.

- Technology is a key enabler to in-house banking (IHB). There are many treasury technology platforms (TMS & ERP) with various IHB capabilities.

In-house Bank Defined

“A dedicated group or legal entity which provides banking services such as cash management, payments on behalf (POBO), collections on behalf (COBO), FX requests, funding and working capital to business units within an organization.”

What Are the Top Five Benefits of Introducing an In-house Bank?

- Banking fees can be reduced by limiting the amount of intra-company funds transfers that subsidiaries are executing, with in-house bank physical cash transfers reduced significantly. This will also reduce operational risk by avoiding unnecessary movements of cash.

- Higher returns can be earned on investments by pooling all cash and credit balances instead of having them lying dormant in subsidiary accounts.

- If your organization is global, foreign exchange and cross-border payments can be minimized, and transactions can be conducted by the corporate office, rather than going through local in-country payment processing.

- Corporates can negotiate better pricing, service and flexibility from banking providers through aggregation of spend into a centralized treasury function.

- Instead of subsidiaries going to banks, loans can be provided to subsidiaries. Lending internally is much less expensive than paying interest to a third party.

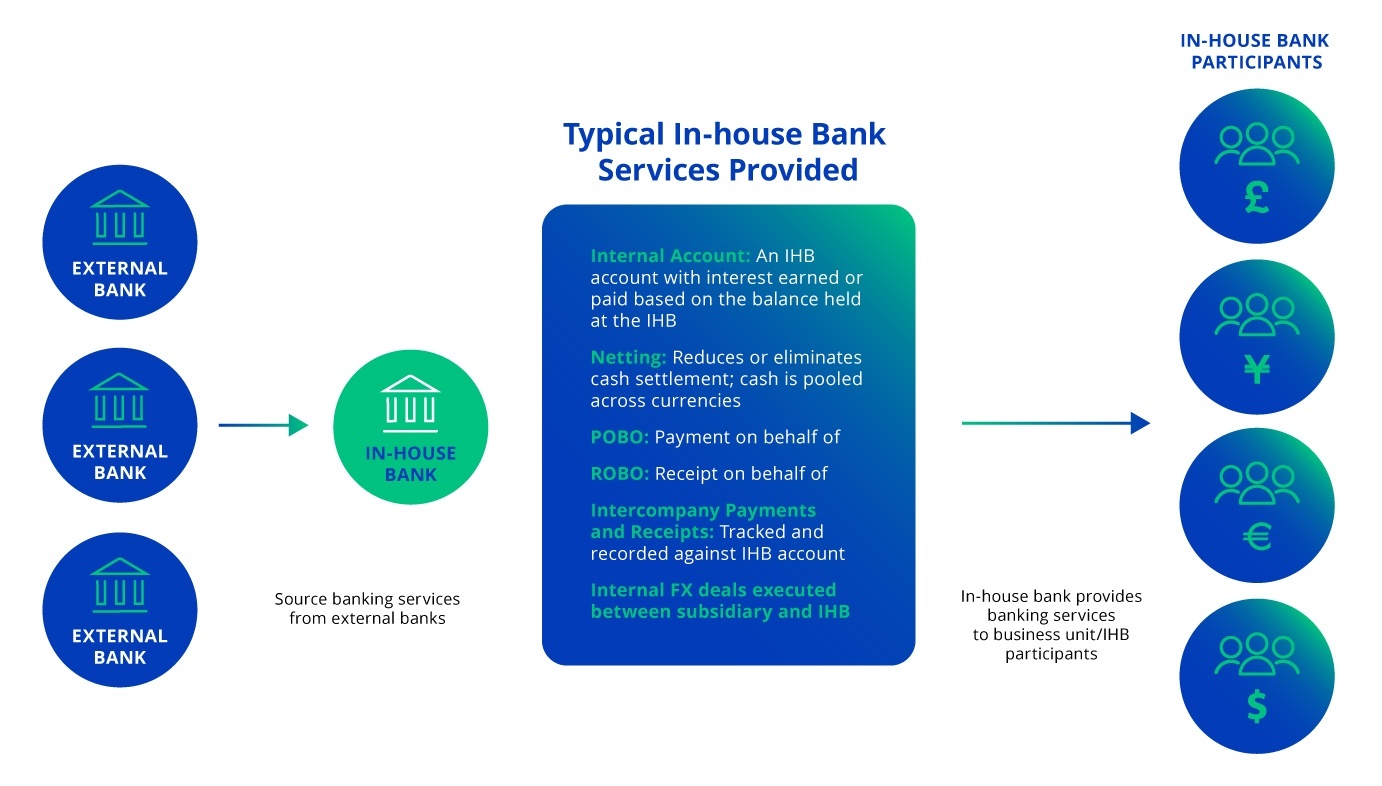

What Services Could an In-house Bank Provide to an Organization?

An in-house bank will operate just like a commercial bank by providing resources and services to the participants, including payment processing, collections activities, liquidity management, FX and servicing funding requests.

In-house Bank Account Design

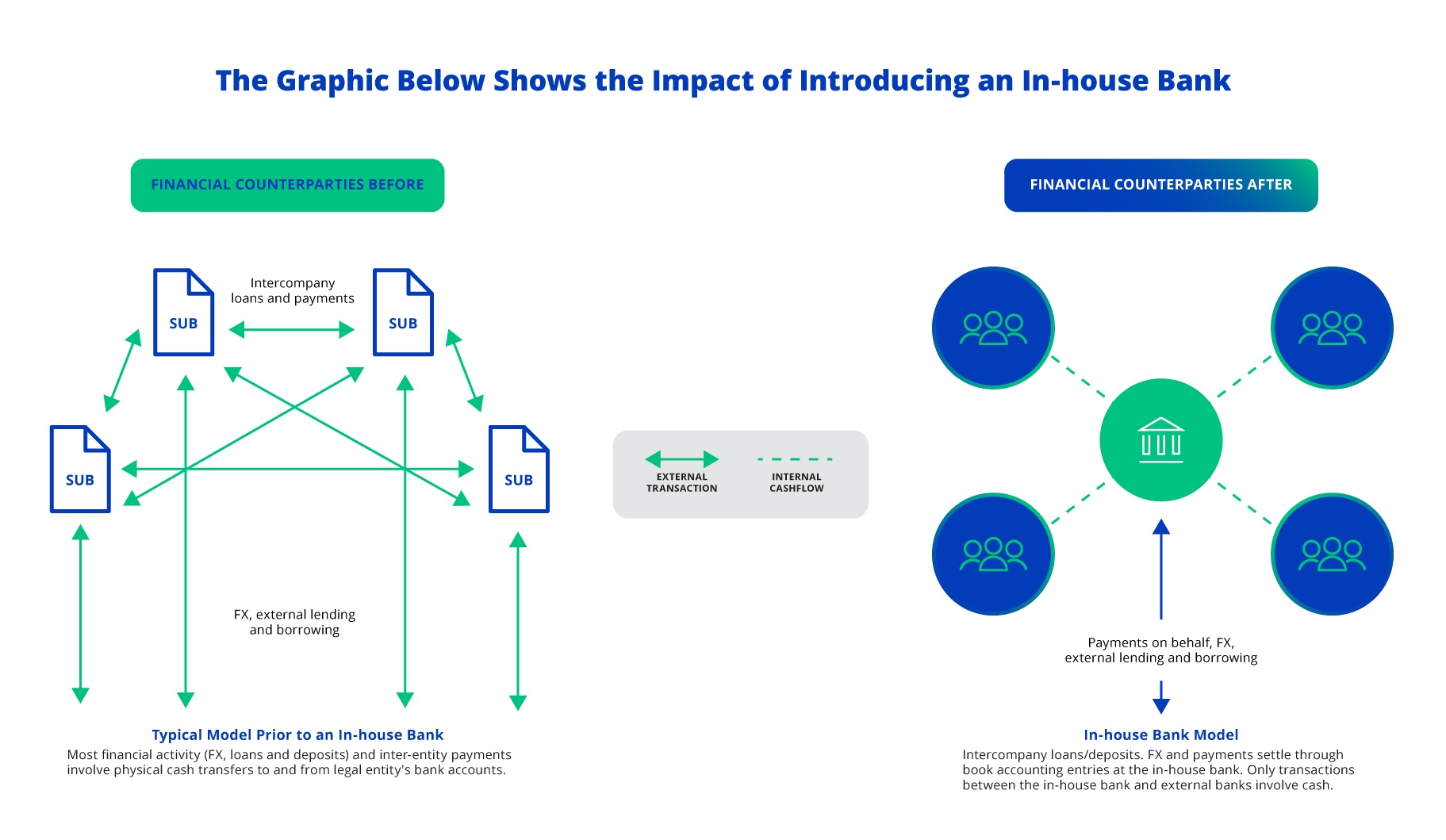

By creating an in-house bank structure and moving to a mostly internal transaction basis and “on-behalf-of” processing (i.e. corporate headquarters executing transactions on behalf of subsidiaries), bank accounts can be rationalized.

The in-house bank account design should be based on the following:

- Internal payments are settled without the need for physical cash transfer whenever possible. Specific exceptions (e.g. dividend payments) should be identified by the Tax department.

- Cash is only moved to manage the consolidated needs of the IHB.

Account Structure (Master vs. Sub Accounts)

- The in-house bank owns multi-currency master accounts with banks.

- The in-house bank manages liquidity in the master accounts through external borrowing or lending.

- Business units maintain current accounts with the in-house bank sub accounts.

- Business units may run net credit (cash) or debit (overdraft) balances in the sub accounts.

- Business units earn/pay interest on net debit/credit balances.

- Overdraft balance limits are set and reviewed in accordance with company policy.

FX and the In-house Bank

An in-house bank structure will provide many benefits to your FX program, including:

- Greater visibility of corporate-wide FX exposures

- More effective hedging, better currency protection

- Reduced number of hedging transactions (and costs)

Realized gains:

- Reduced cost of trade spreads due to lower trading value and less exposure to banks

- Monitoring of natural balance sheet hedging to reduce currency exposures

- Fewer administration requirements

- Enhanced controls

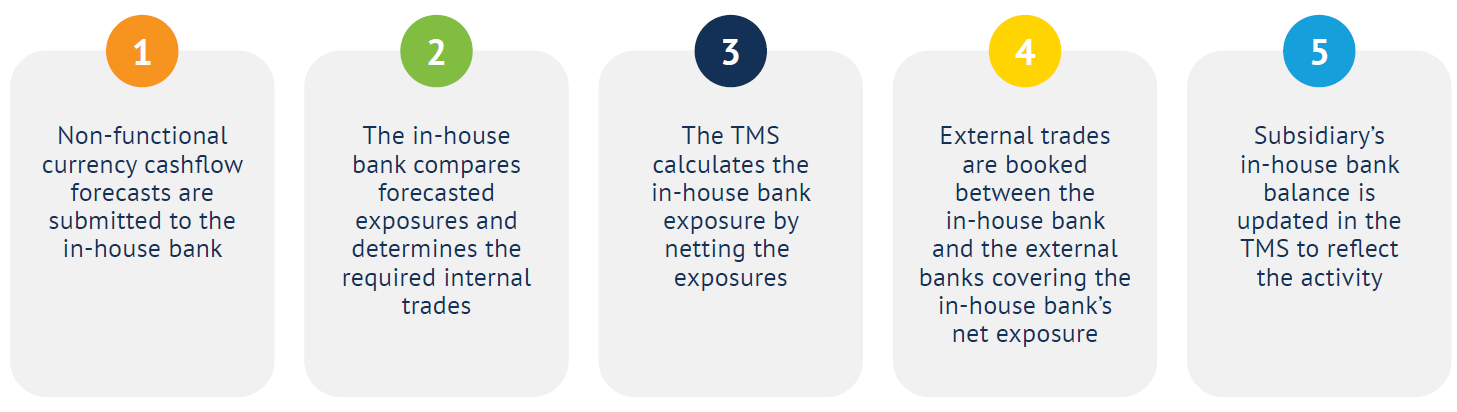

The process typically flows as shown below:

Key Considerations When Implementing an In-house Bank

When implementing an in-house bank, there are several key considerations to review:

When implementing an in-house bank, tax and legal should be a part of the conversation from the beginning planning stages. Topics may include:

- Tax impacts in certain countries: local taxes, thin capitalization, VAT on interest, no capitalization required.

- Transfer pricing

- Withholding taxes on bank interest is required in some locations

- Review of regulatory environment

- Are payments-on-behalf-of (POBO) transactions allowed in the country?

- What will be the treatment on cross-border payments?

- What paperwork needs to be in place?

Technology is a key enabler to the in-house bank process and a TMS is an absolute necessity in order to track intercompany transactions and achieve the level of automation needed for an efficient process. In addition, as in real estate, choosing an in-house bank’s location is key. Depending on the location, there could be potential tax drawbacks. Locations with a favorable tax environment should be considered.

Integration with ERP

Implementing an in-house bank will require an investment in technology. A TMS can be used to support the operation of the bank and to facilitate proper bookkeeping. Accounting groups and ERP programming will need to be involved to develop the clearing of the accounts and an automated program to facilitate the clearing of intracompany (within the sub-accounts of the inhouse bank) and inter-company (between a non in-house bank account and the in-house bank) loans.

To best prepare for the designing of the programs, scenarios should be clearly defined. epending on the function of the in-house bank, some commonly overlooked scenarios are receipt of non-functional currencies (either the sub’s nonfunctional or the in-house bank’s non-functional), and external trades executed on behalf of a participant for a third party or vendor.

Once these scenarios are defined, certain information can be passed from the ERP to the TMS to allow for the proper mapping. The data can be generated in the TMS, if the ERP doesn’t have automated capabilities, but the ERP should be considered as a data source to populate intercompany transactions in the TMS.

Benefits of Implementing an In-house Bank Program

Improved Operational Flexibility

By implementing an in-house bank, there exists the opportunity for improved operational flexibility, especially when integrating multinational businesses. The in-house bank can also serve as the building blocks to a corporate center of excellence, offering expert banking transaction-related customer service to the subsidiaries/participants.

Lower External Borrowing

IHB will lower subsidiaries’ need to borrow at high local rates while others invest surplus cash at low rates. In an in-house bank, they will borrow from or lend to each other and go to the bank only to cover the net shortfall or invest the net surplus. Improve your own bottom line instead of the bank’s.

Lower External FX Transaction

IHB will lower the volume of external FX deals. With an in-house bank you will offset the trades and pay the outside dealers only for the trades you need to cover the corporation’s net needs.

Improved Visibility

With in-house banks enabling pooling of all the investable cash or short-term borrowing, corporations can command lower loan rates or higher investment rates for larger parts of the business. By streamlining accounts, corporations often can reduce maintenance fees and reconciliation tasks.

Lower Costs and Bank Independence

Implementing an in-house bank using a single technology for communication with the banking environment will result in lower costs and a greater degree of bank independence.

Conclusion

In-house bank programs can provide deep financial and operational benefits for both subsidiaries and corporate treasury alike. Using internal accounts is an efficient means of executing internal funding transactions via a debit to the central IHB account, and simultaneously generating a matching credit to the subsidiary’s account. A TMS can also automatically track transactions and perform interest calculations as well as generate in-house bank statements to the subsidiaries or participants.

An in-house bank program may not be the right choice for every company. However, for those meeting certain key criteria – typically large multinational corporations with multiple business units and high volumes of intercompany transactions, there are many benefits to establishing this model.

More and more companies are looking at the possibility of using an in-house bank to increase efficiency, reduce banking fees and improve visibility and control. Is in-house banking right for your organization?

Special thanks to the authors of this eBook: Craig Chapman and Jason M. Dobbs!