eBook

Five Strategies for Treasurers Amid Economic Volatility

In today’s highly volatile economic landscape, treasurers are confronted with a new set of challenges, including soaring global inflation, elevated interest rates and an uncertain economic outlook. These obstacles significantly impact financial decision-making and require CFOs and treasurers to devise robust strategies to tackle them effectively.

Treasurers grapple with significant challenges amidst economic volatility. Rising inflation erodes purchasing power and necessitates effective cash and liquidity management to mitigate financial risks. High interest rates further add complexity to the equation, making it harder to secure affordable financing, manage debt, and optimize working capital. Treasurers must evaluate the impact on financial stability, explore interest rate hedging, and adapt to uncertain economic outlooks affected by geopolitical events, regulatory changes and market fluctuations.

In this climate, treasurers must take advantage of the available tools, techniques and technology to overcome these challenges and operate as efficiently as possible. By staying agile and proactive, treasurers can optimize financial performance, manage risks effectively, and position their organizations for long-term success.

Treasurers can focus on the following five areas to give themselves a competitive advantage in this challenging market:

- Planning For the Next Major Upheaval

- Standardizing Global Payments

- Integral, Essential Fraud Prevention and Detection

- Optimizing Liquidity Through Working Capital Solutions

- Reducing Intercompany Transactions with Multilateral Netting

Read on to find out how treasurers can leverage these topics to standardize, centralize and optimize across people, process and technology.

Table of Contents

- Planning For The Next Major Upheaval

- Standardizing Global Payments

- Integral, Essential Fraud Prevention and Detection

- Optimizing Liquidity Through Working Capital Solutions

- Reducing Intercompany Transactions with Multilateral Netting

- Standardization, Centralization and Optimization Across People, Process and Technology

Planning For The Next Major Upheaval

Business continuity can be disrupted for various reasons, from staffing mobility, shortages or externally caused factors like the ongoing global pandemic. Having measures in place to mitigate risk and minimize the impact of these and other unforeseen disruptions is essential. Treasurers must ensure critical daily tasks, such as core safeguarding activities like cash positioning, operating liquidity, investing, supporting strategic decision-making, regulatory compliance and risk management continue to take place without interruption. Treasurers should therefore have suitable measures in place and should document these with a robust business continuity plan.

In particular, treasurers should consider the following:

Standard procedures for remote work

This should now be considered essential in a successful business continuity plan. A recent Fortune report found that 71% of employees now prefer a hybrid or entirely remote schedule due to various factors such as a better work-life balance, not having to commute and having more time for family/personal obligations. With full-time remote work now a norm post-COVID, treasurers and organizations need to enforce detailed processes for daily treasury workflows such as payments, cash reporting and bank account management.

Procedure documentation

This ensures that treasurers have documented steps needed to complete critical daily tasks. The implementation of a treasury management system (TMS) can help to facilitate this effort by providing outlined next steps for each workflow that can be documented with related reports and data. With a documented process in place, treasurers can enhance cross training for new employees and provide clear instructions for employees backing up absent team members.

Employee cross training

Employee cross training establishes a basic understanding of how to execute essential workflows. In the case that an employee is sick or leaves the organization, teams can be sure that daily operations will continue without any gaps in necessary processes.

A strong system with robust security and controls

This ensures that teams can continue their daily workflows without the fear of external attackers accessing valuable information – especially with more employees now working remotely. Since most solutions are now cloud-based, it is imperative that organizations can rely on their systems to protect treasury workflows and information. Some controls that teams can implement include dual-factor authentication, digital signatures and audit trails.

Business continuity is critically important to treasury – employee cross training, documenting critical daily tasks, having employees work remotely – and testing all of these elements, contribute to a strong business continuity program for treasury teams.”

—Treasury Manager, Manufacturing Company

Standardizing Global Payments

Payments is a major focal point for modern treasurers seeking a competitive advantage. Without centralization, a company’s payment processes tend to be fragmented and inconsistent.

Manual processes are associated with a higher risk of error and fraud, while the need to integrate multiple different systems can lead to higher costs and greater inefficiency. Payment centralization, which can be achieved using shared services or payment-on-behalf-of (POBO) structures, can be used effectively to standardize companies’ payment processes. This can result in several benefits, including greater visibility over outgoing cash flows, streamlined banking relationships, reduced costs and improved control over the timing of payments.

Risks can be reduced by expanding payment controls, digitizing audit trails, and introducing intelligent and automated workflows to manage exceptions. Treasury will need to work with representatives from other parts of the business, including accounting, accounts payables and supplier management to map out how payment workflows, including approvals, will operate to ensure that payment processing automation is uninterrupted. Companies will also need to consider what type of software and connectivity are needed to efficiently centralize, including the use of APIs.

Integral, Essential Fraud Prevention and Detection

The risk that companies will fall victim to fraud is considerable. The AFP Payments Fraud and Control Survey found that 90% of organizations saw the level of payments fraud as the same or worse than the previous year.

In addition, 74% of organizations reported to be the target of attempted or successful payments fraud. As fraudsters adopt increasingly sophisticated techniques, it is more important than ever for corporate treasurers to understand different types of fraud and take appropriate measures to safeguard their companies.

Specific threats include business email compromise (BEC) scams, whereby criminals send an email to a company’s employee requesting that a high value payment is made into a specific account. AFP research reveals that BEC scams were the primary source of fraud attacks in both 2019 and 2020, and as these types of scams increase in sophistication, cybercriminals will certainly continue to use BEC to target at risk organizations.

Some of the recent refinements in BEC attacks include:

- Adapting lures to target human resources departments for PII, such as W-2 tax forms to commit stolen identity return fraud, rather than requesting wire transfers.

- Widening money laundering networks, including domestic transfers prior to laundering the money overseas, which presents challenges and opportunities for countering BEC scams.

- Fabricating fake merger-and-acquisition scenarios that require a two-fold impersonation scheme involving the target organization’s CEO and external legal counsel. Cybercriminals will then ask target employees to work with “external legal counsel” to coordinate the payments needed to close the purported acquisition.

Payments fraud prevention can be improved through the use of machine learning (ML) and artificial intelligence (AI) rulesets and logic to catch not only fraud attempts, but anomalies and errors – both common and uncommon. The use of these tools can enable real-time detection that stop suspicious payments before being sent out by banking partners. ML and AI can also facilitate centralized alerts and data visualizations to ensure that only authorized transactions are executed, thus addressing a concern that most treasurers have about potential internal and external attacks on their payment processes.

Digitizing organizational payment policies to automate policy compliance and improve internal governance can ensure that suitable security measures are in place to reduce the risk of fraudulent payments. A system, such as a TMS, can implement pre-defined detection rules to screen for suspicious payments that may need further attention. For example, a solution can define international payments being made to countries where there is no supplier as a transaction that needs to be flagged for further review. In this case, the corporate policy of not making payments to new, foreign countries can be enforced without the need to manually check each outgoing payment. By digitizing fraud detection controls and rules, treasurers can seamlessly automate internal governance and compliance that might be inconsistently adhered to.

Recent advancements in technology can help businesses stop payments fraud before it happens:

- Data visualization can identify and manage exceptions so that payments can easily be reviewed and cleared to minimize delays.

- Artificial intelligence and machine learning algorithms can compare outgoing payment requests to historical payment patterns, identifying and isolating any anomalies.

- Application programming interfaces (APIs) built into your payments platform allow real-time connection to apps that can match payments against third-party data. Such data allows you to verify ownership of the account you’re paying and confirms that you’re not paying an entity on the Office of Foreign Assets Control (OFAC) sanctions list.

Optimizing Liquidity Through Working Capital Solutions

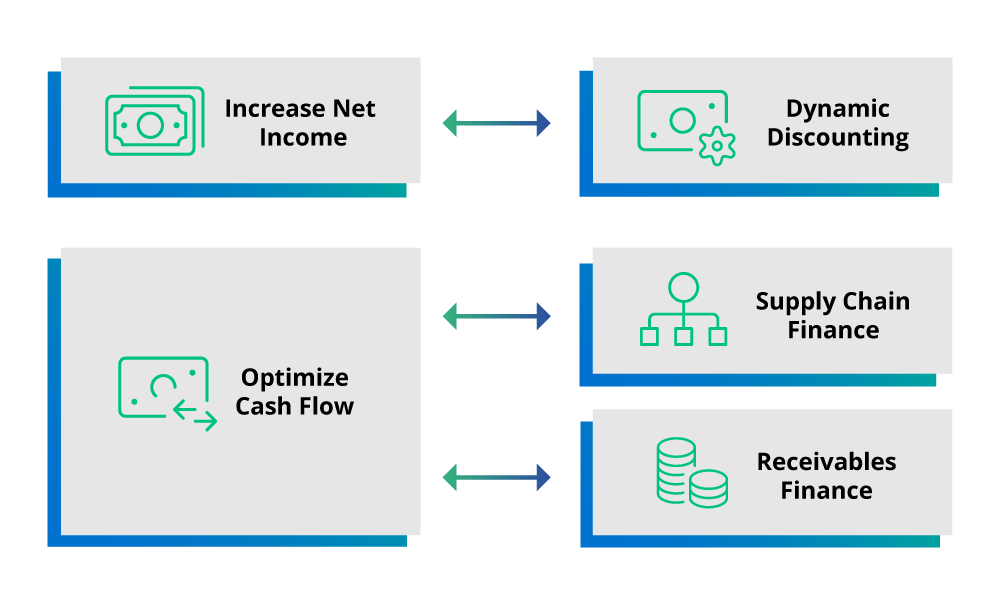

Treasurers can gain competitive advantage by using payables finance and receivables finance structures to reduce supply chain risk and fully optimize liquidity.

Working capital programs allow companies to mobilize liquidity and inject cash into supply chains so that suppliers receive a financial lifeline, while strategically supporting business growth. Such programs can bring a number of benefits for both buyers and suppliers:

- Buyers can fully leverage their supply chain to optimize payment terms, enhance cash visibility and provide a financial incentive for sustainability sourcing.

- Suppliers can increase free cash flow, reduce financing costs and increase sales by utilizing early payment working capital programs.

Different working capital solutions are available, including dynamic discounting, supply chain finance and receivables finance programs:

- Dynamic discounting programs allow early payment discounts to be managed in a more flexible way. Sliding scale discounts enable buyers to choose payment dates in accordance with cash availability, while sellers can choose which invoices to offer for discount.

- Supply chain finance programs allow buyers to enable their suppliers to optimize payments terms for invoices via the buyer’s bank. Buyers can therefore improve liquidity for their suppliers, even if payment terms are restructured.

- Receivables finance programs empower suppliers to access early payment on outstanding receivables due from buyers. This type of solution allows suppliers to remain in control of obtaining the most efficient funding sources for its receivables, while increasing sales and reducing the corporate credit risk position.

This is the most exciting area for the treasurer that wants to be a key strategic business partner across all functions of the corporation. […] You can build stronger relationships down the chain and increase your competitiveness up the chain, all while increasing profits – it is the true win-win that comes from using technology to do things smarter.”

—Global Treasury Director, Fortune 500 Construction Company

Reducing Intercompany Transactions with Multilateral Netting

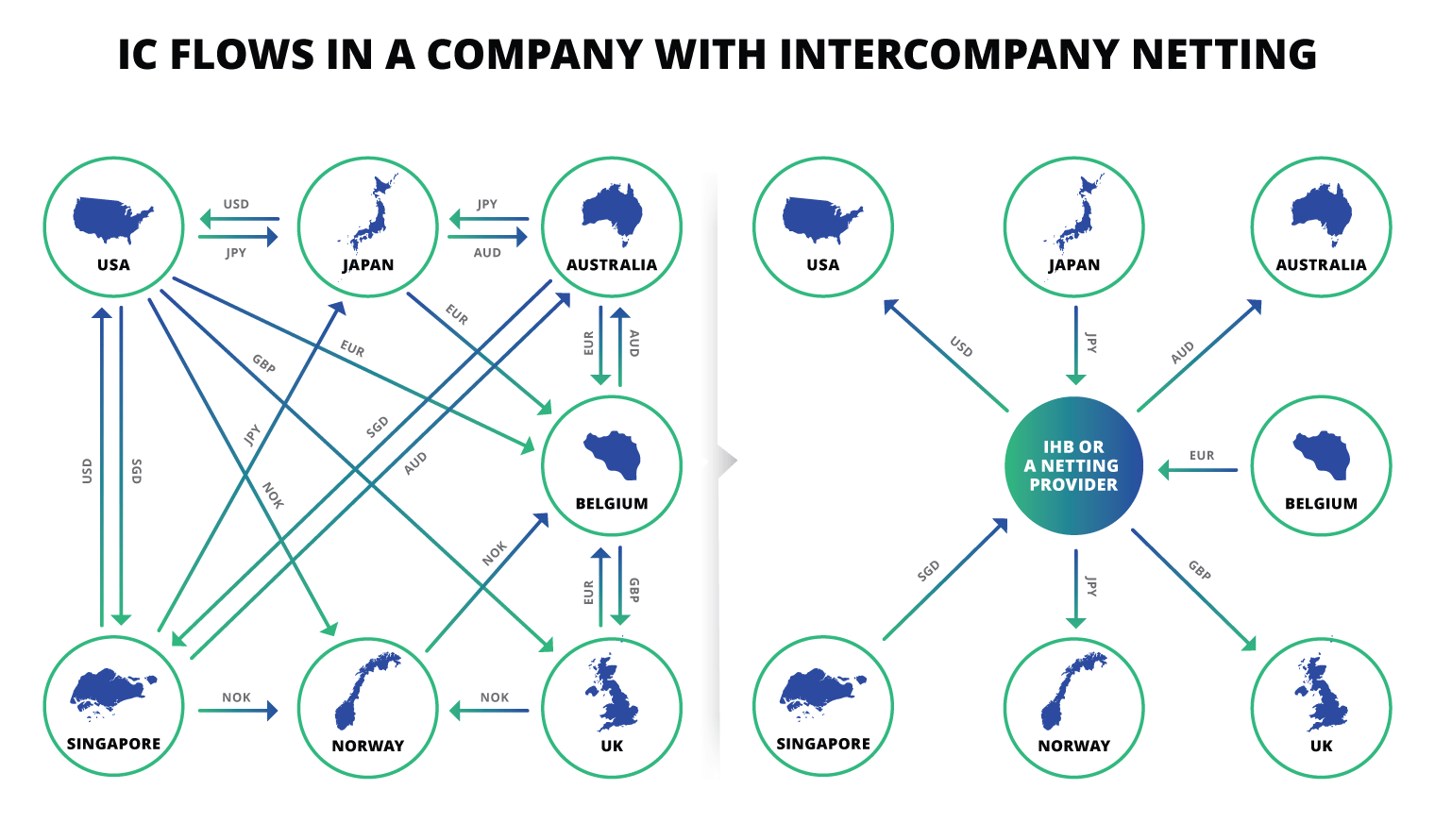

Organizations can incur intercompany balances and make intercompany payments due to several different activities, including dividends, trade payables, cost shares and intercompany loans.

Companies that see a high volume of intercompany payments can experience higher bank fees, FX payment costs and settlement risk. To add, the task of processing intercompany payments is often a manual and time-consuming exercise.

Companies with large volumes of intercompany payments can use multilateral netting solutions to reduce the number of physical payments which need to be made. A netting system consolidates intercompany payments, with each participant making or receiving a net payment each month instead of settling each payment individually. This has the result of reducing bank fees, while eliminating manual tasks and settlement risk.

It is important to note that companies can realize significant benefits when implementing an in-house bank to facilitate a netting structure. Some key areas that can be improved with an in-house bank include the following:

- Global cash pooling gives organizations a bird’s-eye view of where their cash is at all times, increasing the visibility to ultimately allow leadership to challenge local entities to get rid of extra cash on hand and be allocated to different resources or investments.

- Centralized risk management allows each entity the opportunity to reduce or eliminate spot trades and process cross-border wires, which can significantly reduce bank fees.

- Payments centralization reduces the cost of failure as payments are being paid from a central account with verified, successful payment workflows. The consolidation of payments also increases visibility and improves accuracy to ensure that reporting is more accurate for leadership to make better, more informed decisions.

- Optimized FX payments can be achieved by way of reducing payment volumes provided through netting results, while the larger payment amounts per transaction delivery provides better pricing for FX spot or forward contracts.

Netting systems can provide a standardized workflow process which can be used consistently around the globe. Leveraging technology to clean up the flow of transactions between each entity can empower organizations to increase their visibility and better understand cash flow to ultimately improve financial closes and the stability of an organization’s capital in each entity.

Standardization, Centralization and Optimization Across People, Process and Technology

The current business climate presents treasurers with considerable challenges, from evolving working environments to ever-changing payment formats and from persistent cyber-crime to supply chain disruptions. These and other challenges will continue to dominate headlines, but treasurers can fortunately leverage the process techniques and operational structures outlined in this ebook to overcome the modern-day obstacles and gain a competitive advantage.

The 5 ways to overcome today’s treasury challenges all center around standardization, centralization and optimization. The challenges of today present scenarios that typically fall outside of treasury’s control, so it is imperative that treasurers equip their teams with processes and workflows that combat external factors. For example, cybercriminals are going to continue their fraudulent attempts especially as technology continues to advance. With the appropriate processes and systems in place, treasurers can safeguard all their global teams with standardized workflows to ensure that liquidity is being protected, no matter where the attack is coming from.

Implementing a system to optimize and centralize treasury processes will not only defend treasurers from today’s challenges but will also empower treasurers to uplift their teams as strong influencers and partners across the organization. Today’s treasury teams can provide invaluable information for CFOs regarding cash flows, working capital and risk management. Having a centralized view into all liquidity processes is the foundation of an innovative treasury department and will allow leadership to make better, more informed decisions for growth opportunities. Standardizing, centralizing and optimizing treasury operations is essential for treasury teams looking to flourish in today’s rapidly changing environment.