eBook

Centralizing Payments with an In-House Bank to Fully Optimize Working Capital

Modern treasury teams have numerous available tools and structures to succeed in today’s global economy. With supply chain disruptions and decreased cash flows prevalent, treasury can leverage an in-house bank (IHB) and Payments Hub to optimize working capital for an improved liquidity portfolio.

This eBook highlights three key areas in which an IHB can improve working capital operations through centralization and standardization:

- Setting the stage for a working capital program

- Knowing when to pay suppliers

- Knowing how much to allocate to working capital operations

Table of Contents

- What is an In-House Bank?

- Centralizing Outgoing Transactions with a Payments Hub

- A Payments Hub Supports the Structure of a Working Capital Program

- Centralizing Payments Allows Leadership to Determine When to Pay Suppliers

- An IHB Facilitates Cash Visibility to Determine the Amount of Funds to Allocate for Your Working Capital Program

- Leveraging Technology to Enable a Successful IHB and Working Capital Program

What is an In-House Bank?

Today’s fast-moving global business environment demands leading treasury teams have full visibility into their liquidity. To combat the challenges from growing numbers of entities, banking relationships, internal transactions and intercompany loans, treasurers are utilizing an in-house banking structure to centralize daily operations and organizational cash flow.

An in-house bank (IHB) is a dedicated group or legal entity within the organization that provides banking services such as cash management, payments-on-behalf-of (POBO), collections-onbehalf-of (COBO) and working capital to different business units within the company. Put simply, an IHB centralizes flows and balances by executing all transactions through the designated, operating IHB entity.

Benefits for Your Organization

Implementing an IHB can deliver improvements to most, if not all areas of your business. Through intercompany netting, an IHB can centralize all internal flows through the designated entity to simplify the company’s payment structure and reduce payment volumes. Payments and collections to/from third parties act similarly:

- POBO: Outgoing transactions are executed by the IHB entity on behalf of operating companies and then debited to the operating companies’ intercompany account.

- COBO: Receivables are received into the IHB’s bank account on behalf of the operating companies and then credited to the operating companies’ intercompany account.

Aside from simplifying internal and external transactions, in-house banking structures provide numerous benefits for large, global organizations:

| Treasury Process | ||||

| CASH | PAYMENTS | FX | WORKING CAPITAL | |

| Benefits | ||||

| Increase cash visibility and control with global cash pooling | Mitigate fraud attacks with the centralization of outgoing payments | Centralize risk management processes by aggregating the number of exposures | Ensures better support for business units and easier selection of the right invoices for inclusion in your supply chain financing program | |

| Simplify your banking landscape, the number of banking relationships and the number of physical bank accounts | Reduce the number of intercompany loans and solidify your organization’s intercompany loans management process | Net your FX payments to reduce the number of transactions and increase per trade volume, receiving better spreads | Improve working capital with increased visibility into cash flows | |

| Increase returns with less idle cash through sweeps, better repatriation | Reduce the number of internal transfers to/from different entities with multilateral netting | Reduce cross-border payment fees | Gives more opportunities for discounting through better visibility in a POBO or payments hub model | |

Important to note, many treasurers have recently made working capital a key focus moving forward, as the current economy’s supply chain disruptions have continued to persist. The remainder of this ebook will discuss how the centralization of payments through an IHB can improve working capital and ensure that your company is making the most of your liquidity for future growth.

Centralizing Outgoing Transactions with a Payments Hub

Before discussing how working capital processes and decision-making can improve with an inhouse bank, it is important to understand how a payments hub can be introduced with the help of an in-house bank implementation.

Global entities often make payments to the same third-party vendor through their own separate bank, which creates a complex and unnecessary string of transactions. The introduction of an IHB allows organizations to utilize a POBO model to consolidate and streamline payments that are being made to the same vendor.

Organizations can reap numerous benefits by centralizing all separate, outgoing transactions, some of which include:

- Reduced bank fees associated with payments

- Increased visibility into outgoing payments and liquidity

- Improved and more accurate forecasting reporting through visibility to payments

- Reduced cost of failure due to payments being paid from a central account

- Less idle cash as only the Payments Hub needs to keep liquidity

Centralizing all outgoing transactions through an IHB can improve daily processes that are not only related to payments. One area of the business that treasurers are realizing significant value gains in is working capital management. Centralizing payments with an IHB can fully optimize your organization’s working capital through the following three components:

- A payments hub supports the structure of a working capital program

- Centralizing payments allows leadership to determine when to pay suppliers

- An IHB facilitates cash visibility to determine the amount of funds to allocate for your working capital program

A Payments Hub Supports the Structure of a Working Capital Program

Standardizing and automating payment workflows through a payments hub can help to ease the implementation of a working capital program.

The vast amount of payment and treasury management vendors in today’s financial space makes it simple to standardize and automate payment processes. The biggest impact that treasury teams can expect when automating payment workflows is visibility into incoming and outgoing invoices to better understand transaction lifecycles. With real-time data into organizational invoices, treasury teams can work toward shortening invoice lifecycles to be able to leverage early payment discounts with suppliers.

A recent AP & Working Capital Report acknowledged that 31% of respondents found that manual routing of invoices for payments and approval stood in the way of an early payment discount. Manual AP processes can also lead to incomplete/ missing information on invoices, lost invoices, invoice exceptions and decentralized receipt of invoices, which can all impact an organization’s working capital performance.

Overall, standardizing and automating the procure-to-pay process will result in a clearer picture of your organization’s financials and increase the insight you have into supplier relationships.

Some best practices when standardizing payment processes to improve working capital include:

- Centralize payment processes and reporting to enable global teams to have better visibility into all outgoing transactions. Centralization also facilitates the standardization of processes to ensure that workflows like invoicing consist of accurate and timely procedures.

- Digitize payment processes to reap significant benefits when setting up a supplier portal. Efficiently communicating with suppliers through an electronic portal allows suppliers to automatically generate invoices for each new order, electronically validate and accept invoices, and electronically track the status of orders and payments received.

- Develop an effective procurement process to keep track of all received invoices and reconcile each invoice to its associated PO to produce better forecasts for cash flow reporting. An effective procurement process also ensures that your organization is working with pre-approved vendors to stay within the authorized spending limits.

- Create a strong accounting process to improve visibility into how much and how often companies should pay their suppliers. Optimizing payment terms will empower your organization to make the most of your working capital program and fully optimize liquidity.

Centralizing Payments Allows Leadership to Determine When to Pay Suppliers

The centralization of your organization’s payments process will empower decision makers to know when the best time is to pay suppliers – and also when not to.

The best practice of creating a strong accounting workflow to optimize payment terms can aid in the process of determining when to pay suppliers. In the case that a solid payment structure is present, organizations can leverage centralized payments to have better visibility into outgoing transactions and thus, cash flows.

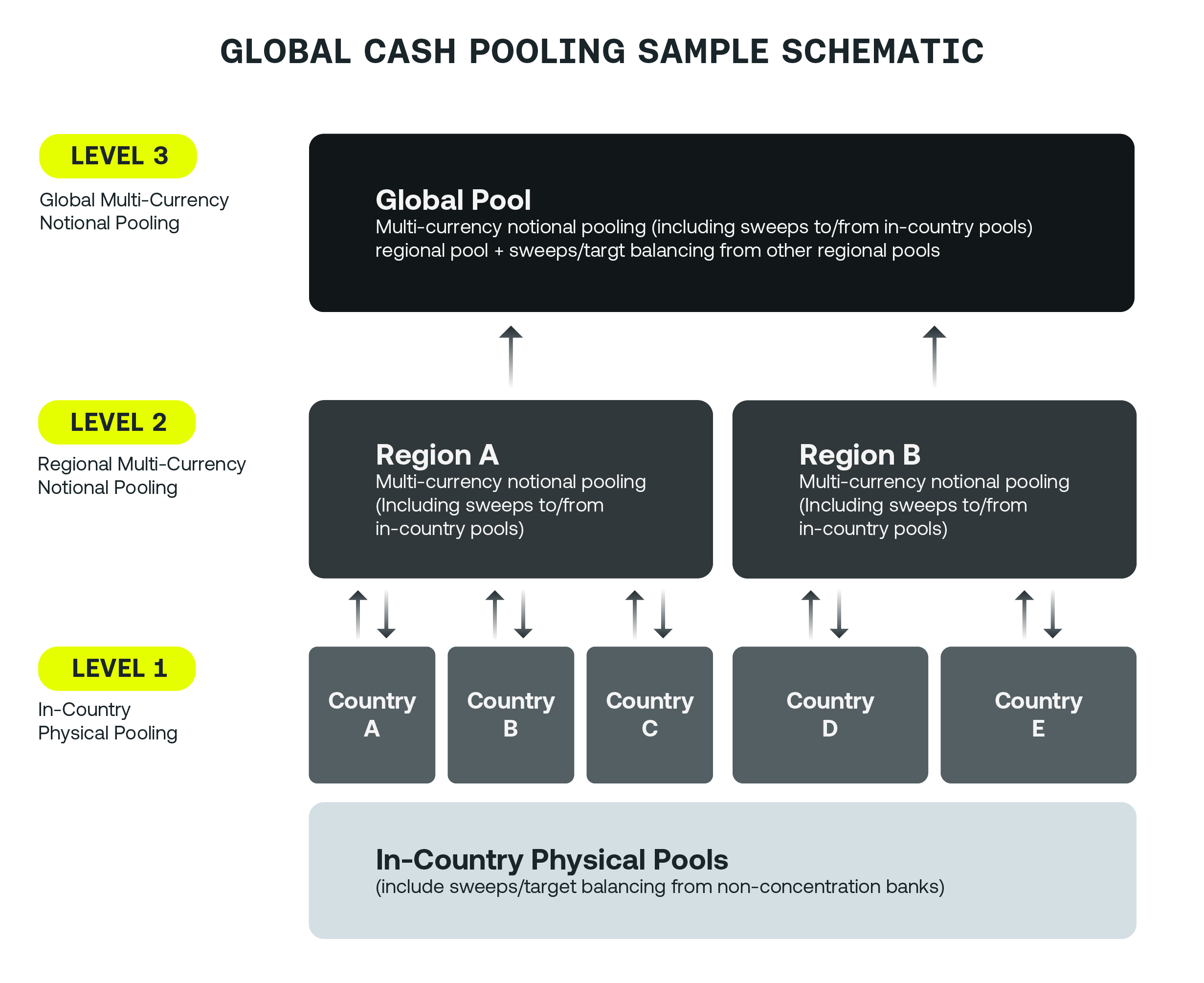

Centralizing payments through a payments hub and IHB facilitates better reporting for treasury teams to forecast with more accuracy and consistency. The ability to sweep local funds into regional cash pools increases the confidence of an organization’s cash on hand, while also enabling teams to transition from point-in-time and end-of-month balances to real-time visibility into liquidity. With reliable forecasts and reporting available, organizational decision makers are empowered to make more informed decisions to improve working capital processes.

Clear visibility into cash and outgoing transactions allows treasury teams to know when they might have more cash on hand to allocate towards working capital operations. Having a clear, transparent view into the organization’s cash flow patterns can enable teams to negotiate payment terms with suppliers, while also having the confidence that the suggested payment terms are in alignment with company balances.

Optimizing payment terms can result in a number of benefits for buyers depending on the type of program(s) implemented, some of which include:

- Increased cash flow

- Reduced supply chain risk

- Reduction in cost of goods sold (COGS) and improved margins

- Strengthened supplier relationships

- Enhanced corporate social responsibility (CSR) credentials

Working capital programs that optimize payment terms for buyers also provide significant benefits for suppliers:

- Reduction in days sales outstanding (DSO)

- Greater certainty predictability over cash flows

- Reduced corporate credit risk

- Access to cheaper liquidity than can typically be obtained, as the cost is calculated based on the risk of the buyer and not the supplier

An IHB Facilitates Cash Visibility to Determine the Amount of Funds to Allocate for Your Working Capital Program

Centralizing payments through an in-house bank increases the confidence in cash reporting and forecasting to determine how much liquidity should be allotted for working capital operations.

Reporting across disparate systems, multiple banks and various entities is a challenge for most organizations so without an automated payment structure in place, cash and forecasting processes can often involve manual efforts that are prone to errors and inconsistencies. If liquidity information is not updated in realtime, leadership is most likely making decisions based on outdated information, which can lead to the inappropriate allocation of funds. Reliable and clear access to reporting ensures that treasury teams are strategically allotting the correct amount of organizational funds to their working capital operations, depending on the outlined metrics that they desire to achieve.

Having trustworthy data empowers teams to be certain that their budgets are legitimate and that their plans for business growth are on track. Accurate and timely payments reporting is critical for the success of a working capital program and by marrying the visibility of cash and payment processes through centralization, real-time decisions can be made on the fly.

Another consideration to take into account when evaluating the benefits of an IHB includes the idea that an organization can consolidate the number of global bank accounts with the assistance of an IHB and payments centralization. The cash pooling function of an IHB can improve visibility and controls, allowing enterprise companies to reduce the number of accounts needed to operate efficiently. A high number of bank accounts can oftentimes lead to an inefficient working capital program, as the amount of work to consolidate daily cash positions for forecast reporting increases with the number of accounts. Decreasing the number of global bank accounts creates concentrated cash pools that leadership can pull reports from to determine the correct allocation of funds for a working capital program.

The concentration of cash through physical and notional pooling allows organizations to have a bird’s eye view of how much cash is on hand, at all times. The structuring of concentrated cash pools also enables leadership to fully leverage the maximum amount of cash for working capital, as the increased visibility encourages local teams to get rid of all extra cash on hand.

Lastly, cash pooling helps to facilitate offshore treasury centers, which helps to improve the flow of capital through these offerings:

- Favorable tax laws

- Reduced risk and greater growth potential

- Cost savings for the business

- Protection of assets during times of instability

Leveraging Technology to Enable a Successful IHB and Working Capital Program

The implementation of a treasury management system (TMS) can simplify the implementation of an in-house bank and create a working capital program that fully optimizes cash for significant gains.

A sustainable IHB and payments hub features automation that is typically facilitated by a TMS. Most companies use a TMS to manage the internal, complicated processes of receiving external bank statements, converting those statements into internal versions and creating all the needed postings. Potential netting processes and the management of the pay-on and collect-on behalf of models also leverages TMS features that banks or internally-developed systems cannot handle. While organizations can create a manual or internal IHB, a TMS reduces the time it takes to start a program and simplifies the effort of an implementation and ongoing maintenance.

All of the listed capabilities on the previous page work to create standardized and optimized operations for a streamlined business. Leveraging technology to create a successful IHB structure will lend itself to a profitable working capital program that can also be improved with the use of a third-party system. A TMS can help to create standardized workflows, facilitate connections to third-party funding and build a successful supplier portal for your organization’s working capital solution. Without technology in place, the process of constructing a working capital program can be unnecessarily difficult and time consuming. Leveraging a system to simplify leadership’s effort in creating a program will be appreciated in the long run and ensure that a successful foundation is in place.

Leveraging a TMS to facilitate processes such as working capital and payments will provide significant benefits for treasury teams looking to free up cash flow and reduce supply chain risk. The implementation of a TMS will also prove to automate other areas of treasury operations so that employees and leadership can focus on strategic, business growth initiatives. Utilizing technology for your company’s daily processes will ensure that future success is supported by a reliable structure that promotes innovation and optimization.

Aside from automation, a TMS can help to provide the following:

- Robust multi-bank connectivity

- Secure controls and standardized, pre-built processes

- Streamlined global payments

- Cash flow forecasting templates and workflows

- Electronic bank account management

- Advanced intercompany loan and multilateral netting features

- Deliver the extensive company and cross-company GL postings created by an IHB