eBook

International Treasury Centers Unlock Global Cash Visibility

During the pandemic, most organizations have experienced unexpected fluctuations in their cash and liquidity levels due to the volatile, unsettled global economy. Treasury operating models have a direct correlation to how well cash positioning and liquidity forecasting is delivered and executed. Making the change to an International Treasury Center (ITC) can help deliver greater efficiency and visibility into liquidity levels, payments and core functions like netting or intercompany reporting.

The type of treasury operating model your organization falls into directly impacts how effective your people, process, and technology can support daily workflows to drive better operational and strategic capabilities.

See the table below for the advantages of an International Treasury Center:

| Decentralized | Centralized | International Treasury Center | |

| Process |

|

|

|

| Operations |

|

|

|

| Technology |

|

|

|

ITC structures are organizations often interchangeable with, and also known as, an in-house bank. ITCs allow organizations to better centralize risk, aggregate cash, and manage intercompany positions and payments, while promoting consistent organizational workflows, processes, controls, and driving continuous improvement.

By acting as an in-house bank, ITCs help organizations achieve better efficiency over their global liquidity and risk management by allowing for greater control of bank balances, subsidiary funding, and pooling funds. Through increased control over liquidity, treasury and finance teams drive realization of significant benefits in the following areas:

- Global Cash Pooling

- Intercompany Netting

- Centralized Risk Management

- Payments Factory

Global cash pooling is foundational in developing and supporting in-house banking and International Treasury Centers. Once banking structures and pooling arrangements are in place, the other components of an ITC can be implemented as needed and in whatever order is most beneficial for business needs. As global cash pooling provides the ability to provide closer to 100% visibility of liquidity, additional benefits like better rates and shared use of surplus liquidity to minimize intercompany loans or internal transfers can be leveraged after the pooling structure is in place.

The pooled use of funds by a centralized treasury center becomes the foundation for further expansion of the ITC and empowers organizations to have complete control over their liquidity, intercompany lending arrangements, and ensuring the delivery of funds for new or emerging market subsidiaries.

The remainder of this ebook will further discuss how each component of an ITC can positively impact your organization in the context of an overall solution.

Global Cash Pooling

By pooling global cash balances into a single account or net group position, organizations can realize:

- Improved visibility, on-demand access, and enhanced control of cash

- Efficiencies gained as a result of centrally managed liquidity

- Improved working capital management

- Timely settlement of transfer pricing transactions

- Reduced bank fees and an increase in available credit lines

By sweeping balances into designated, centralized pools, organizations can have a bird’s-eye view of where their cash is at all times. This increased visibility allows leadership teams to challenge local entities to get rid of extra cash on hand and be allocated to different resources or investments. Ultimately, having clear, reliable data on how much cash is available facilitates better discipline within organizations and eliminates the need to take on extra, unnecessary debt.

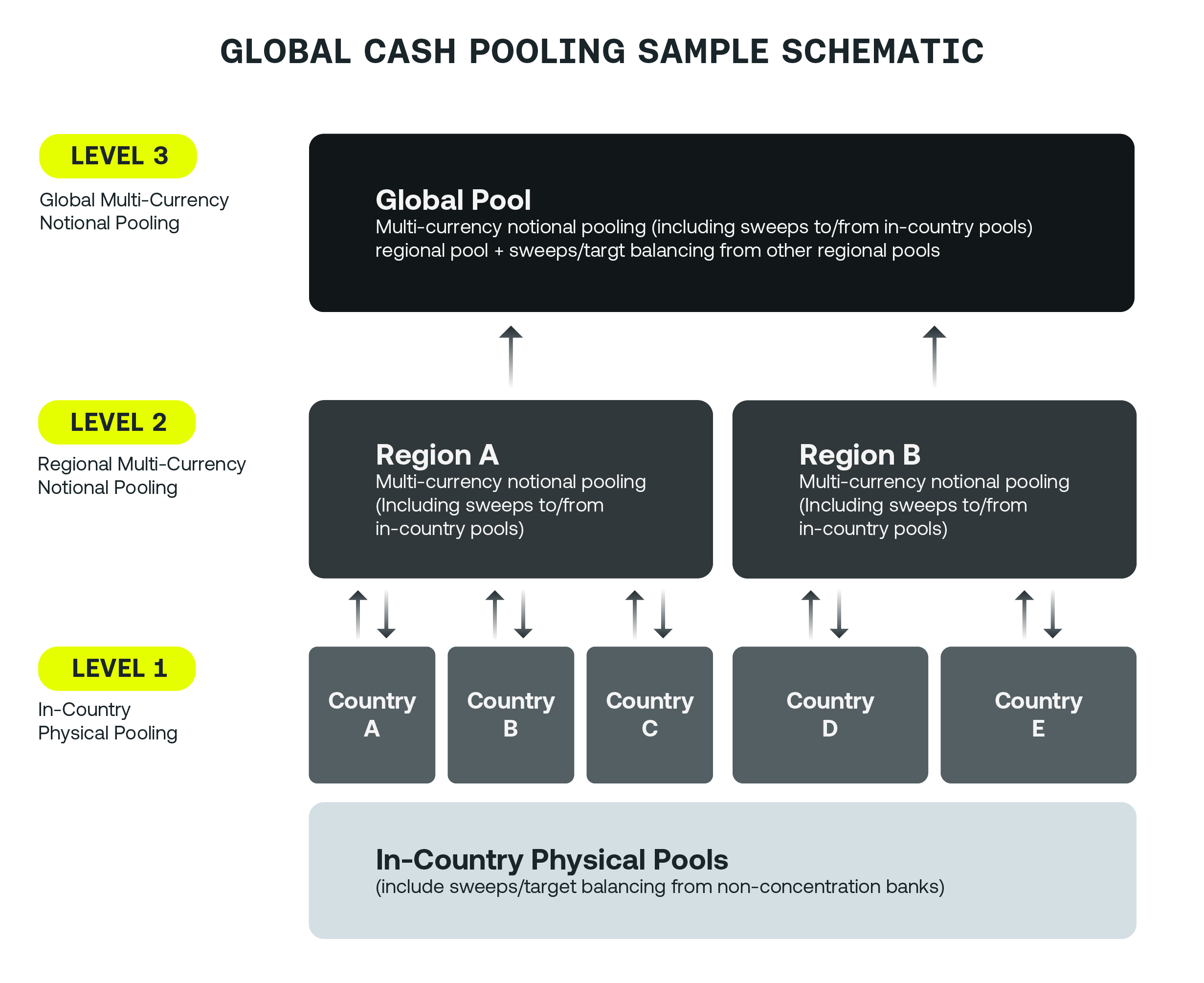

When looking to build a global cash pooling schematic, global organizations will typically have three different levels to consider:

- In-country physical pooling

- Regional multi-currency notional pooling

- Global multi-currency notional pooling

- In-country physical pooling: Level 1 includes aggregating funds at a country and local currency level from non-concentration banks that will ultimately be swept up into regional pools. Depending on how many countries an organization is pulling cash from, it is important to note how many different currencies will be involved.

- Regional multi-currency notional pooling: Level 2 creates a more regional view of an organization’s cash by sweeping cash to/from in-country pools. The number of countries will determine the number of regional pools needed in the cash pooling structure, as this level of pooling looks to centralize matching currencies for a consolidated view.

- Global multi-currency notional pooling: Level 3 includes sweeps to/from in-country and regional pools to provide a targeted, global view of an organization’s cash. One consideration while creating this top-level pooling structure is whether to pool cash at a single entity or multi entity level. Although most organizations are opting for a single entity level, multi entity level pooling structures are also an option – since banks want to ensure that other entities can cover one another, the concept of a cross guarantee is created to ensure that the bank has the right offset across different currency balances. With this in mind, single entity levels are easier for banks to implement from a regulatory perspective and are still useful for organizations looking to implement an in-house bank.

Intercompany Netting

As organizations grow and intercompany flows increase, the transactions between legal entities start to look like a spider web — hundreds of payments going back and forth with no centralization creates a web-like-mess that is complex and confusing.

The communication between each part of the business becomes more and more complicated as different currencies and languages are added, creating an inefficient process that is essential to daily operations. Organizations that utilize an International Treasury Center and implement an intercompany netting program can help to streamline this process, while also reaping the following benefits:

- Reduction in banking fees and FX cost as the result of fewer transactions

- Automated accounting reduces Record to Report (RTR) manual processes

- Increased efficiency for RTR through automated intercompany processes

- Increased control of intercompany processes

- Reduced transaction volumes for Procure-to-Pay (P2P) and reduced journal entries for RTR

Features of companies with netting

- Simplified payment structure

- Reduced FX exposures

- Reduced FX transactions

- Reduced payment volumes—significantly reduced bank fees—avoid using banks to pay ourselves

- Improved financial close, improved stability of capital in subsidiaries due to timely payments

Utilizing technology to clean up the flow of transactions between each entity can allow organizations to make a single settlement, instead of hundreds or thousands, to simplify their payment structure and reduce payment volumes. By doing so, organizations can also increase their visibility and better understand the flow of cash as they no longer have to sort through endless transactions to summarize the amount of cash on hand at each entity. Intercompany netting programs can ultimately improve financial closes and the stability of an organization’s capital in each entity, as payments are more likely to be made on time with the simplified process.

Centralized Risk Management

International Treasury Centers can help to centralize risk mitigation processes that are associated with cash management, FX execution and hedging, and debt and investments. By aggregating all of the appropriate currencies into one, the number of exposures can be reduced and the conversion process for each entity is simplified.

The potential benefits that an organization can derive from centralizing their risk management processes include:

- Reduced FX execution spreads and settlement volumes

- Improved efficiency in risk mitigation due to centralization

- Lower transaction costs due to reduced volume of transactions, better pricing from higher value FX trades

- Reduced effort and staffing required for FX management and execution

- Lower costs of compliance

- Improved management and exposure reporting

- Improved internal controls

- Standardized treasury operations

Centralizing FX processes allows each entity the opportunity to reduce or eliminate spot trades and process cross-border wires, which can significantly reduce bank fees. Not only does this save money and increase the amount of cash on hand, but it allows organizations to view their liquidity in a centralized location instead of at each entity level. Having an ITC serve as the central location for any and all risk workflows unlocks the possibility of improved cash visibility and liquidity best practices.

Payments Factory

Organizations can simplify their payment processes and consolidate individual payments made to the same vendor when implementing an International Treasury Center by using a pay-on-behalf-of (POBO) model.

Instead of each entity paying through their own separate bank, a Payments Factory allows organizations to centralize their payments through the ITC bank (this can also be referred to as the in-house bank) and streamline the appropriate transactions to each shared vendor. By having a multi-currency, central entity pay on behalf of each subsidiary, organizations can reap the following:

- Consolidated accounting view for Record to Report (RTR)

- Consolidated payments to global vendors, enabling lower bank fees and simplified tracking for Procure to Pay (P2P)

- Less idle cash as only the Payments Factory needs to keep liquidity

- Creation of cash pools to allow entities to borrow and utilize excess funds

- Single bank payments file and straight-through processing (STP) from payment to accounting and bank reconciliation

- Ease of auto reconciliation for RTR using Payments Factory

Payment Factories reduce the cost of failure as payments are being paid from a central account with verified, successful payment workflows. By consolidating each separate transaction, visibility is increased and reporting can be more accurate for leadership to make better, more informed decisions. With the improvement of payment processes, other areas of the business, such as cash reporting and forecasting, will also see refinement to allow the organization to grow and improve.

Utilizing a TMS to Facilitate an ITC

When considering if an organization would benefit from implementing an International Treasury Center structure, it is also important to consider if implementing a Treasury Management System (TMS) to facilitate the ITC would be just as impactful.

While ITCs do a great job of streamlining and simplifying processes, the restructuring process of an organization’s workflows can be daunting. Utilizing a TMS to help set up these processes not only makes the restructuring process easier, but also provides some added benefits that don’t come with just an ITC itself.

The idea of implementing an ITC program lends itself to automation, as they look to ultimately streamline processes. While an ITC can certainly automate processes, implementing a TMS to facilitate the automation of workflows can alleviate some of the front-end work that IT departments might have to configure when structuring cash pooling. In addition, the connectivity options that a TMS offers is unparalleled.

Being able to seamlessly connect with banks, ERPs, and other systems allow organizations to have even more visibility into their data points, which further improves the business case for a cash pooling environment. With all the different transactions, accounting entries, and FX exposures to track, it only makes sense to incorporate a centralized system that frees teams of working in manual, decentralized environments.

The main point to recognize is that a TMS can facilitate the implementation of an ITC or in-house bank. With this in mind, it only makes sense for organizations to take the next step and centralize all of their processes, even the ones that may not be seen within the ITC. Centralizing cash pooling, intercompany netting, risk management, and payments is a great start, but having a system that can unlock all of an organization’s liquidity is certainly a case to consider.