Fact Sheet

Kyriba Analytics

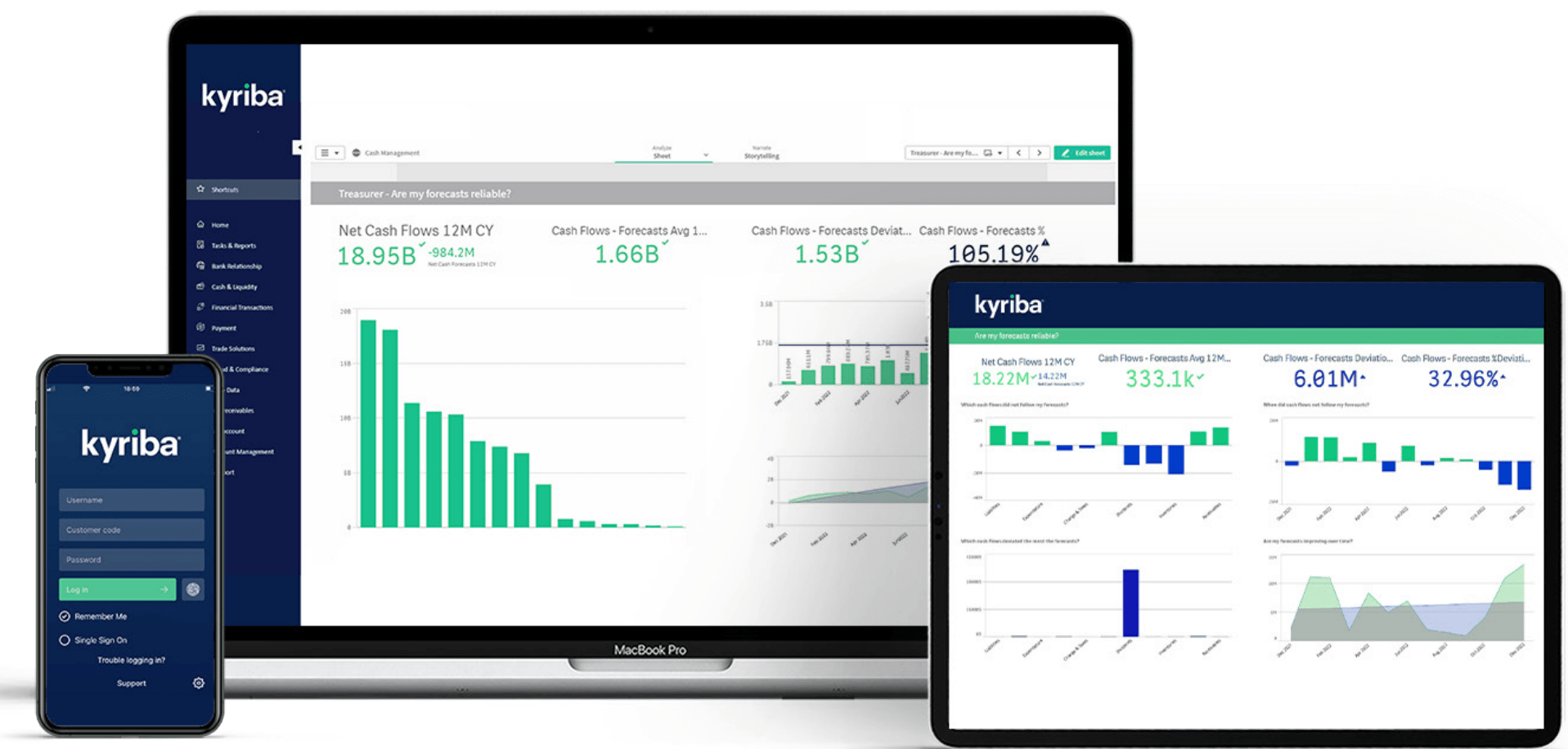

Kyriba Analytics delivers integrated visual dashboards and pre-built data analytics for cash flow management, liquidity management, treasury and risk management, payments management and supply chain finance management modules.

Kyriba Analytics goes beyond traditional reporting by offering on-demand drill down, dashboard editing, and a transformed visual experience for presentation-ready information sharing.

Data visualization, reporting and insights into more cross-functional information are key areas where CFOs need treasury to improve its technology solutions to match industry best practices.

Table of Contents

Strategic Insights into Liquidity and Risk

Kyriba Analytics provides treasury analytics to enable predictive decision-making in the hands of finance with AI. Dashboards for scenario analysis, apply trends, market data and past criteria to drive improved insights:

- Visualize cash and liquidity across your entire organization

- Forecast debt with flexible scenario analysis on both cash inflows and outflows for clarity against future shifts

- Visualize debt and risk level impacts to your profitability

- Support CAPEX spend and strategic decision-making for optimal ways to fund acquisitions or support funding international subsidiaries

- Know where debt load is and across types of instruments

Featured Highlights

Interactive Analysis

- Dynamic visualization and drill-down analysis

- Uncover data relationships and trends through graphical exploration

Ready to Go

- Instant access to standard reports and formulas out of the box

- Leverage pre-built KPIs, visualizations, and calculations

Self-service Dashboard

- Build your own interactive dashboards

- Share your customized dashboards with your teams

Fully Integrated

- Fully secure within Kyriba’s cloud

- Complete data segregation by user

- Empower team collaboration

Treasury Analytics: Use Cases

Liquidity Analytics

- What is my net debt and my liquidity?

- How and when best to pay down my debt?

- How many “days of survival” do I have?

Cash Analytics

- Do I have enough cash?

- Is my cash forecasting reliable?

- What is my activity with banks?

Payments Analytics

- Where is my biggest concentration of payments?

- Are we sending too many wires?

- Which users execute payments and who approves them?

Treasury Risk Analytics

- How much is available on my credit lines?

- What is my borrowing profile?

- What is the value of my financial assets?

SCF Analytics

- What is my supplier participation rate?

- How many documents have been uploaded?

- Which invoices are financed?

Compliance Analytics

- Who are the users and where are they located?

- Which modules can they access with which rights?

- What data can they access?

Why Kyriba Analytics?

| Traditional Reporting | Analytics | |

| Advanced data visualization |  |

|

| Self-service dashboard creation |  |

|

| Data drill-down |  |

|

| Variable change on-the-fly |  |

|

| Large data volume handling |  |

|

| Empower better collaboration across the organization |  |