Research

The CFO as the Chief Growth Officer

Table of Contents

Executive Summary

CFOs are working side by side with the CEO and board to set strategy and chart the growth trajectory of the enterprise. They are facing an increasingly volatile global business environment, one reshaped by disruptive technologies and the emergence of new global competitors and business models. To ensure their companies thrive, top executives need insight into the financial performance of the organization, so they can make rapid decisions about future resource allocation as fast or faster than their industry peers. CFOs, supported by their treasury teams and technologies, have access to the company’s financial liquidity position and the ability to pull specific levers to free up cash and enhance the company’s ability to achieve its growth targets.

The New Role of the CFO

One of the CFO’s critical roles is helping management optimize the company’s deployment of its financial resources. To deliver on this mandate, CFOs require an unencumbered view of the company’s monetary assets. Using new, cloud-based treasury management systems, they can see through legal entities, bank account structures and geographical barriers to get a real-time view of the company’s financial position. The technology gives them clearer line of sight into future liquidity, and thus lets them make more valuable contributions to critical business decisions, such as making transformative investments and renegotiating vendor terms. They can also help fund growth opportunities by condensing the cash conversion cycle to release significant amounts of cash and minimize the cost of external borrowing. By adopting treasury management systems (TMS), CFOs can advance their company’s growth objectives in the following ways:

- They can optimize the company’s generation of internal cash flow.

- They can provide real-time visibility into current and future cash.

- They can deliver a holistic view of the company’s risk exposure.

Shortening the Cash Conversion Cycle

Using new, technology-powered supply-chain finance approaches, CFOs can see across the entire financial supply chain and enable transactions like reverse factoring (see sidebar on next page). The TMS can connect buyers and sellers of receivables directly and facilitate the application and exchange of early payments or calculations of dynamic discounting. This helps CFOs find opportunities to reduce companies’ days sales outstanding (DSO) to unleash significant free cash flow. That cash can be put to work not only to fund ongoing operations but also to finance enterprise-level initiatives like acquisitions, new product development and marketing campaigns. Additionally, it can be earmarked for paying down debt or dividends, or buying back stock.

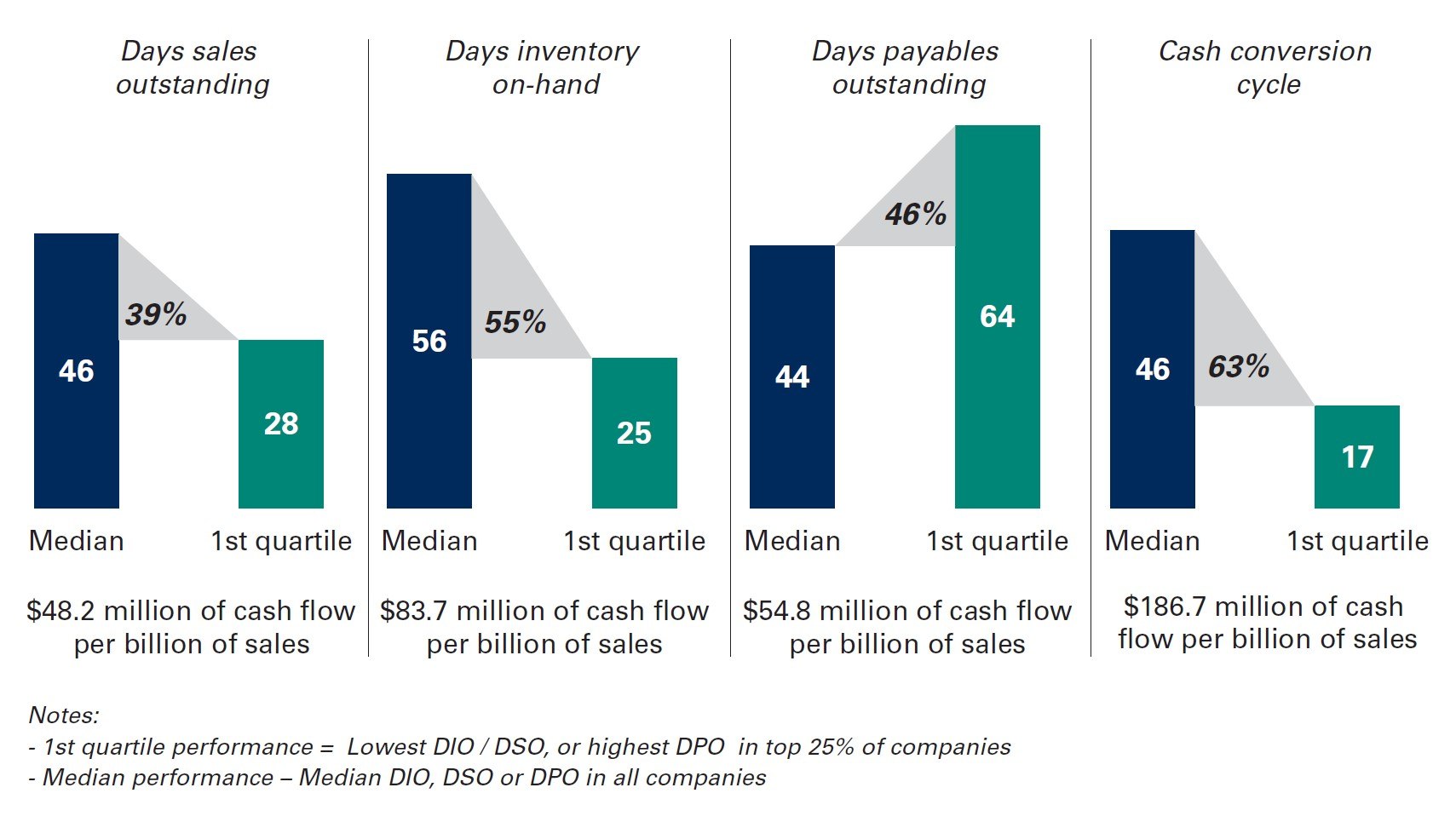

Top-performing finance organizations realize significant benefits from automating and optimizing their working capital management. Our 2017 Hackett-REL Working Capital Management study revealed a growing gap between organizations that excel in the practice, as opposed to those just doing an average job (Fig. 1). By implementing best practices and making greater use of automation, finance teams in the top quartile have 39% lower DSO than the median, generating $48 million of incremental cash flow per $1 billion of sales. They extend DPO by 65% to yield additional $187 million in cash flow for every $1 billion in sales, versus median performers.

Figure 1. The Free Cash Flow Benefits of Reducing the Cash Conversion Cycle

Reverse factoring

Reverse factoring is when a bank or finance company acts as an intermediary between the company and its supplier. It commits to pay the company’s invoices at an accelerated rate (to benefit from early-payment discounts), charging the buyer a reduced interest rate. The program is a triple win: The company initiating the program can preserve its working capital (i.e., extend DPO), but not be compelled to pay early. The finance company earns a fee, and the supplier maximizes its working capital by being paid fast to reduce its DSO.

Optimizing Liquidity Management

Most large companies have hundreds of bank accounts globally, often in different institutions and regions. Typically, each bank requires treasury to log in through a proprietary portal or interface. Just building the cash position can take hours, days or even weeks. This slow, disjointed approach denies the CFO real-time access to the company’s liquidity status.

Today’s cloud-based treasury management systems easily streamline the balance collection process by building automatic connectivity to multiple banks, assuming the tedious multi-portal access process and delivering the CFO daily (or even real-time) information about the organization’s global cash position. This holistic view facilitates decisions about how to efficiently shift funds from cash-rich to cash-poor entities; concentrate excess cash in investment accounts to maximize return; and free up cash to pay down debt, fund operations and growth. The CFO can minimize the need to turn to external sources such as credit lines or public debt. The latter is especially important when interest rates are headed upward, as they are currently.

Improving Forecast Accuracy

Full visibility into cash and liquidity and easy integration with the company’s ERP system enables modern treasury management systems to increase the speed and accuracy of cash forecasting. They replace the traditional way of collecting projections through various emailed spreadsheets, as users can access the application directly via a browser. And a TMS lets them link directly to the accounts payable and accounts receivable modules of the ERP to see upcoming inflows and outflows. Data about future cash trends, delivered more frequently, is essential to liquidity management. It can help management make more confident decisions about future resource allocation.

According to The Hackett Group’s 2018 benchmarking data, world-class finance organizations are six times more likely to produce accurate one-month cash forecasts than more typical companies (dubbed the peer group). (The sidebar on the next page describes our empirical methodology for identifying world-class performance.) That is in large part because they are more likely to have automated their processes.

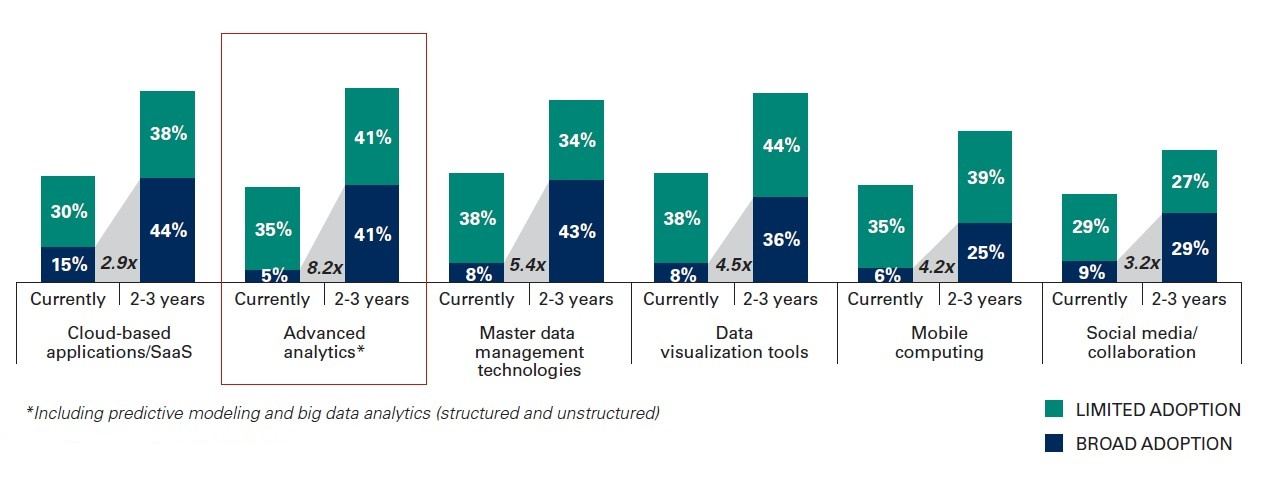

As time goes on, the accuracy of the forecast will only increase, as existing solutions are enhanced by emerging technologies, like artificial intelligence and cognitive computing, which let them sift through massive amounts of data, detect patterns and run predictive models to facilitate scenario planning. Once these capabilities become more pervasive, they will permit CFOs to conduct richer conversations with other executives about how to accelerate growth. That day is not far away. Our 2018 Key Issues study discovered that broad-based adoption of advanced analytics solutions is expected to rise by over 8X in the next two to three years (Fig. 2), reflecting the availability of big data and dedicated, often cloud-based modeling solutions that are easily integrated into on-premises and other cloud platforms.

Figure 2. The Free Cash Flow Benefits of Reducing the Cash Conversion Cycle

Developing a Holistic View of Risk

By optimizing free cash flow and effectively managing global liquidity, CFOs can more effectively fund growth in their organizations. To ensure growth is sustainable, they must work closely with other executives to encase the strategic plan within an appropriate risk management framework. CFOs typically rely on their treasury team’s risk-management acumen to construct the company’s enterprise risk approach and execute its components, from identification to measurement to mitigation. Treasury has long been considered the “resident expert” on risk because of its experience managing currency, interest rate, and commodity exposures.

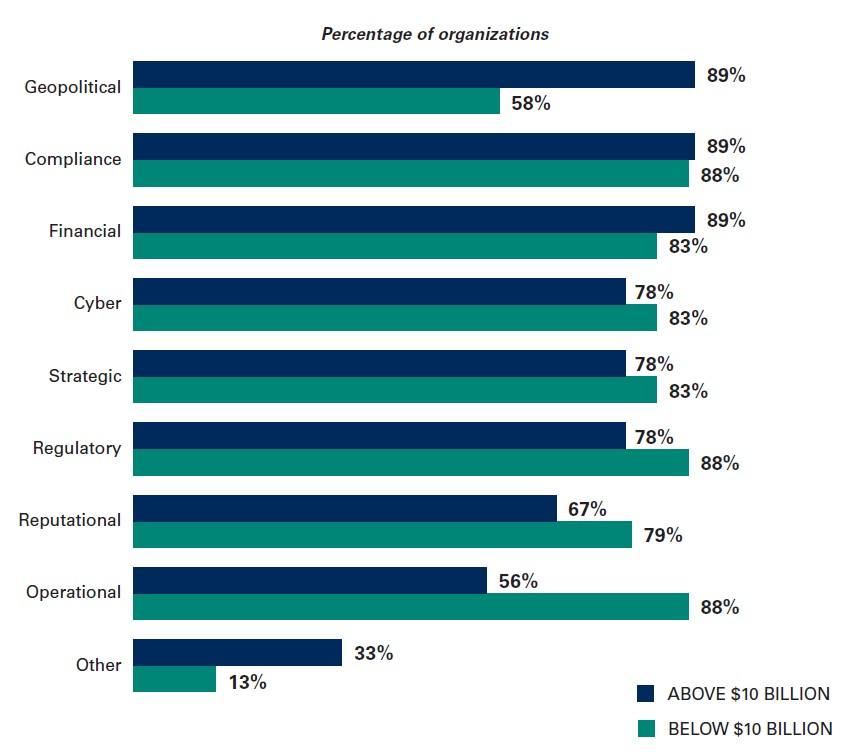

Yet CFOs need to look beyond financial risks. Larger organizations with more mature enterprise risk management (ERM) programs consider geopolitical and compliance risks as well as financial risks (Fig. 3). As a result, CFOs are working more closely than ever with their global treasury teams, which have the tools to collect risk information across functional silos (via cloud solutions), centralize the risk management and risk data collection process and use risk valuation techniques like value at risk, or VaR, to measure the degree of exposure.

With the help of a TMS, treasury teams can provide the CFO with a more holistic view of risk through enhanced integration with bank systems and operational applications, as well as and third-party information (e.g., news feeds).

Figure 3. Risks included in enterprise risk management program

Defining world-class performance

For the purposes of ranking the performance of finance, along with human resources, information technology, procurement and other business services, The Hackett Group has defined process groups, incorporating individual processes, sub-processes and activities. Further, we collect data on staffing, costs and best practice utilization for each function and process group.

To identify the world-class organizations in our database, we analyze these performance metrics using a proprietary value grid. Metrics associated with efficiency are scored on the horizontal axis (also known as the “X” axis). These may include such output measures as cost as a percentage of revenue and cycle time. Performance metrics associated with effectiveness are scored on the vertical (or “Y”) axis.

Each company is ranked relative to the others in the comparison group. Those above the break-points of the top quartiles in both efficiency and effectiveness are designated as “world-class overall.”

Conclusion

Rather than simply acting as financial custodians, CFOs today are party to all major strategic decisions. They bring credibility and value to discussions about how to increase shareholder value not only through cost-cutting, but also by selecting and funding growth opportunities, while protecting the company from risk.

To deliver on this expanded mandate, CFOs must:

- Shorten the cash conversion cycle by leveraging technologies and supply chain financing techniques to decrease DSO and extend DPO.

- Gain complete, real-time visibility into global cash by consolidating the arduous task of logging in to individual bank portals into a single, automated solution that streamlines that activity and delivers a timely, accurate update of the company’s cash position.

- Optimize their liquidity management approach, taking advantage of complete cash visibility to reduce external borrowing, maximize investment returns and sharpen their forecasting capabilities.

- Create a holistic view of risk and go beyond their traditional financial risk management purview to include strategic and operational exposure, in order to protect the company and ensure it can achieve its strategic objectives.