Mitigate FX Risk and Market Volatility

Reduced FX Risk

Learn moreProactively manage and reduce foreign exchange risk by pinpointing and quantifying exposures in real-time, ensuring adverse currency fluctuations do not impact financial performance.

Enhanced Visibility and Control

Learn moreGain comprehensive visibility into all FX exposures across the organization, enabling better strategic decision-making and more effective hedging strategies.

Eliminate Manual Work

Learn moreAutomate and simplify FX processes to reduce manual effort, prevent potential errors, save time, and improve the accuracy and reliability of FX management activities.

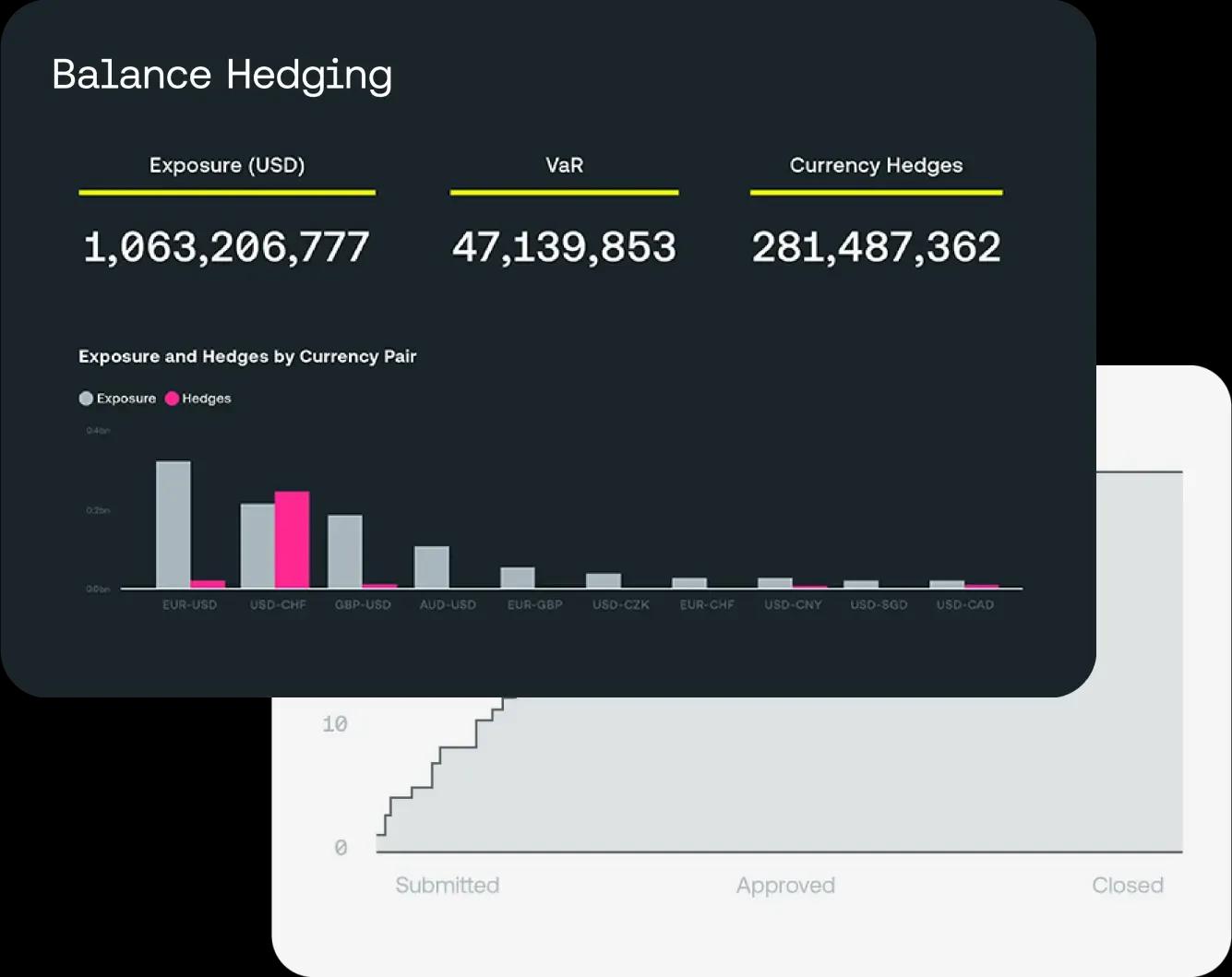

Working with Kyriba, Trane Technologies achieved 97% real-time visibility of group FX exposure and reduced global risk by over 50% in 12 months based on the VaR quantification:

“Kyriba resolves our immediate FX risk management limitations and allows us to develop best in class solutions. We in treasury have evolved into a true strategic partner to the business rather than just a corporate function.”

Game-changing features.

Kyriba’s CoRE Analysis

Quantifies FX exposures and risk, providing visibility to impacts.

Complete FX Data

Enables data-driven and real-time decisions to protect against currency impacts and market volatility.

Hedge Effectiveness

Empowers CFOs to hedge or reduce net exposure, reducing the impact of currency market volatility on financial performance.

FAQs about FX Exposure Management

How does Kyriba help reduce FX risk?

Kyriba provides real-time visibility, advanced analytics, and automated processes to identify, measure, and mitigate FX risk effectively.

How does Kyriba streamline FX exposure management?

Kyriba automates data collection from ERP systems, consolidates exposures, and provides actionable insights to simplify and enhance FX management.

What is Kyriba’s CoRE Analysis, and how does it benefit organizations?

Kyriba’s CoRE Analysis benchmarks FX exposure, calculates potential earnings impact, and identifies cost-effective strategies to reduce risk and improve efficiency.

What tools does Kyriba offer for hedging FX risk?

Kyriba supports automated hedge recommendations, trade management, and integration with trading platforms to optimize hedging strategies.

How does Kyriba improve decision-making with FX analytics?

Kyriba’s interactive dashboards and business intelligence tools provide detailed insights into FX exposure, risk, and hedging performance for better decision-making.