Blog

Transforming into a Data-Driven Treasury

Each year, AFP Pinnacle Award winner Health Care Service Corporation (HCSC) becomes more data-driven, and a panel session at KyribaLive 2023 reveals how HCSC transformed their treasury operations into a data-centric system, unlocking cash flow, optimizing working capital, and unleashing 1,000+ hours of productivity.

In this blog you will find a summary of this inspiring panel discussion focusing on the journey to treasury data transformation, highlighting the following topics:

- Why global treasury teams must become data-driven

- What type of data is critical to treasury and how to use API integration to unify data in a single source

- How modern treasury analytics and AI can truly empower financial leaders

Importance of a Data-Driven Treasury for Digital Transformation

HCSC’s David Deranek, Senior Director, Treasury Operations, explains that HCSC’s treasury philosophy is to act as “a consultative organization and strategic think tank that unlocks significant value to the organization,” rather than a “heads-down production or Excel spreadsheet farm type of organization.”

Becoming a data-driven treasury is key to fulfilling HCSC’s strategic think tank philosophy, and Deranek reveals how the pursuit of digital transformation allows HCSC to:

- Become a data-driven enterprise by building digital analytics, dashboards, and enterprise liquidity reporting

- Unify data and processes to improve accuracy and reduce of errors

- Reduce redundancy, improve decision-making efficiency, and re-purpose liquidity and capital

- Improve responsiveness to support finance strategic initiatives

- Unlock significant business value

- Increase agility to react to new initiatives and crisis

Through its digital transformation, HCSC’s treasury has unlocked efficiencies, increased agility, and achieved substantial business gains, in terms of both quantitative and qualitative outcomes. Deranek highlights the significant outcomes and capabilities HCSC has attained:

- Visibility: 100% of enterprise cash, liquidity, and financial exposures

- Investments: Unlocked investable capital

- Forecasting: Ability to reduce Tier 1 idle cash from $4.0B to as low as $25M (90% decrease)

- Responsiveness: Ability to quickly pivot as external and market pressures required

- Productivity: Continually repurpose positions to assignments supporting new strategic functions

Benefits of a Data-Driven Treasury for Working Capital Optimization

HCSC’s philosophy of continual evolution and digital automation has helped them streamline their treasury processes to optimize working capital. Deranek explains that HCSC’s treasury transformation project “really met our need to capture and analyze more data to increase the effectiveness of our treasury decision-making.”

Not only does the project facilitate data-driven decision-making, but it also consolidates HCSC’s isolated treasury analytics into systems of insight and action. The treasury team at HCSC is prepared to process data and make decisions in real-time, which is vital as bank reporting transitions to real-time information.

Deranek also emphasizes crisis readiness is one of the “best benefits that we reap from this project.” HCSC’s current readiness in response to pandemic impacts, geopolitical volatility, and interest rate shocks has been seamless, providing a level of readiness that allows ample time to plan for subsequent crises.

By becoming a data-driven enterprise, HCSC’s treasury is more effective and productive, with the ability to act quickly and seamlessly to reduce volatility.

Best Practices for a Successful Transformation

HCSC’s results demonstrate a transformational path many global organizations can follow to bring their treasury and finance operations to the next level. Deranek shares three best practices.

First, treasury departments should get involved to create a culture of engagement, automation, and continual process improvement within an organization. “We never stop trying to find the ultimate solution to 100% automation of what we’re trying to solve,” Deranek highlights.

Second, treasurers should ideate and lead to develop a vision of how treasury should work within the organization, while working to build relationships with CFOs, directors, and other stakeholders to ensure they understand their organizations’ strategic objectives.

Third, treasurers should appreciate the value of technology, while learning enough about technology and interconnectedness to understand how everything fits together. Finding the right technology and banking partners to deliver best practice is also key to creating and maintaining a data-driven treasury.

The Power of Treasury Analytics

By incorporating technology and knowing the interconnectedness of systems, organizations can immediately access data that helps them know what to do and have the actionability to do it. The technical capabilities organizations need to deliver data and optimize working capital are available today, and Kyriba can further support organizations embarking on a data journey.

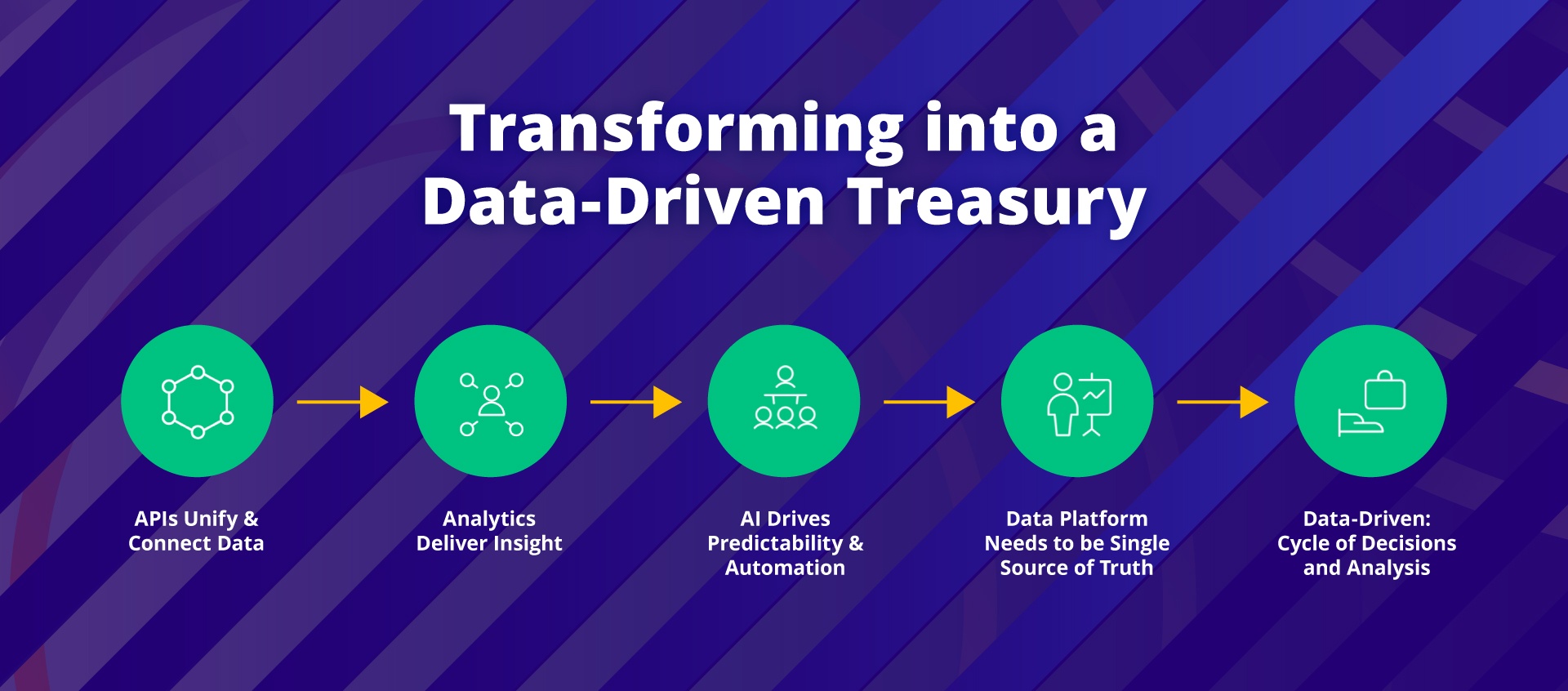

Kyriba’s Bob Stark, Head of Market Strategy, explains how application programming interfaces (APIs) connect all the data from disparate systems and capture it in one place. Treasury analytics, such as Kyriba Analytics, help deliver insight to improve decision-making, and artificial intelligence (AI) drives predictability and enrichment. APIs, data analytics, and AI are central to technology-driven decision-making:

- APIs connect banks, ERP systems, apps, and any system with your Kyriba data

- Analytics turn data into insight and intelligence

- Artificial intelligence (AI) drives predictive analytics, data enrichment, and usability

All this information feeds into a data platform and becomes what Stark terms a “single source of truth with all of your organization’s data in one spot, creating a data-driven cycle of decisions and analysis.” Ultimately, Stark comments, “This data platform arms treasury with the capability, insight, and confidence to build better decisions about all aspects of their organization’s financial management.”

Building on Stark’s point on how a data platform is an organization’s single source of truth, Kyriba’s Jean-Baptise Gaudemet, Senior VP, Data & Analytics, emphasizes successful working capital optimization is a team collaboration empowered by actionable treasury analytics that drive insightful decisions.

For example, Kyriba Analytics goes beyond providing dashboards and treasury analytics. In its essence, it creates a cross-functional platform to support collaboration across the office of the CFO and beyond.

Table: How Kyriba Analytics Empowers Each Role in the Office of the CFO

| Role in Enterprise Liquidity Management | How Kyriba Analytics Enhances the Role | |

| CFO | Minimize the weighted average cost of capital | Anticipate the financing of the liquidity plan with AI-powered cash forecasting |

| Risk Manager | Protect against market movement and rising interest rates |

|

| Treasurer | Borrow money at the cheapest possible cost |

|

| Cash Manager | Optimize the cash return while ensuring the solvability of payments | Maximize cash investment with AI-powered recommendations |

Conclusion

By leveraging technology and recognizing the interconnectivity of systems, organizations can strengthen decision-making to optimize working capital. Using APIs, AI, and treasury analytics, organizations can capture information scattered throughout their systems and unify it in a single source. This data platform becomes a single source of truth, enabling data-driven decisions.

With Kyriba Analytics, the office of the CFO can collaborate more effectively, with each role empowered by actionable treasury analytics that drive insightful decisions for successful cash flow forecasting, liquidity management, and working capital optimization. As Stark emphasizes, “Let the data give you the advice in terms of what your decisions should be. That’s what being data-driven is all about.”

Watch our on-demand webinar to learn more about how to transform into a data-drive treasury.