Blog

Elevating the Business Case for a Digital Treasury Transformation

The economic uncertainty and volatility in the market today is causing many organizations to turn to cost-cutting initiatives to ensure business longevity. While most businesses are planning to maintain their budgetary allocations for investment in their people and technology, treasury departments could still face obstacles, including limited budgets and competition with other projects. Therefore, the business case for a digital treasury transformation must be elevated to speak directly to the CFO and clearly define treasury’s role in supporting strategic corporate initiatives.

A panel session at KyribaLive 2023 discussed how to showcase the need for a digital treasury transformation. An executive level business case must address three key pillars and in this blog we will summarize each of them.

What to Change?

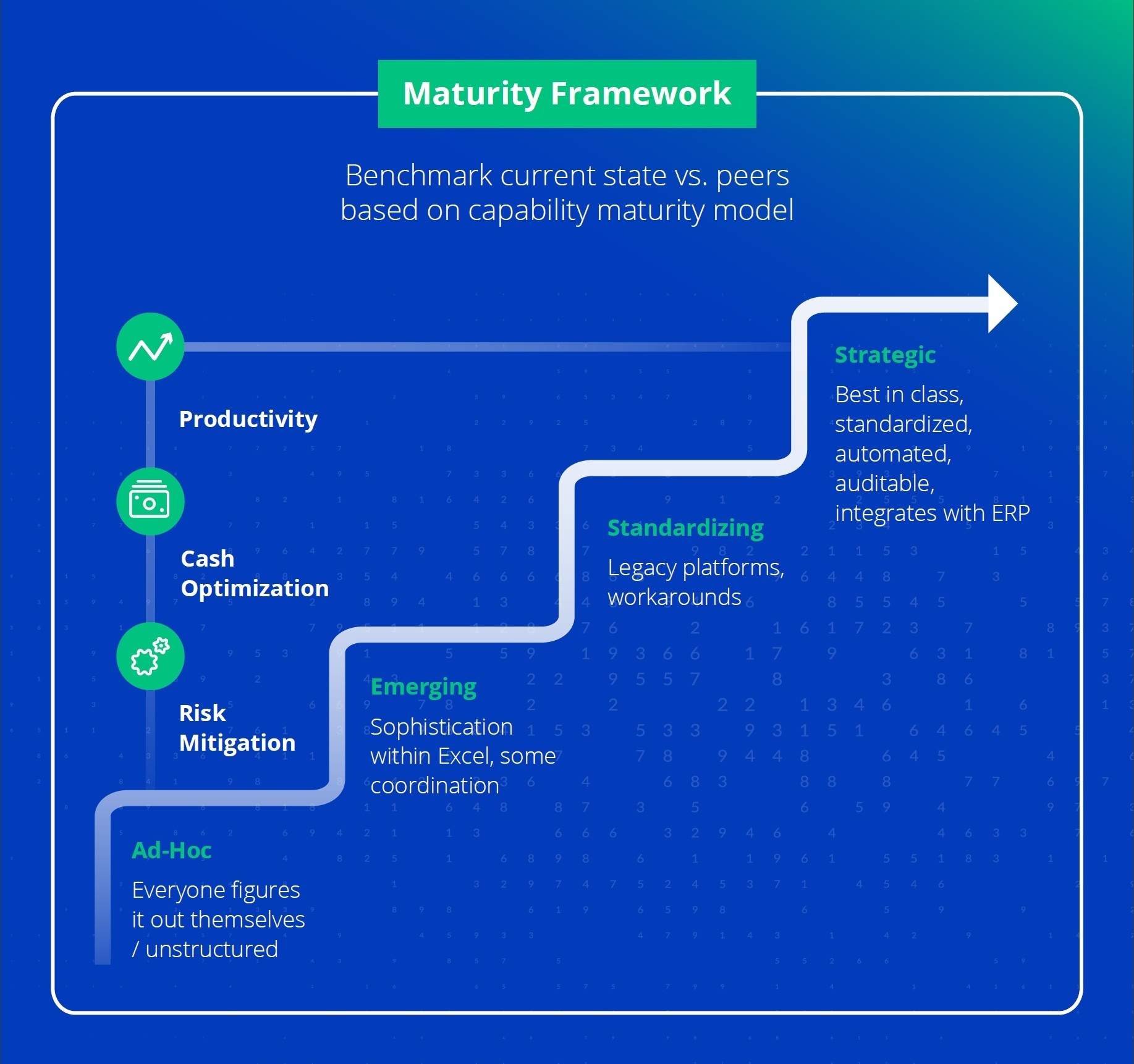

To understand the potential value of a digital transformation, a proper evaluation of the current state must be completed. By documenting where current processes and operations fall in terms of maturity and capabilities, organizations can identify what areas have the largest opportunities for improvements. Leveraging benchmarking can visually highlight gaps between a company’s process and those of its peers and best practice.

A proper current state evaluation requires internal collaboration of all key stakeholders including Treasury, Accounting, Accounts Payable, Accounts Receivable, IT and Risk Management. This type of cross-functional partnership enables organizations to assess consistency of data streams and processes across the financial organization.

By understanding the big picture, companies can entirely reimagine how they manage finance and create a vision for the potential future landscape. Solidifying an understanding of the potential benefits of centralized data flows and processes into a single source of truth will ensure internal alignment for the objectives and road map for the project.

Why Change?

Once the entire finance team has a clear understanding of what improvements are needed and a clear vision of future state objectives, the business impact of implementing the changes needs to be articulated. When identifying the value of treasury digitization, a business case needs to focus on the quantitative benefits of data centralization and business continuity.

The tangible bottom-line benefits resulting from real-time data reliability must be addressed in a strong business case. Complete visibility into global cash, along with increased forecasting accuracy enabled through proper liquidity planning, will enable the optimization of free cash flow resulting in a quantifiable financial impact. For example, mobilizing free cash to pay off corporate debt and reduce interest expense or increasing interest income through investments would have a direct impact on the P&L.

In the area of risk, better management of foreign exchange exposure would minimize the impact of volatile currency fluctuations and their reported impact on the financial statements. When presenting the financial benefits of process standardization and automation, it is crucial that the value calculations made are both believable and achievable.

While the operational efficiency of automation may seem evident, what is more important is how that time savings can be quantified in the result of better support for higher levels of strategic decision-making. The focus should be on the potential of repurposing the time saved, as well as the potential business impact of supporting those new activities.

For instance, adopting a working capital solution such as receivables financing could accelerate collections and reduce DSO down to 7-10 days, increasing liquidity and providing certainty of cash flow. If DPO is more of an organizational concern, a supply chain financing or reverse factoring program would allow a company to extend payment terms by up to 30 days past the due date, thus lowering cost of capital. Ensuring the business case highlights the expansion of treasury’s current capabilities will showcase how a digital transformation is key to elevating the department to that of a strategic advisor.

Selecting a treasury technology partner is an investment. It is an investment not only in improving current capabilities, but also in the ability to scale and support future organizational growth. A strong business case needs to showcase the value potential today, as well as how the chosen partner can grow and support the organization’s future business needs.

Why Change Now?

The final and most crucial aspect of the business case is to highlight the risk of the status quo. A proper evaluation of current treasury processes includes uncovering the risks associated with doing nothing, as well as the potential implications of continuing with current processes. The focus should be on identifying both the reputational and financial impact on the organization resulting from process shortcomings.

From a reputational perspective, what would happen if strategic investment decisions were made on inaccurate or stale data and quarterly cash flow targets were missed? What would the financial impact of interest expense be for over-borrowing against a credit line due to a lack of global real-time visibility and inaccurate forecasting? Accurately quantifying and articulating the risk associated with the status quo will capture the attention of the risk adverse C-Suite and emphasize the importance of why automation is needed now.

Finally, the business case should include a clear explanation of what needs to be done to mitigate the risks identified and what role technology plays in that process. For example, a complete liquidity planning solution providing standardized and real-time data of all working capital inputs inclusive of scenario modeling would allow for proactive adjustments to reduce the risk of missing cash flow targets.

When evaluating FX risk, a complete global view of foreign exchange exposure is critical. The centralization of data into a single source would provide real-time insights into the effectiveness of current hedging strategies allowing for modifications to de-risk the potential to be over-or under-hedged at month or quarter-end. Clearly defining best practices in corporate risk mitigation will showcase the importance of leveraging technology now.

Key Takeaways

Elevating the business case for a digital treasury transformation requires consideration of all three pillars: What, why and why now. It requires a full evaluation of how the organization currently thinks of data, consistency of treasury processes and technology’s role in those processes. This assessment requires the collaboration of various teams across the financial organization and often results in reimagining how the company ultimately manages finance.

Benchmarking and data visualization serve as important aspects of identifying the value potential and benefits of a digital transformation. Without proper resources, the execution of this type of executive-level business case could seem to be a daunting task. However, Kyriba’s Value Engineering team is available to help, having assisted over 1,800 organizations through a complete value analysis and building a business case with minimal time commitment from internal resources.

Watch the on-demand session to learn more about business case optimization for digital treasury transformation.