Blog

Optimizing FX Balance Sheet Hedging with Efficient Frontier Concepts

The desire for incorporating efficient frontier concepts within FX balance sheet hedging programs has been bubbling up over the past several years. One obvious reason is the ability to execute portfolio hedging decisions that can yield effective risk mitigation results while also minimizing the cost of hedging.

However, there have also been hurdles to putting the concept into action. First, a company needs reliable accessibility to an efficient frontier analysis. Second, the company needs a practical and easy way to incorporate that analysis into their hedging process.

In this blog, we take a closer look at these challenges, and identify ways companies can incorporate efficient frontier concepts within their hedging processes.

What Is Portfolio Value at Risk Analysis?

Companies often use a Portfolio Value at Risk (PVaR) analysis to better understand the risks associated with their portfolios. It compares individual currency pair risks to the overall risk of the portfolio, considering how currencies may partially offset each other. This analysis helps companies gain better insights into their portfolio’s actual risk.

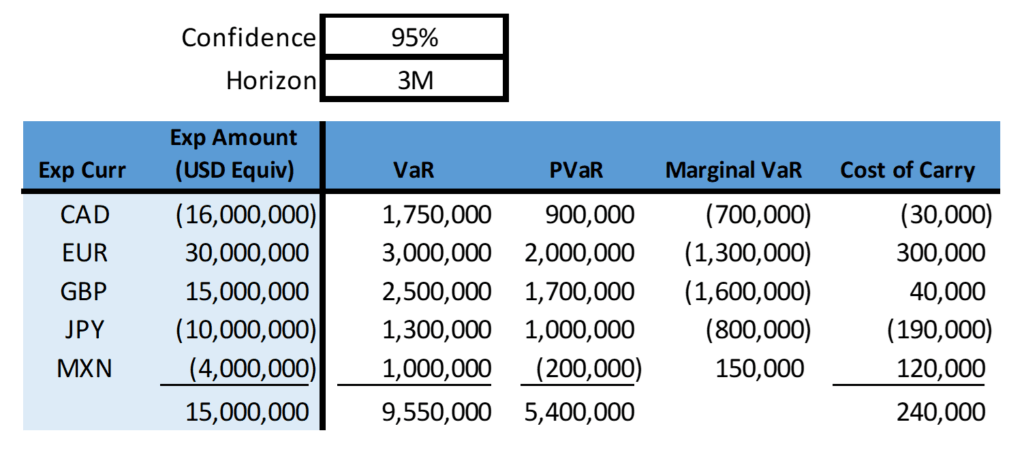

In the simulation above, the example company can see the natural correlation effect of their portfolio by comparing the individual VaR to the PVaR. If looking only at individual currency pair VaR, the company would have believed their risk over the quarter was $9.5mm, while a PVaR statistical model gives them assurance that they can expect currency pairs to partially offset each other and a more realistic quantification of the risk is $5.4mm. It is not realistic to assume that all currencies will move negatively in the same direction, which the VaR total would indicate. With PVaR, the company has a better context regarding the materiality of the risk in their portfolio and can make more informed decisions.

To provide further context, the Marginal VaR column quantifies the impact of hedging, or removing specific currency pairs from the portfolio. For instance, if a company hedges one currency, the correlations of the entire portfolio are impacted in addition to the direct PVaR impact associated with that currency. Using the example above, if we look at hedging CAD, one might think it reduces the company’s VaR by $900k. However, the actual VaR reduction is expected to be the $700k Marginal VaR because CAD exposure had $200k of offsetting risk impacts to the overall portfolio. Therefore, hedging CAD would reduce PVaR by $900k but add back $200k of PVaR to the (“CAD-less”) remaining portfolio. Marginal VaR provides better insight into the impact of addressing specific currencies within the portfolio.

Lastly, the analysis includes the cost of carry, which represents the cost/benefit of hedging a particular exposure. This information helps companies identify the best hedging strategies with the most effective risk/reward balance.

Overall, the PVaR analysis lays the foundation for making smart, efficient frontier-based decisions. Now, the challenge is how companies can access and implement this analysis effectively.

Limitations of PVaR Analysis from Banks

Historically, companies have relied on bank relationships for PVaR analysis. Although a convenient offering, it is not without limitations. Banks require a turnaround time between collecting the client’s exposure data, running the analysis, reviewing, and delivering the final output to the client. This is not a systematic on-demand offering, so companies do not have complete control over the process. Additionally, the delivered analysis is static, meaning companies do not have the ability to make modifications or test different scenarios. In most cases, this is treated as a one-off or month-end exercise.

In order to gain more access and control over PVaR analysis, some companies are exploring using analysis tools like Bloomberg. Leveraging a separate analysis tool can help solve the frequency and dependency issue; however, it could come at a cost. In addition, there will still be a manual aspect to the FX hedging workflow. These tools are not taking the PVaR analysis concepts and incorporating them into a company’s processes.

Regardless of either option, organizations are generally left with a more static analysis that is not integrated into their processes. These options lend themselves more to one-off senior management analysis requests rather than using for actionable FX risk mitigation decisions.

Move from a Static Analysis to a Dynamic Approach

No matter how the PVaR analysis is sourced, the next challenge for a company to solve is turning that report into valuable insights for their hedge program. How can they move from a static analysis to a dynamic and streamlined process that optimizes the costs of hedging?

The example report above is useful for understanding how currency pairs impact the portfolio at a high level, but it does not fully provide what is needed to grasp the concept of efficient frontier. It falls short when it comes to exploring different scenarios. For instance, what if we hedge 100% of EUR , 75% of CAD and 50% of JPY? Is that the best combination, or is there a more optimal solution? Unfortunately, the current analysis can’t model out these scenarios or test various policy thresholds or risk targets.

Historically, companies have hit a roadblock here. To take the concept further, they need a more dynamic analysis that can be easily integrated into their decision-making process when it comes to hedging. Without a dynamic approach, companies can only get partial value from the standard PVaR analysis, as they won’t be able to streamline their processes or make the most effective choices.

Kyriba’s Fully Integrated FX Hedging Solution

Kyriba has designed a fully integrated efficient frontier solution for FX balance sheet hedging, solving both challenges.

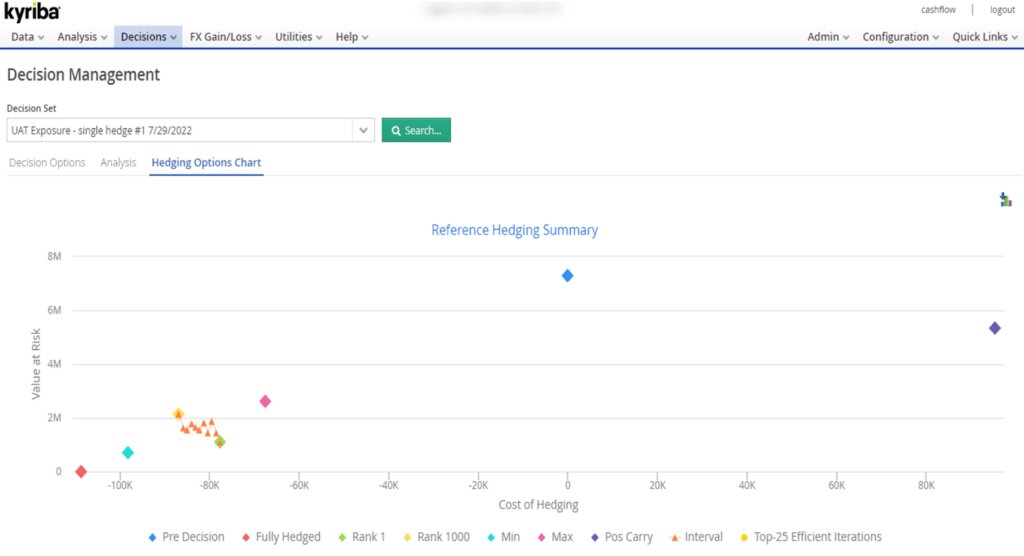

The analysis of PVaR is easy, flexible and accessible 24 hours a day within the application. Exposure and risk target scenarios can be run on command, including actual current exposures, past exposures and forecasted exposures. The PVaR analysis can then be converted into actionable hedge decisions. The application will run 1,000 scenarios that evaluate your risk targets and thresholds, PVaR and hedging costs, with recommendations of the optimal hedge decisions aligned to that scenario’s specific efficient frontier.

Once the hedge recommendations are reviewed and determined, the hedge decisions can be integrated into a trade portal for execution. The entire FX hedge program workflow is maintained in a best-practice streamlined solution, while optimizing the process for the most cost effective hedge decisions.

The cost of hedging volatility over the last two years has hit many companies hard. With Kyriba addressing the roadblocks, efficient frontier has finally moved from a board presentation concept into a day-to-day value-added treasury process. For this reason, an increasing number of Kyriba clients are implementing the efficient frontier into their standard FX hedging process.