Blog

Top Three Cash Flow Mistakes Every Treasury Makes

In today’s rapidly changing financial landscape, effective cash and liquidity management is vital for treasuries to ensure financial stability and support an organization’s strategic objectives. However, many treasurers are falling victim to the same cash flow mistakes over and over again – lack of real-time cash visibility, silos of legacy systems and processes and absence of forecast accuracy leading to long cash conversion cycle (CCC).

In this blog, we will delve into these three persistent cash flow forecasting challenges faced by today’s treasurers, and come up with a few actionable and effective strategies to help you overcome them.

Mistake 1: Neglecting Real-Time Visibility

Real-time visibility plays a significant role in effective cash flow forecasting; however, it is often overlooked by many organizations. According to a survey from Blackline, 62% agree that understanding cash flow in real time is going to become more important for their company in the face of economic uncertainty. But nearly all respondents (98%) say they could be more confident in the visibility they currently have over cash flow.

One big reason for such lack of confidence is that many organizations still rely heavily on manual processes or outdated systems that lack real-time data integration. The same survey shows that 49% are worried their company is making decisions based on inaccurate or out-of-date information and 44% say the lack of visibility over cash flow makes them less confident that their organization can remain competitive over the next 12 months.

Without accurate and timely information, businesses may struggle to make informed decisions regarding liquidity, working capital and investment opportunities. And, in turn, this can lead to cash flow gaps and, in some instances, financial instability.

Mistake 2: Relying on Outdated Systems

Many organizations are still heavily relying on legacy systems and processes – like manually entering data into a spreadsheet. This is not only time consuming, but also prone to errors and fraud risks, which impacts their overall cash flow forecasting and risk management capabilities. Using outdated systems limits efficiency and accuracy, making it challenging to keep up with the pace of business and respond quickly to changing market conditions.

The combination of current events and the growing emphasis placed on liquidity and cash management has put treasury management software in the spotlight, according to the freshly published IDC MarketScape report. However, transitioning from a manual model to an intelligent model presents various challenges and change management is the real challenge, increasing the importance of making the treasury department run more efficiently to meet changing demands. Updating legacy systems and overly complicated processes will allow organizations to improve their cash flow forecasting capabilities now and in the future.

A good example is treasury data analytics. It can play a pivotal role in reducing hedging costs. It allows organizations to gain full visibility into their currency exposures, assess the cost of hedging and automate processes. When multinationals’ FX headwinds wipe out $22b in revenue, integrating sophisticated tools and technologies allows organizations to confidently navigate currency fluctuations and strengthen their financial foundation in uncertain markets.

Mistake 3: Overlooking the Cash Conversion Cycle

Volatility and market uncertainty present a challenge in maintaining organizational financial resiliency. Overlooking the management of the cash conversion cycle can significantly impact an organization’s ability to navigate uncertain times – and it is a common occurrence.

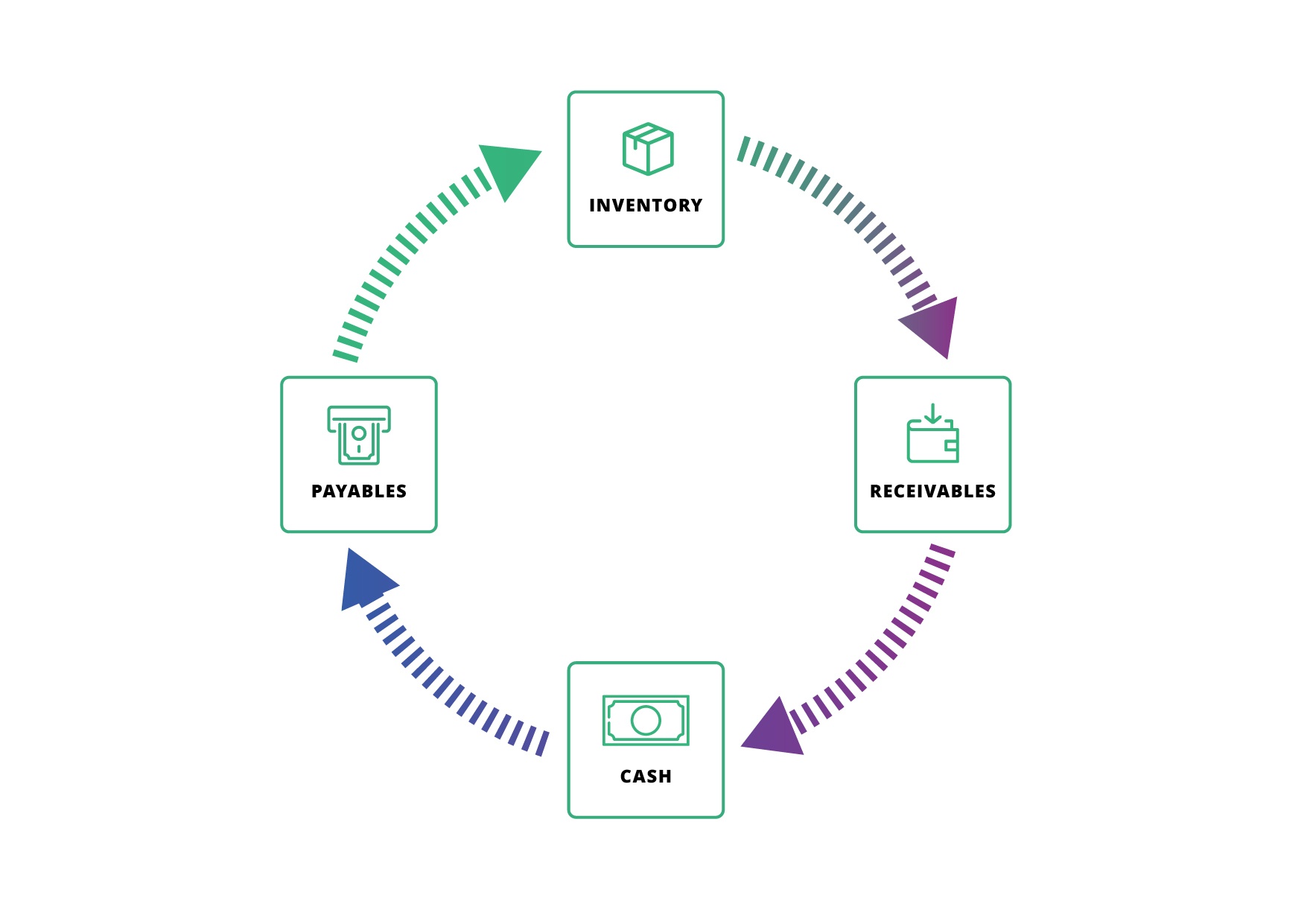

The cash conversion cycle refers to the time it takes to convert inventory cycles into cash. In face of rising interest rates and borrowing costs, organizations must focus on shortening this cycle. Implementing strategies, such as improving accounts receivable processes, optimizing inventory management and offering early payment discounts, companies can unlock their internal cash flow and bolster their financial health in the face of market uncertainties.

Deploying a reverse factoring or supply chain financing program can play a crucial role in shortening the cash conversion cycle. These programs allow companies to extend their payables (DPO) and expedite the collection of their outstanding receivables (DSO). According to the annual Working Capital Scorecard from CFO and The Hackett Group, found that when DPO and DSO are worked into the cash conversion cycle equation, the cash conversion cycle has risen by 1.2 days, now up to 36.4 days (in 2022).

Remedy: Augmenting Cash Forecasts with Real-Time Insights

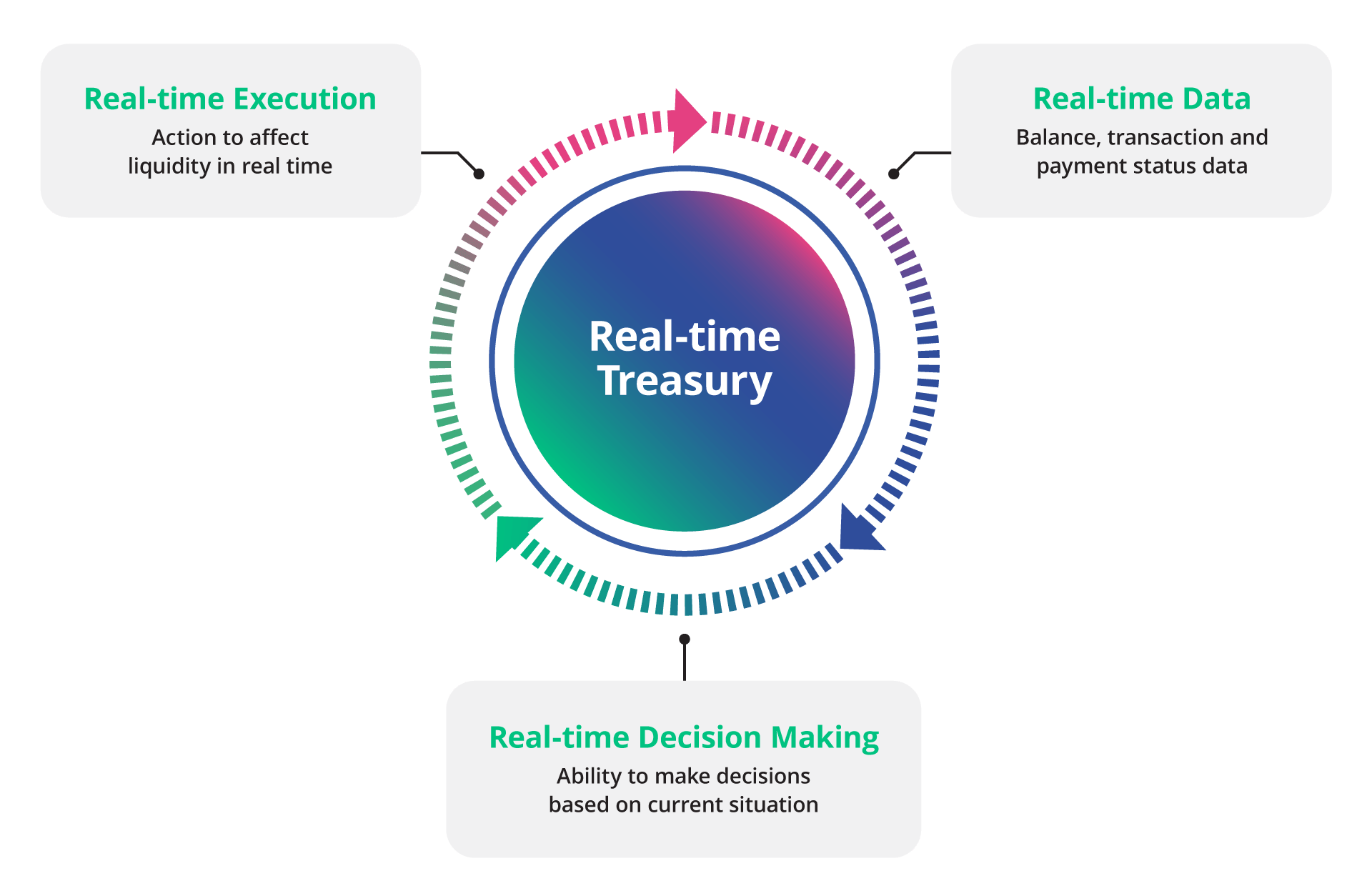

Cash flow forecasting is essential for corporate financial planning. To get the most accurate forecast, Modern technologies – namely APIs, artificial intelligence (AI) and analytics – allow organizations to construct an informed forecast. Cash management is focused on today and yesterday, while forecasting looks at tomorrow and beyond. Liquidity planning takes forecasting a step further by surrounding the forecast with data to assess the impact of liquidity decisions

API ingration, for example, provides the ability to intermingle data from the forecast and actuals to make informed decisions through data integration from internal systems and banks. Through the dynamic data exchange, treasury and finance teams can monitor cash positions and analyze the impact of any changes.

AI and analytics, on the other hand, go beyond cash visibility. These tools allow for better predictions and enable faster execution, thus enabling finance and treasury teams to continually refine their forecasts. Incorporating the real-time data – enabled by API connectivity – into the cash forecasts allows financial leaders to make reliable, data-driven financial decisions that impact liquidity. Analytics platforms can also visually represent data and provide insights into various scenarios, helping organizations assess the impact on cash and liquidity.

Key Takeaways

Cash flow is crucial for businesses and their success. Failure to address cash forecasting challenges can have detrimental effects on an organization’s financial health. Outdated systems, inaccurate data, data gaps and continued volatility and uncertainty hinder a treasury and finance team’s decision-making and execution ability. The lack of real-time visibility and accurate forecasting also poses problems with optimizing working capital and an organization’s ability to respond to market dynamics with agility.

Understanding these challenges is the first step toward implementing effective strategies to improve and build confidence in your forecasts. Proactively addressing through the adoption of modern solutions – such as APIs, AI and analytics – allows organizations to unlock the full potential of their cash flow, make data-driven decisions, optimize their cash conversion cycles and thrive in uncertain market conditions.