Blog

Six Financial Risks Kyriba Can Help CFOs Tackle in 2023

As the role of the chief financial officer (CFO) continues to evolve, so do the financial risks they face in today’s dynamic business landscape. In 2023, CFOs are confronted with an array of challenges, ranging from regulatory compliance to cybersecurity threats and economic volatility. This blog focuses on the current financial risks CFOs encounter and explores how Kyriba can help mitigate these risks effectively.

Navigating Complex Regulatory Environment

The regulatory environment has become increasingly complex, influenced by factors such as global economic shifts, technological advancements and changing societal expectations. Regulatory bodies worldwide are introducing new rules, enhancing existing frameworks and implementing stricter enforcement measures to address emerging risks and protect stakeholders’ interests. Adhering to such ever-changing compliance regulations remains critical for organizations.

However, regulatory compliance is a time-consuming heavy duty for corporates who do not have strategic compliance teams like their banking counterparties. In addition, the CFO – along with their accounting and treasury teams – is held responsible for financial compliance and thus needs to understand the details of the associated regulations and the nuances of compliance.

Kyriba offers a range of features and functionalities that help streamline compliance processes. Clients can use the Kyriba platform to meet regulatory requirements such as:

- FBAR reporting

- OFAC sanction screening

- EMIR reporting

- Basel III monitoring

- MM fund NAV reporting

- SOX auditing

- Hedge Accounting and more

Kyriba helps CFOs establish robust internal controls and accurate financial records, and ensure timely reporting with data transparency to avoid legal, reputational or financial risk stemming from non-compliance.

Mitigating Fraud & Cybersecurity

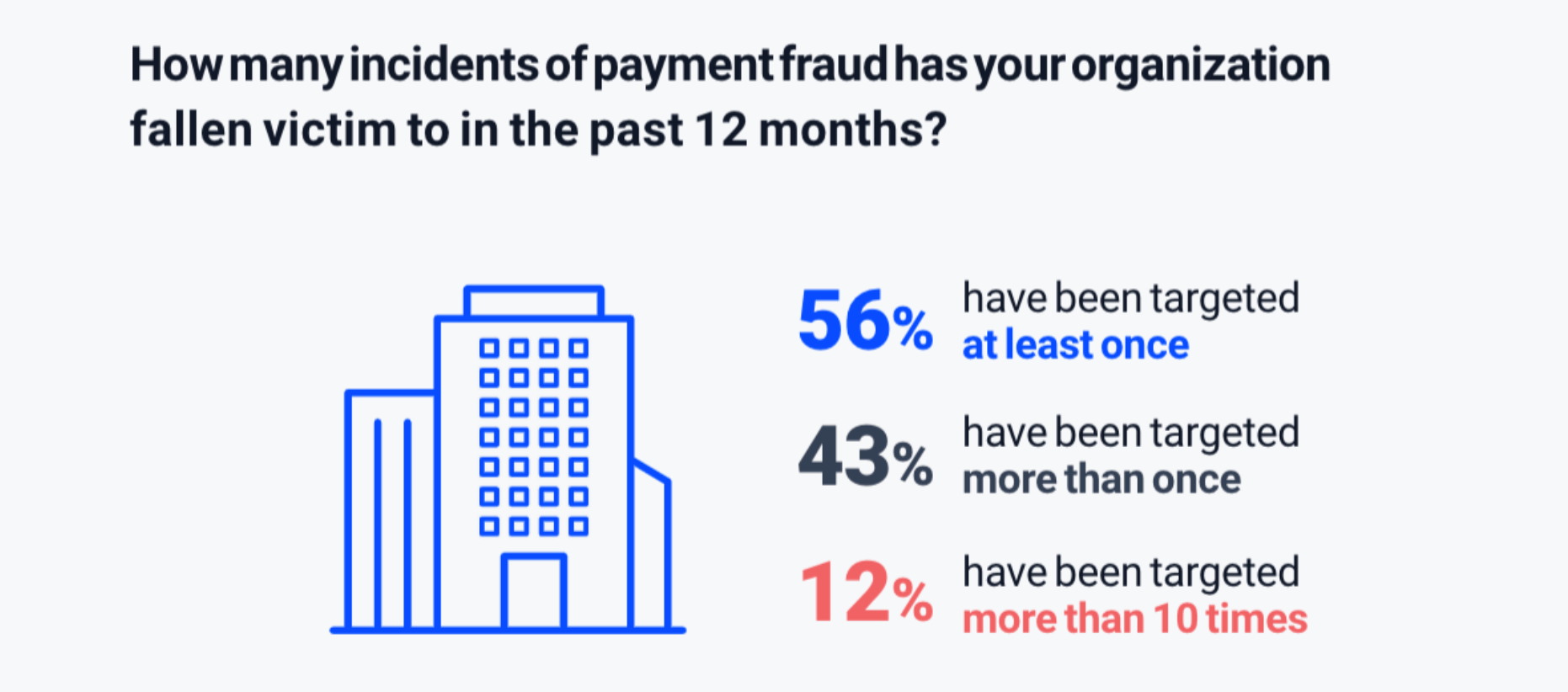

Fraud and cybersecurity threats are still two of the biggest risks any organization faces in 2023. According to a recent US companies and B2B payment fraud survey report published by Trustpair and Giact, 56% of US companies were targeted by B2B payment fraud in 2022 and 82% of senior leaders consider fraud prevention to be a top priority for 2023.

The landscape continues to evolve with expanding attack surfaces and more sophisticated attack methods, presenting new challenges and complexities for CISOs as well as CFOs. The threat actors are becoming more tech savvy, employing advanced techniques to exploit vulnerabilities in financial systems and compromise sensitive data. As custodians of financial health and integrity, CFOs are faced with the daunting task of mitigating these risks and safeguarding their organizations’ assets and reputation.

With its advanced financial technology solutions, Kyriba’s cloud-based Saas platform offers a range of features and functionalities designed to protect against fraudulent payments activities, including:

- Protected login

- Data encryption

- Standardized payment controls

- AI-powered fraud detection

- Bank account validation and more

In short, Kyriba enables CFOs to safeguard financial systems, financial data and streamline workflows to minimize the risks that could result in both financial and reputational consequences.

Planning Around Economic Volatility

In 2023, CFOs are faced with unique challenges in managing economic volatility and market risks. The ongoing global recovery from the pandemic, the shifting geopolitical landscape and the increasing pace of technological disruption create a complex and uncertain environment.

With rising interest rates showing no sign of stopping, liquidity is the lifeblood of any organization. Investors and analysts have begun to scrutinize the balance sheet, question the use of spending, and react harshly when liquidity is devalued due to currency volatility.

Kyriba offers a range of features and functionalities designed to optimize risk management strategies and provide insights for informed decision-making. For instance, CFOs and their teams can use the pre-built models and scenario planning tools with centralized data and insights to drill into all aspects of liquidity planning. In turn, CFOs can take action to boost margins and pull working capital levers where liquidity constraints might exist, thus gaining full control over their liquidity. All these allow CFOs to tackle potential uncertainties and focus on enforcing financial discipline for continuing growth.

Withstanding Supply Chain Disruptions

Part of the CFO’s role includes ensuring the resilience and continuity of their organizations’ supply chains. They must navigate the intricate web of suppliers, distributors, logistics and inventory management to alleviate the risks associated with supply chain disruptions. Effectively addressing these challenges, CFOs can safeguard their organizations’ financial stability, maintain customer trust, and even gain a competitive edge in the marketplace.

Currently, one of the top priorities for CFOs is improving working capital. The most obvious ways to meet these objectives include improving Days Payable Outstanding (DPO) and Days Sales Outstanding (DSO). However, extending DPO by delaying supplier payments or accelerating DSO by negotiating unfavorable payment terms stresses the liquidity of the suppliers in the supply chain.

Kyriba offers a full suite of solutions for CFOs in different businesses to facilitate working capital optimization, including:

- Supply chain finance (SCF)

- Dynamic discounting (DD)

- Receivables finance (RF)

- Hybrid programs

Extending payables and accelerating receivables through the implementation of one of these programs creates a win-win for both the buyers and the suppliers, as it stimulates working capital or optimizes cash returns.

Harnessing Emerging Technology

Technological advancements have the power to reshape business models, streamline operations and enhance financial performance. As the role of CFOs evolves, it becomes increasingly crucial for them to possess the necessary knowledge, skills and strategies to effectively leverage these advancements while effectively managing associated risks.

One particular technology that has captured significant interest from the finance community is artificial intelligence (AI). AI offers the remarkable capability to hyper-automate mundane and repetitive tasks that have traditionally burdened finance teams. By automating processes like reporting, finance teams can minimize errors and allocate more time and resources towards strategic initiatives.

Similarly, AI-powered chatbots, such as ChatGPT, have emerged as invaluable tools within Treasury Management Systems (TMS) and finance operations. These chatbots can adapt and respond to user instructions, keywords and questions, thereby offering a seemingly limitless range of functionalities. From retrieving and presenting relevant data from the systems to generating on-demand reports, these intelligent chatbots significantly enhance the user experience, streamline processes and improve operational efficiency.

The transformative potential of emerging technology in finance extends beyond automation. CFOs now have the opportunity to tap into the power of data analytics and machine learning, enabling them to gain deeper insights and uncover valuable patterns and trends. However, as with any technological advancement, CFOs must remain cognizant of the associated risks. From data privacy concerns to potential biases in AI algorithms, a comprehensive understanding of these risks is imperative for effective risk management. CFOs must establish robust governance frameworks and employ ethical practices to ensure that the benefits of emerging technologies are harnessed responsibly with transparency.

Kyriba lends guidance to CFOs when addressing these risks by delivering pre-built functionality and seamless integration with enhanced cloud security. For example, the following toolkit is ready for use without any IT implementation efforts required:

- Cash Management AI for short-term cash forecasting

- Kyriba Analytics with interactive dashboards for liquidity, cash, payments, risk, SCF and compliance

- A total of 140 APIs across the platform that are live in production with one API gateway to connect to over 1000 banks

Balancing Environmental, Social, Governance

The year 2023 presents a critical juncture for CFOs as they grapple with the evolving landscape of ESG mitigation challenges. The urgency to combat climate change, promote social equality and uphold transparent governance practices has never been greater. To address these continued concerns, CFOs are being requested to develop comprehensive and implementable ESG strategies, allocate sufficient resources to these initiatives and provide transparent disclosures to stakeholders.

This used to be a regulatory and compliance matter but recently, as shown in RSM’s 2022 ESG report, 70% of the bank/corporate ESG impacts have derived from their supply chains creating a negative impact on business performance and reputation. Assessing the ESG impact of multiple suppliers is certainly no easy task for a corporation. Some have resorted to creating an internal framework while others have outsourced to ESG rating providers, which can be slow, difficult and costly.

Providing a quick, easy and economical solution, Kyriba helps organizations incorporate ESG considerations into their financial and operational strategies. Through Kyriba’s supplier sustainability program, CFOs are connected with a network of ESG rating providers to efficiently rate suppliers based on their ESG strategy and incentivize accordingly through their SCF programs. This directly impacts buyers and indirectly impacts suppliers, creating better alignment while improving overall sustainability efforts.

Key Takeaways

The world of finance in 2023 does not have to be an unnavigable maze. CFOs are invited to embrace Kyriba’s comprehensive, user-friendly and versatile financial technology solutions and see how they can support the transformation of challenges into opportunities, strengthening the financial health and resilience of organizations while fostering sustainable growth.

Now is the time to unleash your organization’s full potential and steer it confidently towards success in 2023 and beyond. Reach out to the Kyriba team today to learn more about how our solutions can be tailored to your unique needs.