eBook

The Six Key Areas Where CFOs Fail to Deliver for the Board of Directors

It’s been a long time since CFOs moved beyond financial reporting and accounting and added “strategic business partner to the board of directors” to their list of responsibilities. Nonetheless, a new survey from CFO Research, in collaboration with Kyriba, finds that CFOs aren’t always delivering the information and decision support that boards want as they seek to manage corporate risks. The survey identifies six key areas, led by fraud monitoring and mitigation, where CFOs need to communicate more effectively, and act more decisively, in helping boards protect shareholder value. (See Figure 1). To do that, the survey suggests, CFOs need not only the right training and instincts but also the right technology.

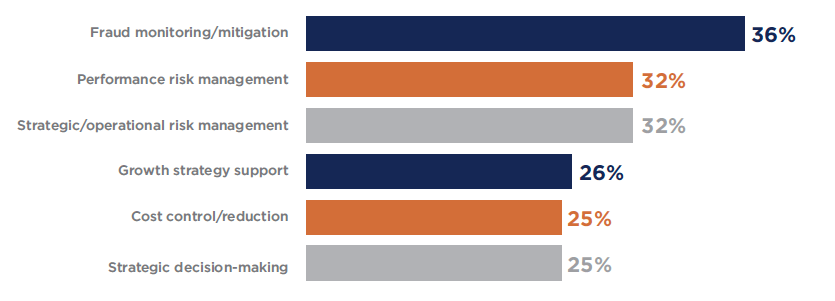

The top areas where Boards most often fail to receive critical information and decision-support data from the CFO

Table of Contents

The Board/CFO Relationship

The relationship between the CFO and the board of directors must support the board’s mandate to protect shareholder value. The good news? Ninety-four percent of the 167 U.S. senior finance executives surveyed by CFO Research—at companies with revenues between $100 million and $5 billion, across a range of industries—say CFOs are perceived by their boards as critical, strategic business partners. According to those surveyed, the most important areas where a strategic CFO can deliver value to the board and the CEO are:

- Managing business planning and continuity (cited by 52 percent of the survey respondents)

- Managing financial risk to prevent loss (51 percent)

- Reducing costs and improving margins (43 percent)

- Helping unlock working capital to spur growth (37 percent)

- Ensuring regulatory compliance (30 percent)

What Boards Need From the CFO

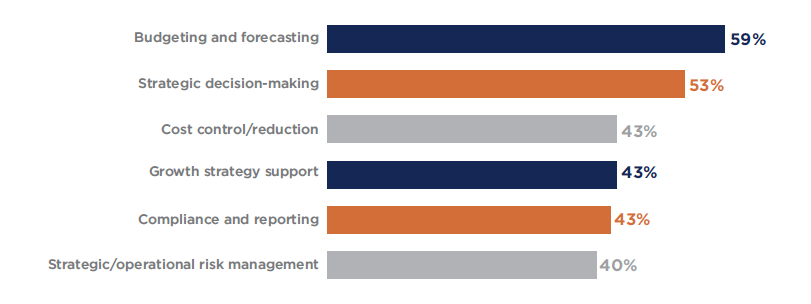

To some extent, then, CFOs serve the board’s interest merely by doing their jobs. But boards also depend on CFOs for critical information and decision-support. Although CFO insights and advice are sometimes funneled through the CEO, most directors today—especially those on the audit committee—expect to have a close, direct working relationship with the CFO as well. According to the finance executives polled by CFO Research, the areas where it is most important for boards to receive information and decision-support from the CFO are budgeting and forecasting, strategic decision-making, and cost control and reduction. (See Figure 2).

The top areas where it is most important for Boards to receive critical information and decision-support data from the CFO

The Six Areas Where Boards Aren’t Getting What They Want—and Why

The survey found that a substantial percentage of board members appear to not be getting the information and insights they need from their CFOs (See Figure 1). And the areas of shortfall are mission-critical, led by fraud monitoring and mitigation, which was cited by nearly half—43 percent—of the finance executives surveyed. Rounding out the Top Six list were performance risk management, strategic and operational risk management, growth strategy support, controlling and reducing costs, and strategic decision-making.

After decades of investing in finance, treasury, and risk management systems, why are some CFOs still not able to meet their board’s expectations for information and insights? The most commonly cited factor is a suboptimal organizational structure in which different corporation functions and business units are walled off from each other in their own silos, a hindrance cited by one in every two survey respondents. Other major contributors include a corporate culture that does not promote or facilitate a better relationship between the CFO and the board (41 percent), a lack of time on the CFO’s part (30 percent), straightforward communications issues (29 percent), and, finally, the composition of the board itself, cited by 27 percent of respondents.

The Role of Technology

To their credit, CFOs seem to have gotten the message that they need to do better. A whopping 94 percent of the survey respondents say their CFO is seeking better ways, and better technologies, to meet demands from the boardroom and the CEO. On the technology front, finance executives say, the specific areas where CFOs need better tools to help boards make better decisions are, in order of respondent popularity, fraud risk, compliance risk, performance risk, and regulatory risk.

Fraud risk is high on boardroom agendas in large part because it remains a stubborn and growing problem. Although many companies have embraced a broad range of fraud-fighting tools and strategies, including user authentication processes, expanded use of electronic payments rather than more vulnerable paper checks, and daily reconciliations, the incidence of fraud shows no signs of slowing down. Indeed, in the latest CFO Research survey, 40 percent of finance executives say their industries are experiencing higher rates of payments fraud than they did two years ago. Similarly, the 2017 AFP Payments Fraud and Control Survey conducted by the Association for Financial Professionals found that 74 percent of organizations had experienced attempted or actual payments fraud in 2016, up from 62 percent in 2014 and the highest level of payments fraud the AFP has recorded since it began tracking the problem in 2006.

Given that a big part of corporate treasury’s role is safeguarding corporate cash, it’s not surprising that this focus on payments fraud interests the board. The treasury functions most important to boards, the CFO Research survey found, are cash and liquidity management and forecasting (cited by 66 percent of the survey respondents); risk management, as it relates to all risks (cited by 46 percent); and financial transactions, including debt, investment and foreign exchange (46 percent).

Providing information directly from the systems, without the opportunity for teams to ‘Clean it up,’ is critical.”

Moving from Theory to Practice

The finance executives polled by CFO Research say that apart from acquiring better technology, CFOs can take additional measures to make that technology, and the insights it can help provide, more useful to corporate directors and CEOs. For starters, says one finance leader, CFOs should establish a consistent way of providing information to boards so that board members aren’t continually forced to learn new ways of seeing things. “Put together a standardized set of metrics and formats of financial data that you share with the board of directors at every meeting,” this executive suggests. “Don’t make them try to understand new formats all the time.”

CFOs also can hone their own listening skills. “Learn what matters to them (directors) by listening first, and then tailoring the message accordingly,” one survey respondent writes. Along those same lines, another encourages CFOs to have an “honest give-and-take with (directors) on what current technology can provide, versus what information is desired by the board of directors.”

All that said, another finance leader cautions CFOs against falling into the trap of “prettying up” reports to the extent that boards don’t get the full story that data has to tell them—even if that story isn’t always upbeat. “Find ways to eliminate manipulation and prettying up of reports,” this executive says. “Providing information directly from the systems, without the opportunity for teams to ‘clean it up,’ is critical.”

Notwithstanding these comments, CFOs should continue to look for ways to improve how they present data to the CEO and the board. There’s a big difference between “cleaning up” data so that the bad news is hidden—no CEO or corporate director wants to be surprised when that bad news inevitably surfaces—and presenting data in a clear, easy-to-follow, and, ideally, interactive, format. That’s becoming all the more important now that big data and advanced data analytics create the potential for decision-makers to be inundated with information.

For CFOs or those laboring under them, being a whiz with spreadsheet or presentation software may not be enough to make all that data understandable. Fortunately, new data visualization and business intelligence tools are coming to market all the time that can help make data-driven insights more readily understandable and defensible. These tools can be invaluable for CFOs looking to provide guidance to corporate directors.

For CFOs or those laboring under them, being a whiz with spreadsheet or presentation software may not be enough to make all that data understandable.”

In all of these efforts, CFOs can further their cause by working with other business leaders in their companies to break down silos and promote faster and more complete sharing of information across the enterprise. As Big Four accounting and consulting firm Ernst & Young put it in its 2016 study, “The DNA of the CFO,” “a bold technology strategy for the finance function should include systems and tools that enable disparate teams to share information and make connected, data-driven decisions.”

CFOs also can push for the adoption of technologies that can automate many of the standardized processes and procedures employed in the finance organization—and in those parts of the business that interact with it—to free up more time for the CFO and his or her staff to spend on strategic initiatives. As EY noted, CFOs and their finance teams “will only be able to focus on higher value tasks, such as analytics and forecasting, if the technology is in place both to take care of transactional processes and to provide the data needed for the generation of strategic insight.”

As for that finding that 27 percent of finance executives say the makeup of the board can impede the CFOs ability to get critical information and insights to directors? In an article last year examining the relationships between CFOs, CEOs, and boards of directors, Jenna Fisher and Clare Metcalf, senior executives at executive search firm Russell Reynolds Associates, advise CFOs to get to know their directors on their boards and to be empathetic to the pressures they face. Understanding directors’ individual personalities and preferences, they write, will make it easier to deliver information to them in a clear, concise manner.

Here, too, there’s plenty of work to do. In a recent survey of 100 CFOs, Russell Reynolds found that only 34 percent rated their relationship with their board as very strong. That same survey also revealed that CFOs were unlikely to have a strong relationship with their board if they didn’t already have a strong relationship with their CEO, the chair or lead director of the board, or the chair of the board’s audit committee—thereby reinforcing the importance of relationship-building.

Conclusion

CFOs have long battled for a seat at the strategy table. Today, most have made it there; 94 percent of finance executives surveyed by CFO Research say finance chiefs are perceived by their boards as critical, strategic business partners.

CFOs jeopardize their ability to impact the enterprise, though, when they fail to deliver the insights and advice that CEOs and corporate board members need to make decisions. Right now, surveyed finance executives contend, many CFOs are indeed failing to deliver critical information and decision-support data to boards in six key areas, headlined by fraud monitoring and mitigation, which is cited by 43 percent of the executives polled. Nearly a third also say CFOs aren’t providing the same valuable support on performance risk management, or on strategic or operational risk management. And one in four say CFOs aren’t delivering on growth strategy support, cost control and reduction, and strategic decision-making.

The surveyed finance executives, along with other recent research, suggest there is a clear way forward for CFOs who want to do better. CFOs must work to break down functional and operational silos that impede the sharing of information across the enterprise. They must embrace technological innovations, including fraud detection and monitoring systems, that automate standardized processes and procedures and allow them to spend more time on higher-value, strategic activities. Finally, where personalities appear to be getting in the way of progress, they must spend time getting to know the people who serve on their boards, understanding the pressures they are dealing with, and looking for ways to forge more productive relationships.

CFOs who do all this don’t just have a seat at the strategy table, they cement their position as one of its most valuable constituents.