Fact Sheet

Working Capital Optimization

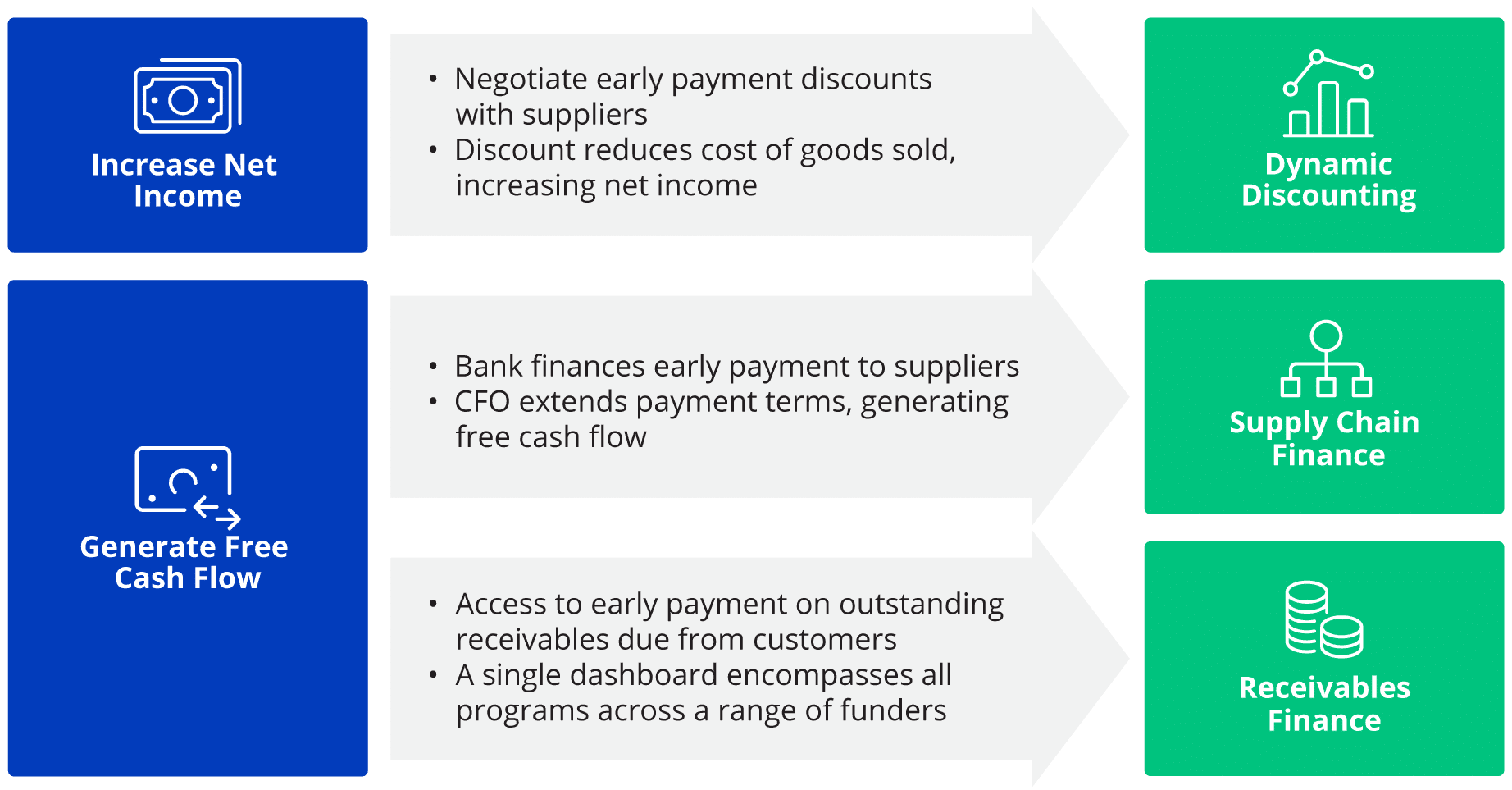

Working Capital Optimization is a strategic objective for CFOs as they fight to generate bottom line value and generate free cash flow. Kyriba offers CFOs two compelling benefits: the ability to improve working capital, as well as the opportunity to increase net income.

Table of Contents

Kyriba Delivers Multiple Early Payment Programs

Kyriba offers both dynamic discounting and supply chain finance programs to improve financial performance.

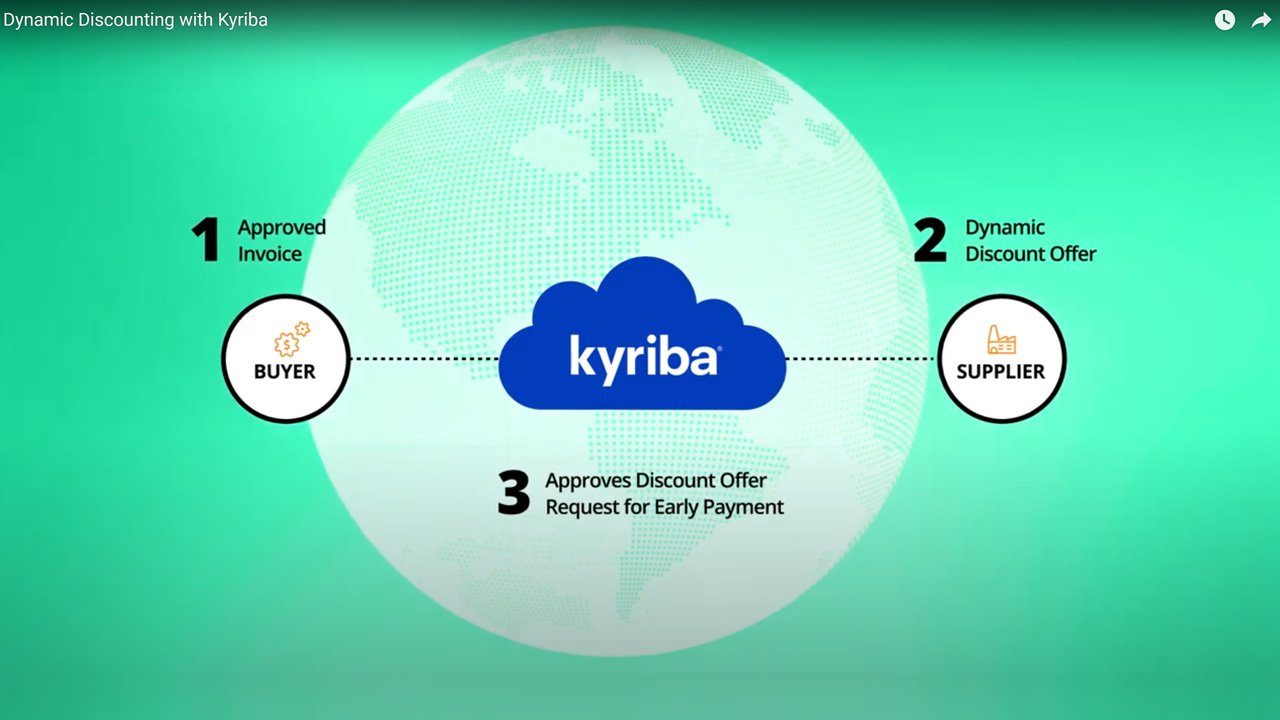

- Dynamic Discounting programs reduce cost of goods sold through the direct discounts earned from suppliers, increasing net income while simultaneously improving the return on excess cash liquidity.

- Supply Chain Finance, also referred to as reverse factoring, facilitates term extension on payables, preserving cash for longer on the balance sheet and increasing free cash flow.

- Receivables Finance optimizes cash flow by allowing sellers to be paid early for unpaid receivables from customers.

“Three years after the project began, the program has already exceeded Auchan’s original goals. We have over 15,500 suppliers on the platform, and financing requests rose by more than 47% in 12 months.”

— François Verrodde, CEO of Auchan Suppliers Advanced Platform (ASAP)

Kyriba’s Working Capital solutions allow suppliers to be paid early in exchange for a discount or financing fee at a lower cost of funding than they can achieve on their own.

Reduce Risk in the Supply Chain

With many organizations under pressure to extend DPO by paying suppliers later, Kyriba’s Working Capital solutions allow suppliers to be paid early in exchange for a discount or financing fee at a lower cost of funding than they can achieve on their own. Early payment programs supported by Kyriba’s cloud platform allow an organization’s suppliers to improve their own working capital to increase production efficiencies and drive growth.

What Is Important in a Supply Chain Finance Solution?

To deliver successful global supplier financing programs, there are five key requirements:

- Expert Teams

Supply chain finance solutions are as much a service as a platform. The vendor should help design the right program to meet specific KPIs, analyze spend and build a business case. - Multi-Funder Platform

Payables financing programs require diversification across lenders to deliver the required liquidity to the global supply chain and to support regional specialization. - Program Flexibility

The solution must support both dynamic discounting and supply chain finance programs, with the flexibility to modify business rules on the fly to meet the KPIs of an organization. - Complete Workflow

A comprehensive program must also include cash visibility, forecasting, payments and pre-built ERP integration. - Supplier / Funder Onboarding

To maximize participation, our portals are easy to understand, in the language of their choice, with feature-rich, intuitive reporting dashboards.

Kyriba delivers an all-in-one Working Capital and Payments solution through our Enterprise Liquidity Network. Now, actionability for purchase orders and invoices can be delivered in a single global platform.

Kyriba: Integration in a Single Platform

Kyriba delivers CFO decision making, analysis and performance management tools in a single cloud portal. Kyriba clients benefit from a comprehensive financial platform.

Kyriba Offers the Most Flexibility and Scalability

Kyriba delivers an all-in-one Working Capital and Payments solution through our Enterprise Liquidity Network. Now actionability for purchase orders and invoices can be delivered in a single global platform.

- Connect local and international liquidity providers to leverage existing bank relationships or introduce new financing partners

- Integrate easily with ERPs for complete liquidity and payment workflows, automation of cash pool allocations and streamlined invoice settlement

- Adjust business rules easily through flexible configuration options by geography, by bank or individual suppliers

- Comprehensive reporting, dashboards and analytics to set objectives and monitor results

- Supplier portal and onboarding tools to maximize supplier participation