Research

Strategic Treasurer 2020 Supply Chain Finance (SCF) and Cash Conversion Cycle (CCC) Analyst Report

During these times of accelerated growth and change, interest in supply chain finance solutions that can provide thorough evaluation and analysis is rapidly increasing. The Supply Chain Finance (SCF) & Cash Conversion Cycle (CCC) Analyst Report will cover a variety of solutions that address pain points in the cash conversion cycle, specifically SCF (supply chain finance) solutions, accounts payable automation systems, and accounts receivable automation systems. The report will cover:

- The relationship between treasury, technology (including emerging technologies), and cash conversion cycle solutions

- The relevance of these solutions in business continuity planning and times of disruption and volatility

- The various SCF models, including reverse factoring and dynamic discounting

- The navigation of challenges such as international legal and jurisdictional issues, supplier participation, and internal corporate conflicts

Finally, it will offer a working capital checklist, which will guide the reader through ideas such as forming working capital councils, establishing a single set of KPIs, understanding suppliers, addressing communication issues, and monitoring usage to refine the approach and optimize working capital.

Table of Contents

Taking a More Integrated View: SCF and CCC

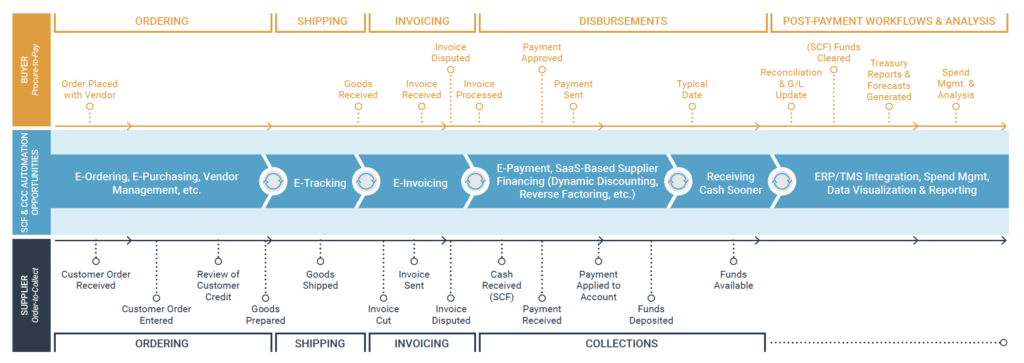

In past years, our third analyst report has covered various forms of supply chain finance (SCF), technology solutions available, and leading practices for implementing an SCF program. This year, we are expanding the scope of this analyst report to cover not only SCF solutions, but also the broad spectrum of solutions that assist with the cash conversion cycle (CCC). This more integrated view will allow organizations struggling with areas such as working capital management or any given portion of the CCC to see a more comprehensive account of the technological options available, how to obtain funding, and ways to increase efficiency.

The solutions covered will fall primarily into two camps. The first is the same as in prior years: SCF. The other types fall under the category of CCC automation. This latter category, the new addition to the report, will include solutions covering portions of the order-to-collect process and the procure-to-pay process. It would be impossible to go into depth on every type of CCC solution available, but we will discuss the spectrum of solutions and the broader problems they address.

While SCF and CCC solutions handle different processes and problems using unique approaches, certain similarities make it logical to address these categories in the same report. Most centrally, all these solutions have an impact on working capital and liquidity management.

Given the similarities between SCF and CCC solutions, related circumstances may drive their adoption, and similar obstacles will need to be overcome to implement each solution.

The following sections highlight some of the reasons that encouraged us to develop the integrated report. Additionally, these points are detailed here because each is either an important driver of or challenge to the adoption of SCF and CCC solutions.

Cash Conversion Cycle: Automation Opportunities

Corporate Departmental Conflict and Communication

Competing key performance indicators (KPIs) will be a recurring theme throughout this report. The cash conversion cycle and SCF cut across multiple environments within an organization, and in order to implement any of the solutions, treasury must gain buy-in and support from multiple people and multiple departments, requiring coordination between departments who are focused on disparate objectives.

The departments involved—AR, AP, inventory management, procurement, etc.—are prone to competing KPIs, each trying to optimize their own operations and often suboptimizing the whole of working capital across the organization. Many activities these departments employ, hoping to solve their individual financing and working capital needs, operate within this system of suboptimal—though unintentional—competition.

While the departmental separation of these more siloed solutions makes for less coordination, and thus an easier implementation often results, they fail to solve the overarching problem. Often, they lead instead to more entrenched disjunction.

SCF programs, like many CCC automation technologies, require significant coordination and deeply intertwine with multiple departments. The processes will be more involved, requiring a concerted cross-departmental effort for initial implementation. To organizations with departmental conflict, that may sound like an insurmountable barrier.

With the added coordination, however, come much greater rewards. All the solutions discussed in this report cut across departments that often experience conflicting goals and poor communication. However, all of them, once implemented, bring not only alleviation to the overall working capital difficulties of the organization, but also greater ongoing efficiency. Since all these solutions have overcoming cross-departmental conflict in common, we felt it made sense to produce an integrated report addressing each solution and addressing the leading practices for their successful implementation.

WFH Environment and BCP

We live in an era of enhanced need for and interest in working from home (WFH) and in ensuring business continuity plans (BCP) allow processes to carry on smoothly and securely if employees must be away from the office for months at a time. At times such as these, having automation and integrated solutions on your side can make a significant difference in your ability to weather the storm smoothly.

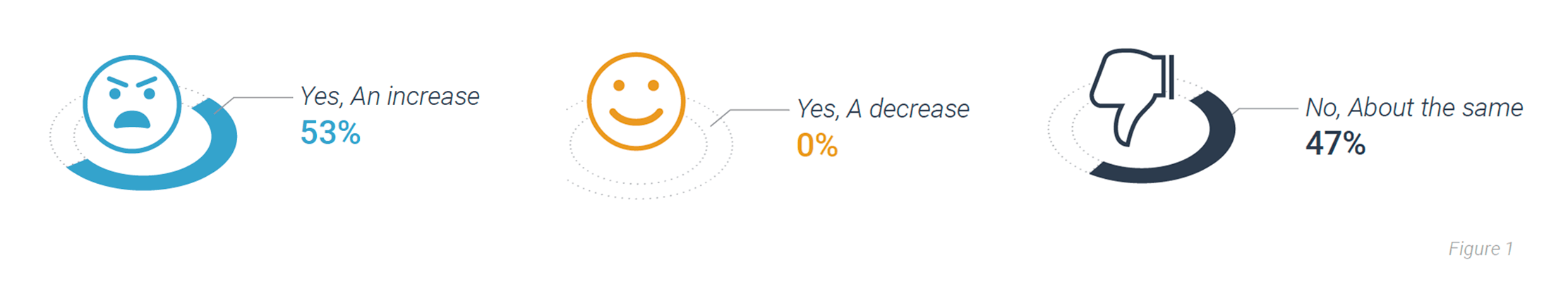

Among various issues that can crop up with WFH, fraud is one of the most universal and dangerous. During WFH conditions, a net 53%1 of organizations surveyed indicated increased fraudulent activity. As companies work to update and strengthen their BCP and WFH policies, many are prudently considering SCF programs or solutions automating portions of the cash conversion cycle. Such integrated systems provide built-in controls and reduce manual handoffs, leading to much more robust security.

Solutions that automate the order-to-collect and procure-to-pay processes can also aid companies in maintaining consistency and avoiding problems during WFH and other BCP scenarios. As just one example, an automated ACH payment process will continue to run smoothly even in situations causing delays to mail and other physical delivery methods, but each solution covered can provide some kind of potentially vital support during WFH.

Whether employees are home due to a BCP scenario or for less dramatic reasons, the use of technology allows for greater security, control and consistency when offices are adapting to new circumstances and remote workers.

Has your organization seen a change in attempts of fraud or cyberfraud?

(Not including “I Don’t Know”)

CCC and SCF Amid Disruption and Volatility

In time of uncertainty or economic stress, supply chains can rapidly unravel. Finding a compromise on DPO (days payables outstanding) and DSO (days sales outstanding) that is agreeable to all parties is difficult enough during good times. When the strains of disruption and volatility are introduced into the equation, it can quickly become a win/lose situation where only one party is able to get the payment terms they need, as buyers extend terms to protect their own liquidity at exactly the time when suppliers can least afford to wait longer to convert their receivables to cash.

This win/lose scenario, however, ultimately becomes a lose/lose, as damage done to any link in the supply chain inevitably affects the rest as well. Payment terms that are good for you but bad for your partners are, in the end, bad for you too.

Keeping the supply chain alive and every link in the chain strong is vital, but a downturn can make it impossible for traditional payment terms to meet everyone’s needs. In such times, third-party SCF programs and technology solutions can provide the flexibility and automation both buyers and suppliers need in order to keep afloat. Larger buyers can leverage their more robust credit to secure financing for their smaller suppliers, protecting the more vulnerable portions of their supply chain while getting better payment terms and more stable liquidity themselves. This allows for a sliding scale when managing programs, enabling quick adaptation, flexibility and agility.

At the same time as volatility threatens the supply chain, any defects and inefficiencies within CCC processes make companies more susceptible to the adverse effects of disruption by creating additional friction and difficulty. Where manual handoffs abound, defects are likely to multiply, and with defects come disproportionate delays in the amount of time to process a payment. Invoices are sent back and must be reissued, resent, and reviewed again, with each step drawing out the outstanding payment collection for days. Working capital becomes hard to forecast, hard to control, and impossible to optimize. In times of stability, this is far from ideal.

In times of economic strain such as we are all too familiar with today, it is untenable. Automating AR, AP or any portion of the CCC strengthens your processes, making your organization able to handle greater scale gracefully and adding resilience in times of financial stress. By minimizing manual handoffs, automation minimizes defects, reduces friction and increases forecasting accuracy. Not only does this help us achieve Six Sigma in quality—a worthy goal in itself—but it also builds resilience into our processes, helping our organizations survive in difficult times.

Between SCF solutions providing flexibility across the supply chain and CCC automation solutions building resilience into your processes, your organization can quickly adjust to weather strong storms and many unforeseen disruptions. Each type of solution discussed within this report can in some way strengthen a company’s ability to maintain working capital at the necessary levels even when circumstances are far from ideal.

End-to-End: Understanding the CCC and SCF

Terms to Know

CASH CONVERSION CYCLE

By the cash conversion cycle, or CCC as we will shorten it to throughout the report, we mean “The measurement of time it takes to convert resources (inventory, AR, AP) into cashflows.”

SUPPLY CHAIN FINANCE

There are other definitions of SCF, often with a narrower scope, but we will be using the definition used by the Euro Banking Association: “The use of financial instruments, practices, and technologies to optimize the management of the working capital and liquidity tied up in supply chain processes for collaborating business partners.”

WORKING CAPITAL

For working capital, there are two definitions, both in the form of equations. While accounting would say that working capital = current assets – current liabilities (a perfectly valid definition for many purposes), for our purposes we will be using net adjusted working capital, defined as AR + Inventory – AP.

The Cash Conversion Cycle

The cash conversion cycle is a measure of a company’s efficiency based on the length of time it takes them to put cash into the cycle and retrieve it back out. What exactly this entails will depend on the type of organization. For example, the steps involved in the CCC will differ significantly between companies that have inventory and those that exclusively provide services.

For the CCC, the focus should be on increasing the efficiency wherever possible. While speed is a part of efficiency, it’s important to remember that accurate, secure and thorough processes are far too vital to allow a sole emphasis on making the CCC as fast as possible. Rather, it should be as efficient as possible.

Understanding their own CCC and calibrating it help companies achieve greater efficiency and give more control over working capital. For companies feeling the need to improve and optimize their working capital, careful attention must be directed to the cash conversion cycle and its effects on liquidity.

Multiple departments and disparate processes play important roles within the CCC. Often, however, these departments fail to see themselves as part of a whole, instead viewing themselves as entities to themselves attempting to meet their own individual goals. Competing KPIs frequently wreak havoc on the CCC and working capital, but it is important to understand and educate others about each department’s needs before attempting to fix this problem.

For most of this report, we will be considering solutions that can help optimize working capital, whether through financing or by automating portions of the CCC. First, however, we need to understand the areas, departments and processes involved to gain an understanding of their individual concerns and the factors involved for each.

Order-to-Collect

The order-to-collect process begins with receiving an order and ends with collection and application of that sale’s payment. The payment process encompasses many areas, each with individual incentives, focal points and concerns.

Credit: Those involved in credit issuance are focused on minimizing credit losses and have no incentive to be too loose in their extension of credit. While too much credit extension does, indeed, result in losses, extending credit within reasonable parameters helps to increase sales. Credit must ensure their KPIs do not too narrowly focus on minimizing losses to the detriment of sales

Sales: On the other end of the spectrum, those in sales are driven by maximizing the ability to sell. If no measure of loss feeds back to them (such as losses due to overextension of credit), they may not realize when they’re maximizing sales to the detriment of overall profit.

Fulfillment: This area is charged with ensuring the quality and speed of delivery.

Invoicing or Billing: Similarly, getting invoices out quickly but also correctly is the focus of invoicing or billing. Defects create lengthy delays and extra work, so this is an area where any steps toward increased efficiency and automation can pay off rapidly.

Collection and Credit Application: The final area in order-to-collect focuses on the DSO measure, (which needs to fall in line with the terms offered) and relieving AR. Their focus does not naturally fall on the actual availability of funds throughout the month.

Note the contrast to treasury, a department highly focused on actual cash availability. It will be vital for treasury to listen carefully to the concerns and priorities of these other departments and help them understand why fund availability must be factored into the equation.

Procure-to-Pay

The buyer’s counterpart to order-to-collect, procure-to-pay encompasses the processes beginning with procuring goods and services and ending with disbursing payment to the supplier. While procure-to-pay has only two individual departments heavily involved, these two departments must handle significant complexity.

Procurement: Several key factors drive procurement: stability and strength of providers; balancing diversification of suppliers, quality, and reduction in the number of suppliers; and cost. The first two drivers are related to consistent, steady delivery of goods and services.

Accounts Payable: AP tends toward a small staff. Driven by controls and disbursements, they typically consider it good to pay a bit slower, making sure they hit minimum DPO numbers. They are also interested in optimizing discounts, which involves paying more quickly and must be balanced with DPO management.

Inventory Management

While inventory management is not directly related to the solutions included in this report, it plays a vital part in determining working capital, and its concerns and drivers must be involved in the integrated KPIs that optimize working capital rather than only portions of the CCC. Inventory management works with procurement and must align KPIs and set goals with them. The factors may vary but will typically include price and avoiding running out of materials, among others.

Financing

As your organization grows, more capital must be deployed into receivables and inventory to support the greater activity. This capital is obtained through financing. Financing is focused on the measure of external cost of capital and on project hurdle rates.

Supply Chain Finance

While supply chain finance is not a department, it is a significant factor in many companies’ processes and working capital management. We’ll discuss it here because it is important to understand it in the context of the processes and departments just covered.

Securing capital has always been difficult for smaller businesses. With less collateral to offer and less robust credit, they struggle to convince lenders that their investments are safe with them. While various economic climates and events have created variation over time in the ease or difficulty small enterprises face, they have always fared worse in the underwriting processes than their larger counterparts.

Since unsecured loans are so difficult for these companies to obtain, they look elsewhere for their capital. They do this by various means. Most of the traditional methods for smaller firms to secure capital, however, come with significant drawbacks:

Payment Terms: Payment terms are one of the most common ways smaller organizations look to maintain sufficient capital, decreasing their DSO and increasing their DPO. Increasing their DPO, however, puts strain on the small firms supporting them, and relying on low DSO puts them at the mercy of a buyer who may at times delay payment to protect their own liquidity.

In many cases, a supply chain that relies too heavily on traditional payment term management to keep each link in the chain afloat pits partners against each other. The arrangement leads to precarious liquidity positions, as any volatility motivates all parties to pull the payment terms further into their own favor at their partners’ expense. Since these companies rely on each other, however, this win-lose can rapidly turn into a lose-lose, as one company’s loss is ultimately a loss to the whole supply chain. It’s also important to note that delaying payment is regulated against in some locations, such as the UK.

Receivables Securitization: Another method smaller firms employ is using their AR for collateral. While this method is often effective and requires relatively little coordination to put into action, it requires consistent, labor-intensive maintenance. Reports on AR must be compiled and submitted each month, and the lenders will adjust what they are willing to offer based on the vendors involved in your receivables. If those who owe your company have poor credit themselves, your receivables hold less power for collateral.

In some cases, AR securitization might require routing your collections through an account the lender controls. That way they can seize funds if needed, creating more security for them. This, however, is hardly an ideal situation for the organization looking for capital.

Managing payment terms and AR securitization are a couple of the traditional methods smaller organizations use. For some, however, these methods create as many problems as they solve. Supply chain finance is a category of more innovative and comprehensive solutions to the problem. Some forms of SCF leverage technology to optimize payment terms and minimize the strain to both companies, while other forms of SCF leverage the larger party’s credit to obtain financing for the smaller companies in the chain.

While SCF may take upfront effort getting all the necessary departments and suppliers on the same page (a worthwhile endeavor for its own sake), the credit barrier to entry for SCF is drastically lower. Since SCF leverages either the capital or the credit of the buyer, the credit of small suppliers is nearly a non-issue, allowing this type of financing to extend further downstream in the supply chain than other forms. Far from pitting the links in the chain against each other, SCF brings greater strength to the chain as a whole. In addition, the ongoing maintenance for most SCF programs is minimal, and many of the technologically enabled solutions bring increased efficiency as well.

The Umbrella of Supply Chain Finance

Terms to Know

FACTORING

A form of supplier-led financing where a supplier sells their short-term receivables to a “factor,” which is usually a bank.

FORFAITING

A form of financing where an exporter sells their medium-term and long-term receivables without recourse to a “forfaiter,” usually a bank or other third party, at a discount. The importer later pays the forfaiter.

AR SECURITIZATION

The selling of a group of receivables as an investment instrument for cash at a low interest rate.

INVOICE DISCOUNTING

A loan based on a percentage of a company’s short-term receivables, often 80% of receivables less than 90 days old.

INVENTORY FINANCING

A form of financing in which a loan is obtained to buy inventory, and the inventory to be bought functions as the collateral.

DOCUMENTARY TRADE FINANCE

Also called documentary collection, this involves an exporter’s bank exchanging documents with the importer’s bank and then initiating payment.

Treasury, the CCC and SCF

While the composition of an organization’s liquidity will vary depending on their industry and other factors, working capital is usually one of the largest influencers. As the stewards and managers of organizational liquidity, treasury must play an active role in overseeing and optimizing working capital. Many of the processes in the cash conversion cycle occur outside of treasury, but it remains treasury’s job to seek out potential problems and opportunities for improvement related to the ultimate impact on working capital and cash liquidity.

These opportunities for improvement may come in the form of SCF and cash conversion cycle solutions. As much as such solutions may ease the everyday burden of various departments (a worthwhile result), treasury’s primary reason for involvement is that all of them can help optimize working capital.

Whether it’s an SCF solution helping strengthen the entire supply chain while maintaining flexible payment terms, an AR solution reducing invoice error rates that slow down payments, or any other solution this report covers, there will be an impact on liquidity. Driving out inefficiency tends to drive out costs with it, and streamlined, automated, lower-defect processes will always result in a greater ability to optimize working capital.

SCF and many of the solutions that streamline the cash conversion cycle overlap multiple departments and help meet higher-level organizational goals more directly than specific, departmental KPIs. While the individual departments involved will reap benefits and have needs that must be taken into account prior to selecting a solution, they may be less likely to seek these cross-departmental solutions out, so it often falls upon treasury to begin a discussion that can benefit everyone.

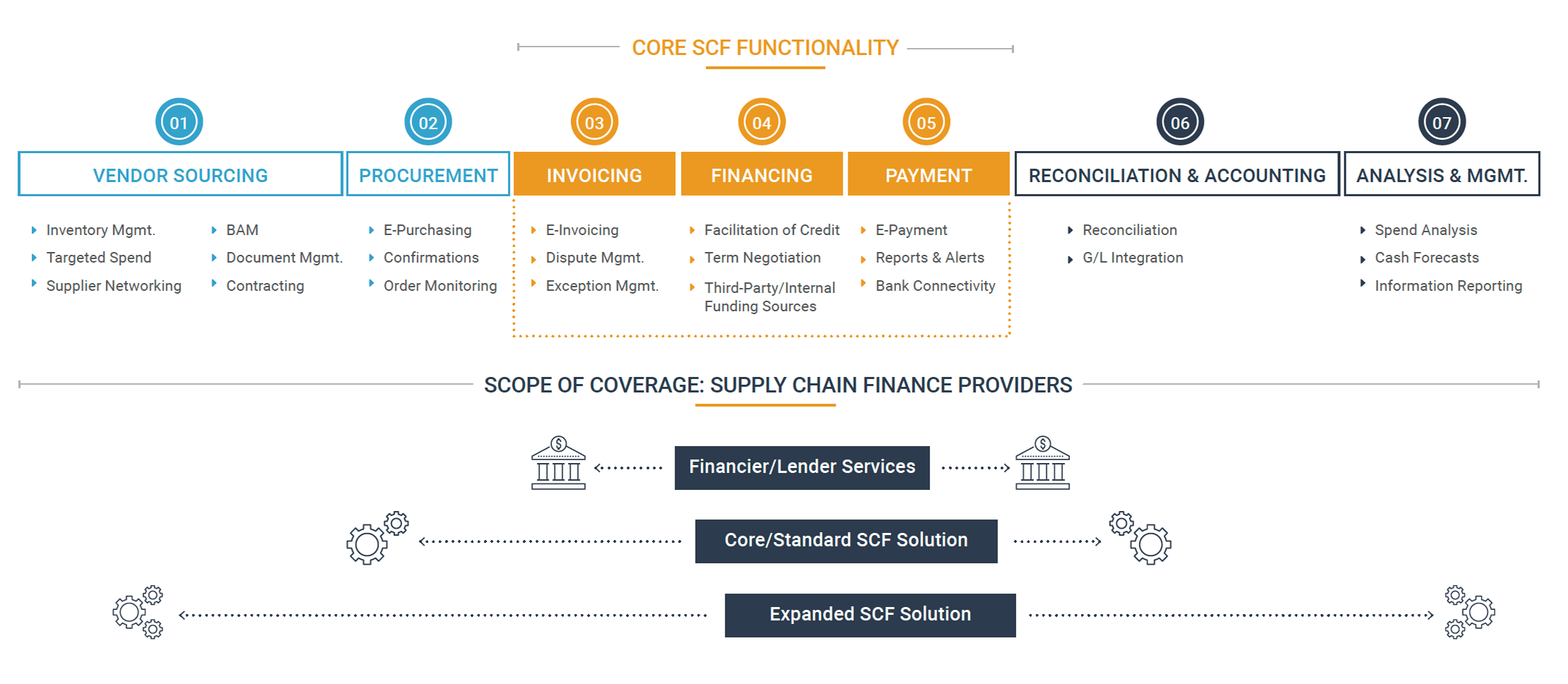

The SCF Landscape Continuum

As you go through the process of choosing strategies for optimizing your working capital and consider SCF in its various forms, you will want to understand various factors in the landscape that affect and drive SCF. This includes elements such as interest rates, the compliance environment, emerging technologies, and the potential role of SCF solutions within the context of your own technology stack as a whole.

Interest Rates

Interest rates differ from year to year, from country to country, and from company to company. The higher they are, the more motivated organizations are to find sources of liquidity outside of traditional financing.

While interest rates fluctuate from region to region and from year to year, there is consistently a gap between interest rates available to smaller firms and those available to large, financially strong firms. This gap can be sizable. At the same times, smaller firms often find themselves with the least margin. They can least afford the high interest rates, and they can also least afford to turn down any financing they can obtain.

As approximately 30% of organizations fluctuate between being cash users and cash generators depending on their business cycles, they will intermittently find themselves in need of funding. With high interest rates and barriers to entry especially for smaller firms, however, the banking industry by itself cannot ultimately meet this need. As a result, organizations turn to their partners, tapping into the cash conversion cycle and payment terms to try to gain the liquidity they need at the times when they need it. This can be done gracefully, or—as discussed earlier—it can be done in an unwieldy fashion that amounts to simply paying your partners later.

SCF allows it to be graceful and collaborative, resulting in win/win terms and benefits for the supply chain at large. Since SCF offers liquidity relief to those with fewer options without increasing counterparty risk by straining partners’ liquidity, high interest rates and disruptive economic conditions both prove significant drivers of its adoption.

Compliance

For many treasury and finance practitioners, complying with various regulations and adapting to new or expanded ones has become a constant struggle. The regulatory environment is always growing in response to outside forces such as fraud, and it cannot be expected that these forces or the responses will become any less complex and extensive in the coming years. Since the compliance landscape can influence trading in general, it will inevitably affect SCF as well.

KYC, for example, has proven a complication to SCF programs, especially for the solutions offered or led by banks. The bank processes for KYC are extremely cumbersome. Interestingly, however, while fintech companies must still cope with KYC as they onboard customers, this process requires less overhead for them than it often does for banks.

On the other hand, SCF can remove or help manage some of the complications brought on by domestic or international compliance. In the UK, for example, domestic compliance includes a “Prompt payment policy” barring organizations from government contracts unless they consistently pay their vendors in a timely fashion. SCF can help these companies obtain funding and hold onto their cash longer without sacrificing their vendors and falling out of compliance.

In terms of cross-border transactions, compliance increases the already heavy friction that often comes with international trade. Regulations vary from country to country, and understanding with any certainty what standards you must meet and what your partner must meet can be confusing. A component of risk can be involved as well, since enforcing your business dealings and disputing transactions when trading with other countries can prove quite difficult.

Trading networks, communities, and other networks can ease the friction in dealing with another party by providing a referee. Banks have also frequently stood in this gap, acting as a mutually trusted party and providing safeguards such as documentary letters of credit.

Ideally, however, documentation occurs along the way. The visibility achievable through an SCF solution can help with this, as different parties can track the shipping and receiving of goods, thus driving the release of funds.

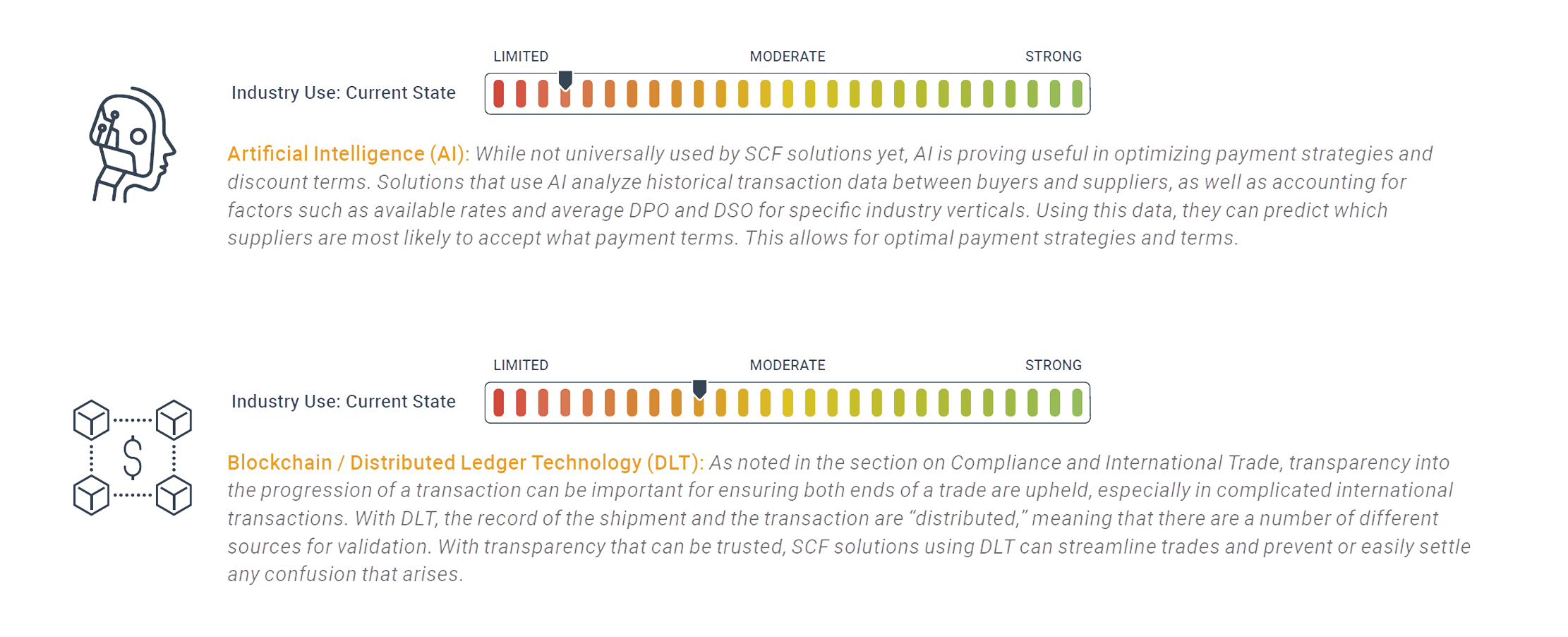

Emerging Technologies

As technology continues to improve and develop, more and better tools become available that can impact the whole process—both from an efficiency standpoint and a financial one. In many ways, SCF solutions are emerging technology themselves, slowly moving the industry away from older processes at the banks. As such, we would regard each vendor included in this report as emerging technology.

It’s worth noting that in prior years, we’ve mentioned software-as-a-service (SaaS) as an emerging technological element of SCF. The SaaS model involves cloud-hosted solutions that are automatically updated and can be accessed online from any computer if the security parameters are met. At this point, we have concluded that it’s becoming questionable to call SaaS “emerging.”

Specific areas of technological development that are either currently enabling SCF technology or show promise for it in the future:

Who Needs an SCF Solution?

- Do your suppliers typically have a lower credit rating than you do?

In many supply chains, the party in most dire need of additional capital is the small supplier. If your own firm is large and has a robust credit rating, while your suppliers often struggle due to lower credit ratings, SCF can allow you to leverage your own credit to negotiate favorable rates and secure financing for the portions of your supply chain that need it most. - Is stability and success of trading partners of top importance, or are they viewed as easily changeable commodity providers?

Depending on industry and other factors, the relationship between buyer and supplier may range from partnership to more transactional with the supplier being easily replaced with others. For companies in more transactional environments, protecting the supply chain may not be a high priority, but if your firm does rely on specific vendors or buyers, who in turn rely heavily on your business, maintaining partner stability can be a vital strategy. If this is a priority for your firm, an SCF solution may prove highly valuable in your efforts to secure funding for and support the liquidity needs of your trading partners. - Do you have extra cash you can deploy for working capital?

If your company often finds itself with excess cash, and you are looking to use it to help optimize working capital, SCF could prove useful to you. The dynamic discounting model, in particular, is a self-funded method of financing that allows your organization to put its excess cash to use to obtain discounts while supporting your suppliers’ liquidity needs. - Do your cash needs fluctuate from a net borrower to a net investor position?

While some organizations find themselves dealing with consistent excess cash and others with a consistent need for cash, a recent study found that 29% of corporations fluctuate between the two. This fluctuation creates a need for extensive flexibility. If this describes your firm’s situation, it would be worthwhile to investigate implementing an SCF solution. Hybrid model SCF solutions are especially useful in situations where flexibility is needed, as they allow you to calibrate your ratio of self-funded to third-party financing as your position shifts. - Have you made all the normal adjustments to optimize working capital, and you still want more flexibility?

If you’ve done all you can to optimize working capital using more common means, but the situation continues to seem rigid and difficult to control, SCF could be a good next step. Its added options allow more flexibility and control over the factors that affect working capital, leading to more optimization while also supporting your supply chain as a whole.

SCF Models

A variety of methods fall under the umbrella of supply chain finance, but two stand out as the most common model (reverse factoring) and technique (dynamic discounting). Most fintech solutions will facilitate one of these or both together, referred to as a hybrid model.

Both reverse factoring and dynamic discounting are buyer-led, payables-centric mechanisms, meaning they are initiated and controlled primarily by the buyer, although the suppliers benefit as well and are always able to accept or reject the terms offered. Where these two methods most noticeably differ is in the funding source. Reverse factoring leverages a third party for financing, whereas dynamic discounting is self-funded as a rule.

SCF Landscape: Technology Offerings

Reverse Factoring

Normally, a buyer’s DPO and their supplier’s DSO can only move in lockstep. This rigidity causes problems when the payment date that would be ideal for one is far from ideal for the other. Unfortunately, this is frequently the case. The buyer benefits from extending DPO, while the supplier benefits from reducing DSO. Essentially, they both want to employ the cash at the same time, but this is clearly impossible with normal, lockstep payment terms. Often considered the most common and “traditional” form of SCF, reverse factoring separates the buyer’s payable from the supplier’s receivable, breaking them out of lockstep. This method involves a large buyer leveraging their more robust credit to obtain financing for their suppliers. The bank or other third party pays the supplier early, often at a discount, and the buyer then pays the bank back later.

All parties benefit from this arrangement. The supplier is able to reduce DSO at the same time as the buyer extends DPO, allowing each party to optimize their own working capital without straining the other. Having flexibility that can extend across the supply chain in this fashion greatly improves the resilience of each link in the chain. At the same time, the bank pays out a discount and is paid back at interest. The bank’s receivable, however, is from the credit-worthy buyer, so their risk is low, and they are willing to offer a low interest rate, which again benefits the buyer.

Dynamic Discounting

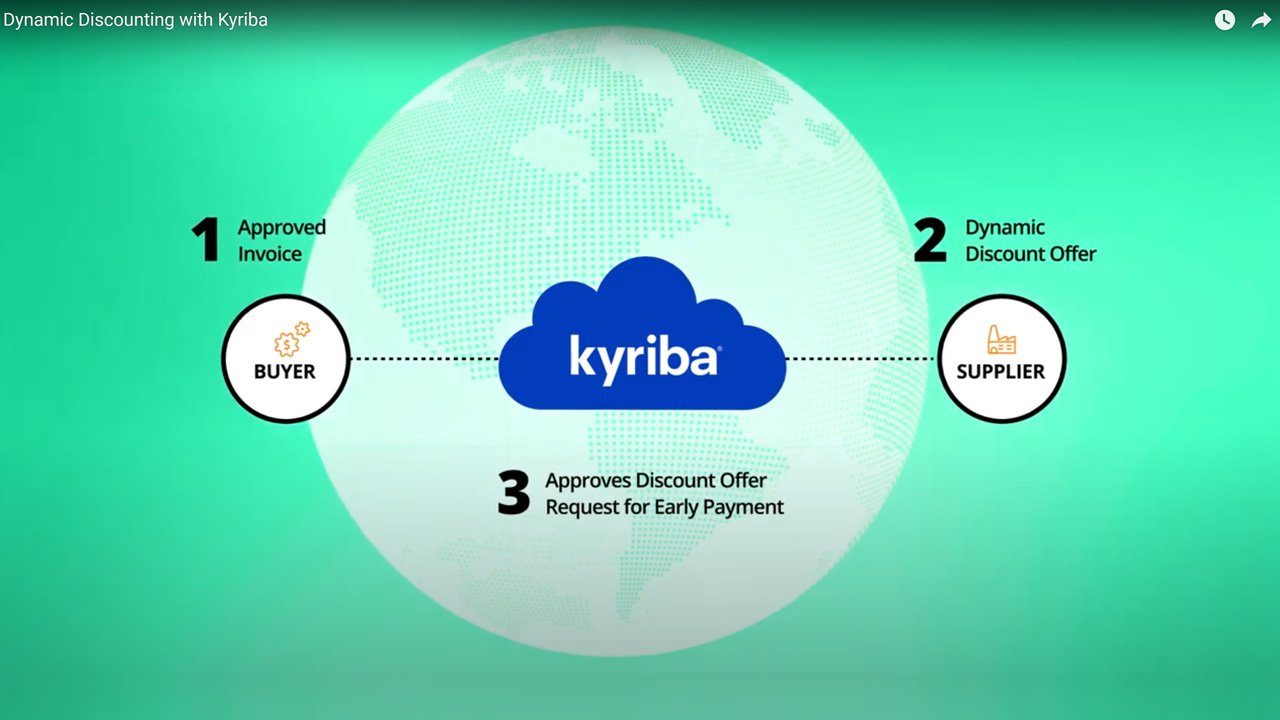

Dynamic discounting is another way of infusing flexibility and optimizing terms for all involved, but it is quite different from reverse factoring. Instead of relying on a third party for funding, dynamic discounting leverages technology to improve on regular payment terms and discount offers, creating a self-funded, graceful, win/win process.

With standard payment terms, for example, 2/10 net 30, the buyer has two options: pay within ten days and receive a 2% discount or pay the full invoice amount anytime during days 11-30. While the offered discount does incentivize earlier payment, it does so in a stiff and only sometimes effective fashion. For example, the buyer has no incentive to pay before day 10, nor is there any incentive to pay between days 11 and 29 – once day 11 hits, the buyer might as well hold onto their cash and put it to work for them elsewhere till the invoice due date. The supplier, meanwhile, is having their own liquidity strained as they wait on the payment.

Dynamic discounting fixes this by introducing a sliding scale. Via an SCF solution portal that both the buyer and supplier can access, the supplier can set discount rates, and the buyer can choose any payment day and receive a prorated discount. For example, a payment on day 12, formerly a low-incentive time for a buyer to pay, might result in a 1.5% discount with dynamic discounting.

While the payment terms still move in lockstep with dynamic discounting, the lockstep is significantly smoother than usual and affords mutual benefit to the two companies. The sliding scale allows the supplier to decide what an early payment would be worth to them on each day, and the buyer is enabled to choose exactly which terms suit them best.

Note that buyers self-fund their dynamic discounting programs. They do not involve financing from an outside source, but instead rely on early payments streamlined by the use of technology.

Hybrid SCF

Both reverse factoring and dynamic discounting expand a supply chain’s options for funding. However, one method might work better than the other at a given time. Determining which will work best often depends on the buyer’s status as relates to excess or negative cash. Since around 30% of companies indicate that they fluctuate between these two states, there is a clear need for flexibility not only in payment terms and funding, but also in the type of financing options accessible to these companies.

To address a fuller scope of SCF and liquidity needs, many fintech vendors have developed hybrid approaches. A hybrid SCF solution allows a buyer to use reverse factoring at times when that is most advantageous and leverage dynamic discounting at others without overextending their own resources. This, too, increases the level of flexibility in supply chain payments, allowing a buyer to calibrate their strategy to their fluctuating liquidity position and to their suppliers’ eligibility and needs.

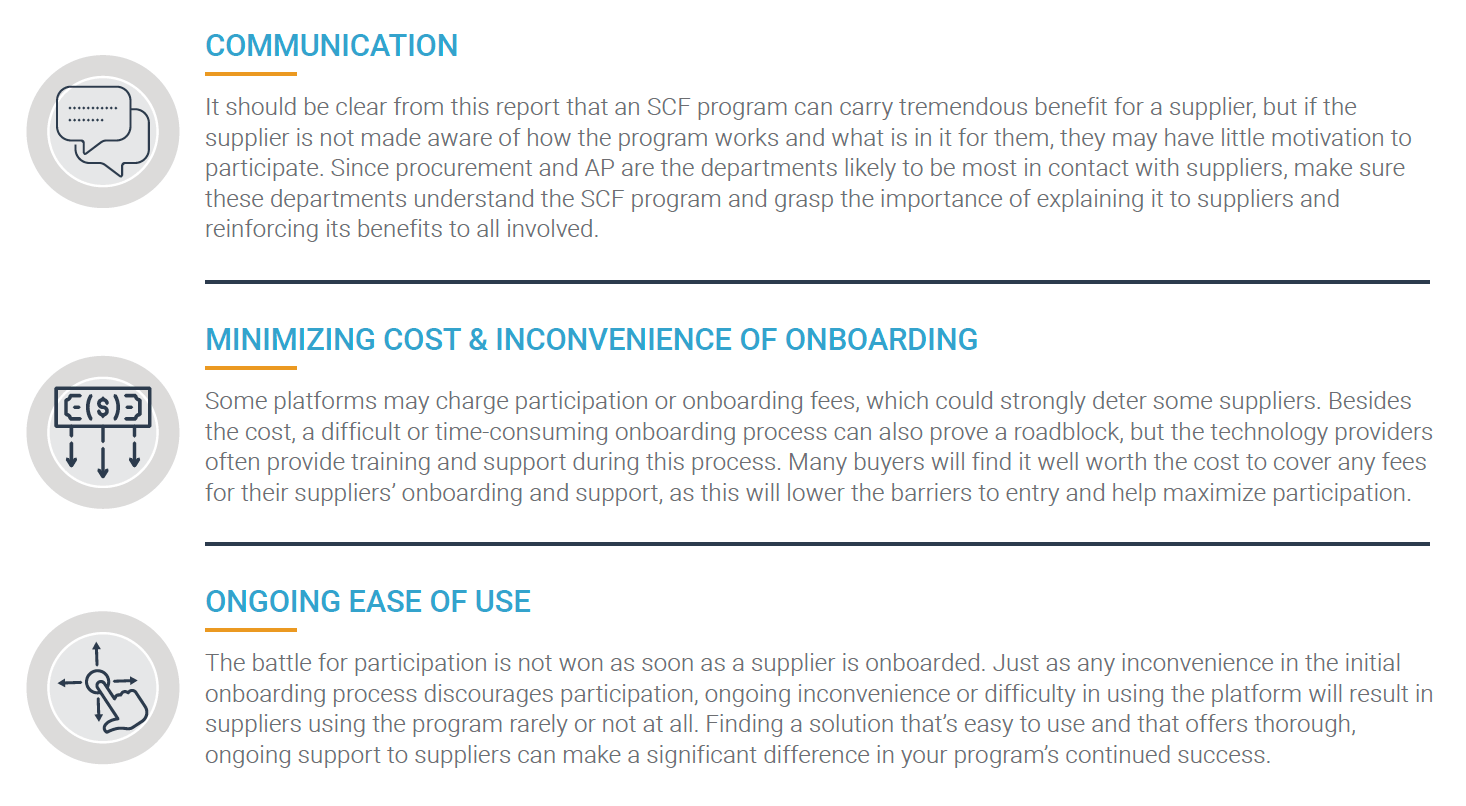

The Power of a Network: Supplier Participation

We often hear how powerful a network can be, but we may have also noticed that not every network seems powerful. What makes the difference? There are two primary sources of value in a network:

- Who is participating.

- How you can leverage it.

What you can do with an SCF solution network has already been addressed for the most part. They not only help optimize working capital by freeing up funds, but they also increase efficiency by streamlining and automating various parts of the cash conversion cycle (which parts will vary based on the vendor).

Supplier participation is vital to the success of the SCF network. In a 2019 Supply Chain Finance survey, more than half the respondents ranked supplier participation as the factor with the greatest impact on an SCF program’s success. Since supplier participation is the most determining factor in ensuring your program succeeds, this section covers some leading practices for maximizing your participation.

Corporate Suppliers: Top 4 Factors Impacting SCF Participation

Overall financial cost of using the solution

Greater visibility into & predictability of payments/cash flows

Enhanced relationships with buyers/partners

Offering of functionality to automate & streamline the CCC

Technology, the CCC and SCF

In the late twentieth century, banks began to offer reverse factoring SCF programs as an extension of their banking services. While these early versions experienced slow adoption, the subsequent improvements in technology and the entrance of fintechs into the landscape accelerated SCF’s growth.

Although many forms of SCF could theoretically be run manually, technology is what makes it a viable option that increases efficiency rather than adding complication. With reverse factoring, for example, the sharing of the information that facilitates the process would create so many review processes and so much friction if attempted manually that it would generally not be worth the effort. After all, reverse factoring programs are usually only taken on by very large buyers who have many suppliers, which would lead to significant complication in trying to handle every invoice and every early payment request on a manual basis.

With technology supporting the program, however, all parties can access all the invoices and other information and see what the situation is and what needs to be done, massively reducing the friction. Necessary information can be shared from the buyer to the portal, and the suppliers can log in and request early payment as they wish.

Similarly, dynamic discounting’s sliding scale is most easily implemented and executed with technology as a mediator. For hybrid models, the coordination of paying at a discount for some suppliers and using reverse factoring for others would be nearly impossible without technology.

In addition to facilitating SCF, itself a means of optimizing working capital, SCF solutions typically come with tools that automate or streamline tasks such as invoicing, exception management, and sometimes even reconciliation. Between the efficiency gains and the liquidity unlocked through the SCF programs, such solutions can make a drastic overall difference in cash availability and overall operational efficiency.

Similarly, solutions that simply streamline one or more portions of the CCC can inject efficiency into the cycle, providing automation that decreases errors, security risks, and time to completion, meanwhile freeing employees up for more strategic tasks. As inefficiencies are driven out, costs are also driven down, and coupled with these solutions’ ability to improve coordination between departments, the results can make a dramatic impact on a company’s ability to optimize working capital.

Order-to-Collect Landscape Continuum

The spectrum of order-to-collect or procure-to-pay solutions are broad and nuanced, with a number of areas, tasks or processes that may be covered in different combinations. That said, every solution in the order-to-collect category will provide functionality that streamlines and automates one or more of the vital processes between credit and collection. One large category in the order-to-collect landscape is that of AR automation, but not all the tools that streamline order-to-collect fall under that category.

Solutions in this continuum may include the following:

- Credit rating and scoring tools

- Shipping and fulfillment tools that automate or allow you to send invoices more easily

- Cash application tools and services

- Collection services

While each of these individual functions is valuable alone, there is often overlap in the functionality a solution provides for these areas. Some providers may offer solutions specifically focusing on just one, but several may also be integrated within an ERP’s or SCF solution’s functionality, for example. In addition, while many solutions aim to assist companies from any industry, others are quite specific, catering to a narrower industry vertical’s needs.

Procure-to-Pay Landscape Continuum

Procure-to-Pay: Scope of Solutions

Similarly, the procure-to-pay landscape contains tools covering multiple areas and processes. Solutions addressing and streamlining portions of the procure-to-pay process may include anything from check printing to integrated payables, file management, maintaining a network that allows you to make and approve payments online, or implementing ghost, virtual, or purchasing cards.

Many solutions automate AP in such a way that the vendors benefit as well. The buyer’s AP processes are streamlined and made more efficient, and manual handoffs are minimized, leading to fewer defects and delays. The vendor receives their payment more quickly and reliably, often with improved visibility and tracking features along the way. The following may be functions that vendors in the procure-to-pay landscape address:

- Procurement platforms

- Vendor management

- Compliance management

- Receiving goods and services

- Receiving invoices

- Payment

There are a range of outsourced and internally managed services for some of these areas, such as the receiving of goods, services and invoices.

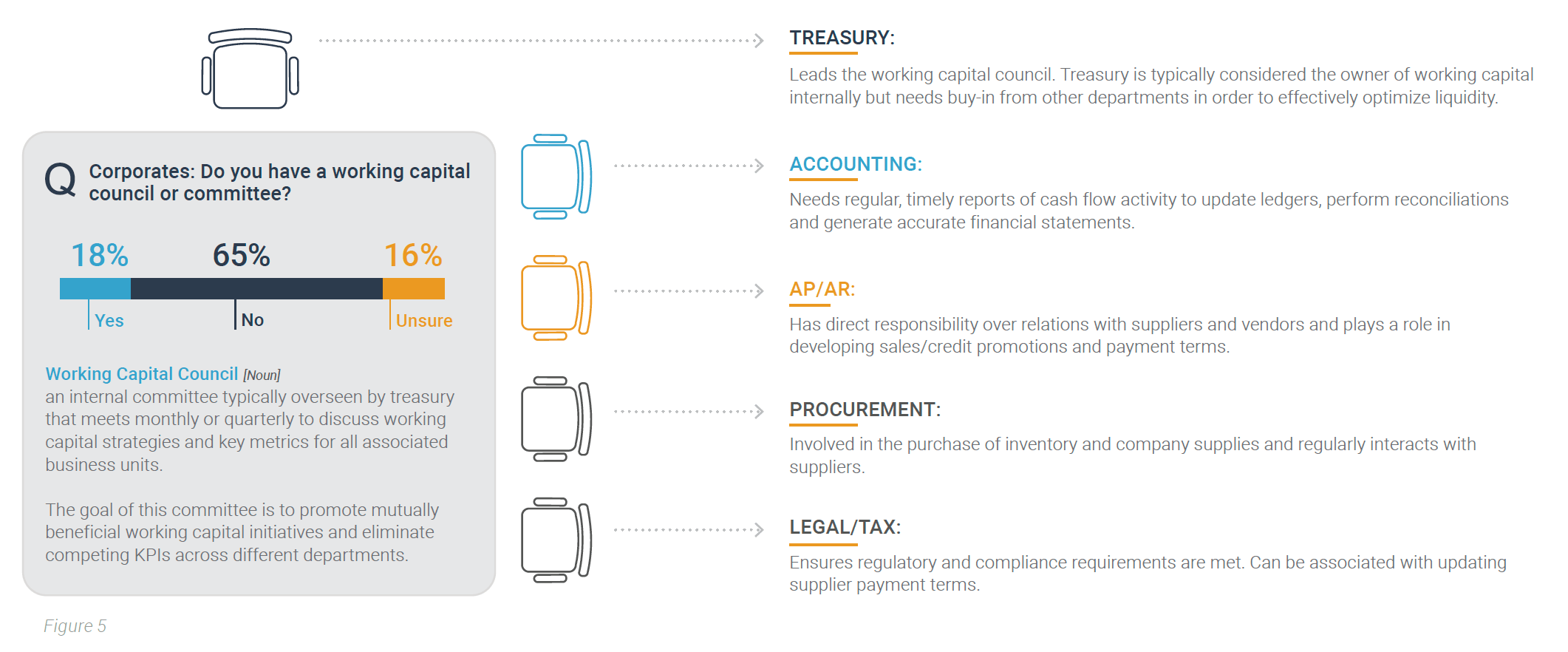

A Working Capital Checklist

Whether your company is looking to implement SCF, order-to-collect or procure-to-pay solutions, significant coordination across departments will be required. In order to find the right solution, obtain buy-in for your plan, and make your project a success, all the stakeholders will need to come together and join forces.

Consult or Create a Working Capital Council

As we’ve seen, working capital affects and is affected by multiple departments. Each of these departments represents a stakeholder for working capital and for any SCF or CCC solution implementation. A working capital council or committee is a group in which each of these different areas comes together, usually once a month or quarter, to discuss strategies, key metrics, and projects surrounding working capital. The purpose of the group, which is often led by treasury and also includes accounting, AP and AR, procurement and legal/tax, is to help eliminate competing KPIs, field each party’s concerns, and find solutions that contribute to overall working capital management and organizational goals.

If your organization does not currently have a working capital council, one should be established before any further steps are taken towards implementing a solution. Before you can choose the best solution and get all the stakeholders on board, you must first hear their concerns and find ways to address them in your plan. This will result in both a better outcome for the project and a better understanding and cooperation between the departments long-term.

Forming a Working Capital Council

Establish a Single Set of KPIs and Objectives for Your Various Initiatives

Working capital and the CCC are often plagued by competing KPIs in many organizations. Certainly, no department sets out to sabotage another or to undermine working capital or the overarching organizational goals. However, these situations can come as natural results of KPIs that seem reasonable from the perspective of one department but are ultimately too narrow for the organization. Working capital councils, as noted, can help bring these departments together and promote greater understanding between them. This can help bring clarity to the fact that some KPIs can lead to a department appearing to function quite smoothly internally while causing problems for other areas and suboptimizing working capital. Ultimately, however, no department can truly thrive while its organization and its fellow departments are not.

In order to address this problem, each area’s individual goals and parameters must be made clear, and all must agree on overarching goals, such as optimized working capital. The council can then establish a single set of KPIs that help departments focus on what’s most vital, not only for their own department, but for the organization at large.

Meanwhile, objectives for various initiatives can also be decided on. These initiatives may include a technology solution implementation or another project. Such objectives allow for shorter-term, narrower goals when necessary that are understood in light of the broader set of goals and are discussed with the working capital council to ensure a united front.

Understand the Other Perspectives: Your Suppliers, Customers, Departments

With so many moving parts involved, distinct sets of processes, and repercussions for both internal and external partners, optimizing working capital is complex. Not only will every department involved have its own perspective, but so will your suppliers and customers. For treasury, as the group usually leading the working capital council, it’s vital to make sure each group is understood and their concerns addressed.

While the working capital council itself, along with the process of establishing a single set of KPIs, helps to bring the different views to the surface and broaden your understanding, external partners and potentially other internal departments will need to be considered. Treasury should ensure that every relevant group (what groups these are will vary from company to company) is heard, that any concerns they may have are addressed, and that their perspectives are integrated into the overarching understanding of what is important and what constitutes “optimized” working capital.

Monitor and Refine the Approach

With your working capital council established, a single set of KPIs settled on, and all the varied perspectives taken into account, you should have all the tools necessary to find and implement the best programs and solutions to optimize your working capital. This may mean a solution to automate AP or AR, it may be an SCF program, it may be both, or it could be something entirely different.

However well prepared you are, it will still be important to monitor and refine the approach. Rather than setting up your new initiative and walking away, track its results, monitor adoption, continue listening to feedback from other stakeholders, and use this information to adjust. Calibrate your methods and solutions on an ongoing basis so that they continue to succeed in supporting the optimization of working capital.