Blog

20-Year USD Highs Driving FX Risk Management Challenges

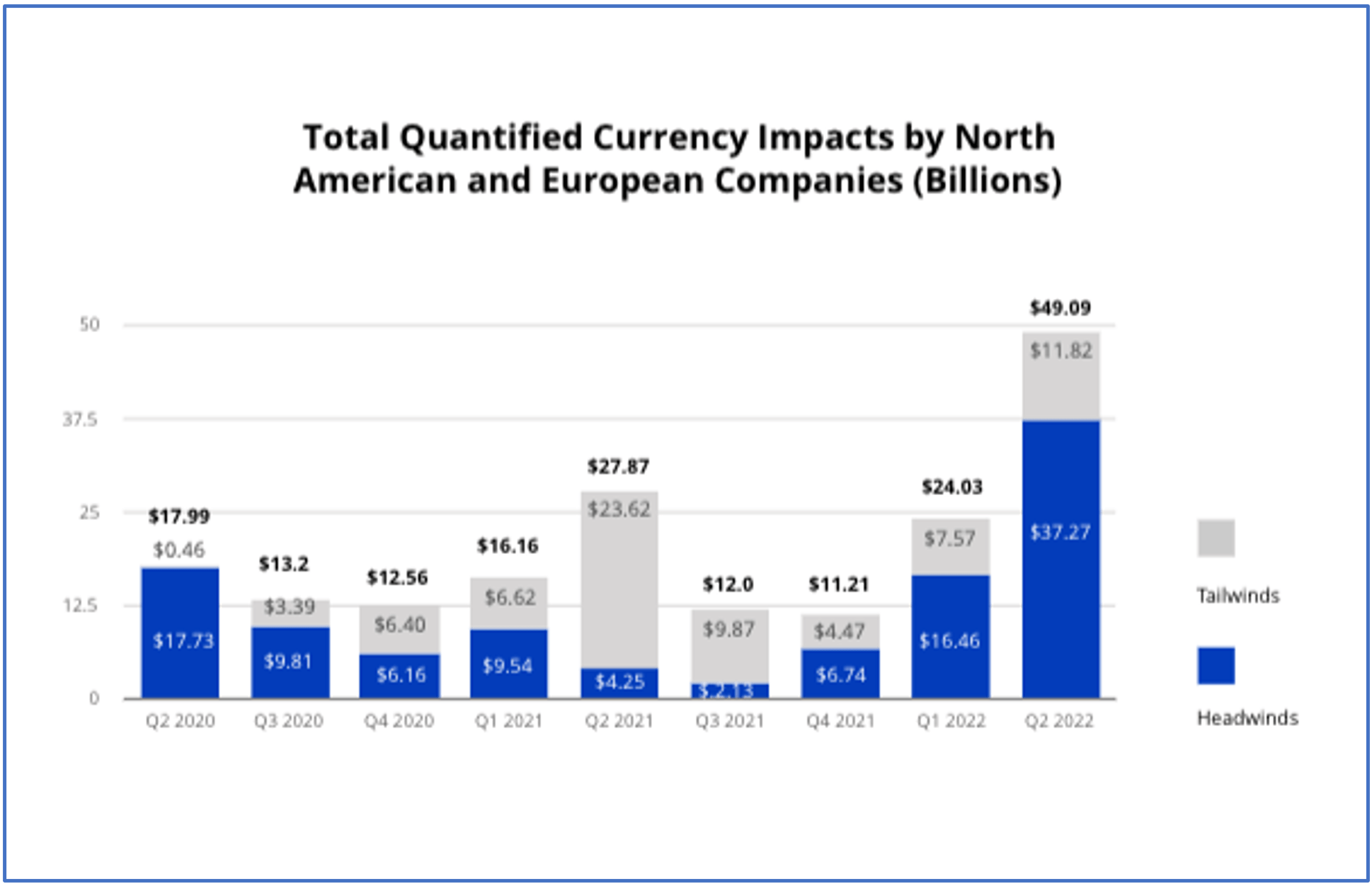

The Kyriba Currency Impact Report for Q3 2022 illustrates the headaches and challenges that CFOs and Treasurers are contending with related to the strong US Dollar and overall heightened currency volatility. The combination of the USD at a 20-year high and rising interest rates drove the largest reported currency impact in over 10 years and poses huge FX risk management challenges for CFOs and treasurers.

For Q3, it is highly likely we will see more of the same as we have seen the USD continue its dominant position while other major currencies such the British Pound have faltered due pessimism and uncertainty about economic conditions. With this challenging market environment, we are seeing two major areas of focus emerge to combat the impact of currencies on corporate earnings.

The first area of focus is on dealing with the multitude of multi-currency accounting issues that can cause noise and confusion in the FX gain/loss results. For many corporates, the sharp rise in the USD combined with overall FX market volatility has uncovered inefficiencies within how they aggregate and define their underlying exposure to currencies. In a relatively “stable” market, these inefficiencies can often be overlooked, but now these inefficiencies combined with significant currency swings are resulting in material impacts to their earnings. In response to this, these companies are re-examining their overall FX risk management approach and looking to expand their usage of automation and analytics to enable better risk management decisions and hedging results. Kyriba’s eBook “The Biggest FX Problem(That No One Talks About)” provides a great walkthrough of the various multi-currency accounting issues that are the source of these inefficiencies.

Kyriba’s FX Solutions and Advisory team have extensive expertise and analytics to help identify and resolve these costly multi-currency accounting issues such as phantom balances, improper remeasurement processes and intercompany balances that do not reconcile on a local and transaction currency basis.

The second area of focus we are seeing is on containing the increasing cost of hedging due to surging interest rates. For CFOs and Treasurers focused on reducing hedging costs, the recipe for success is to take holistic assessment of exposure management methods that can mitigate the increased currency risk in more cost-effective ways. These techniques fall into three basic categories.

- Reduce exposure to currency risk through internal actions such as reducing exposures through internal accounting actions such as converting cash balances or settling intercompany transactions as well as expanding the use of netting currency trades to reduce the overall hedging volume

- Using more sophisticated hedging strategies based on Portfolio VaR techniques that identify correlations in currencies that can help CFOs achieve P&L risk targets in a more cost-effective way

- Examining different hedging instruments to determine how they can impact their overall hedging costs

For more information how companies can leverage enhanced analytics and decision support tools to reduce hedging costs, check out the recent blog “FX Risk: Optimizing Hedging Costs with Protection is Critical” by Jeff Goggins, Director of FX Risk Advisory for Kyriba.

Reach out to our FX Risk Advisory Team today to achieve quick wins with our technology enabled risk assessment methodology. Whether looking at hedging for the first time or looking to adapt existing hedge programs to new market conditions, we are ready to partner with you.