Blog

How API and ERP Integrations Are Transforming Corporate Treasury

Adopting API technology to integrate ERP systems with treasury systems is a transformative step for corporate treasury management. Such integration facilitates real-time data transfer, ensuring that treasurers are equipped with the most up-to-date financial information for accurate stakeholder reporting and enhanced decision-making. Additionally, APIs bring heightened security in data transfers, offer scalability for growing business needs and ensure flexibility in adopting new functionalities.

While there are many benefits, businesses are yet to grasp the full potential of API connectivity, especially for ERP integration, and even more importantly, how non-technical teams such as treasury can take full advantage of API solutions. During KyribaLive 2023, Kyriba’s Félix Grévy, VP of Connectivity and Open API, and John Brandt, VP of Product Connectivity, explored the transformative potential of APIs. Providing updates on Kyriba’s Connectivity-as-a-Service solutions, Félix and John also shed light on how a technology partner like Kyriba assists treasurers on their API journey.

APIs Empower Financial Professionals

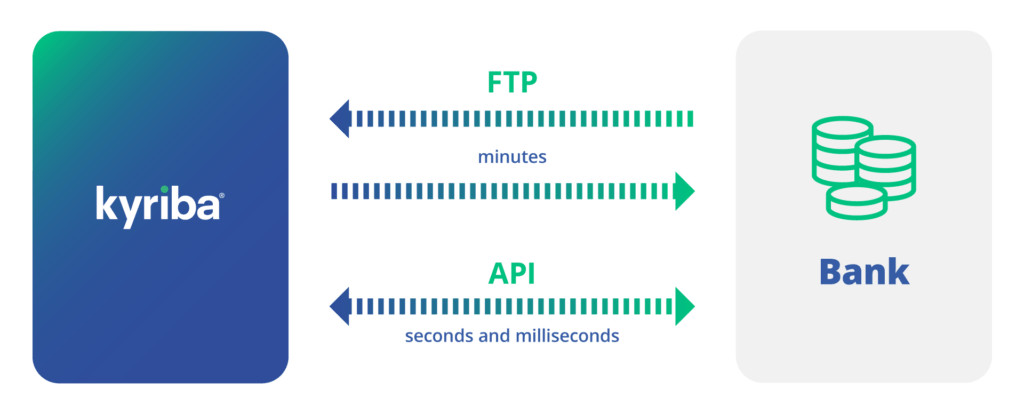

Simply put, an API is a program that allows multiple pieces of software to “talk” to each other. APIs are like “bridges” enabling two separate applications to work together and share data. They allow developers to access certain features or functionalities of software applications without having to understand the underlying code or architecture.

In the world of finance, APIs are enabling real-time treasury management and empowering finance professionals like never before. They connect internal and external systems, facilitating real-time data retrieval for use cases such as bank balance and transaction reporting, cash flow forecasting and FX exposure management, integration of trading portals, market data providers and AI tools.

Building on this point, Félix and John elaborated on the three pillars of Kyriba’s API connectivity solution as an example to demonstrate how APIs can be used in finance and treasury:

-

Bank API Connectors

support a variety of banking services, including real-time payments, payment status, bank balance updates, bank statements and transaction reporting and SWIFT gpi payment tracking. With the banking industry embracing the real-time flow of data, bank API connectors provide a significant advantage for modern finance teams, bringing treasury management and banking closer than ever before.Kyriba’s solution: Kyriba is the largest bank API aggregator in treasury management, enabling clients to leverage one API gateway to connect with over 1,000 banks. With a single connection to Kyriba, finance teams gain access to bank statements from multiple banks, eliminating the complexity of file translations and formatting.

-

ERP API Connectors

allow interaction and data exchange to seamlessly integrate ERP with TMS. These ready-to-use connectors can streamline workflows and enhance operational efficiency, from importing and exporting critical data types, such as forecasted cash flow and payment information, to journal entry exports that feed the general ledger.Kyriba’s solution: Kyriba has launched ERP connectors for SAP, Oracle, Dynamics 365, Oracle NetSuite and has the experience connecting to over 10,000 ERP instances. Check out Kyriba Developer Portal for more information.

-

Open APIs and App Marketplace

extend platform capabilities by enabling connectivity with external partners. Through this open connectivity, partners and app developers can embed their solutions into different financial workflows, such as trading portals, market data providers, data lakes, sanction and fraud screening and bank account validation.Kyriba’s solution: Kyriba offers an extensive Open API and use case catalog for public access through its developer portal. With plug-and-play integration made possible by APIs, the Kyriba Marketplace opens doors to a growing financial ecosystem, including Acterys Next Level Planning, Bank Account Validation by Trustpair, Sis ID and Goldman Sachs Mosaic.

Looking towards the future of API adoption, John explored the untapped possibilities of APIs. John emphasized how Kyriba envisions exciting developments in how to integrate ERP with TMS, including expanding ERP integrations, incorporating third-party data sources, enabling event-driven orchestration through webhooks and even AI-generated integrations.

Expanding on the topic of artificial intelligence (AI), John and Félix remarked how AI presents real opportunities for ERP integrations. Although there is still a lot of maturing to do, developments such as Open AI ChatGPT and Microsoft Copilot Artificial Intelligence show the potential for AI to assist treasurers with complex tasks.

By leveraging these powerful AI tools, finance professionals can transform their daily work, ask questions on reports, uncover valuable insights and receive intelligent suggestions. APIs play a pivotal role in enabling these tools to interact seamlessly among the systems, allowing technology vendors to harness the growing power of external AI technologies and natively integrate them to their own solutions.

How Kyriba Enables Embedded Treasury for Clients

Recently there has been a growing interest in embedded finance and embedded treasury. John delved into Kyriba’s APIs for ERP integration, spotlighting how Kyriba already offers a set of packaged integrations that extend and embed the treasury core workflows into other business systems:

- Payments and payments status workflows facilitate immediate payment transmission, payment tracking and fraud prevention.

- Cash flow forecasting workflows import cash flows from the ERP to Kyriba, including invoices and non-Kyriba payments.

- GL export workflows send GL entries back into the ERP for reporting.

- Bank statement workflows connect the ERP directly with banks, simplifying bank statement integrations and eliminating format translation concerns.

- FX balance sheet workflows allow frequent updates and easy tracking of currency exposures.

- Working capital management workflows exchange AP and AR invoice details between the ERP and Kyriba for early payments or other funding options.

- GL reconciliation workflows reconcile bank transactions with GL entries by matching bank account entries from the ERP with bank transactions in Kyriba then updating the ERP with any adjustments.

Despite the high interest level for embedded treasury, clients are often lacking the expertise or IT resources to implement such integrations. Kyriba’s Connectivity-as-a-Service is designed exactly for such client needs. John overviewed the options Kyriba makes available to our clients, prospects and partners. With a versatile array of ERP integration scenarios, Kyriba guarantees the freedom and flexibility to accommodate enterprise IT complexity and sophisticated business needs.

| Integration Scenario | Description | Suitable for |

| Bring Your Own Data (BYOD) | Client handles data extraction, transformation and transmission to Kyriba. | Customers with legacy applications or broad existing SFTP landscape |

| Kyriba Packaged ERP Integrations | End-to-end solution. Kyriba handles data extraction, mapping transformation and transmission via API to Kyriba. | Clients with new integrations or with minimal workflow customizations |

| À La Carte | Hybrid custom integration. Allows use of individual Kyriba integration components. Clients can mix and match integration methods. | Clients with complex landscapes, including middleware or legacy platforms |

| Custom Direct API Connect | Custom-built extract and mapping. Clients can use open APIs from the Kyriba Developer Portal to build workflows to meet their specific processes. | Companies with complex workflows or those who desire full control of their API orchestration |

Transforming Treasury with API-Driven Connectivity

Connectivity is key to successful treasury management and APIs are the catalysts for treasury transformation. With real-time data exchange contributing to a more connected and efficient financial ecosystem, API connectivity empowers treasurers with the latest financial information and the flexibility to meet evolving business needs. The benefits are many and the untapped potential of API connectivity, especially for ERP integration, remains a growth opportunity for treasury. With embedded ERP workflows to support core treasury needs, treasury can streamline processes and make more informed decisions.

To stay ahead, it is time for treasurers to take advantage of exciting possibilities in API adoption, including AI integration opportunities. With its Connectivity-as-a-Service solutions, Kyriba offers flexible, game-changing solutions for the office of CFO to build a truly connected and comprehensive financial ecosystem.