Blog

Seamless API Integration Helps Treasury Get the Most Out of Cash

With cash being more important than ever and increasing pressure to make the most out of their excess reserves, treasury professionals must deploy the necessary tools for quick and easy deployment of excess cash.

A panel session at KyribaLive 2023 discussed how Kyriba and global investment portal ICD’s partnership is transforming the way that treasurers can drive cash flow optimization, making the most out of their cash and treasury management tools. Bob Stark, Head of Global Market Strategy at Kyriba, Keith Payne, Managing Director of Treasury at Rollins, and Justin Brimfield, Head of Global Partnerships and Chief Marketing Officer at ICD, provide an in-depth look at how APIs enable treasury teams to optimize cash and liquidity management.

With the launch of a new API connector in 2022, Kyriba and ICD provide a valuable tool to deliver real-time visibility of cash and short-term investments for CFOs and treasurers. The API integration for investment enables treasury teams to research, trade, analyze, and report on investments. In addition, joint clients can sweep excess bank balances into money market funds to ICD directly from their Kyriba Dashboard.

Cash and Treasury Management in Turbulent Times

A wide variety of unprecedented events are causing significant economic pressures for businesses at the moment: banking failures, economic sanctions, and Federal Reserve uncertainty over rates to name a few. With this, Keith spent the first part of the session describing how Rollins is managing these disruptive times. Rollins owns several leading pest, termite, and wildlife control companies worldwide, providing essential services to over two million residential and commercial customers. Operating on six continents, Rollins needs solid strategies to navigate turbulent times.

With the current market situation, Keith stressed the importance of remaining “adaptable and agile” across all facets of the business, inclusive of technology, people, and processes. Keith’s goal as a cash and treasury management leader is “to get reliable information you can trust, so then you can make those strategic decisions as to how you’re going to pivot with whatever the scenario is. And then you have to be able to communicate it to your board, to your CFO in a way that they understand the impact.”

To achieve this goal, Rollins requires real-time visibility into where they have exposure, which is fortunately something Kyriba and ICD’s seamless API integration can provide.

Why Rollins Chose Kyriba and ICD

Rollins continues to be a highly acquisitive organization with 30 to 40 acquisitions per year, and connecting the new acquisitions into Rollins technical infrastructure is key. Rollins wanted to focus on a platform that could provide them with visibility, automation, security, and integration. When Rollins looked at Kyriba, they found the functionality, tools, and features they were looking for.

For a global organization like Rollins, visibility into treasury data analytics is paramount to cash flow optimization in terms of managing a treasury function efficiently and effectively, as well as minimizing risk for an organization. Keith commented that by providing real-time access to treasury data analytics through API integration, Kyriba “really allows you to get information quickly so you can make quick and more effective decisions.” Over time, cash and treasury management grows from cash forecasting to delving into and applying analytics. As a result, Keith continued, “You get smarter in the present, which tends to make people smarter in the future.”

With a high number of acquisitions each year, integration for Rollins means combining lots of systems into their infrastructure. Kyriba’s single sign-on platform provides seamless integration for visibility through the system, with “very little administrative hassle.”

Keith emphasized how Kyriba’s effortless automation of repetitive, manual tasks frees up time for more important, strategic tasks, such as improving cash flow optimization. Keith remarked how Kyriba’s features “take friction out of your day, allowing you to move from recurring, manual tasks to value-added tasks.”

The tools provided by Kyriba and ICD have helped Rollins gain traction in today’s challenging market conditions, as the organization can clearly identify their position and report seamlessly via the Kyriba platform. Keith also pointed out that since the data is embedded, it improves risk management by enhancing data security.

Additionally, Keith made a notable mention of Kyriba’s unique mobile app offering, highlighting that “You really can’t function today if you don’t have a mobile app.”

API Integration is Essential for Data Unification

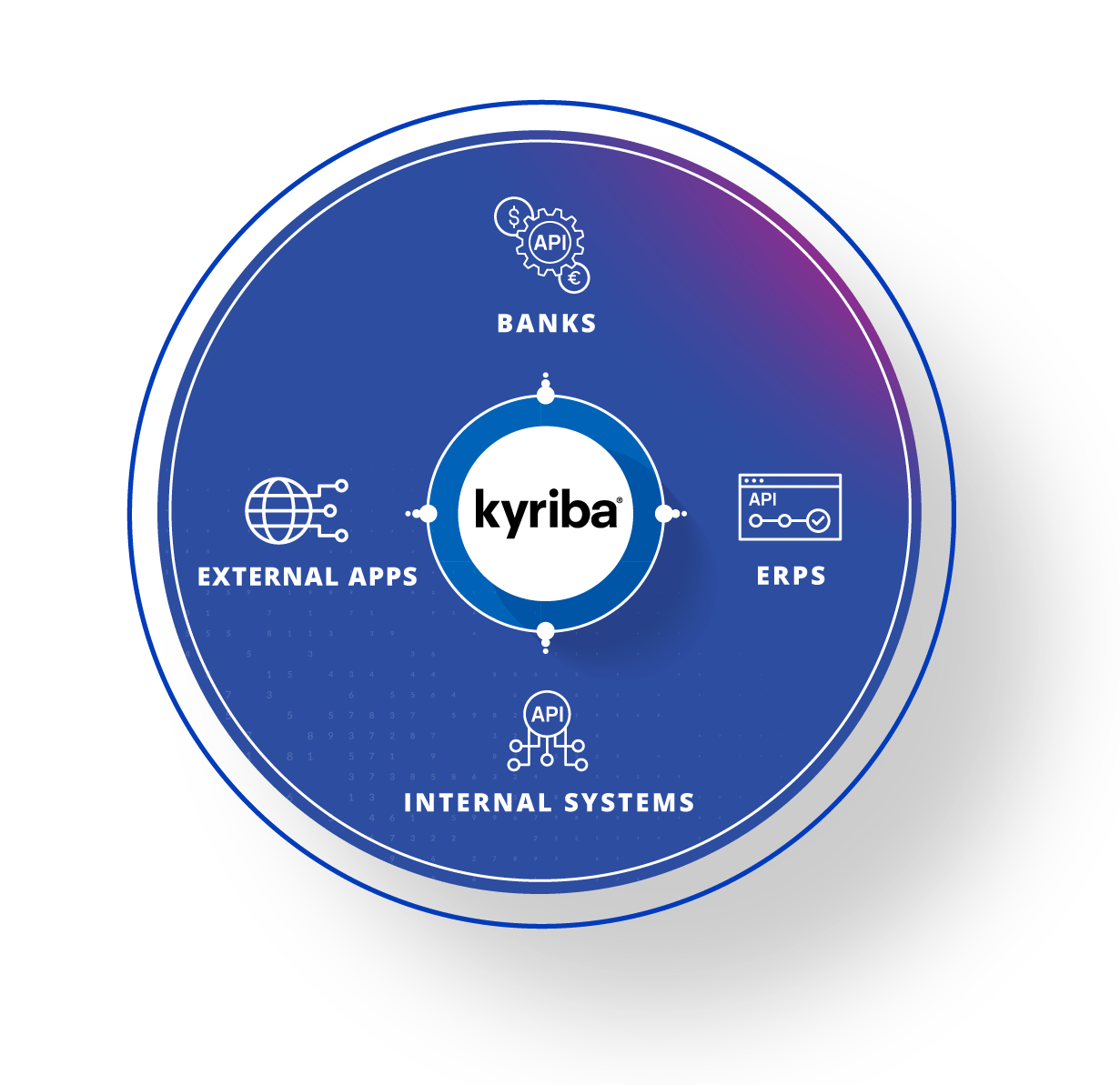

To highlight the significance of API integration, Bob spoke about how APIs connect both internal and external systems to unify and move data across all areas of a business’s technical infrastructure.

- Connectivity to Banks: Kyriba connects to 1,000+ banks via multiple connection methods. Many of them are currently working with Kyriba to connect via API, with 20+ banks already live for bank reporting and/or real-time payments.

- Connectivity to ERPs: Kyriba offers pre-built and pre-tested API connectors to leading ERP providers, including SAP, Oracle, Microsoft Dynamics 365, and Netsuite.

- Connectivity to Internal Systems: Kyriba’s Open API platform allows clients to leverage pre-built solutions, proving favorable for IT teams who fully understand the time savings of a self-service technology provider. Additionally, there is a whole network of Kyriba partners to help advise on API integration solutions.

- Kyriba’s Marketplace for external apps: External applications serve as extensions of the Kyriba workflow to instantly unify and move data. ICD is a prime example of an app that can be seamlessly connected to Kyriba leveraging API integration.

Using Rollins as an example, Bob highlighted how they are “able to leverage APIs to bring in data from all these different apps without signing on to multiple systems. With a single user experience, Rollins can get complete transparency in terms of their cash, their liquidity, and obviously additional data, such as what funds might have some exposure that they need to make decisions about.”

While clients want an agile product now, they also want to know what the future is. Keith spoke about Rollins wanting to leverage AI technology going forward. In response, Bob highlighted how Kyriba is remaining at the forefront of AI-enabled treasury solutions. For example, with ChatGPT making headlines, Kyriba’s development teams are already looking at how generative AI can make a difference for treasury operations.

API Integration Makes the Forecast Actionable

Additionally, AI and APIs can improve cash flow optimization by making the forecast actionable. As Bob explained, “APIs are going to unify data. AI is going to help you enrich that data. And BI or analytics is going to help you understand what you’re looking at so you can make sense of what that next decision should be.” Easy access to comprehensive and organized data creates the opportunity to make a forecast actionable and the opportunity to invest more than you did previously.

Justin added that the real-time, on-demand visibility enabled by APIs allows treasurers to comprehensively analyze cash and treasury management opportunities in order to make informed decisions based on complete data. He stressed, “Visibility matters, but seeing the data the way that you want to see it and being able to engage with the data and drill into it if you have questions is really more important than ever.”

Justin and Keith both reminded the audience CFOs also have access to their own cash visibility snapshot in the system. Whether it is on-screen directly through the actual application or through a daily emailed report, CFOs can view cash visibility anytime, anywhere. Many clients are already benefiting from such visibility, including Hunt, Riot Games, and Alexion, who successfully use ICD and Kyriba to transform cash and treasury management workflows.

Time to Value and the Future of Connectivity

The panel session also answered one key question many treasurers ask when they evaluate APIs for treasury: how long does API integration take for different systems? Justin and Bob highlighted one of the main benefits to API integration is the time to value that it can provide. With Kyriba, the API integration is a matter of days for full end-to-end implementation, so clients realize immediate advantages.

APIs unify data sources, allowing for seamless integration and real-time connectivity between platforms like Kyriba and ICD. This real-time data exchange empowers clients with instant access to their positions and enables them to make well-informed decisions promptly. Additionally, the data protection within integrated solutions ensures valuable information remains secure.

As Bob emphasized, “In reality, what API integration comes to is there’s an opportunity to create more data movement in real time to make your decisions more reactive to what’s happening in the moment, so that you’re not slow to make decisions and you’re not slow to action those decisions.”

Watch this on-demand session to learn more about how treasury teams can benefit from API integrations for daily cash and treasury management.