Blog

Making Your Treasury Cash Forecasting Actionable

Treasury cash forecasting has become an integral part of an organization’s financial operations, as budgeting and forecasting allow organizations to be more forward thinking. With interest rates on the rise, FX volatility, supply chain challenges and the possibility of a recession looming, this forward-thinking mentality has become increasingly important for organizations.

Unfortunately, a 2022 IDC survey indicated that cash forecast data tends to be unreliable. In fact, 80% of finance leaders – treasury and FP&A combined – were not confident in their forecasts beyond one month. And it only gets worse with 95% of respondents indicating that they did not have confidence in their forecasts beyond three months.

Tom Gavaghan, VP of Global Presales at Kyriba, and Fred Schacknies, Treasurer at TechnipFMC, discussed the value liquidity planning could add to long-term cash flow forecasting at KyribaLive 2023.

The Real Problem with Spreadsheets

The problem for many organizations is not the cash flow forecast itself; the problem lies with the systems they are using to do their treasury cash forecasting. Many treasurers experience difficulties with integrating multiple data sources, managing what-if scenarios and the inability to model the most basic formulas and calculations.

Spreadsheets, as a traditional and commonly used software, are easier for treasurers to use. We frequently hear from treasury clients that it is easier to type, copy and paste than to enter things into a TMS. In addition, they find modeling to be easier in Excel.

Gavaghan commented on the ease of use being one of the biggest reasons why organizations use Excel; however, he noted that it has its limitations, such as:

- Errors: Excel is notoriously error prone due to the need to input data manually.

- Scalability: Although simpler to use, Excel is not scalable for large, complex cash flow forecasting models or for organizations with many business units or subsidiaries.

- Time Consuming: Manual data input leads to more than errors. It also costs treasury teams invaluable time, especially if their cash flow forecast model is complex or requires frequent updates.

- Amount of Data: With the amount of data that companies have access to today, a spreadsheet is no longer sufficient for budgeting and cash forecasting.

“When I was working at Hilton, we built in Excel an award-winning forecast model,” Schacknies recalled from previous experience. However, the COVID-19 pandemic made the award-winning workbook less effective. “When 80% of your EBITDA disappears overnight, whatever forecasting capabilities you have are suddenly irrelevant,” he said.

The problem, Schacknies said, was that Excel was not flexible. And flexibility is imperative for an organization to be agile.

The Cost of Inaccurate Forecasts

An accurate cash flow forecast starts with data. In the past, organizations used historical models to predict cash flow needs. The methodology of using past cash flow patterns is no longer feasible in today’s landscape, because the datasets to make key financial decisions are simply too large. Unfortunately, the amount of data to create an accurate prediction can be too much for one person to analyze on his own.

That’s why planning using advanced statistical modeling and artificial intelligence (AI) to deliver more accurate cash flow forecasts is more important than ever, as the lack of planning can have negative implications for corporates:

- Inaccuracies: Inaccurate and unreliable data fails to reflect a company’s true cash needs, which can create future cash flow problems.

- Vulnerability: The point of a cash forecast is to help an organization to plan for the future of their cash position. Without liquidity planning, an organization is now vulnerable to unexpected liquidity gaps due to changes in market conditions or unforeseen expenses.

- Disruptions & Risk: Unexpected expenses and liquidity gaps can lead to disruptions in operations, putting a company’s financial stability at risk.

Missed opportunities, reduced financial stability and operational disruptions – a cash flow forecast that doesn’t provide you with the data and action you need can cost your organization. An inactionable forecast further limits an organization’s ability to effectively plan for the future and manage resources.

Why Liquidity Planning is a Game-changer

Liquidity planning is a critical component for creating an action-oriented cash flow forecast. Gavaghan pointed out that Kyriba’s Liquidity Planning module is designed for actionability, making it a game-changing solution to address the challenges. Combining user-friendly setup, flexibility, comprehensive variance analysis and more, Kyriba Liquidity Planning can empower you to optimize cash flow forecasts and mitigate risks.

Simplified Setup and Structure

Many treasury and finance teams have indicated that they prefer the simplicity and ease of use that Excel offers, making them hesitant to switch to new tools. The Kyriba Liquidity Planning module, Gavaghan explained, can be set up any way an individual wants to conform to an organization’s reporting needs.

Within the module, “this gives you the ability to create as many different layouts, if you will, of what your forecast looks like.” Gavaghan said. He pointed out that the tool can look and work similarly to Excel spreadsheets. The simple and straightforward structure allows users to adapt quickly to the platform.

The platform also enables users to create multiple layouts for their cash flow forecasts, catering to different perspectives and time horizons. In fact, users can easily configure the structure to match their requirements, whether indirect view, a direct forecast or a long-term versus short-term perspective.

In addition, the Kyriba Liquidity Planning platform provides flexibility in organizing and grouping items for easy customization. The integration of workflow tools such as menu maps enhances the overall planning process, ensuring smooth navigation and streamlined workflows.

Variance Tracking Is Vital

One of the critical aspects of treasury cash forecasting is the ability to track for variances. It allows an organization to improve cash flow projection accuracy, as well as allows for timely adjustments. Monitoring and analyzing variances allows treasury and finance teams to better manage their organization’s overall financial stability.

According to Gavaghan, the forecast variance capability within Kyriba’s module is a key differentiator. With Kyriba, organizations can run calculations using actuals and provide up-to-the-minute data detailing where the organization is in terms of cash and liquidity. “We track our variances, and then we make the changes we need to in order to plan better for the next time horizon,” Gavaghan said.

Schacknies commented, “it’s a holy grail kind of functionality.” He also indicated that the ability to track variances in Kyriba allows organizations to ensure that their data architecture is correct. “You can only reconcile forecasting to actual if your coding is somewhat harmonious in purpose,” he said.

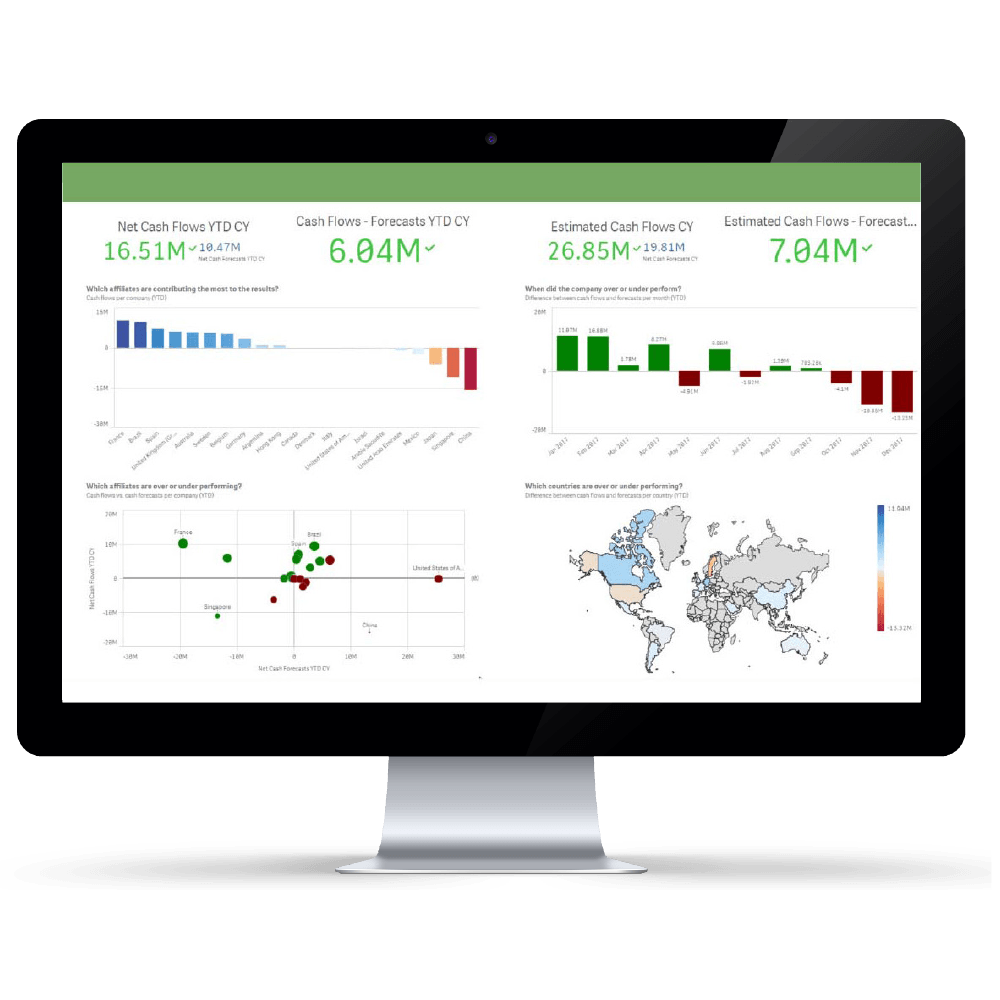

Gavaghan also mentioned the power of Liquidity Analytics, an integrated part of Kyriba’s Liquidity Planning module. “Liquidity Analytics is our visualization of all the liquidity information that you have in Kyriba inside of one singular cockpit: your cash, your investments, your credit, your capital markets.” It helps you make better sense of the liquidity information and gain a more granular understanding of your cash positions to identify trends, patterns and risks.

Watch the on-demand webinar to learn more about how to build actionable treasury cash forecasting.