Video

Kyriba Risk Management: Three Steps to Reduce Volatility

Kyriba Risk Management: Three Steps to Reduce Volatility

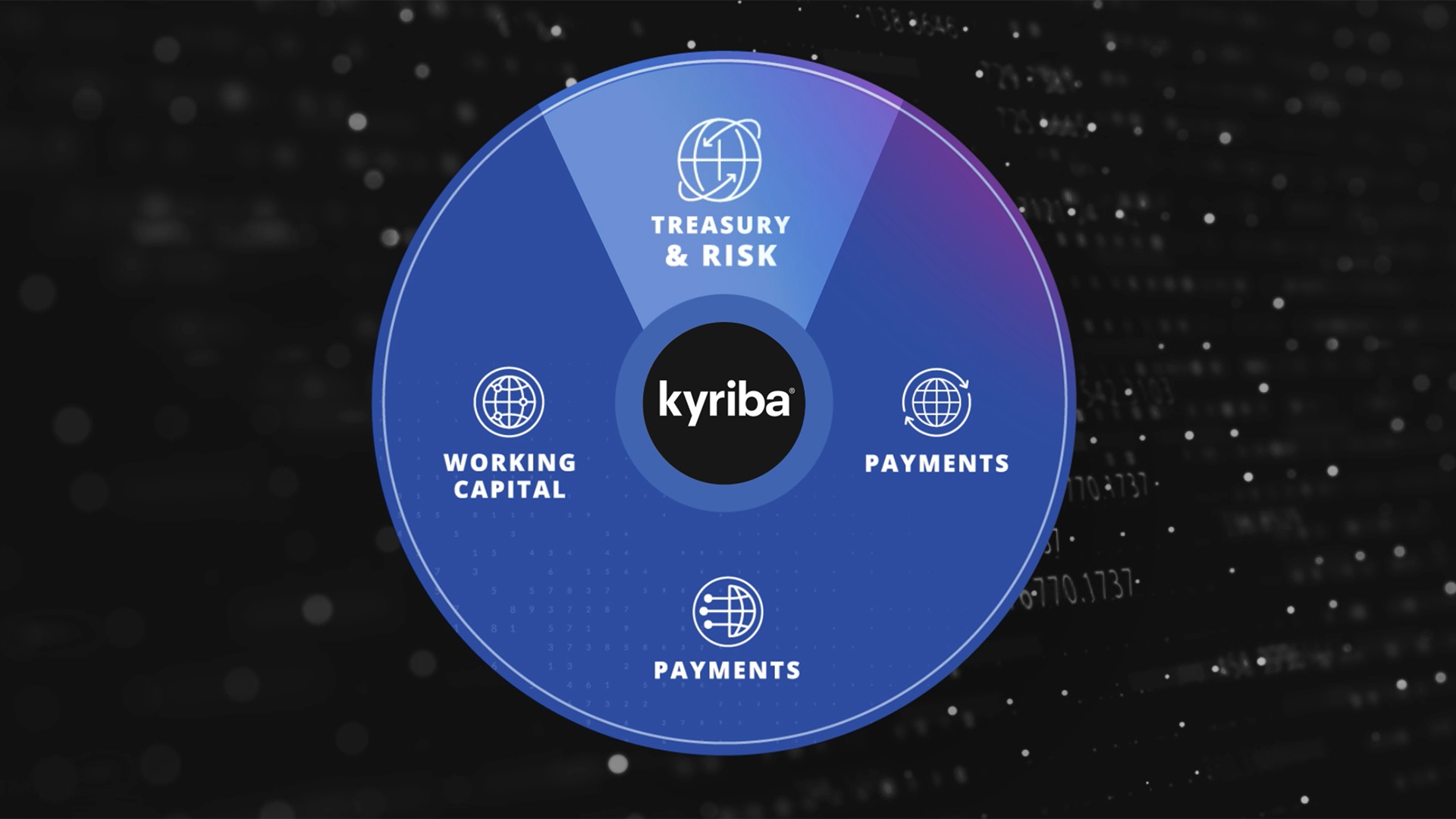

Kyriba’s Risk Management minimizes the effects of market fluctuations on revenue, earnings and balance sheets. In three easy steps, Kyriba helps CFOs, treasurers and risk managers:

- Gather exposure data from the ERP system

- Quantify the impact of currencies on revenue and earnings, presenting this information in a clear and organized manner

- Take action to hedge or decrease net exposure

End-to-End Risk Management

With comprehensive pre-trade, trade and post-trade compliance, Kyriba effectively mitigates risk and trims hedging expenses, safeguarding against market volatility in currencies, interest rates and commodities. Kyriba facilitates:

Pre-trade:

- Exposure collection

- Exposure analytics

- Hedging policy

- Business Intelligence

Trade:

- Orders executed on trading platform

Post-trade:

- Position keeping

- Confirmation and settlement

- Valuation and effectiveness

- Hedge accounting

See how Kyriba empowers finance leaders to eliminate volatility and increase predictability of earnings, revenue and cash flow guidance.

For more details, watch the Kyriba Risk Management Product Video.

Share