Video

Kyriba Working Capital: Empowering CFOs to Unlock Liquidity

Kyriba Working Capital: Empowering CFOs to Unlock Liquidity

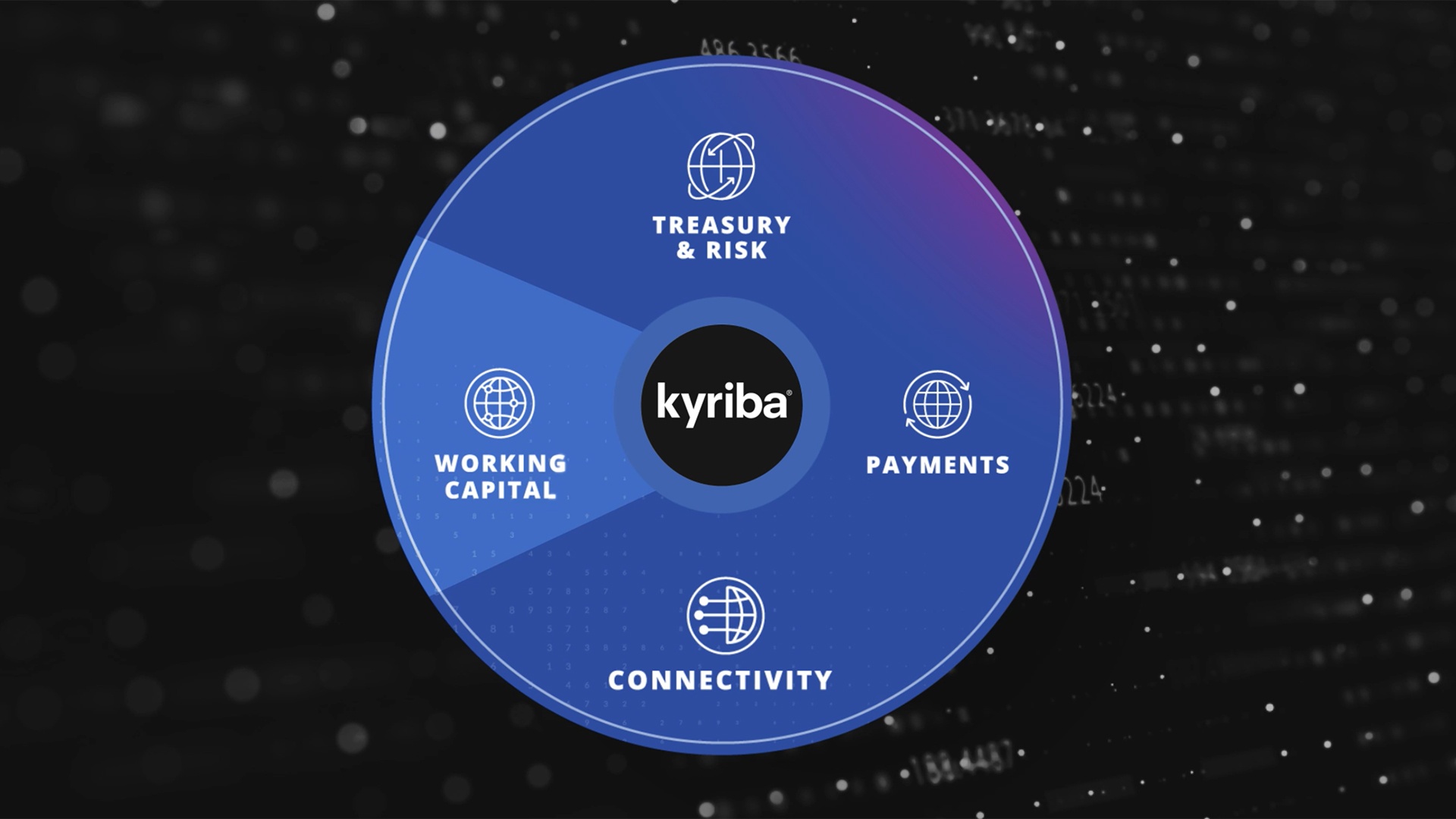

Kyriba’s Working Capital Solutions help CFOs improve working capital and cash conversion through early payment financing and receivables finance. Kyriba empowers CFOs and their teams with the flexibility to infuse liquidity into supply chains, fine-tune payment terms and expedite cash flow.

Advantages of Early Payment Financing and Receivables Finance

In early payment financing, suppliers want to be paid earlier while buyers want to pay later. Kyriba provides a win-win scenario where buyers and suppliers can make informed payment decisions on all approved invoices. Suppliers benefit by receiving payments earlier, ensuring financial stability and fostering business growth. Buyers can optimize their working capital or secure discounts that they control. For CFOs, receivables finance is a strategic priority aimed at accelerating customer payments and enhancing their days sales outstanding (DSO).

Streamlined Workflow and Interactive Dashboards

Kyriba’s user-friendly, step-by-step workflow presents eligible invoices integrated from the ERP. Interactive dashboards offer insights into funding availability, customer pre-payment history and other crucial analytics.

Optimize Payables and Receivables to Unlock Liquidity

See how Kyriba enables CFOs to access liquidity, streamline financial operations and drive sustainable growth through optimized payables and receivables management. Kyriba’s Working Capital Solutions support supply chain finance, reverse factoring, dynamic discounting and receivables finance.

For more details, watch the Kyriba Working Capital Product Video.