eBook

The Chief Liquidity Officer: The CFOs New Secret Weapon for Enhancing Growth and Enterprise Value

Table of Contents

Driving New Value Through Liquidity

Companies that want to grow need money – but even for promising projects, external sources of finance can be difficult and expensive to access. However, for many companies, there is a secret and untapped source of cash available to them: the estimated $1.1 trillion worth of liquidity trapped inside companies’ accounts and operations. The problem is one that has existed forever: how to identify and release liquidity across the company.

Some organizations have turned to a treasury management system (TMS) to solve the problem, which is an excellent first step, but not nearly enough to make the biggest impact. Many advanced companies have gone further by introducing a better approach to activating and protecting liquidity that extends beyond a basic treasury management system to include payments, working capital and financial risk management.

This approach has yielded increased productivity and cost savings, improved transparency and controls, and enhanced risk management. In an age of advanced analytics, some companies have started to turn the data they have gathered into actionable insights.

The benefits can be sizable, closing the performance gap between median and best-in-class performance for financial working capital and freeing up around $103 million per $1 billion of revenue, or 10.3 percent of sales, in trapped liquidity.1

Lack of an Overarching Strategy

The puzzling question is why traditional treasury management systems have not surfaced these benefits more widely. According to a recent IDC survey, only 1 percent of treasurers believe their companies are currently well equipped to benefit from better process centralization and autonomy, a prerequisite to enabling treasury to play a more prominent, strategic and proactive role as a business partner and adviser to the CFO.2

The benefits can be sizable, closing the performance gap between median and best-in-class performance for financial working capital and freeing up around $103 million per $1 billion of revenue, or 10.3 percent of sales, in trapped liquidity”

A major factor in this underperformance is that most organizations have disjointed initiatives, and at the tactical level, the overall goals and tools are fragmented across multiple departments. Deployments ranging from treasury management to supply chain finance to foreign exchange risk management are common at many companies, but lack an overarching liquidity performance strategy.

In this article, we make the case for the creation of the ‘chief liquidity officer,’ a leader who takes a strategic and holistic approach to truly activating liquidity, steering cash management and forecasting, payments, risk management, working capital and all of the levers that can affect liquidity. Based on my experience working with thousands of companies over the last 20 years, such a role would not only pay for itself simply through operational savings, but it could benefit the organization many times over through better return on investments, fewer missed earnings targets and faster growth through the additional liquidity made available.

Activating Liquidity: The New Enterprise Priority

Leading organizations that employ a truly integrated, holistic liquidity strategy have embraced liquidity as an enterprise priority and have invested in organizational change, digital technology and advanced analytical practices. Liquidity is dependent on many internal and external factors, such as taxation, compliance, regulatory environments, economic outlook and internal processes.

To get there, CFOs and CEOs need to fundamentally rethink the role of the treasury, from custodian of historical cash activities with a point-in-time view of liquidity, to a more strategic and expansive mandate of enterprise liquidity across the full liquidity lifecycle.”

One of the challenges most companies face is that separate functions within the enterprise own different fragments of liquidity: treasury owns cash and investments, procurement owns suppliers and spend, and operations owns inventory. Hence, liquidity performance is simply not possible. The good news is that improving liquidity performance through process standardization, automation, streamlining and integration can generate a more than 80 percent increase in productivity, boost capital efficiencies and reduce financial risk.

To get there, CFOs and CEOs need to fundamentally rethink the role of treasury, from finding a custodian of historical cash activities with a point-in-time view of liquidity, to adopting a more strategic and expansive mandate of enterprise liquidity across the full liquidity lifecycle.

There are a number of fundamental challenges that need to be addressed, ranging from the need for in-house expertise to support such a mandate to the platform and data requirements needed to support decision making. This challenge requires a break-up of the traditional cash management approach and a need to expand the scope to other key components involving the mobilization, protection and growth of enterprise liquidity. A high-performing liquidity management approach relies on harmonized, centralized and automated process flows. The choice of platform must not only cover all potential sources of liquidity for the company but also provide an open, connected architecture allowing for seamless integration with upstream and downstream systems to enable effective and timely decision making.

Success Stories

When all this is applied, the results can be substantial. An end-to-end, active liquidity strategy allows CFOs to improve cash returns by 15 percent or more by reducing borrowing costs and/or increasing investment yields, eliminating FX-related earnings volatility, and minimizing transaction and operational costs.3 There are a number of companies whose liquidity programs have yielded impressive results.

Health Care Service Corporation, a U.S. health insurance provider with $62 billion in revenue, has documented large benefits from its liquidity activation strategy, including 100 percent cash visibility across all holdings and entities, a $3.95 billion reduction in working capital requirements and a $140 million return on long-term investments.4

Brighthouse Financial, a provider of life insurance and annuity products that recently spun out of MetLife with $135 billion under management, was able to improve return on cash by $50 million per year while significantly reducing transaction costs.5

Newell Brands, a U.S.-based manufacturer of consumer goods with $16 billion in revenue, achieved near complete cash visibility across all currencies, 25 business units and 38 seperate ERP systems. The project allowed the company to reduce trading fees by $1.3 million while reducing overall systems spend across affected business lines by $120,000 per year.6

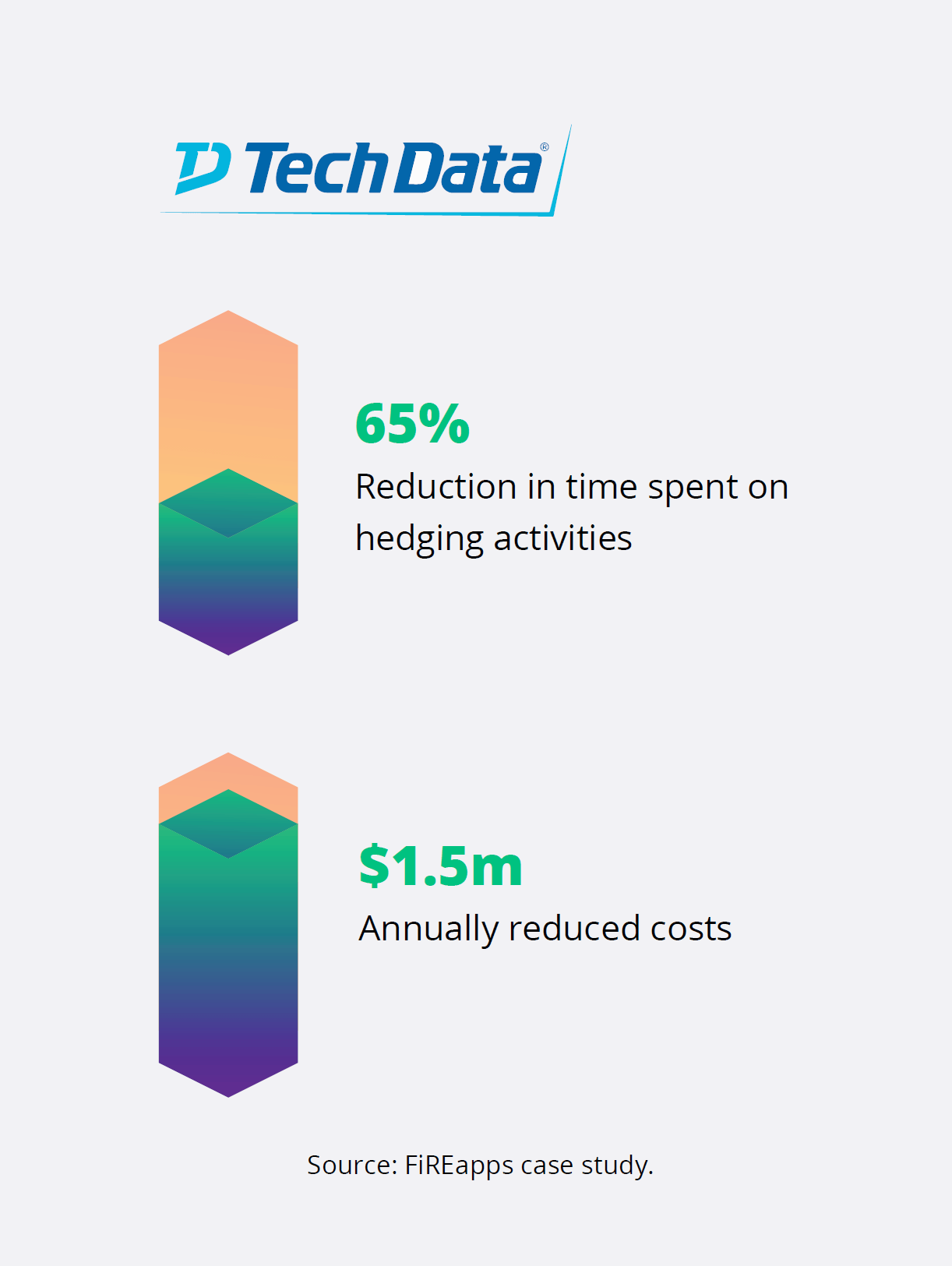

Unfortunately, all these gains can be easily reversed through unexpected foreign exchange rate movements. Businesses reported $23.39 billion in negative FX impacts in Q1 of 2019 – with an average $0.05 EPS at risk due to FX reported in North America.7 Fortunately, the increased visibility and transparency afforded by a holistic liquidity activation program allows best-in-class companies to reduce this impact to less than $0.01, often while reducing their hedging costs through natural organic offsets by more than 50 people. TechData achieved exactly that. The $25 billion wholesale distributor of technology products and services reduced hedging costs by $1.5 million annually, while at the same time reducing time spent on hedging activities by 65 percent.8

The Beginning of a New Era

Modern liquidity management is intrinsic to the process of protecting and creating enterprise value. It is this value creation potential that warrants a re-definition of its role, position and investment requirements. The historical challenge of disparate ownership of key liquidity elements can be addressed by designating a single, authoritative, point of accountability in the organization: a chief liquidity officer reporting directly to the CFO, taking charge of the whole lifecycle of liquidity, focusing on the development of a holistic strategy and making informed decisions based on the company’s enterprise objectives. The era of the chief liquidity officer has arrived.

References

- The CFO as Chief Growth Officer

- Enhancing Treasury Through Digital Transformation

- Treasury Management for Healthcare Providers

- How Treasury’s Data Transformation at HCSC Reduced Working Capital from $4B to $25M

- How a New Insurance Company Hit the Ground Running Using Kyriba

- Modernizing Treasury: Reducing Risk and Increasing Margins through Automation

- Kyriba Currency Impact Report, July 2019

- FiREapps Case Study, Tech Data