FAQ

What are Corporate Payments?

Corporate payments, or B2B payments, usually refer to the financial transactions made by a company or corporation to pay for various expenses related to its business operations. These payments may include salaries, wages, bonuses, and benefits for employees, payments to suppliers and vendors for goods and services, taxes, rent or lease payments for office space or equipment, insurance premiums, and other expenses.

Efficient and secure management of corporate payments is critical to the financial health of a company. Effective payment systems can help improve cash flow, reduce the risk of fraud and errors, and ensure that the company can meet its financial obligations to its employees, suppliers, and other stakeholders.

Table of Contents

- What Are Some Common Types of Corporate Payments?

- Methods of B2B Payments Transfer

- How Do Businesses Manage Their Corporate Payments?

- What Are Some Challenges with Corporate Payments?

- Hidden Cost of Payment Errors and Non-Compliant Payments

- Use of Treasury and Payment Solutions

- Best Practices of Managing Corporate Payments

What Are Some Common Types of Corporate Payments?

Corporate payments usually include the following types:

- Treasury payments: loans, debts, investments

- These payments are important for the financial health and stability of a company. Loans and debts are necessary for companies to finance their operations, whether it’s to purchase new equipment, expand their facilities, or pay off existing debts.

- Investments, on the other hand, are crucial for companies to grow their wealth and generate more revenue. By making smart investments, companies can increase their profits and expand their business operations.

- Supplier payments or Account Payable (AP) payments: payments a company makes to a supplier for purchased goods or services

- These payments are a critical component of a company’s cash flow, as they ensure that suppliers are paid on time for the goods or services they provide.

- By making timely supplier payments, companies can build stronger relationships with their suppliers, negotiate better prices, and ensure a steady supply of the goods and services for business continuity.

- Tax payments: payments to tax authorities to fulfill the legal taxation obligations

- These payments are an essential part of a company’s financial responsibilities, and failure to make them can result in significant legal and financial penalties.

- Tax payments can include income tax, sales tax, property tax, and other types of taxes. By making accurate and timely tax payments, companies can avoid costly penalties and maintain their legal and financial standing.

- Salary payments: the amount a company pays on agreed terms to its employees in exchange for job performance

- These payments are essential for attracting and retaining talented employees, as they provide a stable income and financial security. By making salary payments on time in the correct amount, companies can build a motivated and productive workforce, reduce turnover, and enhance their overall performance.

Methods of B2B Payments Transfer

B2B payments may be made through various methods, such as cash, checks, wire transfers, electronic funds transfer (EFT), credit cards, or other forms of payment. But they are usually electronically transferred through banks. In the US and some other countries, checks are still being used, while ACH and wire payments remain the most popular methods.

New B2B payments methods such as real-time payments are gaining ground globally. Recently some corporations have also started to accept crypto currency. Bank transfers can be split into domestic payments and cross-border payments. For cross-border payments, there is usually an associated foreign exchange risk.

How Do Businesses Manage Their Corporate Payments?

It varies company to company, but it is common that the business process owner for corporate payments is treasury under the office of the CFO. Without payments being received on time in the right amount, businesses can face late supplier deliveries or other contractual penalties which endanger all sorts of business activities.

Therefore the B2B payments process (including claims and accounts payable) is considered as a business-critical process. Effective payment systems can help improve cash flow, reduce the risk of fraud and errors, and ensure that the company can meet its financial obligations to its employees, suppliers, and other stakeholders.

However B2B payments processing remains inefficient in many companies, often due to the following reasons:

- Siloed and obsolete home-grown back-office systems: Companies may use multiple systems for different types of payments, such as separate systems for payroll, vendor payments, and expense reimbursements. This can lead to inefficiencies and a lack of visibility into overall payment processes.

- Manual processes with a lack of end-to-end process automation: If payments are processed manually, such as using paper checks or invoices, it can be time-consuming and prone to errors. These manual processes may require a lot of manual data entry, which can lead to typos, incorrect information, and lost documents.

- Legacy connectivity to banks: Payment systems may not be integrated with other systems used by the company, such as accounting or ERP systems. This can lead to duplication of efforts, manual data entry, and errors.

- Decentralized payment processing teams: If payment data is stored in different systems or departments, it can be difficult to get a comprehensive view of all payments being made. This can lead to inefficiencies in tracking and reconciling payments, and even worse, increased fraud risks.

What Are Some Challenges with Corporate Payments?

Corporate payments are traditionally challenged by their sheer volume of payment activities and manual processing inefficiency. Some of the most outstanding problems with B2B payments are:

- Outdated back-office payment systems requiring extensive and costly IT support

- Long lead time to connect to banks via bank APIs or H2H with own IT resource

- Unavoidable payment errors and oversights from manual processing

- Potential money loss from undiscovered duplicate payments

- Increased operational risks due to potential fraud and non-compliant payments

- Slowness to leverage faster payment rails (e.g., RTP®) or other nascent payment methods (e.g., Zelle) to support customers’ evolving B2B payments needs

Hidden Cost of Payment Errors and Non-Compliant Payments

Perhaps it is not often visible to the stakeholders in a company how much manual and analog systems can cost, or perhaps the practice has been the way it is for so long that it has just become an accepted cost of doing business. Through a step-by-step process description it is possible to demonstrate how much money businesses are losing each year in their payments processing – particularly those with cross-border activities and FX exposure.

Costs can come from a few different sources and very often companies underestimate the accumulated costs that arise from these payments:

- Manual errors causing remitted funds to not arrive at the correct destination

- Duplicate payments that could be the result of a mistake or fraud

- Non-compliant payments that run afoul of official sanctions lists, leaving the firm open to fines and other regulatory action

Our analysis finds that companies can significantly reduce the erroneous and non-compliant payments that the average business is losing by persisting with outdated processes. If only ten payments are affected each month this can result in extra annual costs of over $40,000 on average.

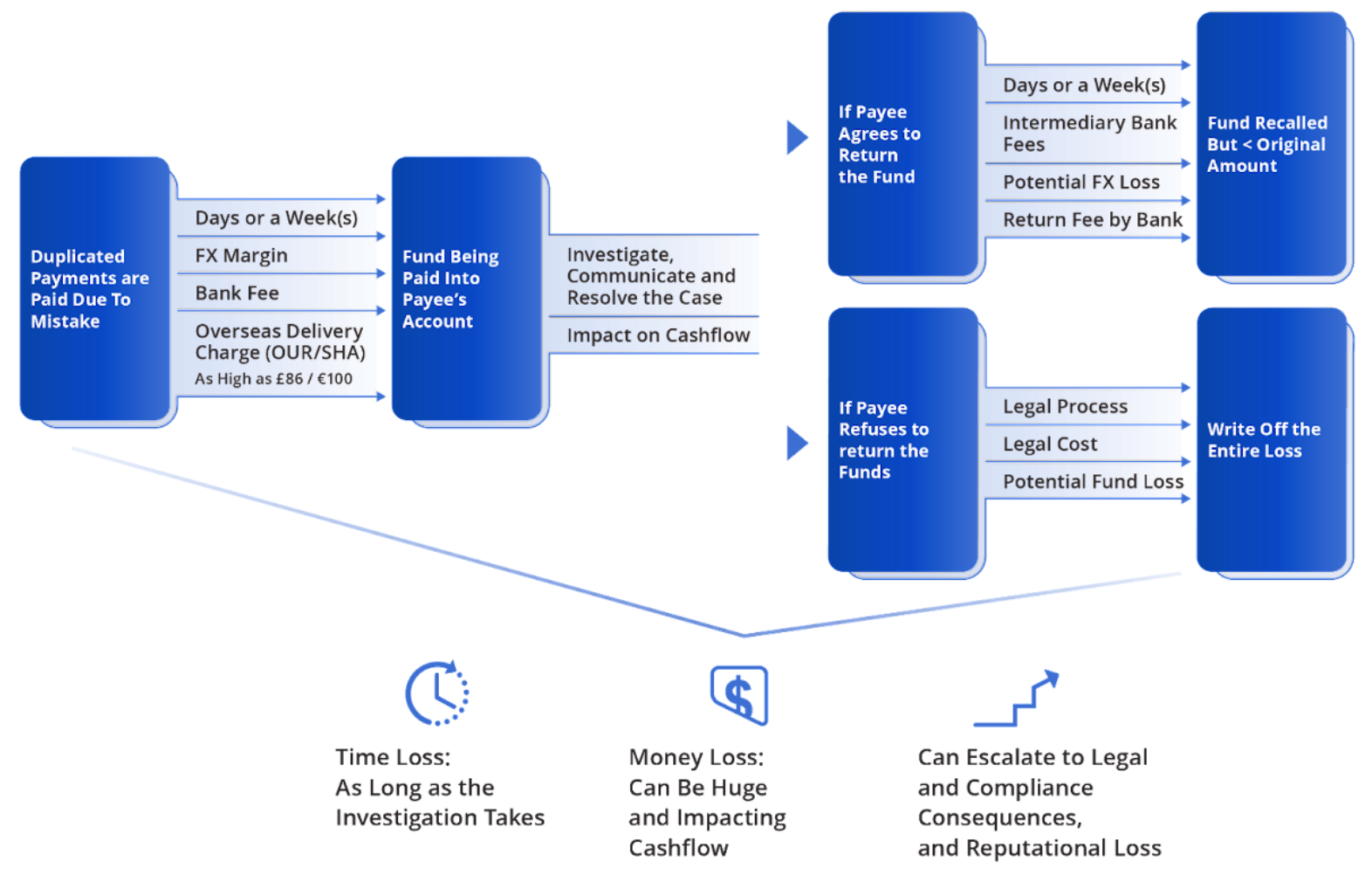

The following flowchart shows in detail how costly a duplicated payment made by mistake can be for a given company, not to mention that in many cases these errors can be compounded as companies expand organically and by acquisition, adding layers of complexity to find out where and how such mistakes have been made.

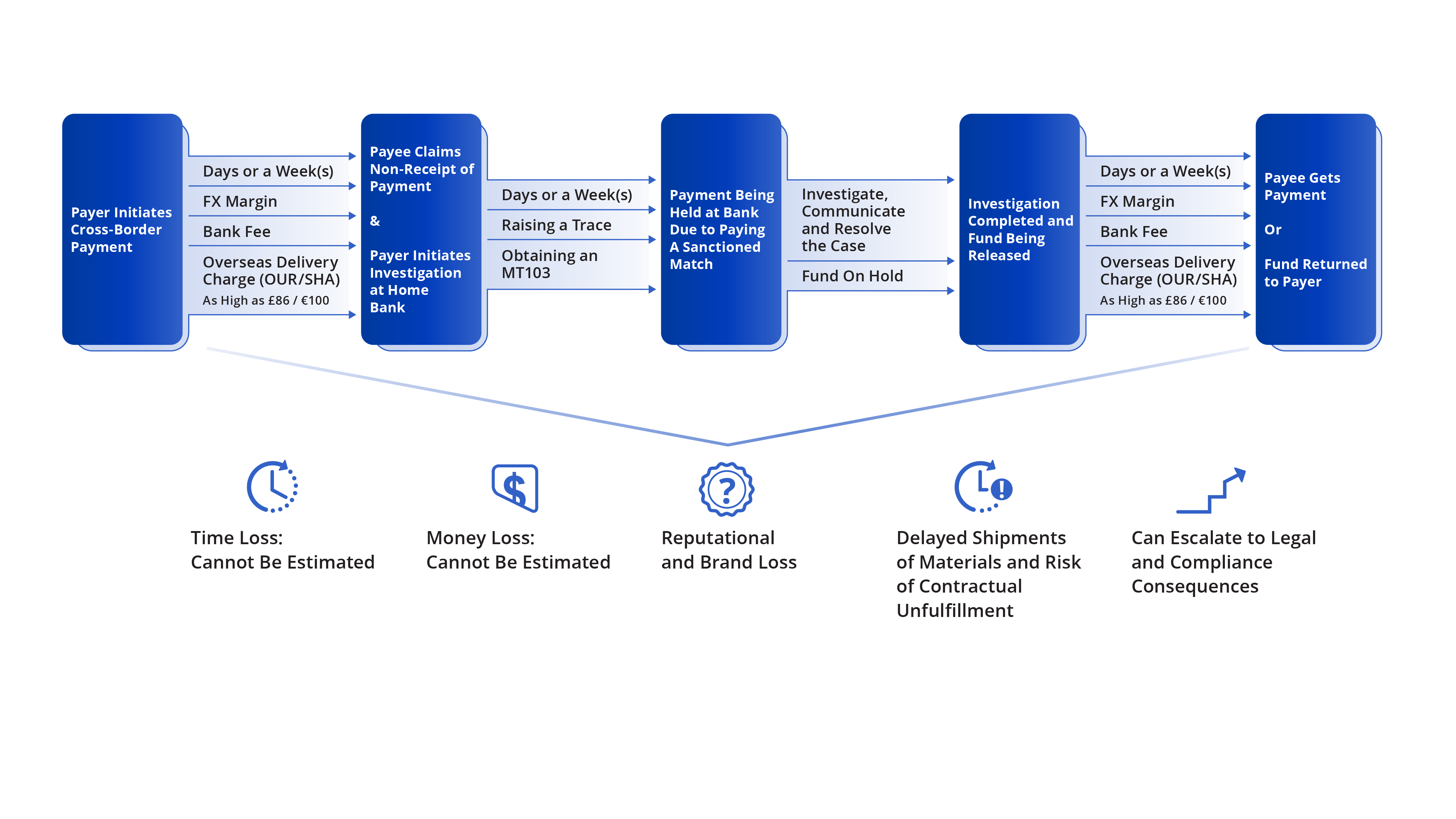

The increasingly disparate structures produce more risk, whether FX or regulatory, and greater vulnerability to payment fraud too. Steps to standardize controls and simplify and automate processes can not only mitigate these exposures, but with more accurate information can also strengthen decision-making and lay the foundations for future growth. Below is another detailed flowchart to show how much time and money a company can lose when a foreign supplier payment fails to arrive in the payee’s account.

Use of Treasury and Payment Solutions

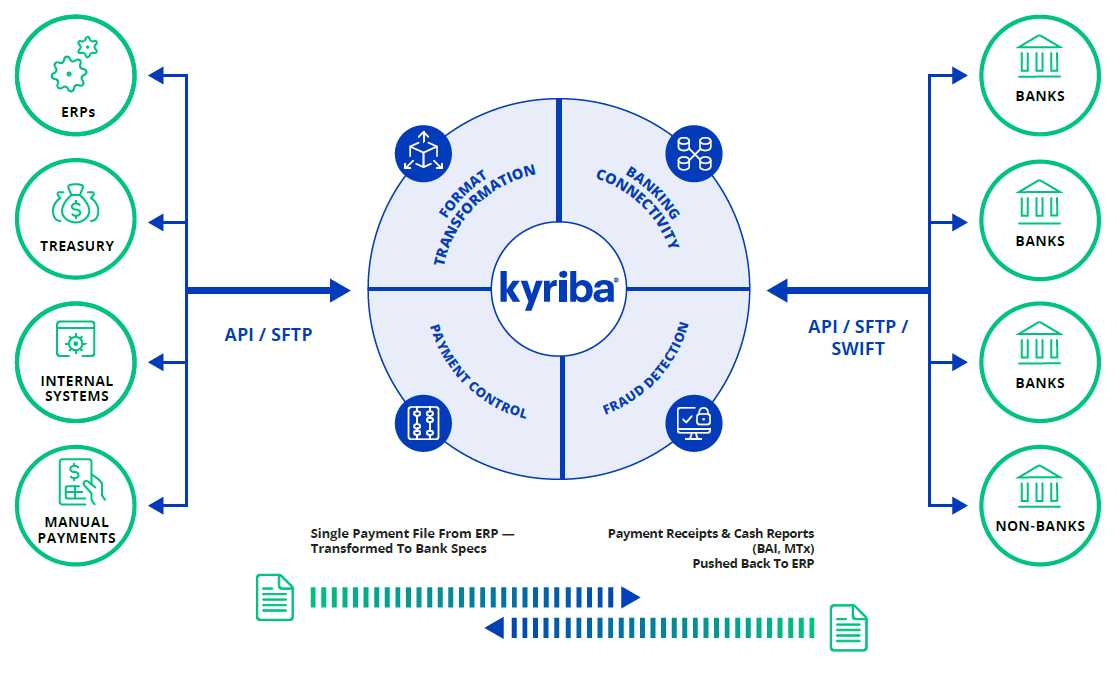

To effectively manage corporate payments, it is recommended to choose a treasury and payment solution that meets an organization’s current and future business needs. One of such solutions is a payment hub, also known as a B2B payments platform or a payments processing system. Such a hub consolidates payment requests from ERPs and other payment initiating systems, transforming disaggregated and decentralized payment processes into a single source of record for all outgoing corporate payments.

Corporations are changing the way they process payments. Technology, regulation, globalization of trade – all are factors driving the need for payments centralization. CFOs and treasurers worldwide recognize that fragmented and decentralized payment processes do not offer the efficiency.

A cloud-based payment hub such as Kyriba’s enables global real-time access to payment data while as many users as needed can easily be onboarded. This way, the CFO and the treasury team can gain full control and visibility into the status of AP, treasury and other ad hoc payments.

A payment hub can help companies streamline their corporate payments process with great efficiency, cost saving and security.. The primary benefits of centralizing payments with cloud-based payments hubs are:

- Visibility into outgoing cash flows

- Reduced payments fraud and improved operational risk management

- Control over payment timing

- Standardized procedures across all regions

- Increased efficiency and reduced costs

- Regulatory compliance.

Best Practices of Managing Corporate Payments

There are many ways to design the workflows and implement the technical enablers needed to optimize your payment process. Many Kyriba clients have demonstrated successes with best practices they share with the community and their peers.

For example, Cooke Aquaculture has built a robust in-house bank and a payment factory to unlock liquidity, freeing 20% of full-time employees in the financial shared service center for more strategic level work. Even more importantly, by placing focus on process standardization, Cooke has seen a result in 100% accurate and automated accounting and reconciliation from a standardized process across all entities.

Another good example is from Kyriba’s client Adobe. As an organization which has 125 global users manually logging into 10+ banking portals on a daily basis to process payments and statements, the use of Kyriba’s payment hub has led to a centralized repository of 24 signers tracked and 8 bank letter templates maintained with 4 Banks connected for bank fee statement reporting and proactive fee management.