FAQ

What are Payment Systems in the U.K.?

The U.K.’s payment systems are undergoing significant changes impacting various aspects of banking and commerce. Understanding these changes is crucial for businesses, financial institutions and individuals using the U.K. payment ecosystem. This FAQ provides an overview of the current and future state of U.K. payments, including:

- existing payment schemes

- influence of Brexit

- adoption of the ISO 20022 messaging standard.

Table of Contents

What are U.K. Payments?

While many financial institutions in the U.K. also participate in the Single Euro Payments Area (SEPA) scheme given the close economic ties with Europe, the U.K. has its own established payment systems and governing bodies. The Payment Systems Regulator (PSR) is a regulatory body overseeing payment systems in the U.K., while Pay.UK is the U.K.’s leading retail payments authority, operating the U.K’s national retail payment systems, i.e, Bacs, Faster Payments Service and the Image Clearing System.

What are the Different Types of Payments in the U.K.?

Payment schemes in the U.K. are operated by the Bank of England and Pay.UK.

| Payment Systems in the U.K. | ||||

| Operator | System | Description | Bank of England | CHAPS (Clearing House Automated Payment System) |

|

| Pay.UK | Bacs (Bankers’ Automated Clearing Services, aka BACS) |

|

||

| Faster Payments Service (FPS) |

|

|||

| Image Clearing System (ICS) |

|

|||

How has Brexit Affected U.K. Payments?

The impact of Brexit on U.K. payments varies across the market. Brexit has had no impact on U.K. domestic payments, and because the U.K. remains part of the SEPA Zone (and was never part of the EuroZone), the majority of SEPA payments remain unaffected by Brexit.

Since January 2021, however, there have been a number of market developments:

- Increased charges for SEPA transactions: some European Banks now treat SEPA transactions between the U.K. and Europe as cross-border transactions from a fee perspective.

- International Bank Account Numbers (IBAN) discrimination: some companies are refusing to accept SEPA payments and direct debit set-ups from “GB” IBANs even though the European Payments Council (EPC) confirmed the U.K.’s continued participation in SEPA schemes.

- Additional Data Requirements for the Issuer: transactions between the U.K. and the EU always required the payor’s name and account number, but now there is an additional requirement for the payor’s full address, just like non-EU countries that are part of the EU’s single market (Switzerland, Iceland, Liechtenstein and Norway).

What is the Future of Payments in the U.K.?

Several regulatory changes have recently dominated the payments landscape in the U.K. These changes include:

- Open Banking revolution, driven by the requirements of the Second Payments Services Directive (PSD2). PSD2 introduces requirements for strong customer authentication (SCA) to ensure the security of electronic transactions and opens up access to payment account information to third-party providers through APIs (application programming interfaces).

- Continued development of the New Payments Architecture (NPA). Delivered by Pay.UK, this groundbreaking initiative represents the most significant enhancement to the United Kingdom’s payment system in decades, establishing a future-proof, single payment payment platform

- G20’s Financial Stability Board (FSB) Roadmap for Enhancing Cross-Border Payments. This roadmap outlines a comprehensive strategy of objectives and milestones aimed at tackling long-standing issues related to cross-border payments, including high costs, slow processing, restricted access, and inadequate transparency. Adopting a standardized ISO 20022 version for message formats is identified as a pivotal building block in the implementation of this roadmap.

- Renewal of the Bank of England’s Real Time Gross Settlement (RTGS) service through the migration of international payment networks to ISO 20022.

What is the Impact of ISO 20022 Migration in the U.K.?

On June 19, 2023, CHAPS and the Bank of England’s RTGS migrated to the ISO 20022 messaging standard. The adoption of ISO 20022 payments offers many benefits, including:

- Improved Flexibility: ISO 20022 can adapt more easily than current messaging standards, making it more responsive to changes in the economy, emerging technologies and innovation.

- Global Harmonization: Over 70 countries have already adopted ISO 20022, so messages will be harmonized with payment systems around the world.

- Compliance and regulation: Richer data will make it easier for businesses to detect fraud and help target financial crime.

- Resilience: ISO 20022 will be used across many payment systems, thereby improving resilience by allowing re-routing of messages. This capability minimizes the impact of outages on users, ensuring a more robust and reliable financial infrastructure.

- Enriched data: More data can be carried, enabling more detailed and better structured reference information with each transaction.

- Competition and innovation: More flexibility and better data means more competition and innovation in the financial sector.

- Straight-through processing: Less need for banks to make manual interventions, with potentially fewer delays for the end customer.

- Enhanced Analytics: Enriched data will improve analytics because more efficient data collection improves decision-making.

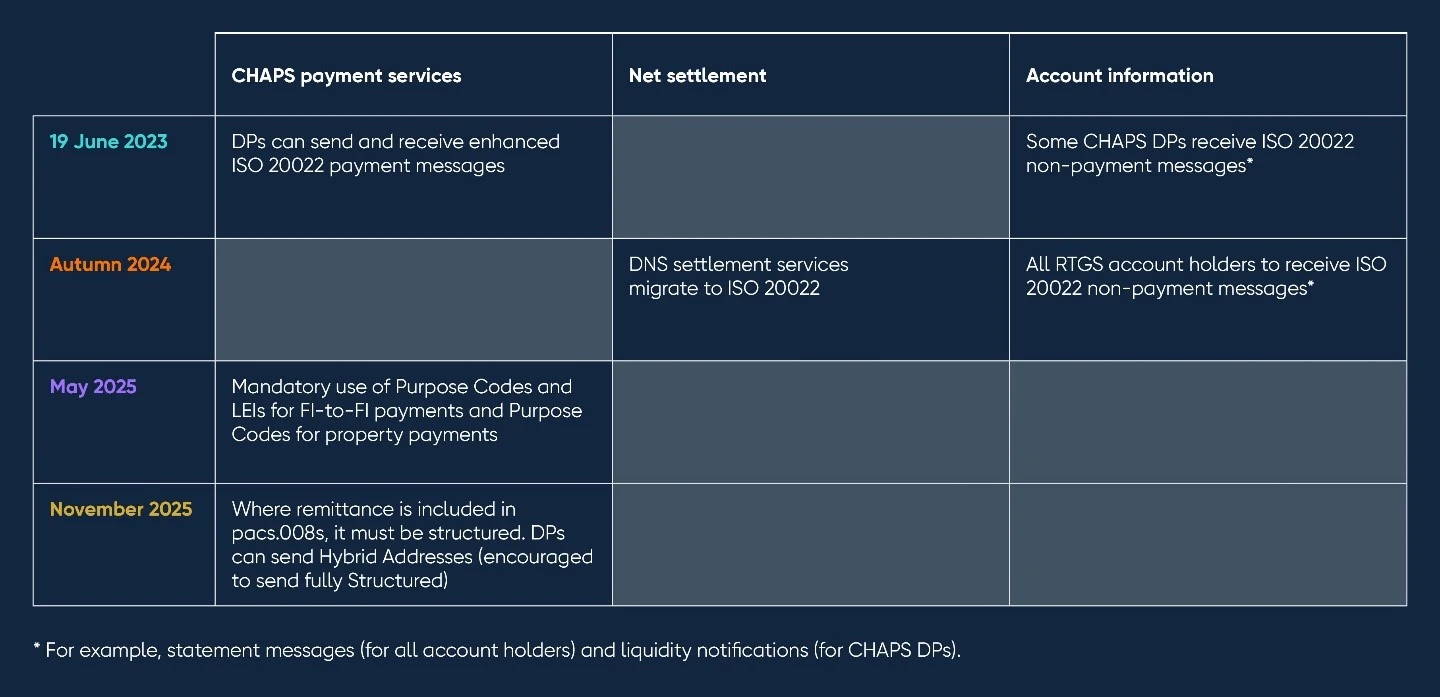

Because of the ISO 20022 adoption, CHAPS payment users (financial institutions and companies with direct access to CHAPS) have to make changes to the way they send and receive payments. Currently, the migration to ISO XML 20022 impacts only CHAPS/RTGS. However, Pay.UK’s New Payments Architecture (NPA), which will replace the U.K.’s Faster Payments system, will also eventually use ISO 20022. In addition to the U.K., several significant jurisdictions have either implemented or are planning to adopt ISO 20022 by November 2025, coinciding with SWIFT’s scheduled retirement of its current MT message standard for cross-border payments. Below is the timeline of the migration for CHAPS:

Although this timeline is for financial institution to financial institution exchanges, there are also implications for corporates using CHAPS payments. For example, starting in November 2024, corporates using CHAPS payments might be asked to provide their Legal Entity Identifiers (LEIs) when sending payments between financial institutions. Additionally, corporates may have to provide Purpose Codes for CHAPS payments between financial institutions and for property payments. The Bank of England provides a list of recommended Purpose Codes.

Beginning in 2025, corporates might have to use structured addresses for the payor and the payee as well as provide the details of the invoices paid through the use of the structured remittance information. For the structured addresses, the minimum data to provide will be the town name and the country code. Globally the Bank of England confirmed that they will follow the Payments Market Practice Group (PMPG) guidance, which is for now recommending the hybrid approach to populate address information:

- Mixed usage of dedicated address components, such as

, , and unstructured (with minimum of and ).

Further, corporates might be required by their banks to receive camt.052., camt.053 and camt.054 instead of SWIFT MT messages. Messages with the “camt” identifier span a range of cash management, reporting and advisory messages. The messages for reporting and advices are:

- camt.052: Bank to Customer Account Report. This message is the intraday information, providing a near real-time view of accounts. It replaces the existing MT 942 messages.

- camt.053: Bank to Customer Account Statement. This message is the previous day bank statement, providing details of all entries in customer accounts for the previous day. It replaces the existing MT 940 messages.

- camt.054: Bank to Customer Debit/Credit Notification. Serving as a notification for customer debit/credit transitions, this message replaces the existing MT 910 and MT 900 statements.

The Bank of England encourages businesses to contact their bank, building society or payment service provider with questions on how corporates should prepare themselves for a smooth ISO 20022 XML migration.