FAQ

What is SEPA Payment?

The European Union (EU), with its diverse tapestry of cultures, languages and economies, has always strived for harmonization and integration in various sectors, and the payment industry is no exception. In this FAQ, we’ll delve into the intricate world of EU payment schemes with a focus on SEPA payments, describing the existing payment types and the future ones, the underlying format and the future modifications and the benefits and limitations of the system.

EU payment schemes have been developed with the overarching goal of creating a unified, efficient, and robust payment infrastructure that transcends national borders. These initiatives not only simplify cross-border trade and transactions but also foster economic growth by creating a seamless payment environment.

Central to this ambition is the Single Euro Payments Area (SEPA), a transformative initiative that has standardized electronic euro payments across the region. But SEPA is just one piece of the puzzle. The EU’s payment landscape is bolstered by a suite of regulations, directives and technological advancements, all aimed at fostering trust, enhancing security and ensuring the rapid processing of transactions.

Table of Contents

The SEPA Milestones

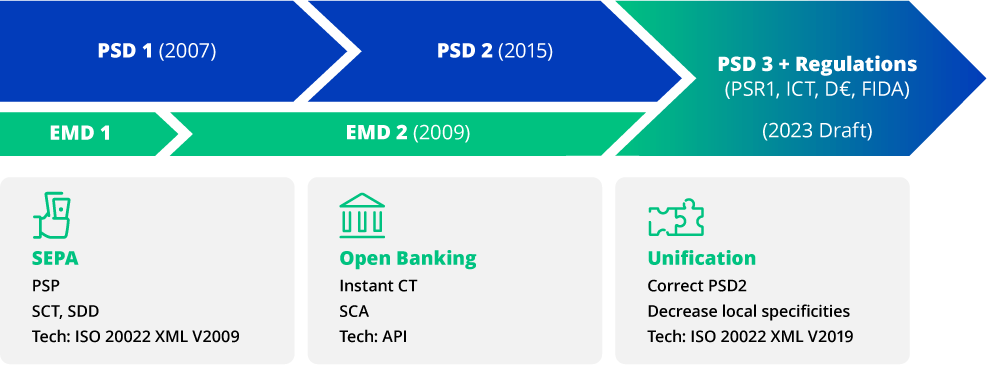

The first Payment Services Directive (PSD1) was adopted in 2007. The purpose was to offer a standardized payment environment for cross border transactions in euro in a defined zone (called SEPA Zone – 36 countries) at the same price as domestic transactions.

The European Payments Council (EPC) was established to create the rulebooks to frame the SEPA Credit Transfers (launched in 2008) and the SEPA Direct Debits (launched in 2009).

The underlying format chosen to support the above schemes was the ISO 20022 XML Pain in 2009. In order to simplify the implementation, it was also decided to use only standardized account numbers and bank codes using the International Bank Account Number (IBAN) and Bank Identifier Code (BIC).

In 2015, the second Payment Services Directive (PSD2) was gradually enforced, launching a new scheme for SEPA Instant Credit Transfers (launched in 2017), creating more security around the emerging payment types linked to ecommerce (card, internet and mobile payments) and introducing open banking, a banking practice that gives consumers full control over their own banking or financial data so that they can decide whether any third-party financial service providers can access the data to provide them with better products and services. That’s why it is also known as “open bank data”.

- In 2019, the authentication and thirty party access requirements (SCA – Strong Customer Authentication) entered into force.

- In 2020, the SEPA Request To Pay scheme is introduced.

- In 2021, SEPA payments account for 94% of all credit transfers and 98% of all direct debits in the SEPA Zone.

- In 2023, the EPC decided to migrate from the 2009 version of the ISO 20022 XML Pain to the 2019 version.

With the PSD3 on the horizon, which could take effect in 2026, a new Payment Services Regulation (PSR) to improve consumer protection will be introduced and stricter rules (more extensive SCA) will be implemented to reduce fraud and increase the security of electronic and digital payments and financial services.

Figure 1: SEPA milestones

What Are the Different SEPA Schemes?

The summary below gives an overview of the different SEPA payments schemes.

Table: SEPA Payment Schemes Comparison

| SEPA Scheme | Type | Transfer Limit | Max Credit Time | Operation | Repudiable |

| Instant Credit Transfer | One off | €100,000.00 | 10 seconds | Calendar day | No |

| Credit Transfer | One off | €999,999,999.99 | 2 business days | Business day | Yes |

| Direct Debit Core | Recurring | Defined by the mandate | 2 business days | Business day | Yes |

| Direct Debit B2B | Recurring | Defined by the mandate | 1 business day | Business day | Yes |

SEPA Credit Transfer

Commonly known as SCT, this is the most used SEPA scheme processing more than 20 billion transactions per year, with the transfer limit being set at €999,999,999.99 (one cent less than a billion euros).

It enables an electronic transfer in euros between two bank branches located in the eurozone and consists of a payment sent by a debtor (payer) to a creditor (payee) for many different purposes such as payroll and expenses, invoice settlement and consumer-to-consumer bank transfers.

The greatest advantage of SCT is that there cannot be any fee deducted from the amount credited on the creditor’s account, which means that the recipient is guaranteed to receive the exact amount due, within two business days.

Any payment using SCT can be recalled by its originator within 10 business days for technical reasons, such as duplicate sending or technical problems, and within 13 months in case of fraud.

SEPA Instant Credit Transfer

SEPA Instant payment is a faster version of a SCT with an execution within 10 seconds.

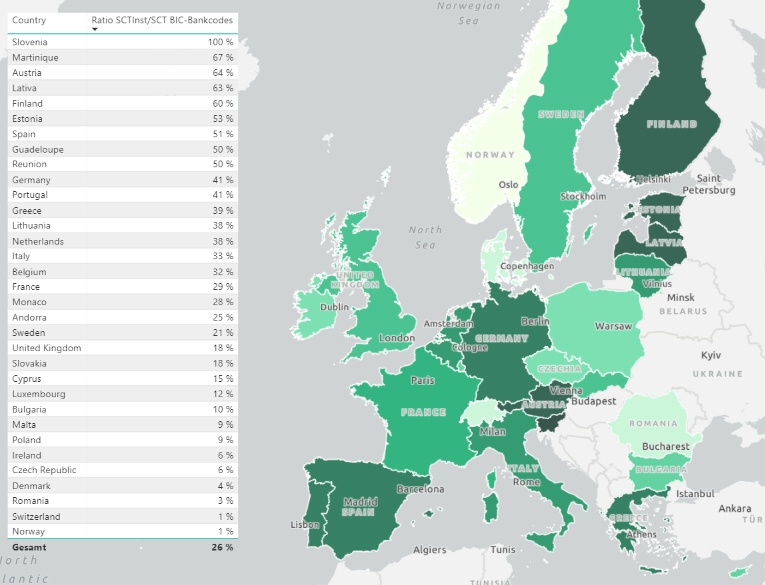

The adoption of the SEPA Instant Credit Transfer remains relatively low mainly due to its cost, which can vary from 0.5 to 12 euros per transaction depending on the banks and the countries. Some other reasons include:

- Lack of interoperability between the two underlying “payment rails” used by SEPA Instant, namely TARGET instant payment settlement (TIPS) and RT1 infrastructure platform. For example, nominal SEPA Instant coverage in France is 26%. In practice, this figure is much lower because some banks only use TIPS, whilst others only accept RT1 payments, causing a high rate of failure.

- Some banks can fully support SEPA Instant but choose to only allow consumers to receive SEPA Instant payments, not necessarily to initiate them. This is because the scheme is only focused on accounts being reachable for transfers by other banks.

Figure 2: SEPA transfers in real time – status quo in December 2022

SEPA Direct Debit Core and Direct Debit B2B

SEPA direct debit payments are offered in two versions: direct debit aimed at consumers (Core) and direct debit aimed at businesses (B2B).

For both schemes, a SEPA direct debit is a payment instruction issued by the creditor (Payee) to debit the debtor’s account. It requires the issuance of a mandate signed by both parties authorizing the creditor to debit the debtor’s account under certain pre-agreed conditions.

The Core SEPA Direct Debits are used for many purposes such as the payments for rents, utilities and loan repayments. The B2B SEPA Direct Debits scheme is commonly used for transactions between companies and with tax authorities to repay loans, pay taxes etc.

SEPA Request-to-Pay

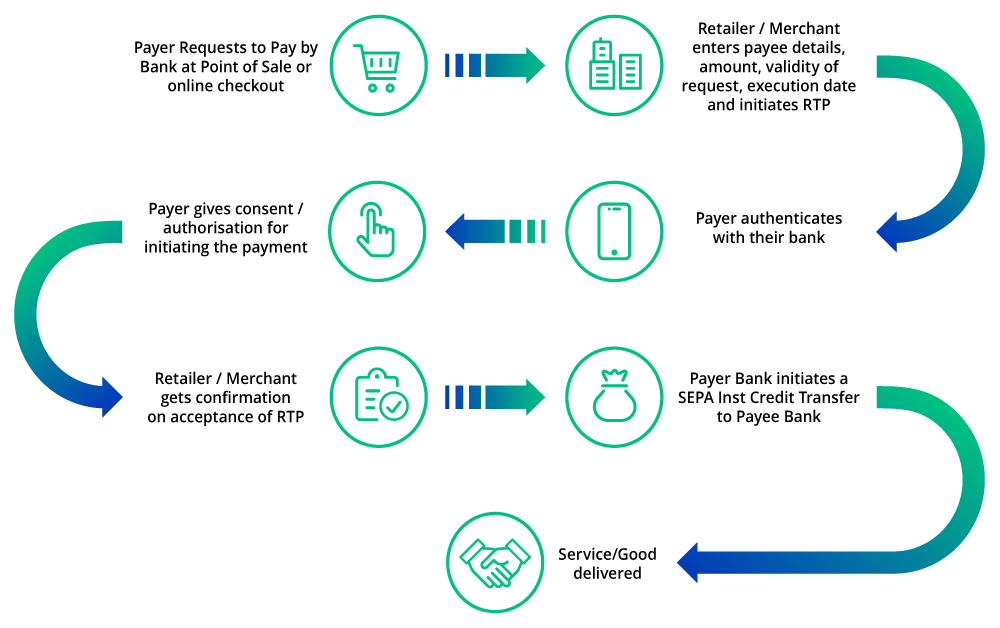

This is the latest addition to the SEPA schemes, also called SRTP. It is not a payment in itself but a means to request a payment initiation from a third party.

It offers several options to the debtor:

- Accept now/Pay now

- Accept now/Pay later

- Accept later/Pay later

Once received by the payer in a secure channel, the payment initiation can be rejected or accepted. If accepted, the payment will then be initiated at the agreed date. The advantage of this approach is to give more controls over the payment collections (less rejection than with Direct Debits) and ease the accounting reconciliation process.

It can be used for many purposes such as E-Billing/Invoicing, E-commerce payments, Point of Sale payments, etc. It gives alternate means of payments for E-Bill payments, card transactions and also traditional Direct Debits.

However to fuel the adoption, there are a lot of challenges that need to be addressed like feasibility of Recurrent SRTP and customer protection issues.

Figure 3: How SEPA Request-to-Pay works

How Kyriba Supports SEPA Payments

With millions of SEPA Credit Transfers and SEPA Direct Debits being initiated and routed each year via the Kyriba Payment Hub, SEPA payments are one of the major focuses for Kyriba, being a leading global payment factory service provider.

Kyriba offers straightforward implementation and highly customizable workflow configurations, and Kyriba also supports multiple protocols including EBICS, FTP, EDITRAN, Swiftnet FileAct and the most recent format rulebooks including 2023 version 1.0. Kyriba aims at making SEPA Credit Transfers, SEPA Direct Debits and SEPA Instant Credit Transfer user friendly for all clients.

If you want to learn more about SEPA payments, the latest changes with ISO 20022 XML and how your organization can take advantage of the new development in SEPA payments, please contact us or get a demo. Our payment experts are ready to support you.