eBook

Improving Efficiency and Reducing Fraud through Payments Hubs: A 15-minute Quick Guide

The real leaders in treasury and finance understand the urgency of digital transformation as a way to centralize and standardize key global processes. This is particularly true in payments, where disparate systems, teams and processes are pre-cursors for chaos and inefficiency, as well as elevated levels of fraud and operational risk.”

— Bob Stark, Global Head of Market Strategy, Kyriba

Table of Contents

The Need to Centralize Corporate Payments Has Never Been Stronger

Payments are a constant focus for CFOs, CIOs, controllers, purchasing managers and treasurers because inefficient payment processes inhibit supply chains, cash flow and profitability. The need to optimize cash and working capital, combined with the increasing threat of cybercrime and payments fraud, amplifies the need to centralize and standardize corporate payments. This e-book will review the business drivers for centralizing payments through a payments hub, including:

- Standardizing and strengthening payment workflows and controls

- Streamlining bank connectivity to optimize payment channel usage

- Facilitating faster bank implementations and bank format harmonization

- Complete payments visibility, including timing, amounts and transaction status

- Provide business intelligence and analytics on all global payments

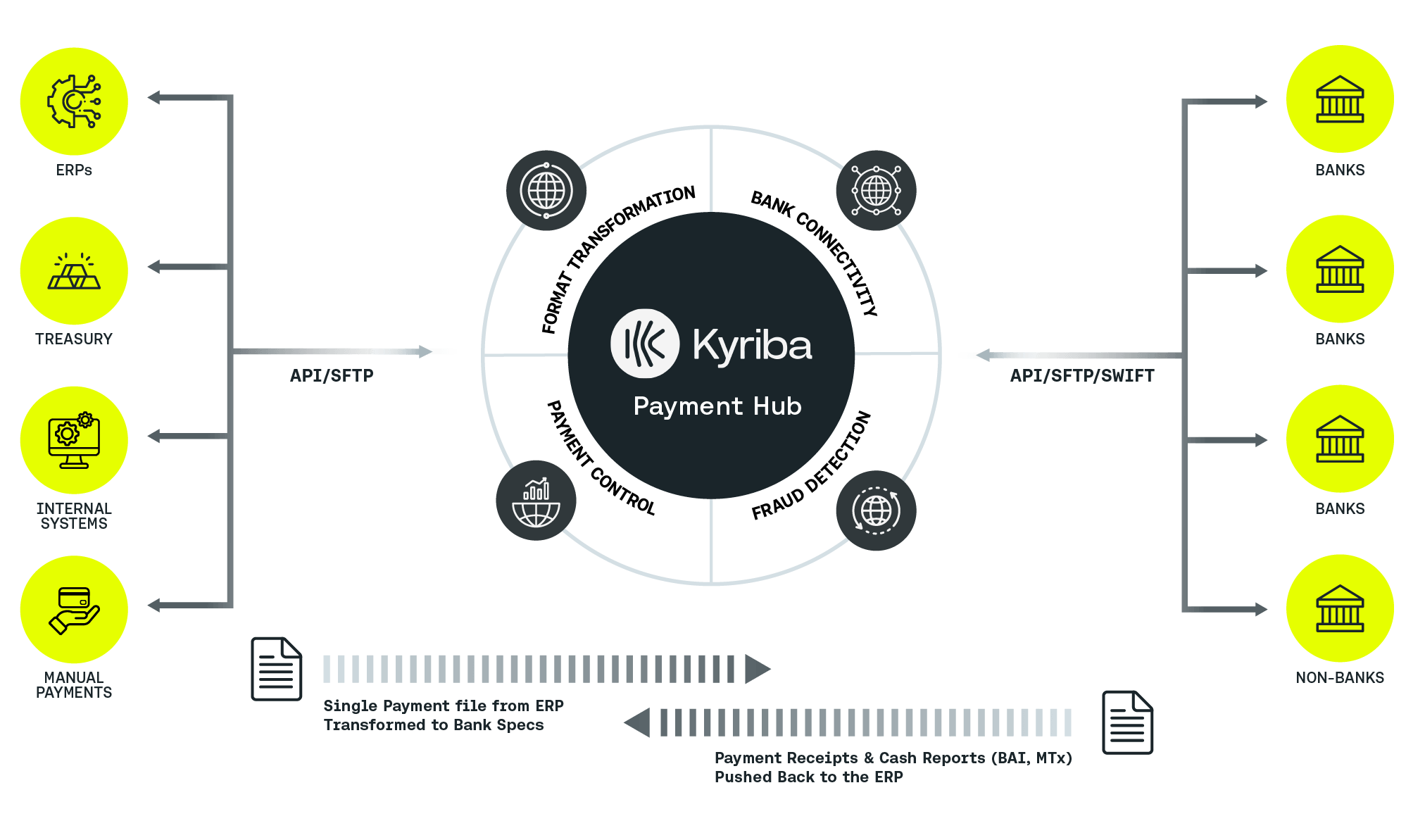

What is a Payments Hub?

A payments hub consolidates payment streams from ERPs, finance, treasury, legal, capital markets and decentralized teams, transforming disaggregated processes into a single source of record for all outgoing payments. A payments hub also transforms payment data into bank specific file formats and connects directly with global banks via multiple protocols, including host-to-host, SWIFT and regional networks. Key features of a payments hub include:

Payment workflow and controls to ensure that manual payments activities align to the organization’s payment policy and standardized payment controls

Real-time payment screening and fraud detection to enable a line of defense against unauthorized payments

Integrated global bank connectivity to deliver out-of-the-box, host-to-host and regional network bank interfaces alongside an embedded SWIFT service bureau

Pre-built format library to meet the needs of every global bank, which require thousands of format variations

Two-way communication to include the receipt of payment acknowledgements, payment tracking, and bank statement reporting for status reporting and payment visibility

Complete reporting and dashboards to arm finance and treasury with analytics, data visualization and business intelligence for all global payments

Payments Hub

It was simply unsustainable to continue logging in to each individual e-banking platform in order to approve payments. Kyriba offers us a single, consolidated point of access across all our bank accounts, [giving us] the ability to set up payments, define different payment types and to receive notification of pending approvals.”

— Andrew Nicholson, Graff Diamonds CFO

5 Core Benefits of a Payments Hub

Implementing a corporate payments hub delivers a wide range of value for treasury and finance leaders, from enhanced fraud detection to reducing the burden on IT resources so they can focus on other strategic initiatives.

- Cost Savings — A payments hub reduces the number of systems that must connect to a bank. Each system that connects to a bank incurs additional bank service fees, software costs, and in the case of on-premise solutions, significant IT resources. Some organizations even manage duplicate payment channels, such as multiple SWIFT solutions.

- Central Responsibility — When multiple systems are used to manage the payment workflow — request, initiation, approval and transmission — the risk of mistakes and unauthorized payments increases. Because a payments hub centralizes payments prior to final transmission to the bank, the CFO can ensure that all payments are the responsibility of a single team — regardless of amount, location or who requested it.

- Fraud Detection — All outgoing payments should be screened in real-time against external sanctions lists (such as OFAC) and a digitized payment policy should be put in place to ensure that only authorized payments are approved and released to the bank. Any suspicious payments should be embargoed for further review with a full-resolution workflow.

- Global Visibility — Centralizing all payments via a payments hub allows complete visibility of all outgoing cash flows so that treasury can optimize cash balances and make effective decisions on where to deploy cash and liquidity. The hub allows the organization to run leaner, minimizing excess balances so that cash can be more efficiently deployed where it is needed most.

- Eliminate Need for IT — Payments hubs are hosted in the cloud and feature bank-format generation and integrated bank connectivity, meaning internal IT resources are no longer needed to build and maintain bank connections. This offers finance teams the freedom to change existing bank relationships, enables scalability to add new banks and gives teams the flexibility to update bank formats, including harmonization to ISO20022.

CASE STUDY

CHALLENGE:

A rapidly expanding part of Crown World Mobility’s service is outsourced expense-payment solutions. However, executing these payments through manual processes based on spreadsheets and web-based banking systems was not scalable and also created operational risks. Crown needed a secure solution that spanned multiple geographies, currencies and payment products.

SOLUTION:

Crown evaluated multiple vendors for security, scalability and efficiency gains. Kyriba was deemed the only supplier to meet these needs and provide a truly cloud-based solution that could accommodate European data privacy storage compliance requirements.

RESULTS:

Crown realized $1.7M in cost savings for clients in the first year and increased staff productivity by 20 percent. The company was also able to benefit from integrated payment and cash management processes.

Key Stages of Payments Centralization

The four key stages of payments centralization lead treasury and finance through payment routing to global bank connectivity.

- Payment Routing

When importing payments into a payments hub, it is important to offer flexibility based on a variety of workflow needs. Some A/P payments may be preapproved, while others require additional levels of approval. A/P payments may also be formatted to the exact specifications of the bank, while others may require alignment to bank-specified format standards based on delivery channel, payment type and location where the payment is being sent to.

A good payments hub will fully support blind routing of preapproved, pre-formatted payments directly to the bank, while at the same time offering intelligent routing for payments that require additional levels of approval or format transformation.

Additional approvals can be performed at a batch or transactional level and may be supported through the use of digital signatures, such as SWIFT’s 3SKey.

- Format Transformation

Bank formats are one of the most challenging responsibilities for finance teams. There are tens of thousands of variations of socalled global formats (e.g., XML ISO20022), making transformation of payments into the required format for each bank payment scenario critical. For payments not already preformatted by the ERP, the payments hub will reformat payments based on:

- Bank Channel — SWIFT, API, host-to-host or other connection method.

- Payment Type — Wire, ACH, SEPA, real-time payments.

- Receiving Location — Banks require different formats for wires to different countries. For example, wires to Egypt vs. wires to Romania.

Format transformation is fully automated so that no additional user intervention is required.

- Real-time Fraud Detection

Payments fraud increases every year, with more creative attempts and successes reported by CFOs. Fraudsters and cybercriminals prey on inconsistent controls — controls that are often a result of manual processes and poorly enforced payment policies.

A payments hub can help protect against fraud by offering a realtime screening of all payments against a digitized version of the organization’s payment policy. Examples include sanction lists screening:

- Ensuring approval controls and limits are enforced

- Verifying beneficiary banking information, including BIC

- Analyzing payment patterns (e.g., amount variances or split payments to same recipient)

- Suspicious behaviors (e.g., first payment to new bank account or payment to a country with no known suppliers)

Proper fraud detection will offer an end-to-end workflow, including impounding of payments, detailed dashboards and alerts, as well as separation of duties to clear false positives.

- Global Bank Connectivity

A payments hub should have end-to-end, integrated bank connectivity. There is no need for a separate solution for bank connectivity as payments hubs connect to all global banks with choices for communication protocols, including:

- Direct Connection — FTP, API or blockchain provider

- Country Banking Networks — EBICS, BACS, Editran, Zengin and more

- SWIFT — Alliance Lite2 and service bureau offerings

The key to efficient connectivity is choice. The right bank connectivity strategy will vary for different organizations based on their geographies, payment types and volume. A combination of bank connectivity channels optimizes cost and scalability while maintaining automation and security.

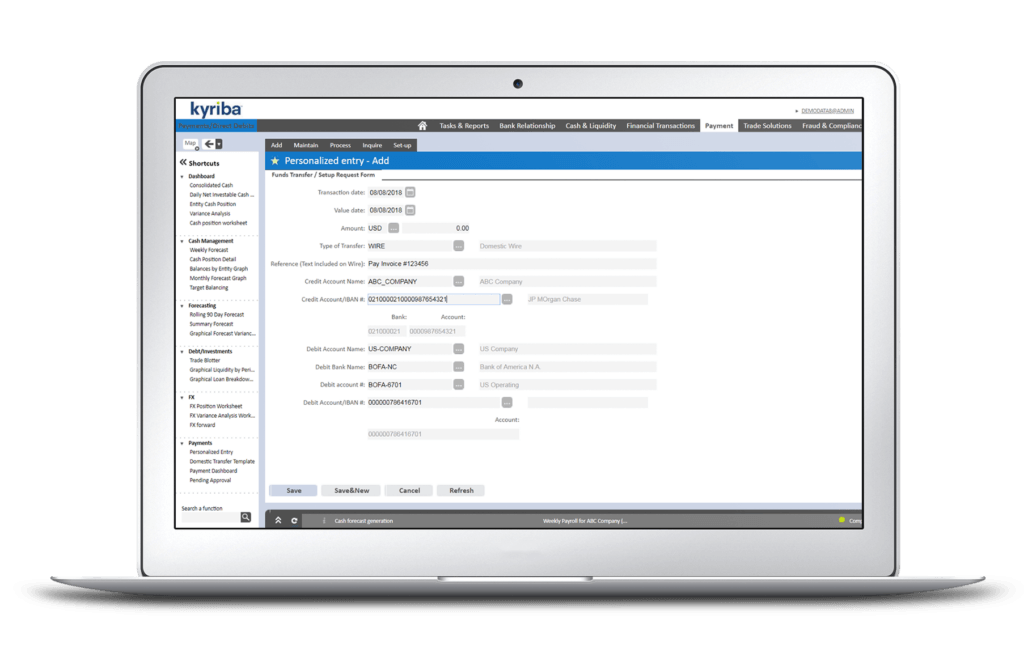

Payments are easy to process using Kyriba. Templates can be set up for repetitive payments. If the volume of payments dictates, they can be uploaded from an Excel spreadsheet — again simplifying the process. Controls and limits can be established in the system, requiring separation of duties [input, approve, release].”

— Bob Hemstreet, Treasury Consultant, Former Assistant Treasurer, Textron

The Future of Payments

Multi-channel payment hubs are the way of the future, with corporates soon to be presented with greater choice in B2B and B2P payment technologies.

APIs

Application programming interfaces (APIs) are programs that allows multiple pieces of software to “talk” to each other. Unlike file transfer protocol (FTP), APIs do not require files to be sent or downloaded. Data is exchanged point to point between systems, allowing for instant data transmission and eliminating substantial risk. Successful payment hubs will need to include a library of pre-built API bank connections. But bank connectors are just the tip of the iceberg; APIs open integration to a variety of systems, introducing capabilities and process automation that had not previously been possible.

Real-time Payments

Instant payment services are now being offered to corporates. While many regions globally have featured real-time payments for personal use, business payments will soon see similar services. Organizations such as The Clearing House in the U.S. and Ripple, a blockchain provider, are using new technologies to instantly deliver payment instructions and remittance information to not only speed up payment settlements, but also improve the payment experience.

Cryptocurrency and Blockchain

Many people associate cryptocurrencies with Bitcoin. While Bitcoin — in its current form — is unusable for mainstream corporate payment volumes, cryptocurrencies may still offer potential as a source of liquidity to reduce the FX transaction costs associated with cross-border payments. The key is in just how efficient FinTechs targeting cross-border payments with their blockchain solutions can be. Yet, the idea to offer a more direct communication between counterparties is an interesting proposition. As cryptocurrencies emerge, payment hubs will support blockchain channels as an alternative to current methods.

Robotic Process Automation

Robotic process, fueled by artificial intelligence, will fully automate and digitize payments in the near future. While algorithmic today, AI will take over repetitive tasks and eventually begin analyzing payment services and strategies. This evolution towards AI will evolve, with workflows such as payments digitization and fraud detection likely the first candidates for more intelligent programs. To avoid obsolescence, payment hubs will begin incorporating robotics processes and machine learning so that, within 10 years, the payments hub will be a self-learning robot.

Four Things to Consider When Selecting a Payments Hub

A payments hub is an integrated component of your financial system’s ecosystem. The decision to select a payments hub must be made not only to meet present-day requirements but also have the scalability to support future needs, as difficult as they may be to anticipate. Best practices when selecting a payments hub include:

- Rich Functionality — A payments hub should combine bank connectivity, end-toend payment workflows, extensive audit and controls, along with integrated bank reporting and payment acknowledgements — including SWIFT gpi — to deliver complete payments transparency and control at every stage of the payment lifecycle.

- Look for a Pre-built Formats Library — Dedicated bank payment format development teams support the payments hub application. A critical feature is format transformation for the 30,000+ payment iterations in the market; buyers need a vendor that has the pre-built library to meet your needs.

- Don’t Skimp on Security — Security should not be sacrificed. This includes payment workflow controls and real-time fraud detection, as well as a vendor that delivers an ISO27001 risk governance program for data security.

- Get Aligned — Geographic alignment with your payments program is key. If your payment banks exist in North America, Europe, Asia and Latin America, then so too should the implementation and product support of your payments hub vendor.

Watch our on-demand webinar to learn more about Beam Suntory’s treasury and payments factory transformation journey .