eBook

2022 Strategic Treasurer Treasury Technology Analyst Report

Welcome to the 2022 Treasury Technology Analyst Report, the definitive guide for thoughtful financial stewardship in the digital age. Strategic Treasurer created this report as an aid to practitioners exploring how treasury technology meets treasury needs.

Treasurers considering digitizing their processes often face a learning curve as they approach the complexity of many categories of treasury technology. AI, ML, API, RPA, and many other technological terms can sound like alphabet soup, and few feel confident about navigating selection, buy-in, and implementation efficiently. This report can help.

Table of Contents

- Treasury Technology Analyst Report 2022 – the Definitive Guide to Treasury Technology Solutions

- The Environment and Challenges Facing Treasury

- Adding Demands Rapidly, Adding Staff Slowly

- Security in the Hybrid and Remote Era

- Efficiency and Scalability

- Heavier Compliance Burdens

- Big Data, Complexity, and Visibility

- Geopolitical Tensions and Economic Stress

- The Treasury Technology Landscape

- The Foundations of Treasury Technology

Treasury Technology Analyst Report 2022 – the Definitive Guide to Treasury Technology Solutions

Today’s treasurer faces a rapidly shifting technology environment full of acronyms and innovations. Those needing the help of modern technology are often those most pressed for time, and the relevant information on technology lies scattered across the internet, buried in either technical jargon or oversimplifications.

The goal of the Analyst Report is to offer a single document explaining what matters about technology to today’s busy treasury department. We release a new report annually with content fully revised to be relevant and up-to-date in the current context. Our hope is that you will be able to pick up a single book (or open a single digital document) and come away with insight into the technology landscape’s trajectory, a good idea of which functionality and solution types are most relevant to your company’s current and anticipated challenges, and a solid framework for how to proceed.

If you have encountered our Analyst Reports in years past, you may have seen separate documents for different technology types. In 2021, anticipating the upcoming addition of enterprise liquidity management (ELM) solutions as a fourth solution category, we decided it was time to combine the reports into a single document to simplify the reader’s experience.

The 2022 Analyst Report begins with an “Overview” section aimed at exploring foundational concepts and terms and discussing treasury challenges and technology innovations on a macro level. Following the Overview, readers will find four categories of solution types explained in detail: treasury management systems / treasury and risk management systems (TMS/TRMS), treasury aggregators, supply chain finance and cash conversion cycle solutions, and the more recently defined category of ELM.

The Environment and Challenges Facing Treasury

The market for digital treasury tools is impacted by every factor that impacts treasury itself. The department’s responsibilities and the environment it must cope with both shift with every major economic event and with every wind that changes the face of corporate operations in general.

What follows is a discussion of what we consider the top factors influencing treasury’s needs and concerns today. Use this section to consider how your own organization and industry relate to the general factors driving treasury technology adoption and how that might impact the solutions available for your specific needs.

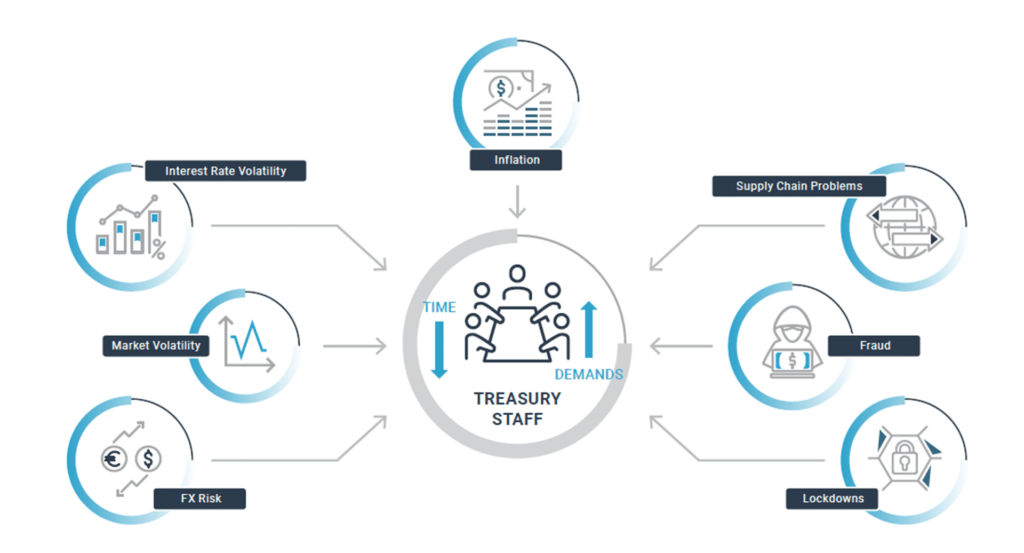

Adding Demands Rapidly, Adding Staff Slowly

The demands placed on treasury seem to multiply with each new economic event and corporate challenge. As more is added to treasury’s plate, the department must respond either with more manpower, more tools to leverage, or both.

Treasury’s core responsibility has always been to protect the organization’s most liquid assets, making them managers of cash and of the risks to that cash. As events occur, corporations become aware of more risks to their cash — often through their own painful experiences, global impacts, or experiences of other companies. Economic crises, clearly increasing fraud risks, and other factors all serve to turn the C-suite’s attention on their liquidity risk managers: treasury.

As a whole, treasury is glad to have the ear of the C-suite, to have the importance of treasury risk management recognized more widely, and to have more specific areas of risk management entrusted to their care. Treasurers are now considered responsible in many companies for improving organizational efficiency and overseeing payment security, and many of the expectations for its foresight and leadership in treasury risk management have climbed. Several of the other items listed in this section on the treasury environment are part of this increase — situations that demand higher risk awareness, more rapid analysis, and broader attention.

While the expansion of treasury’s role is an honor, each increase multiplies treasury’s workload — and these are just the industry-wide increases in treasury demands. As each individual organization grows into new regions, faces new regulations, or acquires subsidiaries, treasury’s workload extends again.

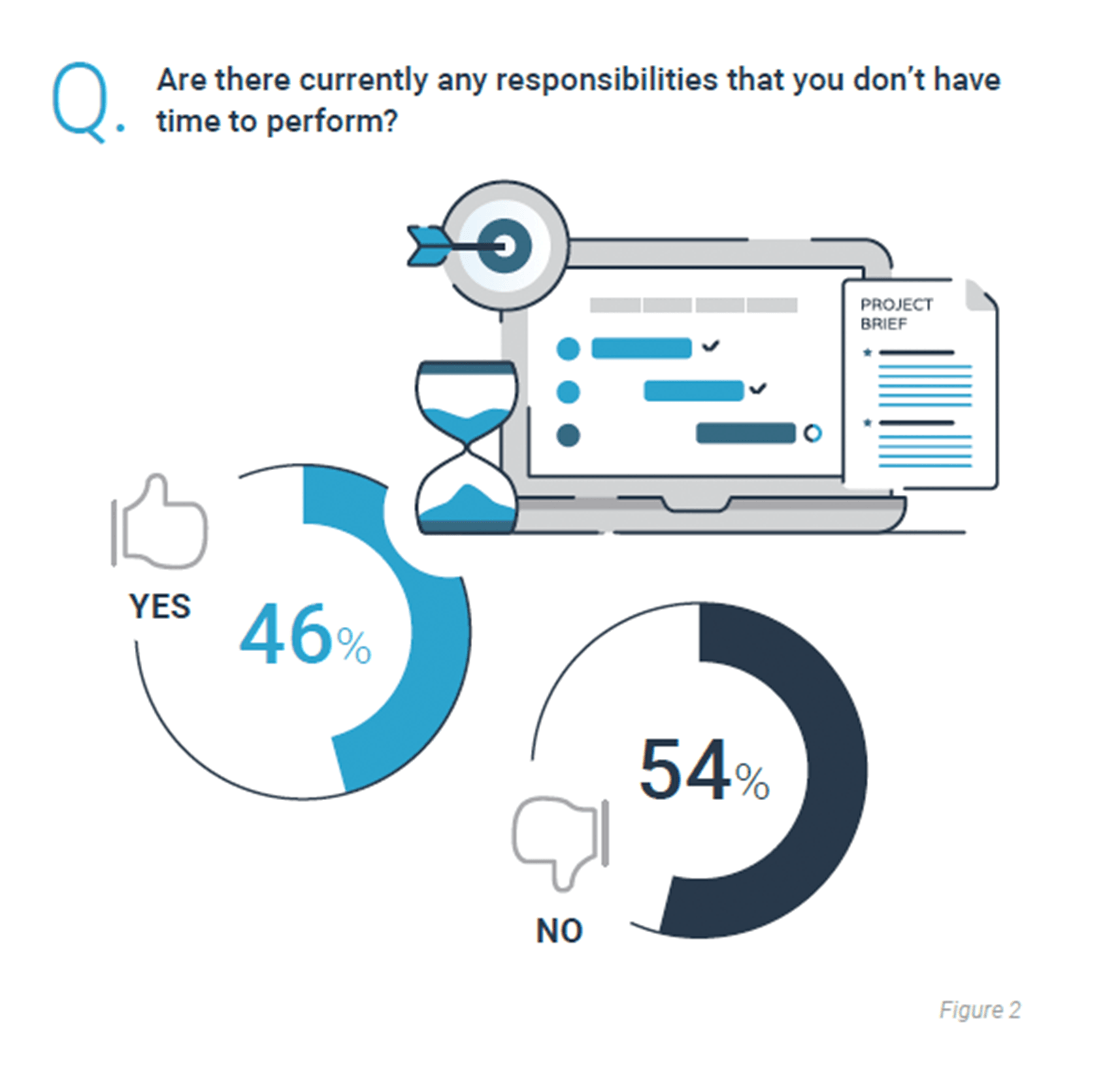

The steady expansion of treasury’s responsibilities has been coupled with fairly little increase in its staffing, as survey data shows treasury teams growing only slowly over the years. One added staff member alone cannot make up for the level of demand increases. Treasury needs leverage, and that leverage can most often be found in the form of technology.

Vendors have responded to seeing treasury departments stretched thin by building highly efficient tools. By automating many of the most onerous and time-consuming tasks, treasury technology extends the reach of the staff and empowers them to do what only they can, such as strategic and advisory tasks.

Some consider the technology vs. staff issue a zero-sum game, but this is not the case in treasury. Certain tasks are, without doubt, being automated in most companies. Staff whose roles are defined by easily automated tasks will need to reskill. However, a lower headcount is not needed in treasury. Rather, technology makes the slow increase in headcount sufficient by offering staff the leverage and efficiency they require in order to do what is increasingly asked of them.

Security in the Hybrid and Remote Era

The abrupt shift in work locations and the temporary (or permanent) closing of offices around the world in the early weeks of COVID-19 brought on a storm of logistical issues as well as fraudulent activity. Some of the factors that contributed to the security situation were temporary, such as the rampant confusion that lent credence to almost any explanation for payment information changes. However, some of the complications forced long-term adaptations, such as digitization of payment processes, that will continue to be used whether the company remains remote or not.

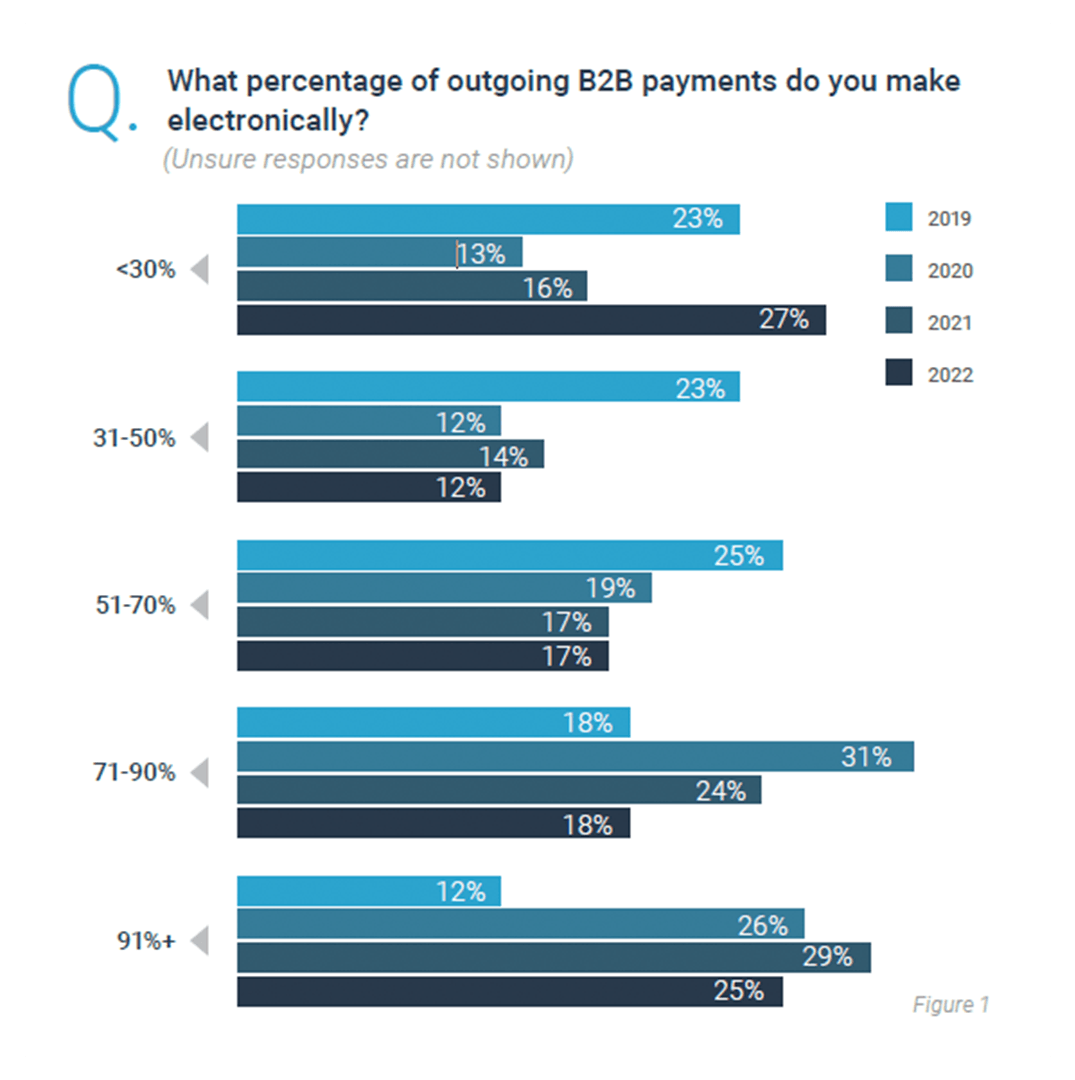

Indeed, the pandemic gave a jolt of forward momentum to adoption of treasury technology. The percentage of payments made electronically shot up in 2020 and has remained elevated since (figure 1). Industry standards have shifted to more electronic processes, and any companies continuing to allow remote work must have the infrastructure and tools to support the logistics and security needs that come with the work from home (WFH) environment.

Despite the long-discussed and somewhat implemented “return to office,” the prevalence of remote work and of companies using a hybrid model (remote some days, in office others) has dramatically and — it seems — permanently increased in the wake of the pandemic. Besides the obvious need for digital systems that allow for remote access, the remote worker’s security needs require modern technology.

Meanwhile, criminals’ tools and methods have continued to improve, forcing more robust security measures regardless of work location. While relying on a solution, especially one housed in the cloud with remote access capabilities, may seem a counterintuitive measure for fraud prevention, these solutions actually serve to strongly counteract vulnerabilities in three primary ways:

- They reduce touchpoints or manual handoffs. The fewer the touchpoints, the less opportunity criminals have to insert themselves into a process.

- They mitigate complexity and improve visibility, narrowing the front that must be defended and making it harder for criminal activity to go unnoticed.

- They allow for built-in controls that cannot be bypassed.

With rising industry standards, heightened risks, cyber insurance requirements, and remote work, the security environment and work location changes are challenging many organizations to speed their adoption timelines for solutions that can help snuff out their vulnerabilities.

Efficiency and Scalability

Whether due to economic conditions, supply chain problems, geopolitical issues forcing abrupt changes, or other issues, companies today find themselves in need of efficiency, scalability, and the flexibility they offer. Efficiency and scalability are both more easily achieved by leveraging modern technology.

Efficiency has to do with processes taking as long as they need to for achieving quality results and no longer. It conserves resources (including time and manpower) so that your company can use them when and where they are most needed.

Inefficiency, on the other hand, brings with it error-prone processes (which can be costly), wasted capital, and limited options. For example, if payment approvals take the full length of payment terms, the company loses the option to avail itself of early payment discounts.

In areas such as these, inefficiency erodes the company’s control over liquidity and flexibility in time of turmoil. This alone is enough to make efficiency across relevant areas of the organization a matter of import to treasury.

In addition, organizational leadership relies on treasury to provide rapid analysis and insight into the impacts and threats caused by various situations. For many treasury departments, the levels of efficiency required to rapidly analyze today’s masses of data despite thin staffing are only achievable through technology and automation.

On the scalability side, recent years have proven volatile for the corporate world. Some have seen rapid growth in certain areas. Some have abruptly had to shutter operations in particular countries or lines of business. Many have had to adjust and redirect their strategies due to supply chain problems, lockdowns and travel restrictions, skyrocketing gas prices, and more.

For these and other reasons, the corporate world is finding itself in need of rapid scalability, and treasury itself may have to swiftly adapt. When processes are manual, scalability is low. Automation multiplies staff efforts, and many solutions — especially those built on more modern concepts such as software-as-a-service or microservices — make it far easier for treasury to easily adjust the capacity and leverage they are working with up or down as circumstances change.

Heavier Compliance Burdens

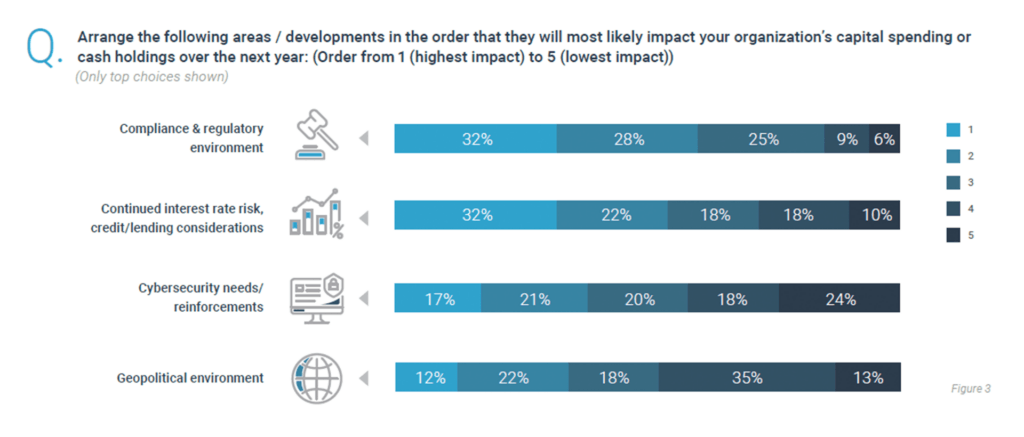

A 2021 survey found that 54% of treasury and finance respondents considered the compliance burdens to be heavier than they had typically been in the past. Over the next 1-2 years, 66% expected their regulatory burdens to increase, and only 3% expect to see any decrease. The compliance and regulatory environment also ranked as the most impactful out of several options on the respondent organizations’ capital spending or cash holdings (see figure 3).

From Know Your Customer (KYC) requirements, which respondents expected to be the most impactful to their operations in the next three years by a large margin, to PCI-DSS, GDPR, FBAR, etc., regulations are put in place to protect against negligence and willful actions that enable fraud and other problems. While many of these regulations help protect companies and banks, complying with them takes time and resources. It is, without doubt, burdensome, and each year seems to add some weight.

Regulations spur the adoption of financial technology in two ways. First, some solutions directly or indirectly streamline the compliance process. For example, networks such as SWIFT are working to ease the KYC process by allowing corporate participants to upload KYC information once to the platform instead of compiling and sending the paperwork anew for each bank. In addition, complying with any regulation that requires financial or account information, such as FBAR, is much easier with solutions that give faster, more accurate financial visibility.

The second way compliance serves to push adoption forward is that some regulations have specific technical requirements that may not be possible to meet for some companies without a modern solution. These regulations are often security related.

Big Data, Complexity, and Visibility

Companies and, specifically, treasury departments in 2022 do not have the luxury of ignoring data. While a strong data strategy takes time to form and implement, every company should at least have a strategy in the works. For many, implementing these strategies will require technology.

The ever-growing “big data,” which denotes the overwhelming amounts of data that are pouring into and through companies in increasingly varied forms, continues to prove both an immense opportunity and a challenge. Companies that harness their data are able to gain valuable insights into everything from their own operations to market behavior. However, harnessing that data effectively requires careful management, thoughtfully architected storage, and massive processing power.

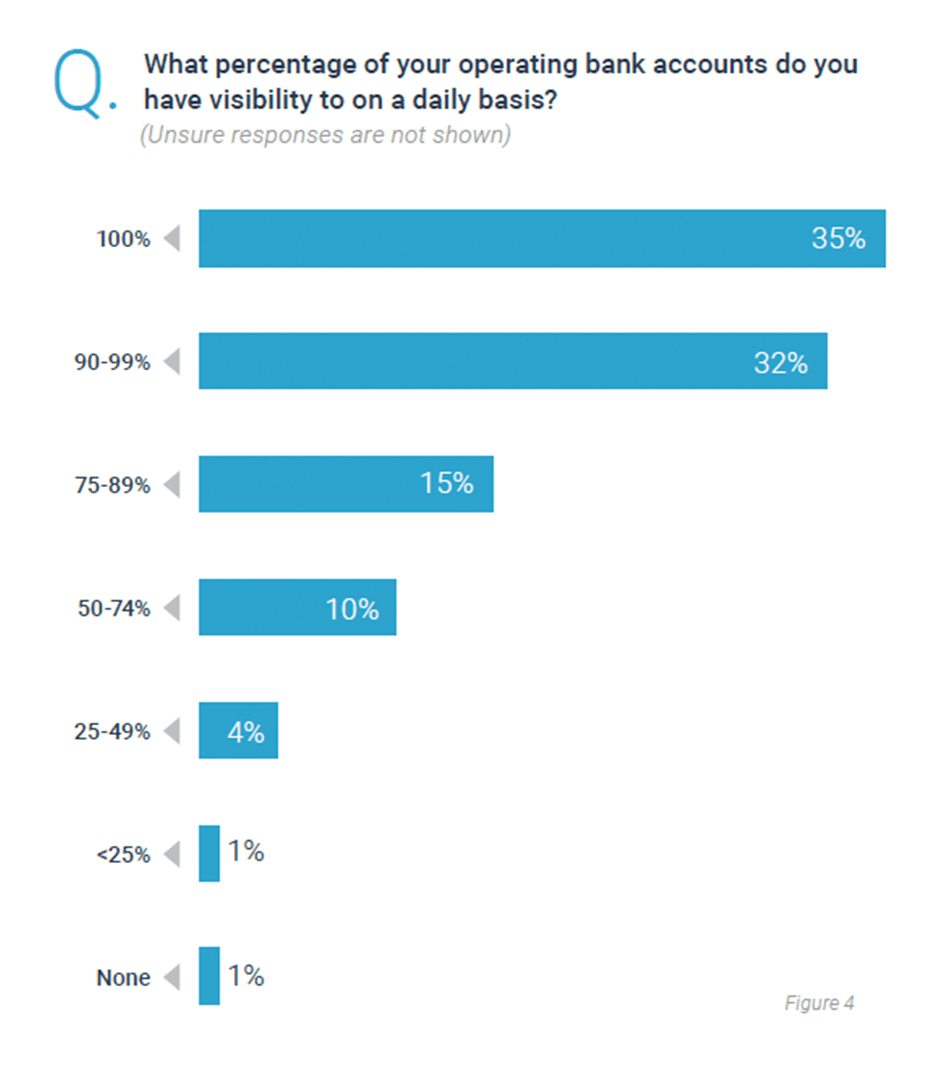

Meanwhile, the complexity that creates big data, coupled with any growth companies are experiencing, leads to complicated processes and difficulty achieving visibility. Many treasury teams that used to get by with manually logging into bank portals and managing cash positions on Excel are now facing more banks, more accounts, more portals to log into, more formats, and more internal information to manage.

Maintaining complete visibility is vital for treasury. Without it, fraud risks are higher, compliance is more difficult, and the treasurer does not have a complete view of the situation from which to advise the organization. Yet with every expansion, every added bank account, and simply every year that passes, increasing data and complexity make it more difficult to achieve that visibility without the use of technology. With solutions that can manage and also help harness data, treasury is able to thrive and support their organizations’ long-term growth.

Geopolitical Tensions and Economic Stress

It should come as no surprise to most readers that 2022 and the years leading up to it have been years of some global turmoil. From pandemics to armed conflicts and from supply chain issues to soaring inflation, companies and individuals alike have had to cope with a great deal.

We’ve discussed how lockdowns, fraud, and the need for scalability in these scenarios have all contributed to rapid adoption of digital processes and robust solutions. The usefulness to treasury of technological support and automation during times of any kind of upheaval, however, is worth discussing separately.

When risks become realities and when economic and geopolitical events loom large, organizations need their treasurers to be ready with rapid analysis and strategic guidance. Treasury cannot do this when manual processes are delaying their cash positions, limiting their visibility to all accounts, or when any part of the process leading up to strategic advising takes too much time and manpower.

Technological solutions such as those discussed in this report offer treasury margin. They automate portions of the process, reduce errors, and save staff time. This allows all members of the treasury team to continue fulfilling their roles even when there is more information to process and more factors to consider,

which is often when the treasury function is most vital to the company’s ongoing success.

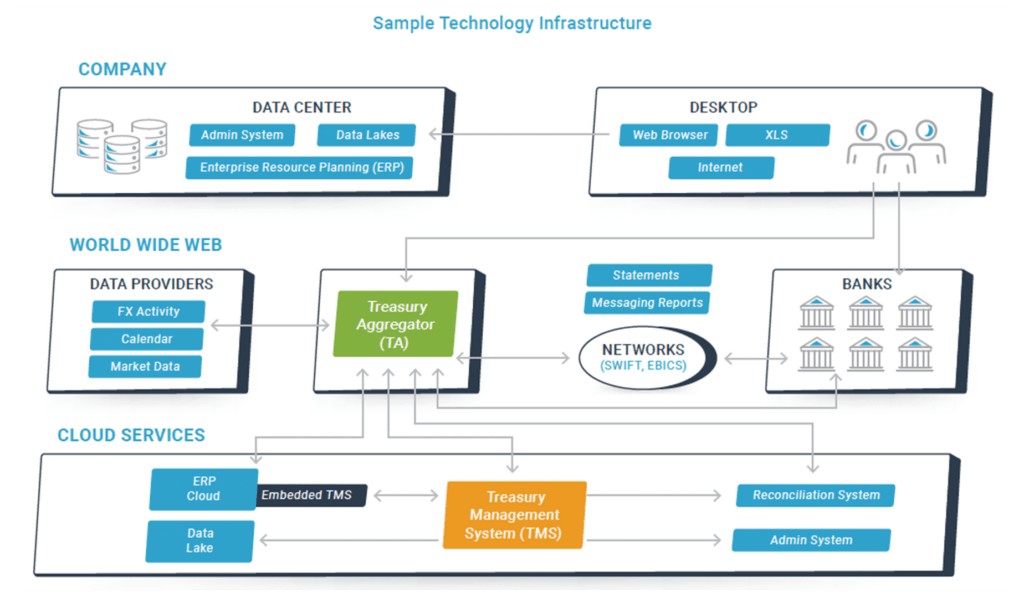

The Treasury Technology Landscape

With a variety of factors driving treasury’s interest in technology, there are quite a few relevant types of solutions. Some of them directly streamline treasury’s own operations. Others are primarily aimed at streamlining different areas of the corporation, but they impact organizational liquidity, efficiency, or security in ways that make them important to treasury’s cash and risk management goals.

In this report, we will discuss the general impact of several components and innovations, from APIs to ML. We will then take some time to focus in on a few solution categories, briefly defined here:

- Treasury Management Systems / Treasury and Risk

Management Systems (TMS/TRMS) A TMS is treasury’s core solution for its own operational needs. When a treasury department outgrows Excel, these systems offer a more robust platform for daily tasks such as cash management and positioning, visibility, accounting, and forecasting. A TMS’s benefits also extend to security, flexibility, and smoothly integrated workflows. For treasury teams that use multiple tools and need to share information with other areas, their TMS can serve as a foundation on which the other tools function and to which other areas’ solutions can connect. A TRMS, while largely comparable to the average TMS, offers deeper risk management functionality. - Treasury Aggregators (TA) A TA combines the functionality of a data consolidator with that of a payment hub. These solutions are ideal for organizations with complex payment flows or banking information. They simplify data gathering and pass aggregated banking information along to any areas that need it, and they establish connections and translate payment formats, allowing for centralized and efficient payment processes.

- Supply Chain Finance (SCF) and Cash Conversion

Cycle (CCC) Solutions SCF and CCC solutions, while they do not directly help with treasury’s own operations, can significantly improve liquidity and working capital. SCF solutions digitally empower programs that create win-win scenarios for buyers and vendors, whether by leveraging the buyer’s superior credit and third-party financing or through leveraging the buyer’s own excess capital. CCC solutions automate various portions of the cash conversion cycle, streamlining processes and, therefore, increasing the efficiency and flexibility of the company’s cash management. Since these solutions tend to cut across multiple departments and impact working capital, the treasurer is often needed as a leader to help identify the real problems and the best solutions. - Enterprise Liquidity Management (ELM) A new evolution in treasury technology, ELM systems offer a comprehensive view of liquidity across the organization. These robust solutions include the base functionality of a TMS, but with far more extensive reach. From supply chain finance and payments to foreign exchange, the data showing what’s really happening to liquidity is often scattered across different departments at large corporations, making it

difficult for treasury to keep close track and strategize accurately. ELM systems are built to integrate information from across the company, allowing treasury to view and manage liquidity on a comprehensive scale.

The Foundations of Treasury Technology

Treasury technology has a multi-decade history and is built on many individual innovations along the way. Understanding where the landscape is today, as well as where it’s going, requires a brief study of where it has come from.

Data

Data has a growth rate of approximately 40% year-over-year. In more recent years, this has led to “big data,” but the growth of data has been challenging and driving innovation since much earlier. From formats to connectivity and processing power, many of the things we will be discussing are built to manage the ever-increasing volumes and types of data. Cash is still king, but treasury departments are learning to value data as a particularly precious resource that allows them to protect the king effectively.

Processing Power

Fortunately, processing power efficiency increases at an even faster rate than data and doubles every 18 months. This allows computers and systems to keep up with and manage the masses of data. However, coupled with data growth, this rapid growth in processing power means that technology is improving, progressing, and changing at a somewhat dizzying rate. Solutions that were state-of-the-art a decade ago are typically far behind the average solutions coming out today.

Connectivity

Connectivity has come a very long way in the past several decades. It has moved from the mail service to teletype machines, and from teletype to host-to-host (H2H) connections and SFTP. Payment Services Directive 2 (PSD2) in Europe — a regulation requiring banks to accommodate customers wanting to access their data through third parties — was largely achieved through application programming interfaces or APIs, which has spurred their adoption worldwide and brought them into the spotlight for a new generation of connectivity.

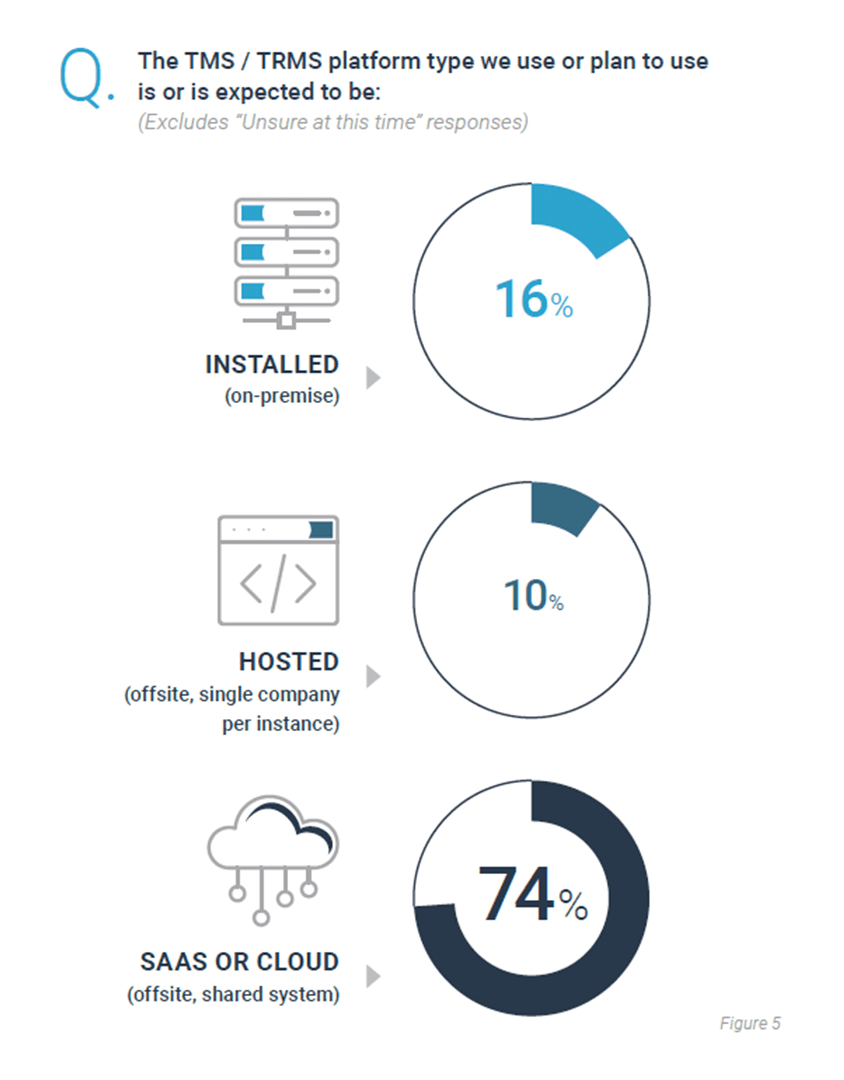

Hosting Models

Hosting models for treasury technology, notably for the TMS, have seen a few iterations over the last couple of decades.

- Early solutions were installed onsite and hosted on the clients’ servers. These solutions, often called “on-premises solutions,” were difficult to upgrade and to

maintain and faced inevitable obsoletion eventually. - Application service providers, or the ASP model, attempted to solve these problems by hosting the solution with a third party tasked with maintaining it. The approach improved upgrade issues and lowered the maintenance burden on clients, but these solutions still faced obsoletion and other issues.

- Software-as-a-service, the SaaS model, is the current standard. These solutions are cloud-hosted and multi-tenant, purchased on a subscription basis, and are maintained and upgraded by the vendor. Since the vendors can directly and fairly easily update and rework the software over time, and since they are incentivized to do so through the subscription payment model, SaaS solutions are seen as holding onto their value for far longer than earlier types.

Democratization of Technology

In 2004, Texas Instruments released the TI-84 graphing calculator, selling it for around $120. This handheld calculator had significantly more processing power and RAM than the most powerful and wildly expensive computers available only 40 years before. Many of us have grown familiar in our personal lives with the experience of looking back on technology from a few years ago and marveling at how much less functionality and power that technology gave us compared to far less expensive technology available today. This applies to the corporate technology world as well. Today’s treasury solutions hold drastically more processing power and functionality than their predecessors and can be obtained for far lower costs. We call this the “democratization” of technology, as the expanded functionality coupled with affordability serve to broaden the market of the solutions. Early installed TMSs, for example, were only financially feasible for extremely large and complex organizations that desperately needed them. Today, there are comparatively powerful options that are affordable enough for a small company of less than $500M in revenue, and the market is only continuing to expand.