eBook

Five Payment Catastrophes to Avoid

A Kyriba Guide to Corporate Payment Workflows

An efficient and secure corporate payment workflow is the backbone of a successful modern enterprise. Every financial transaction – from routine supplier payments to critical intercontinental transfers – relies on a seamless and reliable payment process. However, within the whirlwind of modern financial operations, the complexities of transactions and the persistent threat of payment fraud and cybercrime can create a perfect storm for payment catastrophes. These catastrophes not only disrupt financial operations but also jeopardize your reputation, erode stakeholder trust and undermine the overall stability of your organization.

To shield your organization from these ominous risks and optimize your payment workflow, you need to adopt a proactive and comprehensive approach. In this eBook, we unveil a five-step strategy that helps prevent payment catastrophes and also elevates payment workflows.

Table of Contents

The Pitfalls of Unstandardized Payment Journey

Creating a standardized and efficient journey is paramount for organizations to ensure smooth financial operations. Acting like a well-constructed highway, the payment journey encompasses various stages, including payment initiation, authorization, validation and reporting. When payment workflows are ad hoc and differ from one region or bank to another, companies can fall victim to various issues that can ultimately hinder productivity and increase risk.

Inefficiency and Inconsistency: The lack of standardization means that every payment initiation and approval becomes a unique case. This inefficiency can lead to redundant efforts, time-consuming manual interventions and inconsistent practices, all of which can hinder collaboration and growth.

Increased Errors: Without a streamlined journey, errors are more likely to occur. Variability in data entry, approval mechanisms and formats can lead to data inaccuracies, resulting in failed payments, delayed transactions and reconciliation challenges.

Vulnerability to Fraud: A fragmented payment workflow increases the opportunities for fraudsters to exploit security gaps. Inconsistent authorization processes and a lack of standardized controls can leave organizations exposed to fraudulent activities, leading to financial losses and reputational damage.

Operational Delays: Payments stuck in approval limbo or tangled in complex workflows lead to delays in fund transfer, supplier payments and customer refunds. This strains the relationships with vendors, customers and partners, and, ultimately, impacts the business’ credibility.

Lack of Transparency: A patchwork of payment processes often results in limited visibility into payment status and history. This lack of transparency can deter effective financial decision-making, cash flow management and auditing processes.

A standardized corporate payment workflow is therefore essential to enhance efficiency and consistency while reducing risk and fostering growth and stability. It brings uniformity to data entry, approval processes and formats, minimizing the chances of errors. Key practices for standardization include mapping the payment journey, identifying variability, establishing clear procedures, implementing automation and ongoing monitoring and adjustments.

The Hazards of Neglecting Automation and Technology

A recent Forbes article reports that executives struggle to get real-time key financial metrics and much of the work is still manual and error-prone with financial institutions using different software systems.

Table 1: Challenges with payments process in the US and across the globe reported by the recent Forbes article

| In the USA | Globally |

|

|

Both automation and payments technology are critical components for optimizing payment workflows. Without automation, routine tasks such as data entry, payment validation and reconciliation are time-consuming and error-prone. This results in an inefficient allocation of resources and limits the capacity for strategic financial planning. Additionally, relying solely on manual data entry processes heightens the risk of human errors, including data inaccuracies and improper approval routing. Automation also plays a critical role in enabling real-time tracking of payment statuses, which is imperative for accurate visibility into cash positions and transaction progress.

Another, often overlooked, aspect of a robust payment journey is the ability to address and resolve payment disputes and exceptions swiftly. Failure to manage these situations in a timely manner can have far-reaching consequences that extend beyond just financial losses. Inefficient dispute resolution processes can destroy relationships with vendors and partners, tarnish the company’s reputation and, in some cases, result in legal disputes.

Embracing automation and technology are vital for staying competitive. When building automation for treasury, start with a thorough needs analysis to identify repetitive or error-prone tasks and design an RFP to look for a Treasury Management System (TMS) that can help centralize data and integrate with existing systems like ERP. It is also recommended to use Robotic Process Automation (RPA) for routine tasks like data retrieval and report generation, while incorporating advanced analytics and AI to improve cash forecasting and detect payment fraud.

The Pain of Being Tangled Up in Bank Connectivity

An interconnected network is not just a luxury; it’s a necessity. Bank connectivity is the lifeline of financial operations. A comprehensive connectivity network enables organizations to transmit payment instructions, receive acknowledgments and access account information without interruption. Whether it’s done through H2H, SWIFT network or Bank APIs, the ability to seamlessly communicate with banks underpins the entire payment and bank reporting process.

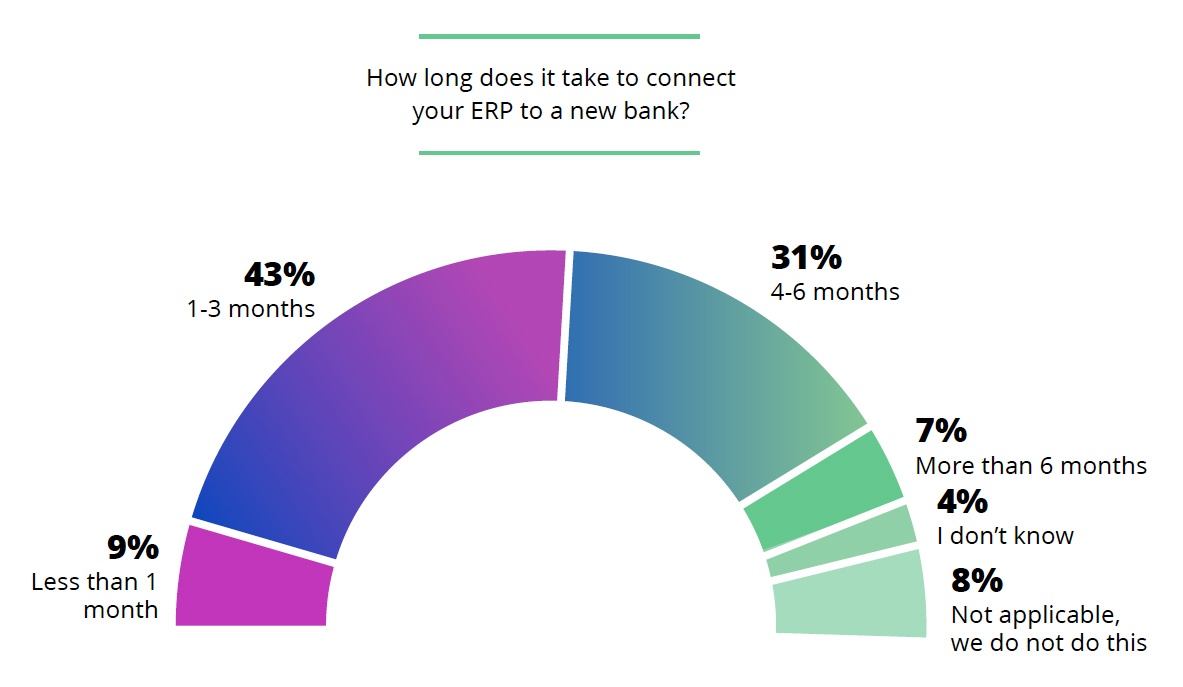

The path to establishing robust bank connectivity is riddled with challenges. With every bank or network having their own specifications, bank connectivity carries a high level of complexity, especially when companies start to connect their payments initiation systems such as ERP or AP systems to the banks for realizing Straight-Through-Processing (STP). A single error can have a multitude of negative consequences including payment delays and even data breaches. The following data came from a Gartner Pulse survey with 100 IT leaders, and the results indicated that most ERP integrations with a new bank would take 1-6 months to complete.

Most ERP Integrations with a new bank take 1-6 months to complete.

Mitigating the challenges associated with bank connectivity requires a strategic approach and a roadmap. Start with your most important banks and identify current bottlenecks and inefficiencies in your corporate to bank connectivity. Opt for a unified platform or payment hub that offers Connect-as-a-Service to streamline multi-bank connectivity, ensuring compatibility with both internal systems like ERP and various banking protocols. Embrace API integrations to achieve real-time data exchanges, enhancing reconciliation and payment processes.

The Looming Specter of Security Breaches and Fraud

As organizations traverse the landscape of payments, security emerges as a crucial concern. The ramifications of security breaches and the constant looming specter of fraud are enough to send shivers down the spine of any financial professional. The stakes are more than an organization’s finances; the reputation and trustworthiness of a business are also on the line.

When security measures are compromised, a cascade of detrimental outcomes follows. Theft of financial data can lead to unauthorized access to sensitive information, putting financial assets at risk and, potentially, violating data privacy regulations. The aftermath of fraud can undermine the integrity of an organization’s financial health.

Table 2: Companies are being targeted by payment fraud attacks

| Payment Fraud Statistics | Percentage |

| U.S. Companies affected by fraud in 2022 | >60% |

| Companies targeted multiple times | >50% |

| Companies targeted >15 times | 5% |

Source: U.S. Companies and B2B Payment Fraud Report by TrustPair and GIACT, 2023

Organizations face a multifaceted battle against cyber threats, and a reactive stance is insufficient to ward off these challenges. Cybercriminals are becoming more sophisticated, using advanced tactics to exploit vulnerabilities in payment systems and networks. Ransomware attacks, identity theft and phishing scams are just the tip of the iceberg. And, these attacks are on the rise, according to a PYMNTS.com article, “Ransomware attacks reached record-breaking numbers in March 2023, with a 91% increase compared to the previous month.” Ransomware attacks typically target any accessible data – including payment information and personal identifiable information. A single successful breach can lead to massive financial losses, legal penalties and lasting reputational damage.

To counter this multifaceted threat, a proactive strategy is essential. Ransomware attacks, phishing schemes and evolving tactics demand a resilient defense. Integrating encryption, tokenization and robust authentication forms the first line of defense. Regular monitoring and swift responses to anomalies are pivotal. When it comes to payments, we recommend bank account validation and fraud and compliance screening before any payments are sent to the banks.

The Hidden Cost of Organizational Silos

Collaboration and partnerships are essential for organizations aiming to streamline corporate payment workflows. However, the persistent existence of silos presents a significant impediment to effective collaboration. Silos, marked by compartmentalized data repositories and disjointed workflows, create substantial communication gaps that obstruct the smooth information flow in an organization’s financial operations, leading to lack of transparency and hindered accessibility to data.

According to a year-long study of more than 100 global businesses conducted by Roland Berger, nearly 80% of surveyed respondents report “strongly pronounced” silos that negatively impact their company’s costs, innovation potential, culture, and profitability. Despite this, only 54% have made breaking bad silos a top company priority, the study found. Regardless if respondents had more than 5,000 employees or under 500, the results were largely the same — most respondents didn’t have the confidence or know-how when combating the problem. Just 20% report having the right measures in place.

The consequences of these silos undermine the efficiency of payment workflows. With data locked away, the flow of information becomes stilted, leading to redundancies, delays and errors. Silos also limit the extent of shared insights and knowledge among the teams who are actually working to achieve the same KPIs, hampering their ability to collaboratively and proactively respond to market fluctuations, changing regulations and emerging opportunities.

Finally, silos contribute to security vulnerabilities. Data dispersed across fragmented systems may be more challenging to protect effectively, increasing the risks of data breaches and fraud.

Silos don’t have a one-size-fits-all solution, yet modern finance thrives on collaboration. Recognizing the issue both from top-down and bottom-up perspectives is essential, but it’s just the starting point. While a centralized treasury and payments platform promotes collaboration, the heart of the challenge lies in reshaping the collaborative mindset of leaders, managers and employees.

Final Remarks

Preventing payment pitfalls requires a diligent, encompassing strategy. The quest for efficient and secure corporate payment workflows never truly ends. With the fast pace of tech evolution, shifting fraud schemes and a mutable financial environment, success favors those with the agility to adapt and the courage to innovate.